Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Cherry Tree Company has issued 300,000 $1 par equity shares, which are at present selling for $4.40 per share. The company needs toraise

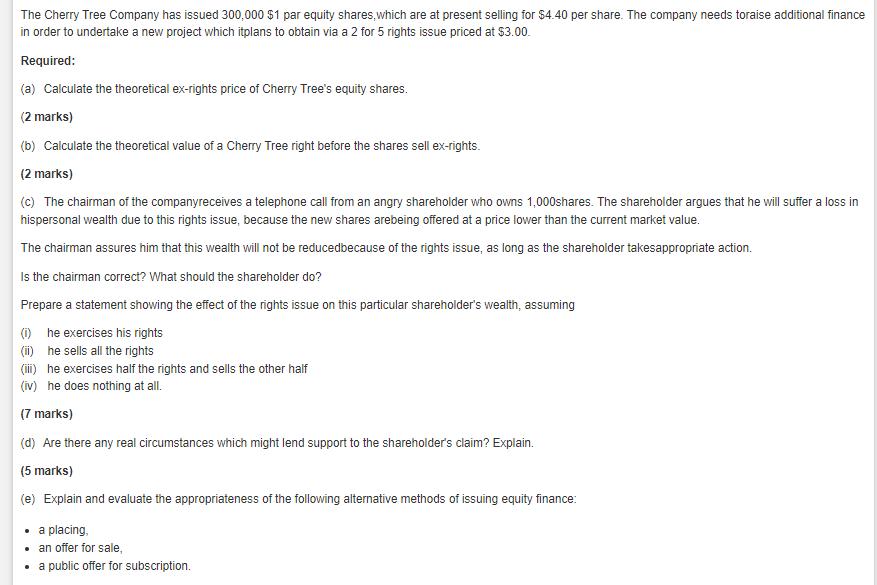

The Cherry Tree Company has issued 300,000 $1 par equity shares, which are at present selling for $4.40 per share. The company needs toraise additional finance in order to undertake a new project which itplans to obtain via a 2 for 5 rights issue priced at $3.00. Required: (a) Calculate the theoretical ex-rights price of Cherry Tree's equity shares. (2 marks) (b) Calculate the theoretical value of a Cherry Tree right before the shares sell ex-rights. (2 marks) (c) The chairman of the companyreceives a telephone call from an angry shareholder who owns 1,000shares. The shareholder argues that he will suffer a loss in hispersonal wealth due to this rights issue, because the new shares arebeing offered at a price lower than the current market value. The chairman assures him that this wealth will not be reduced because of the rights issue, as long as the shareholder takesappropriate action. Is the chairman correct? What should the shareholder do? Prepare a statement showing the effect of the rights issue on this particular shareholder's wealth, assuming (i) he exercises his rights (ii) he sells all the rights (iii) he exercises half the rights and sells the other half (iv) he does nothing at all. (7 marks) (d) Are there any real circumstances which might lend support to the shareholder's claim? Explain. (5 marks) (e) Explain and evaluate the appropriateness of the following alternative methods of issuing equity finance: a placing, an offer for sale, . a public offer for subscription.

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a TERP Market value MV of shares in issue 300000 440 1320000 Proceeds from new issue TERP 2 Number o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started