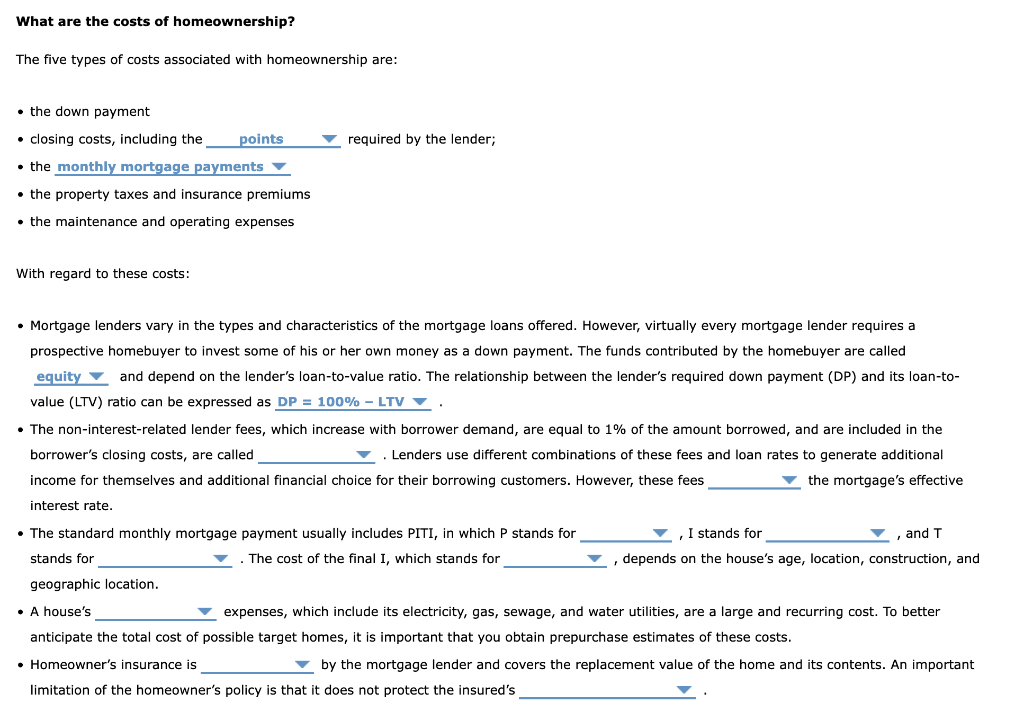

What are the benefits and costs associated with home ownership? Purchasing a home is an investment. It should be made with the same knowledge, objectivity, and deliberation that you would apply to the purchase of stocks, bonds, or life insurance policies. Knowledge of the general costs and benefits associated with owning a home is necessary to make an informed investment decision. What are the benefits associated with homeownership? Owning a home offers physical and psychological as well as financial benefits. Among the physical benefits are shelter and security, while the psychological benefits include: Flexibility and a lack of long-term commitment A feeling of stability and a sense of permanence of the: Property taxes paid on the home Insurance premiums paid to protect the home and your contents Home maintenance and repair expenses Down payment paid to purchase the home This treatment on your federal and, in most states, state income taxes results in a taxable income and tax obligation. However, to realize the full value of this benefit, you mus1 and depend on the lender's loan-to-value ratio. The relationship between the lender's required down payment (DP) and its loan-tovalue (LTV) ratio can be expressed as DP=100% LTV . - The non-interest-related lender fees, which increase with borrower demand, are equal to 1% of the amount borrowed, and in the borrower's closing costs, are called . Lenders use different combinations of these fees and loan rates to generate additional income for themselves and additional financial choice for their borrowing customers. Howeverest these fees interest rate. - The standard monthly mortgage payment usually includes PITI, in which P stands for stands for geographic location. - A house's expenses, which include its electricity, gas, sewage, and water utilities, are a large and recurring cost. To better anticipate the total cost of possible target homes, it is important that you obtain prepurchase estimates of these costs. limitation of the homeowner's policy is that it does not protect the insured's What are the benefits and costs associated with home ownership? Purchasing a home is an investment. It should be made with the same knowledge, objectivity, and deliberation that you would apply to the purchase of stocks, bonds, or life insurance policies. Knowledge of the general costs and benefits associated with owning a home is necessary to make an informed investment decision. What are the benefits associated with homeownership? Owning a home offers physical and psychological as well as financial benefits. Among the physical benefits are shelter and security, while the psychological benefits include: Flexibility and a lack of long-term commitment A feeling of stability and a sense of permanence of the: Property taxes paid on the home Insurance premiums paid to protect the home and your contents Home maintenance and repair expenses Down payment paid to purchase the home This treatment on your federal and, in most states, state income taxes results in a taxable income and tax obligation. However, to realize the full value of this benefit, you mus1 and depend on the lender's loan-to-value ratio. The relationship between the lender's required down payment (DP) and its loan-tovalue (LTV) ratio can be expressed as DP=100% LTV . - The non-interest-related lender fees, which increase with borrower demand, are equal to 1% of the amount borrowed, and in the borrower's closing costs, are called . Lenders use different combinations of these fees and loan rates to generate additional income for themselves and additional financial choice for their borrowing customers. Howeverest these fees interest rate. - The standard monthly mortgage payment usually includes PITI, in which P stands for stands for geographic location. - A house's expenses, which include its electricity, gas, sewage, and water utilities, are a large and recurring cost. To better anticipate the total cost of possible target homes, it is important that you obtain prepurchase estimates of these costs. limitation of the homeowner's policy is that it does not protect the insured's