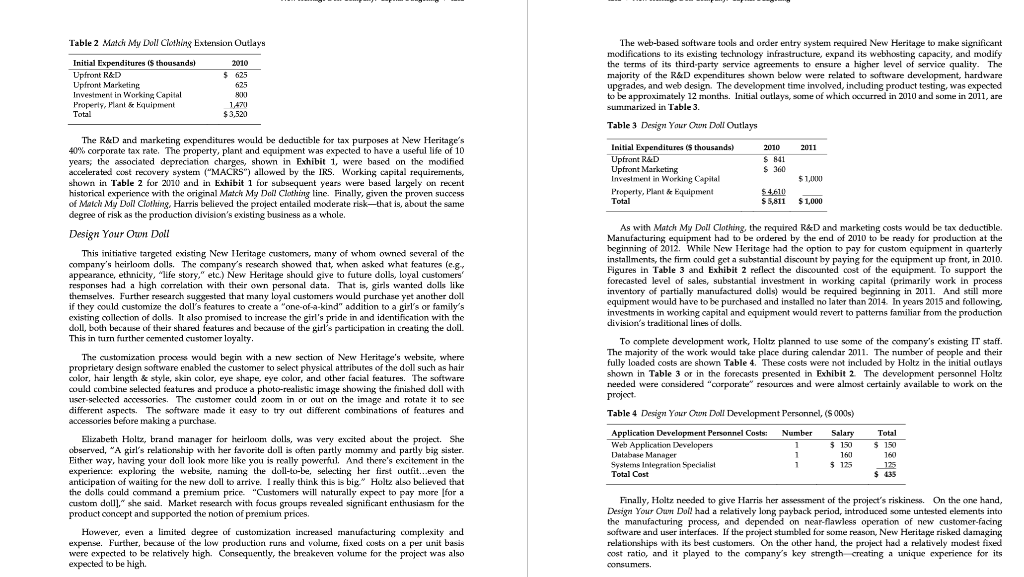

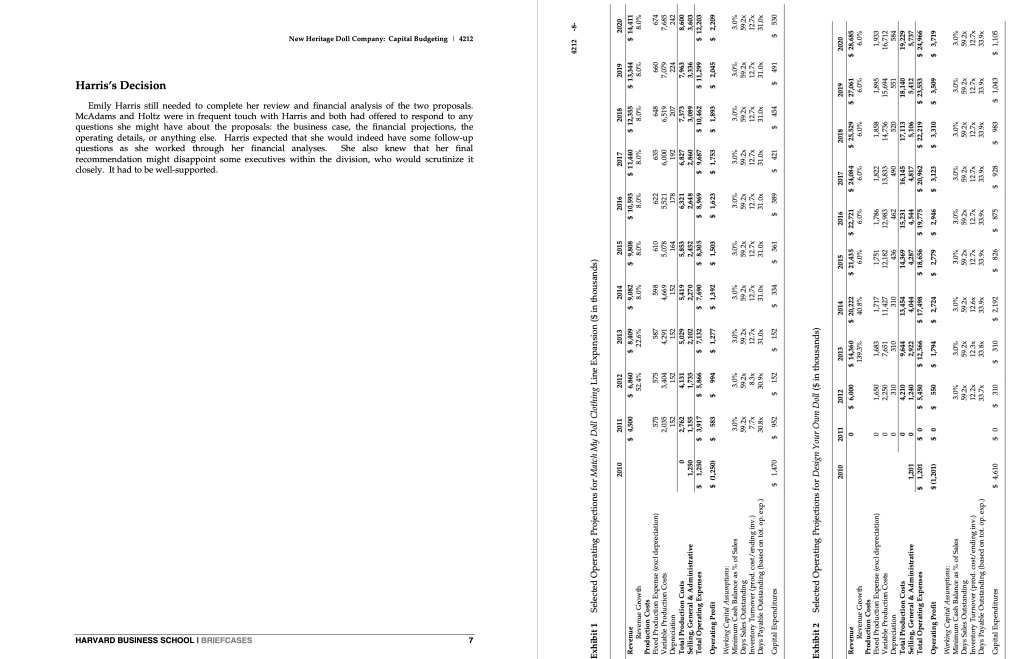

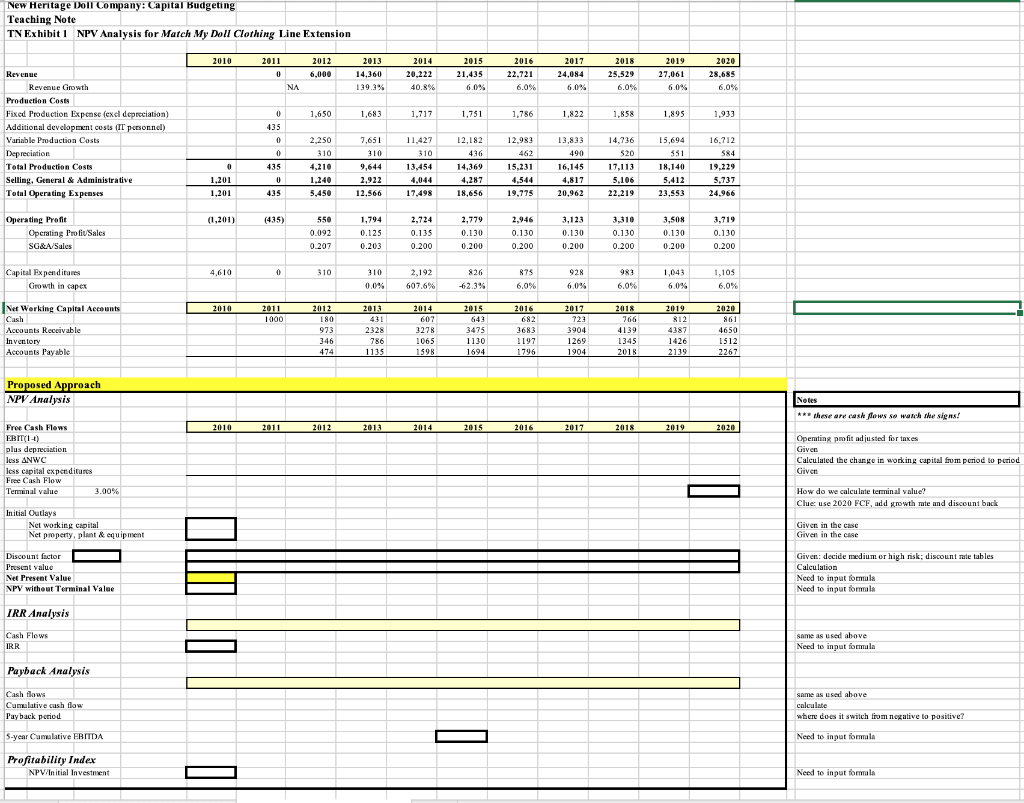

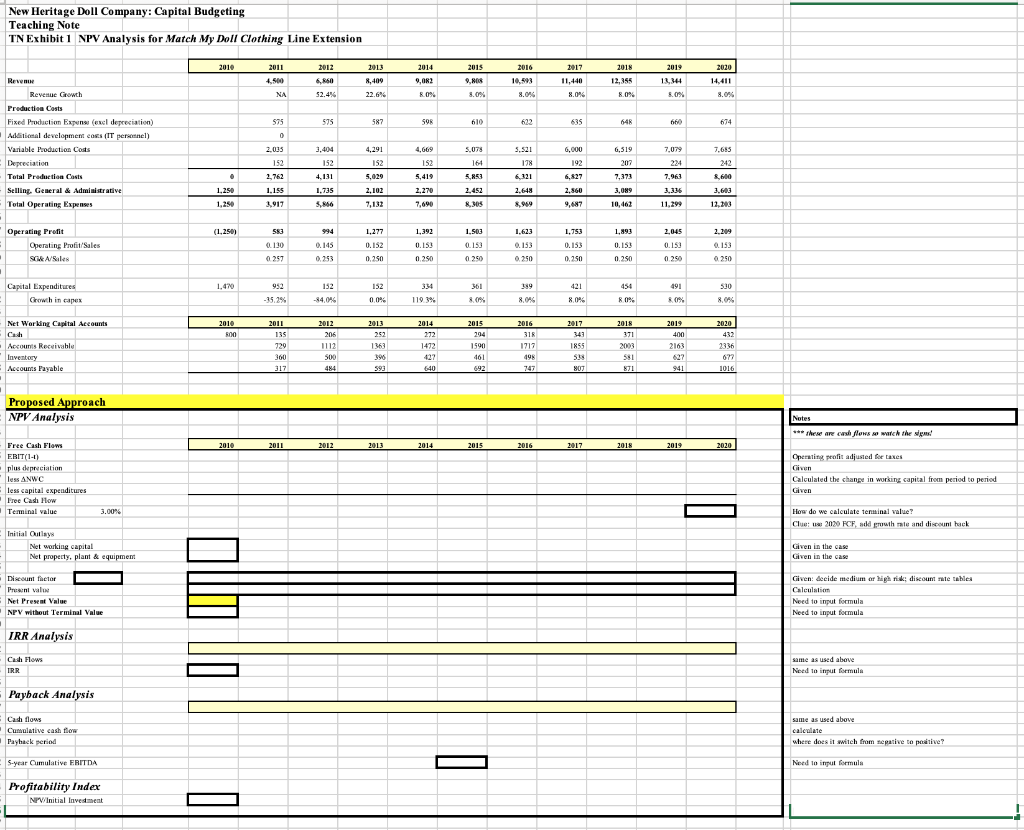

What are the blank fields supposed to be

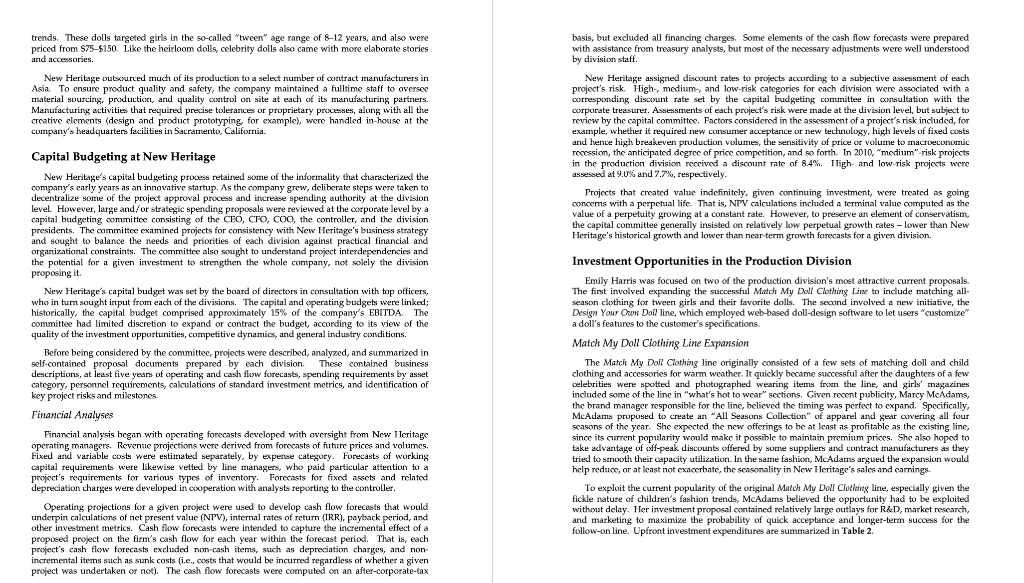

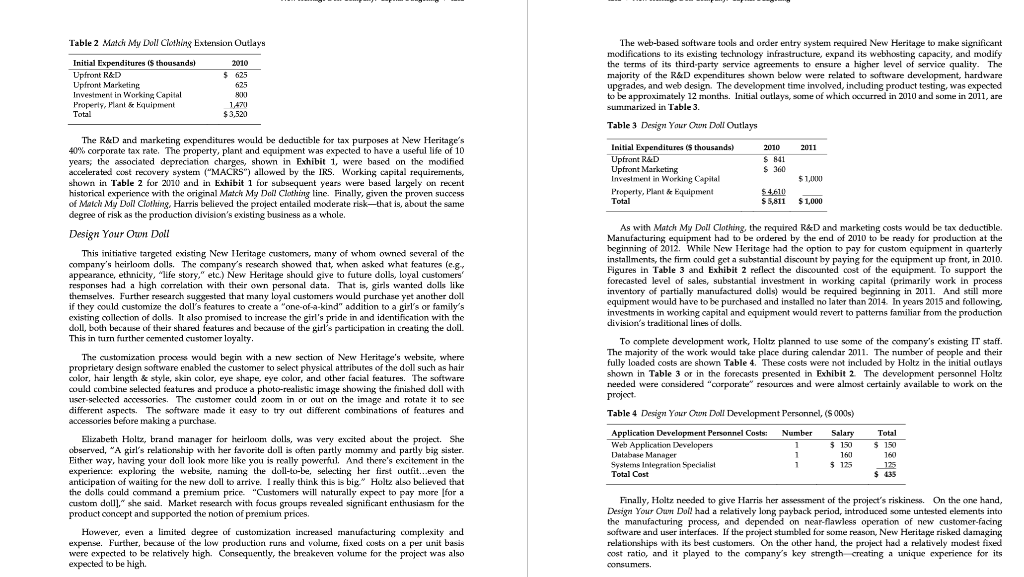

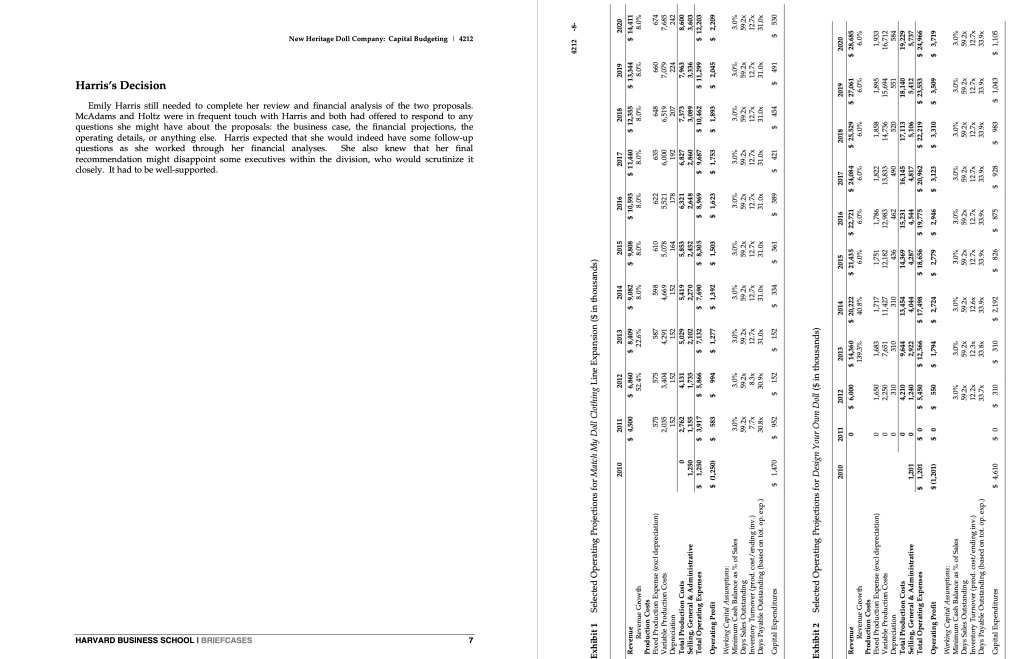

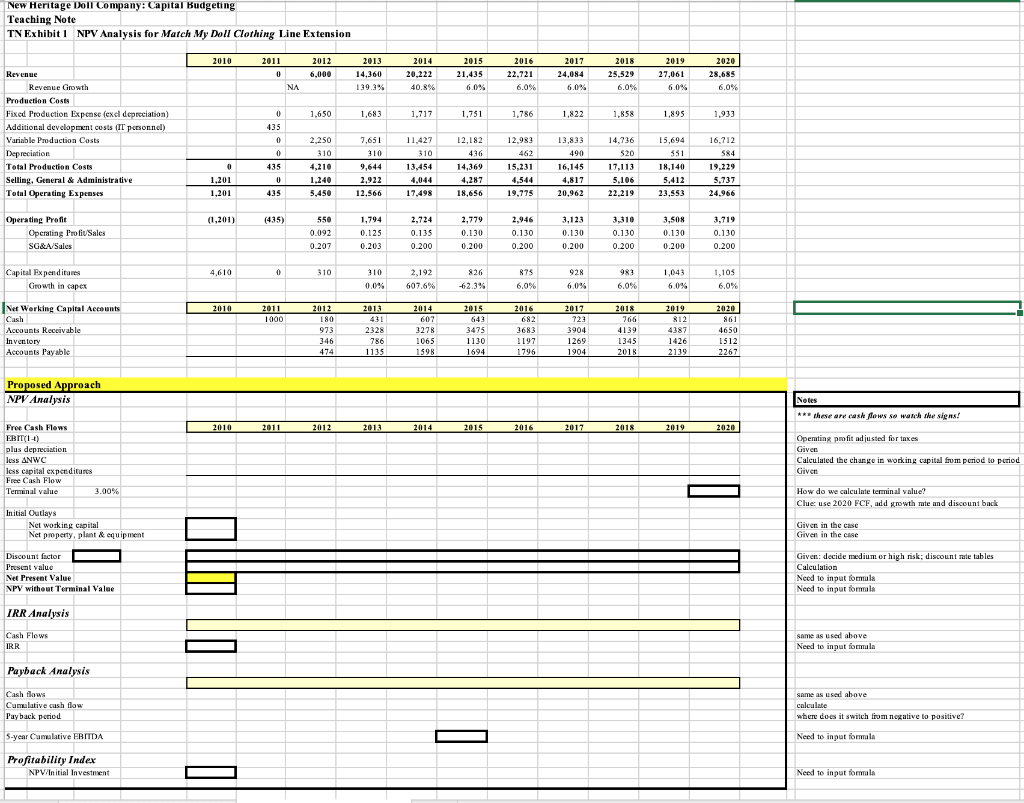

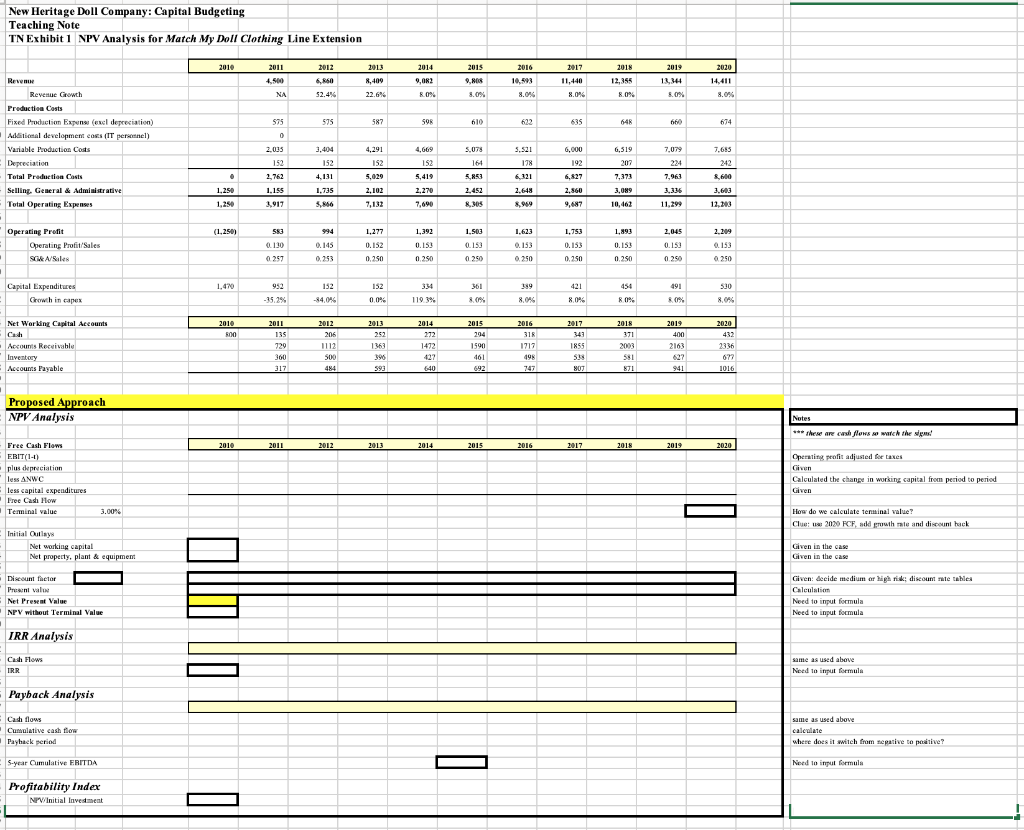

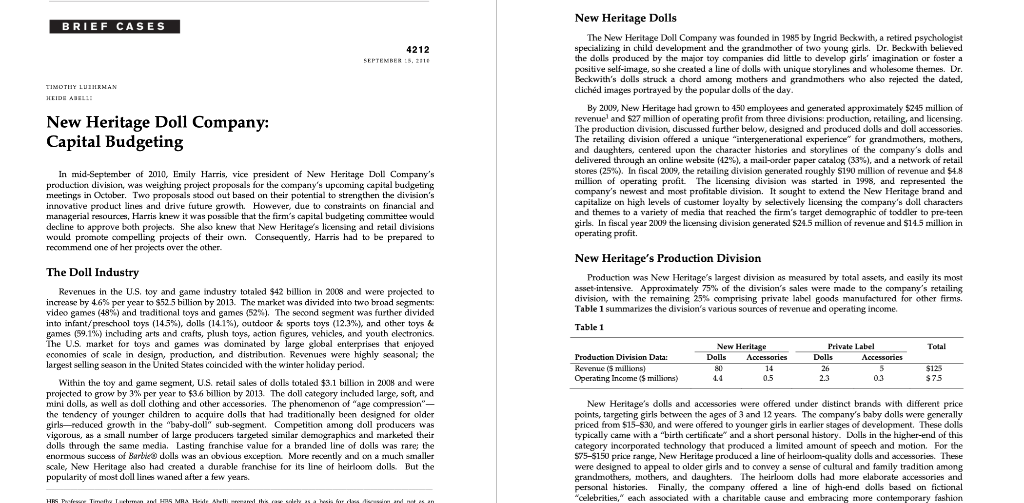

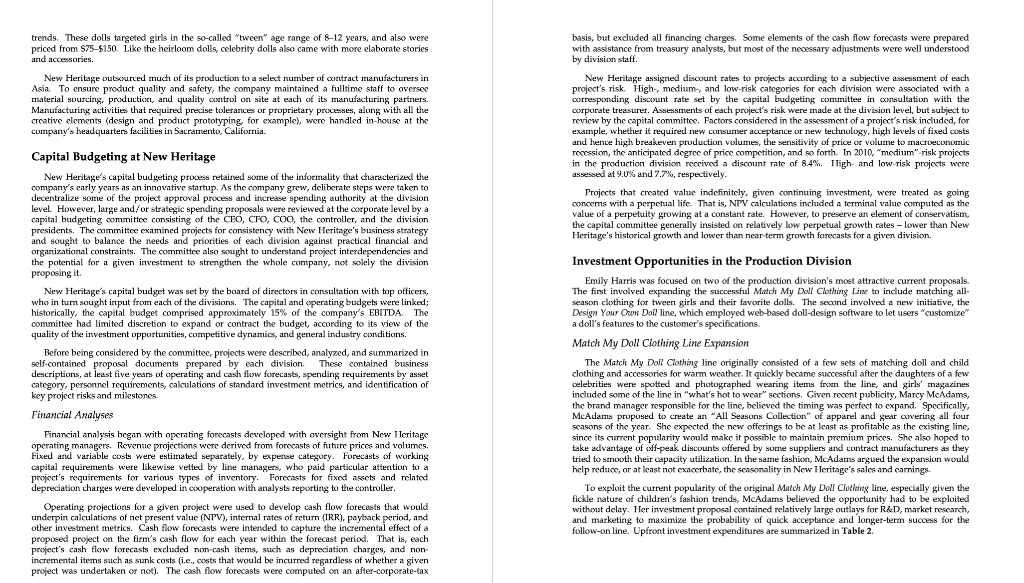

New Heritage Dolls BRIEF CASES The New Heritage Doll Company was founded in 1985 by Ingrid Beckwith, a retired psychologist 42 the dolls produced by the major toy companies did little to develop girls imagination or foster a SEPEMBER TIMOTUY LUAN dichd images portrayed by the popular dolls of the day. HEIDE ABL1D y2009, New Heritage had grown to 450 employees and generated approximately $245 million of revenue and $27 million of operating profit from three divisions: production, retailing, and licensing. New Heritage Doll Company Capital Budgeting The retailing division offered a unique "intergenerational experience" for grandmothers, mothers and daughters, centered uporn the character histories and storylines of the company's dolls and stores (25%). In fiscal 2009, the retailing division generated roughly S190 million of revenue and $4.8 In mid-September of 2010, Emily Harris, vice president of New Heritage Doll Company's production division, was weighing pruject proposals f milbon ot operating protit hceg divn was sLanEd 99, dnd represnta e the company's upcoming capital budgeting capitalize on high levels of customer loyalty by selectively licensing the ampany's doll characters innovative product lines and rive futur enuth Howyer e ta ntrat n financial and managerial resources, Harris knew it was possible that the firm's capital budgeting committee would wuld promotemeling nroits of their wn Conseuentl Harris bad to be prenared tn aperating profit. recommend one of her projects over the other. New Heritage's Production Division The Doll Industry Production was New Heritage's largest division measured by total assets, and casily its most ... rasre bu d E 1 were projecie video games (48% ) and traditional toys and games (52 % ) , The second segment was further divided division, with the remaining 25 % comprising private label goods manufactured f Table 1 summarizes the division's various sources of revenue and operating income. other firms. Table 1 The US. market for toys and games was dominated by large global enterprises that enjoyed. ghly seasonal; the Private Label New Heritage Total Production Division Data: Dolls Accessories Dolls Accessories larast sellingsaon in theinid Secciddwith the rinr bday nri $123 0: Operating Income (S millions) 4.4 05 2: $75 Within the toy and game segment, U.S. retail sales of dolls totaled $3.1 billion in 2008 and were projected to grow by 3 % per year to $36 billion by 2013. The doll category included large, soft, and points, targetinE eirls hetwoen the ages of 3 and 12 vears. The compan's babu dolls uore aapllar priced from $15-S30, and were offered to younger girls in earlier stages of development. These dolls lder girls-reduced growth in the "baby-dol" sub-segment. Competition among doll producers was dolls through the same media. Lastine franchise value for a branded line of dolls was rare: the enormous success of Barble dolls was an obvious exception More recently and on a much snaller cateeory incornorated technolory that produced a imited amount of speech and motion, For the 575-$150 price range, New Heritage produced a line of heirloom-quality dolls and accessories. These wrandmothers mth an dauhtersThe heirim dolls had mone ara acori and personal histories. Finally, the company offered "celebrities," each associated with a charitable cause and embracing more contemporary fashion. nonularit allin waned after a few ve chise for its line of heirloom dolls. But the fhigh-end dolls based on fictionnal line HES Pofesce TmeBy Luchemon and HBS MBs Hde Abelli neard his c basis, but excluded all financing charges. Some elements of the cash flow forecasts were prepared e necessary adjustments were welll understood trends. These dolls targeted girls in the so-called "tween" age range of 8-12 years, and also were heirloom dolls, celebrity dolls also came with mon stories from treasury analysts and accessories. by division staff New Heritage outsourced much of its production to a select number of contract manufacturers in. Asia To ensure product quality and safety, the company maintained New Heritage assigned discount rates to projects according to a subjective assessment of each project's risk High-, medium, and low-risk categories for each division were associated with a fulltime staff to oversee Mauftig it tat uini aie toler prunrigt r ith llthe crorrorate treasune Assessments of arh proi t's risk wene made at the division level but subiest to review by the capital committee. Factors considered the assessment of a project's risk included, for -house at the creative elements (design and product prototyping, for example),, were handled company's headquarters facilities in Sacramento, California e and hence bigh hreakees arvltion wolume the sancitivity recession, the anticipated degree of price competition, and so forth. 2010, "medium"-risk projects Capital Budgeting at New Heritage el 9 m d 7.2 enfi scount rate of 84 %. High and low-risk projects were .retained some of the informality that characterized the the company grew, deliberate steps were taken to decentralize some of the project approval process and increase spending authority at the division New capital budgeting company's carly years as an innovative startup.. Projects that created value indefinitely, given continuing investment, were treate concerns with a perpetual life That is, NPV calculations included a terminal value computed as the value of a perpetuity growing at a constant rate. However preserve an element of conservatism, than New capital budgeting committee consisting of the CEO, CFO, coo, the controller, and the division presidents. The committee examined projects for consistency with New Heritage's business strategy Heritage's historical growth and lower than near-term growth forecasts for a given division. organizational constraints, The committce also sought to understand proicct interdenendencics and the potential for a given investment to strengthen the whole company, not solely the division proposing it Investment Opportunities in the Production Division Emily Harris was focused on two of the production division's most attractive current proposals. ha in tum squght input from each of the divisions. The capital and operating budgets were linked: historically, the capital budget comprised approximately 15% of the company's EBITDA. The Design Your Own Doil line, which employed web-based doll-design software to let users "customize" a doll's features to the customer's specifications of the .cditigns ali f th i t nruit dmcand l id Match My Doll Clothing Line Expansion Before being considered by the committoe self-contained proposal documents prepared by each division. These contained business descriptions, at least five years of operating and cash flow forecasts, spending requirements by asset key proiect risks and milestones. vere described, analyzed, and mmarized in The Match My Doll Clothing line originally oconsisted of a few sets clothing and accessories for warm weather. It quickly became successful after the daughters of a few matching doll and child calculations standard investment metrics, and identification of included some of the line in "what's hot to wear" sections. Given recent publicity, Marcy McAdams, the brand manager responsible- r the line, believed the timing was perfect to expand. Specifically, Financial Analyses f the year. She expected the new offerings to be at least as profitable as the existing line, maintain premium prices. She also hoped to seasons Since its current popularity would make it possible Dcrating manargra Rovenuc proicctions were derivod from fororasts of future priccs and volumes. Fixed and variable costs were estimated separately, by expense category. Forecasts capital requiremnents were likewise vetted by line managers, who paid particular attention to a working tried to smooth their capacity utilization. In the same fashion, McAdams argued the expansion would. help reduce, or at least not exacerbate, the scasonality in New Heritage's sales and carnings. related depreciation charges were developed in cooperation with analysts reporting to the controller. To exploit the current popularity of the original Match My Doll Clotling line, especially given the fickle nature of children's fashion trends, McAdams believed the opportunity had to e exploited Operating projections for a given project were used to develop cash flow forecasts that would underpin calculations of net present value (NPV), internal rates of return (IRR), payback period, and other investmer firm's cash flow for e the foecast pariod Tht depreciation charges, and non oloat sue s ar wodld be ncurrea regaraless of whethera given and marketing to maximize the probability of quick acceptance and longer-term success for the follow-on line. Upfront investment expenditures are summarized in Table 2. project's cash flow forecasts excluded non-cash items, such The web-based software tools and order entry system required New Heritage to make significant modifications to its existing technology infrastructure, expand its webhosting capacity, and modify Table 2 Match My Doll Clothing Extension Outlays Initial Expenditures (S thousandsh Upfront R&D 2010 625 majority of the R&D expenditures shown below were related to software development, hardware upgrades, and web design. The development time involved, including product testing, was expected. king Capital hoccurred in 20 some are Properly, Plant & Equipment Total 147 $3.520 sumunarized in Table 3. Table 3 Design Your Own Doll Outlays The R&D and marketing expenditures would be deductible for tax purposes at New Heritage's 40% corporate tax rate. The property, plant and equipment was expected to have a useful life of 10 itures (S thousands) 2011 RD 841 accelerated cost recovery system ("MACRS") allowed by the IRS. Warking capital requinements, shown in Table 2 for 2010 and in Exhibit 1 for subsequent years were based largely on recent Upfront Marketing 360 et in Working Capilal :Equipment $1,00 $4610 S 5.811 of Match Mu Dall Clothing, Haris believed theproiect entailed moderate riskhat is abut te se degree of risk as the production division's existing business as a whole. Total $1,000 Manufactt My d to he ordernd hy ad of 2010 neady t beginning of 2012. While New Heritage had the option to pay for custom equipment in quarterly Figures in Table 3 and Ebibit t th di h n i aulo. Design Your Own Doll This initiative targeted existing New Heritage customers, many of whom owned several of the company's heirloom dolls. The company's rescarch showed that, when asked what features (e.g, nhad a bigh corelation with their cwn nermal da hat girs wanted dlls like forecasted level of sales, substantial investment in working capital (primarily work in process themselves. Further research suggested that many loyal customers would purchase yet another doll cuinment would baye to be nurchased and installed no later than 2014 In vears 2015 and folloing evisting oalloction of dolls It also promisd to ineroare the gil's prido in and idontifiantionwh ha f the girl's participation in ureating the dol. investments in working capital and equipment would revert to patterns familiar from the production division's traditional lines of dolls their shared features and because doll, both because This in turn further cemented customer loyalty. To complete development work, Holtz planned to use some of the company's existing IT staff. The The customization process would begin with a new section of New Heritage's website, where fully loaded costs are shown Table 4. These costs were not included by Holtz in the initial outlays shown in Table 3 or in the forecasts presented in Exhibit 2 The development personnel Holtz work on the color, hair length & style, skin color, eye shape, eye color, and other facial features. The software were considered "corporate" resoure were alm t certainly available project different aspects. The software made it casy to try out different combinations of features and accessories before making a purchase. Table 4 Design Yaur Own Doll Development Personnel, (S 000s) Application Development Fersonnel Costs: Web Application Developers Database Manager Number Salary Total Elizabeth Holtz, brand manager for heirloom dolls, was very excited about the project. She 130 150 Fither way haing your doll iook more like a i roally na l d experience: exploring the website. naming the doll-tu-be, selecting her firsi outit...even the anticipation of waiting for the new doll to arrive. Ireally think this is big. Holtz also believed that 160 160 125 Total C alion Specialist custom doll she said. Market research with focus groups revealed significant enthusiasm for the product concept and supported the notion of premium prices Finally, Holtz needed to give Harris her assessment the project's riskiness. On the one hand, the manufacturing process ard denend on nearflaless operation of new customer.facing software and user interfaces. If the project stumbled for some reason, New Heritage risked damaging However, even a limited degree customization increased manufacturing cumplexity and tio and it nlaved were exncted to be relatizelz high expected to be high. Consouentiy the breakevenYolume for the it was also the company's key strength cTeating a unigue xpcricnce for its consumers New Heritage Dall Company: Capital Budgeting |4212 Harris's Decision Emily Harris still needed to complete her review and financial analysis of the two proposals. McA a a t o s and both had ottered t roieticns operating details, or anything else. Harris expected that she would indeed have some follow-up closely. It had to be well-supported. 40 HARVARD BUSINESS SCHOOLI BRIEFCASES Exhibit 1 Selected Op manndor ixhibit 2 Selected Op Capital Expenditures New Heritage Doll Company: Capital Budgeting Teaching Note TN Exhibit 1 NPV Analysis for Match My Doll Clothing Line Extension 2012 2010 2011 2013 2014 2015 2016 2017 2018 2019 2020 6,000 Revenue 14.360 20.222 21.435 22.721 24.084 25.529 27.061 28,685 6.0 % 6 000 Revenue Growth NA 139 3% 40 8% 6.0% 60% 6 0% 6.0% Produetion Costs 1,858 1.931 1,650 1,683 1,717 1,751 1.786 1,822 1,895 dditionl dal 435 ... Variable Production Costs 2,250 7,65 11,427 12,182 12,983 13,833 14.736 15.694 16,712 Depreciation 0 310 310 310 43 462 490 520 584 18.140 Total Production Costs 435 4.210 9.644 13.454 14.369 15,231 16.145 17.113 19,229 1,201 Selling, General & Administrative 1,240 2,922 4,044 4,287 4,544 4,817 5,106 5,412 5,737 - 18.65 Total Operating Expenses 1,201 435 5,450 12,566 19.77 20.962 22,219 Operating Profit (1,201) (435) 550 1,794 2.779 2,946 3,123 3,310 3.719 2,724 3,508 Opemting Profit/Sales 0.092 0.130 0.130 0.125 0.135 0.130 0.13C 0.130 0.130 SG&A/Sales 0.207 0.203 0.200 0.200 0.200 0.200 0.200 0.200 0.200 Capital Fxpenditares Growth in capex 4.610 310 310 2.192 826 875 928 983 L043 105 6.0 % 62.3 % 0.0% 607.6 % 6.0% 6.0% 6.0% 6.0 % 20 2012 20 C king Capital Accounts 2010 2017 201 Accounts Receivable 973 2328 275 3475 3683 3904 4139 1387 4650 Inverntory T130 T197 1269 002 342 1420 2267 Accounts Payable Proposed Approach NPV Analysis Notes these are cash dows so watch the signs! 2020 2013 Free Cash Flows 2011 2013 014 2015 201 2011 2018 2019 2010 EBITI4 Opemting pofit adjusted r taxes iation Caleulated the change in working capital from period to period less ANWC less capital expenditures Given 3.00 % How do we calculate terminal value Clue use 2020 FCF, add growth te and discount back Initial Outlays Net oonerty, plant & equipment Given in the case Discount factor Given: decide medium or high risk; discount mie tables Present value Calculation Net Present Value NPV witheut Terminal Value Need to input formala input formmala IRR Analysis Cash Flews same as used above Noed to innat formla IRR Payback Analysis same as used above Cash flows Cumalative cash flow calculate es it switch fom negative to positive? Payback period 5-year Cumalative FRITDA Need to innut formala Profitability Index Nand to innut fomle NPV/Initial Investment New Heritage Doll Company: Capital Budgeting Teaching Noto TN Exhibit 1 NPV Analysis for Match My Doll Clothing Line Extension 2010 013 201 014 201s 2010 2017 201 01 2013 Revenu 8 0% Revenue Growth NA 52.4% 0% 8.0% 8.0% 8.0% .. Preduction Casts Fixed Productiom Expenss (excl depreciation) Stional dexelonment cogs (IT neronnel) 641 STs 587 598 61 623 635 66 674 0 Variable Poduction Cota ,65: 2,035 3,404 4.29 1 66 5.078 5,521 6,000 6,519 7 079 Depreciation 132 - - - - etion Costr .102 Selling, General & Administrative 1,250 1.155 1.735 27 2,452 2648 2.860 3.089 3.31 3,603 Total Operating Expenses 1.250 3917 5866 7.13 ,690 8305 8.969 9.687 10 467 11 299 12.203 1 s0 Operating Profit (1,250) 994 1,623 ,753 1.893 2.045 2 285 Operating Profit/Sales D.15: Q130 0,145 0.15 a.153 0,153 015 153 0,155 0.15 GkA/Sules 0257 0.253 ,250 0.25 0250 0250 0,250 0.250 250% 0.250 Capital Expenditues 1470 952 152 153 36 389 42 45 530 Growh in capex -35.2 % -84.0% 0.0% 119 3% 80% 8,0% 8.0% 8.0% 060 Warking Capltal Accounts 2010 201 201 422 Accounts Receivable Inventory 25 112 363 472 1590 1717 855 003 163 2336 427 530 590 401 Accounts Payable 84 393 47 802 71 41 1010 Proposed Approa ch NPV Analysis Notes warch the em these are cadh Bews Free Cash Flows 013 2017 011 2010 011 014 2015 2016 015 2020 Operating peofit adjusted fe taxes EBIT(14) plus depreciation Given ulated the change in working capital from period to period smital exeeadicupes Free Cash How Teminal value 3.00% we calculate tenminal value add guth rale ua 2020 P dispount back Initial Qutlav working capital Given in the caso in the case epropecty, plant & equipmem Discount factor Given: decide medium or high risk; discoumt ate tables Prewnt Velue ad ta innul formula NPV without Terminal Valud input formula Need IRR Analysis s used above Cah Flows same Need innut Gemule IRR Payback Analysis above cash ow Payhack period where does it witch from segative to poative? Sar Cunulative EBITDA Need to innl formule Profitability Index NVInitial Invesment New Heritage Dolls BRIEF CASES The New Heritage Doll Company was founded in 1985 by Ingrid Beckwith, a retired psychologist 42 the dolls produced by the major toy companies did little to develop girls imagination or foster a SEPEMBER TIMOTUY LUAN dichd images portrayed by the popular dolls of the day. HEIDE ABL1D y2009, New Heritage had grown to 450 employees and generated approximately $245 million of revenue and $27 million of operating profit from three divisions: production, retailing, and licensing. New Heritage Doll Company Capital Budgeting The retailing division offered a unique "intergenerational experience" for grandmothers, mothers and daughters, centered uporn the character histories and storylines of the company's dolls and stores (25%). In fiscal 2009, the retailing division generated roughly S190 million of revenue and $4.8 In mid-September of 2010, Emily Harris, vice president of New Heritage Doll Company's production division, was weighing pruject proposals f milbon ot operating protit hceg divn was sLanEd 99, dnd represnta e the company's upcoming capital budgeting capitalize on high levels of customer loyalty by selectively licensing the ampany's doll characters innovative product lines and rive futur enuth Howyer e ta ntrat n financial and managerial resources, Harris knew it was possible that the firm's capital budgeting committee would wuld promotemeling nroits of their wn Conseuentl Harris bad to be prenared tn aperating profit. recommend one of her projects over the other. New Heritage's Production Division The Doll Industry Production was New Heritage's largest division measured by total assets, and casily its most ... rasre bu d E 1 were projecie video games (48% ) and traditional toys and games (52 % ) , The second segment was further divided division, with the remaining 25 % comprising private label goods manufactured f Table 1 summarizes the division's various sources of revenue and operating income. other firms. Table 1 The US. market for toys and games was dominated by large global enterprises that enjoyed. ghly seasonal; the Private Label New Heritage Total Production Division Data: Dolls Accessories Dolls Accessories larast sellingsaon in theinid Secciddwith the rinr bday nri $123 0: Operating Income (S millions) 4.4 05 2: $75 Within the toy and game segment, U.S. retail sales of dolls totaled $3.1 billion in 2008 and were projected to grow by 3 % per year to $36 billion by 2013. The doll category included large, soft, and points, targetinE eirls hetwoen the ages of 3 and 12 vears. The compan's babu dolls uore aapllar priced from $15-S30, and were offered to younger girls in earlier stages of development. These dolls lder girls-reduced growth in the "baby-dol" sub-segment. Competition among doll producers was dolls through the same media. Lastine franchise value for a branded line of dolls was rare: the enormous success of Barble dolls was an obvious exception More recently and on a much snaller cateeory incornorated technolory that produced a imited amount of speech and motion, For the 575-$150 price range, New Heritage produced a line of heirloom-quality dolls and accessories. These wrandmothers mth an dauhtersThe heirim dolls had mone ara acori and personal histories. Finally, the company offered "celebrities," each associated with a charitable cause and embracing more contemporary fashion. nonularit allin waned after a few ve chise for its line of heirloom dolls. But the fhigh-end dolls based on fictionnal line HES Pofesce TmeBy Luchemon and HBS MBs Hde Abelli neard his c basis, but excluded all financing charges. Some elements of the cash flow forecasts were prepared e necessary adjustments were welll understood trends. These dolls targeted girls in the so-called "tween" age range of 8-12 years, and also were heirloom dolls, celebrity dolls also came with mon stories from treasury analysts and accessories. by division staff New Heritage outsourced much of its production to a select number of contract manufacturers in. Asia To ensure product quality and safety, the company maintained New Heritage assigned discount rates to projects according to a subjective assessment of each project's risk High-, medium, and low-risk categories for each division were associated with a fulltime staff to oversee Mauftig it tat uini aie toler prunrigt r ith llthe crorrorate treasune Assessments of arh proi t's risk wene made at the division level but subiest to review by the capital committee. Factors considered the assessment of a project's risk included, for -house at the creative elements (design and product prototyping, for example),, were handled company's headquarters facilities in Sacramento, California e and hence bigh hreakees arvltion wolume the sancitivity recession, the anticipated degree of price competition, and so forth. 2010, "medium"-risk projects Capital Budgeting at New Heritage el 9 m d 7.2 enfi scount rate of 84 %. High and low-risk projects were .retained some of the informality that characterized the the company grew, deliberate steps were taken to decentralize some of the project approval process and increase spending authority at the division New capital budgeting company's carly years as an innovative startup.. Projects that created value indefinitely, given continuing investment, were treate concerns with a perpetual life That is, NPV calculations included a terminal value computed as the value of a perpetuity growing at a constant rate. However preserve an element of conservatism, than New capital budgeting committee consisting of the CEO, CFO, coo, the controller, and the division presidents. The committee examined projects for consistency with New Heritage's business strategy Heritage's historical growth and lower than near-term growth forecasts for a given division. organizational constraints, The committce also sought to understand proicct interdenendencics and the potential for a given investment to strengthen the whole company, not solely the division proposing it Investment Opportunities in the Production Division Emily Harris was focused on two of the production division's most attractive current proposals. ha in tum squght input from each of the divisions. The capital and operating budgets were linked: historically, the capital budget comprised approximately 15% of the company's EBITDA. The Design Your Own Doil line, which employed web-based doll-design software to let users "customize" a doll's features to the customer's specifications of the .cditigns ali f th i t nruit dmcand l id Match My Doll Clothing Line Expansion Before being considered by the committoe self-contained proposal documents prepared by each division. These contained business descriptions, at least five years of operating and cash flow forecasts, spending requirements by asset key proiect risks and milestones. vere described, analyzed, and mmarized in The Match My Doll Clothing line originally oconsisted of a few sets clothing and accessories for warm weather. It quickly became successful after the daughters of a few matching doll and child calculations standard investment metrics, and identification of included some of the line in "what's hot to wear" sections. Given recent publicity, Marcy McAdams, the brand manager responsible- r the line, believed the timing was perfect to expand. Specifically, Financial Analyses f the year. She expected the new offerings to be at least as profitable as the existing line, maintain premium prices. She also hoped to seasons Since its current popularity would make it possible Dcrating manargra Rovenuc proicctions were derivod from fororasts of future priccs and volumes. Fixed and variable costs were estimated separately, by expense category. Forecasts capital requiremnents were likewise vetted by line managers, who paid particular attention to a working tried to smooth their capacity utilization. In the same fashion, McAdams argued the expansion would. help reduce, or at least not exacerbate, the scasonality in New Heritage's sales and carnings. related depreciation charges were developed in cooperation with analysts reporting to the controller. To exploit the current popularity of the original Match My Doll Clotling line, especially given the fickle nature of children's fashion trends, McAdams believed the opportunity had to e exploited Operating projections for a given project were used to develop cash flow forecasts that would underpin calculations of net present value (NPV), internal rates of return (IRR), payback period, and other investmer firm's cash flow for e the foecast pariod Tht depreciation charges, and non oloat sue s ar wodld be ncurrea regaraless of whethera given and marketing to maximize the probability of quick acceptance and longer-term success for the follow-on line. Upfront investment expenditures are summarized in Table 2. project's cash flow forecasts excluded non-cash items, such The web-based software tools and order entry system required New Heritage to make significant modifications to its existing technology infrastructure, expand its webhosting capacity, and modify Table 2 Match My Doll Clothing Extension Outlays Initial Expenditures (S thousandsh Upfront R&D 2010 625 majority of the R&D expenditures shown below were related to software development, hardware upgrades, and web design. The development time involved, including product testing, was expected. king Capital hoccurred in 20 some are Properly, Plant & Equipment Total 147 $3.520 sumunarized in Table 3. Table 3 Design Your Own Doll Outlays The R&D and marketing expenditures would be deductible for tax purposes at New Heritage's 40% corporate tax rate. The property, plant and equipment was expected to have a useful life of 10 itures (S thousands) 2011 RD 841 accelerated cost recovery system ("MACRS") allowed by the IRS. Warking capital requinements, shown in Table 2 for 2010 and in Exhibit 1 for subsequent years were based largely on recent Upfront Marketing 360 et in Working Capilal :Equipment $1,00 $4610 S 5.811 of Match Mu Dall Clothing, Haris believed theproiect entailed moderate riskhat is abut te se degree of risk as the production division's existing business as a whole. Total $1,000 Manufactt My d to he ordernd hy ad of 2010 neady t beginning of 2012. While New Heritage had the option to pay for custom equipment in quarterly Figures in Table 3 and Ebibit t th di h n i aulo. Design Your Own Doll This initiative targeted existing New Heritage customers, many of whom owned several of the company's heirloom dolls. The company's rescarch showed that, when asked what features (e.g, nhad a bigh corelation with their cwn nermal da hat girs wanted dlls like forecasted level of sales, substantial investment in working capital (primarily work in process themselves. Further research suggested that many loyal customers would purchase yet another doll cuinment would baye to be nurchased and installed no later than 2014 In vears 2015 and folloing evisting oalloction of dolls It also promisd to ineroare the gil's prido in and idontifiantionwh ha f the girl's participation in ureating the dol. investments in working capital and equipment would revert to patterns familiar from the production division's traditional lines of dolls their shared features and because doll, both because This in turn further cemented customer loyalty. To complete development work, Holtz planned to use some of the company's existing IT staff. The The customization process would begin with a new section of New Heritage's website, where fully loaded costs are shown Table 4. These costs were not included by Holtz in the initial outlays shown in Table 3 or in the forecasts presented in Exhibit 2 The development personnel Holtz work on the color, hair length & style, skin color, eye shape, eye color, and other facial features. The software were considered "corporate" resoure were alm t certainly available project different aspects. The software made it casy to try out different combinations of features and accessories before making a purchase. Table 4 Design Yaur Own Doll Development Personnel, (S 000s) Application Development Fersonnel Costs: Web Application Developers Database Manager Number Salary Total Elizabeth Holtz, brand manager for heirloom dolls, was very excited about the project. She 130 150 Fither way haing your doll iook more like a i roally na l d experience: exploring the website. naming the doll-tu-be, selecting her firsi outit...even the anticipation of waiting for the new doll to arrive. Ireally think this is big. Holtz also believed that 160 160 125 Total C alion Specialist custom doll she said. Market research with focus groups revealed significant enthusiasm for the product concept and supported the notion of premium prices Finally, Holtz needed to give Harris her assessment the project's riskiness. On the one hand, the manufacturing process ard denend on nearflaless operation of new customer.facing software and user interfaces. If the project stumbled for some reason, New Heritage risked damaging However, even a limited degree customization increased manufacturing cumplexity and tio and it nlaved were exncted to be relatizelz high expected to be high. Consouentiy the breakevenYolume for the it was also the company's key strength cTeating a unigue xpcricnce for its consumers New Heritage Dall Company: Capital Budgeting |4212 Harris's Decision Emily Harris still needed to complete her review and financial analysis of the two proposals. McA a a t o s and both had ottered t roieticns operating details, or anything else. Harris expected that she would indeed have some follow-up closely. It had to be well-supported. 40 HARVARD BUSINESS SCHOOLI BRIEFCASES Exhibit 1 Selected Op manndor ixhibit 2 Selected Op Capital Expenditures New Heritage Doll Company: Capital Budgeting Teaching Note TN Exhibit 1 NPV Analysis for Match My Doll Clothing Line Extension 2012 2010 2011 2013 2014 2015 2016 2017 2018 2019 2020 6,000 Revenue 14.360 20.222 21.435 22.721 24.084 25.529 27.061 28,685 6.0 % 6 000 Revenue Growth NA 139 3% 40 8% 6.0% 60% 6 0% 6.0% Produetion Costs 1,858 1.931 1,650 1,683 1,717 1,751 1.786 1,822 1,895 dditionl dal 435 ... Variable Production Costs 2,250 7,65 11,427 12,182 12,983 13,833 14.736 15.694 16,712 Depreciation 0 310 310 310 43 462 490 520 584 18.140 Total Production Costs 435 4.210 9.644 13.454 14.369 15,231 16.145 17.113 19,229 1,201 Selling, General & Administrative 1,240 2,922 4,044 4,287 4,544 4,817 5,106 5,412 5,737 - 18.65 Total Operating Expenses 1,201 435 5,450 12,566 19.77 20.962 22,219 Operating Profit (1,201) (435) 550 1,794 2.779 2,946 3,123 3,310 3.719 2,724 3,508 Opemting Profit/Sales 0.092 0.130 0.130 0.125 0.135 0.130 0.13C 0.130 0.130 SG&A/Sales 0.207 0.203 0.200 0.200 0.200 0.200 0.200 0.200 0.200 Capital Fxpenditares Growth in capex 4.610 310 310 2.192 826 875 928 983 L043 105 6.0 % 62.3 % 0.0% 607.6 % 6.0% 6.0% 6.0% 6.0 % 20 2012 20 C king Capital Accounts 2010 2017 201 Accounts Receivable 973 2328 275 3475 3683 3904 4139 1387 4650 Inverntory T130 T197 1269 002 342 1420 2267 Accounts Payable Proposed Approach NPV Analysis Notes these are cash dows so watch the signs! 2020 2013 Free Cash Flows 2011 2013 014 2015 201 2011 2018 2019 2010 EBITI4 Opemting pofit adjusted r taxes iation Caleulated the change in working capital from period to period less ANWC less capital expenditures Given 3.00 % How do we calculate terminal value Clue use 2020 FCF, add growth te and discount back Initial Outlays Net oonerty, plant & equipment Given in the case Discount factor Given: decide medium or high risk; discount mie tables Present value Calculation Net Present Value NPV witheut Terminal Value Need to input formala input formmala IRR Analysis Cash Flews same as used above Noed to innat formla IRR Payback Analysis same as used above Cash flows Cumalative cash flow calculate es it switch fom negative to positive? Payback period 5-year Cumalative FRITDA Need to innut formala Profitability Index Nand to innut fomle NPV/Initial Investment New Heritage Doll Company: Capital Budgeting Teaching Noto TN Exhibit 1 NPV Analysis for Match My Doll Clothing Line Extension 2010 013 201 014 201s 2010 2017 201 01 2013 Revenu 8 0% Revenue Growth NA 52.4% 0% 8.0% 8.0% 8.0% .. Preduction Casts Fixed Productiom Expenss (excl depreciation) Stional dexelonment cogs (IT neronnel) 641 STs 587 598 61 623 635 66 674 0 Variable Poduction Cota ,65: 2,035 3,404 4.29 1 66 5.078 5,521 6,000 6,519 7 079 Depreciation 132 - - - - etion Costr .102 Selling, General & Administrative 1,250 1.155 1.735 27 2,452 2648 2.860 3.089 3.31 3,603 Total Operating Expenses 1.250 3917 5866 7.13 ,690 8305 8.969 9.687 10 467 11 299 12.203 1 s0 Operating Profit (1,250) 994 1,623 ,753 1.893 2.045 2 285 Operating Profit/Sales D.15: Q130 0,145 0.15 a.153 0,153 015 153 0,155 0.15 GkA/Sules 0257 0.253 ,250 0.25 0250 0250 0,250 0.250 250% 0.250 Capital Expenditues 1470 952 152 153 36 389 42 45 530 Growh in capex -35.2 % -84.0% 0.0% 119 3% 80% 8,0% 8.0% 8.0% 060 Warking Capltal Accounts 2010 201 201 422 Accounts Receivable Inventory 25 112 363 472 1590 1717 855 003 163 2336 427 530 590 401 Accounts Payable 84 393 47 802 71 41 1010 Proposed Approa ch NPV Analysis Notes warch the em these are cadh Bews Free Cash Flows 013 2017 011 2010 011 014 2015 2016 015 2020 Operating peofit adjusted fe taxes EBIT(14) plus depreciation Given ulated the change in working capital from period to period smital exeeadicupes Free Cash How Teminal value 3.00% we calculate tenminal value add guth rale ua 2020 P dispount back Initial Qutlav working capital Given in the caso in the case epropecty, plant & equipmem Discount factor Given: decide medium or high risk; discoumt ate tables Prewnt Velue ad ta innul formula NPV without Terminal Valud input formula Need IRR Analysis s used above Cah Flows same Need innut Gemule IRR Payback Analysis above cash ow Payhack period where does it witch from segative to poative? Sar Cunulative EBITDA Need to innl formule Profitability Index NVInitial Invesment