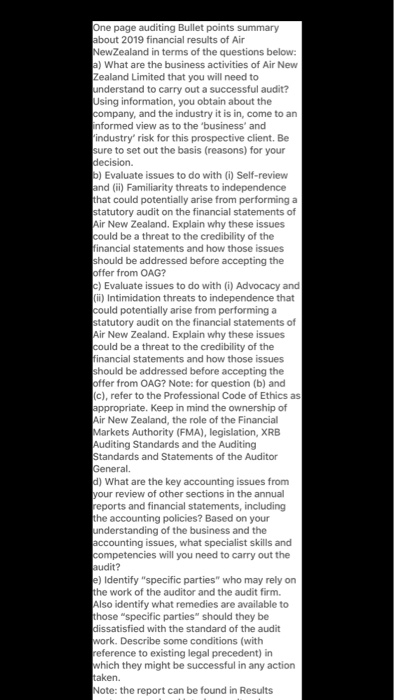

What are the business activities of Air New Zealand Limited that you will need to understand to carry out a successful audit? Using information, you obtain about the company, and the industry it is in, come to an informed view as to the business and industry risk for this prospective client. Be sure to set out the basis (reasons) for your decision

One page bullet points summary about 2019 financial results of Air New Zealand, from audit point.Could you make the bullet point summary which contains the answers to questions in last photo.

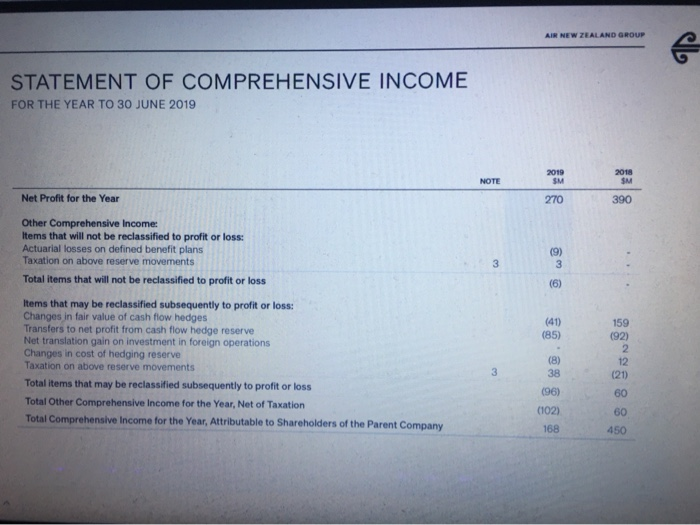

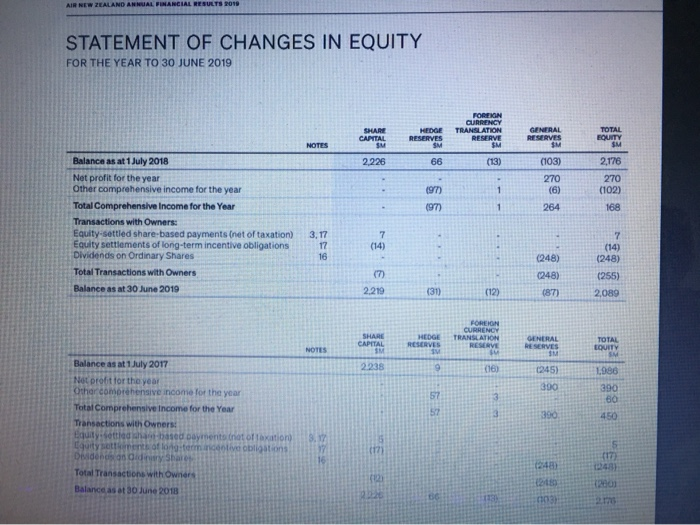

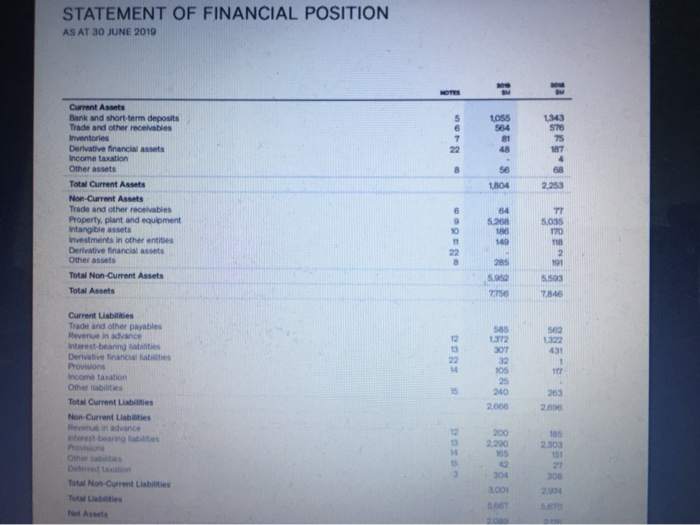

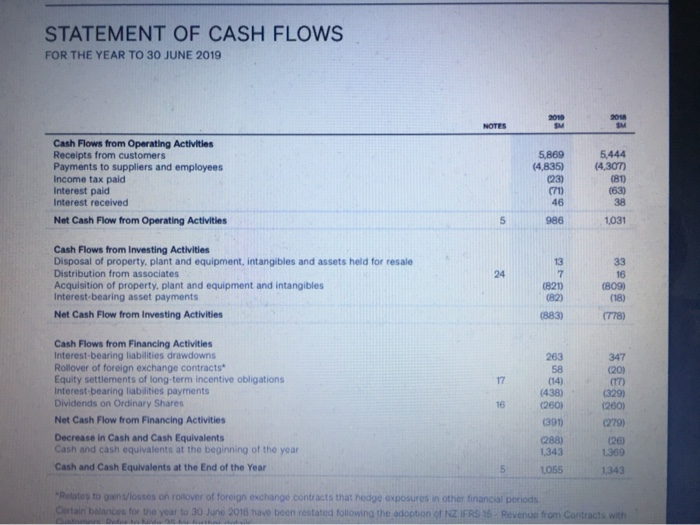

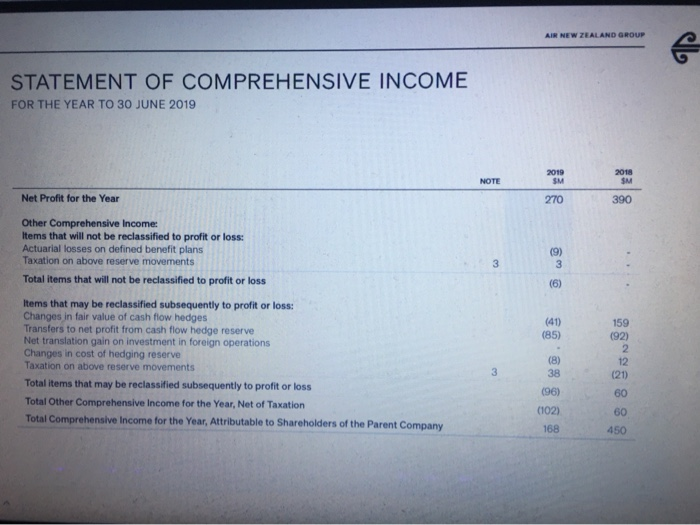

AIR NEW ZEALAND GROUP STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR TO 30 JUNE 2019 2019 SM 2018 SM NOTE Net Profit for the Year 270 390 3 (9) 3 (6) Other Comprehensive Income: Items that will not be reclassified to profit or loss: Actuarial losses on defined benefit plans Taxation on above reserve movements Total items that will not be reclassified to profit or loss Items that may be reclassified subsequently to profit or loss: Changes in fair value of cash flow hedges Transfers to net profit from cash flow hedge reserve Net translation gain on investment in foreign operations Changes in cost of hedging reserve Taxation on above reserve movements Total items that may be reclassified subsequently to profit or loss Total Other Comprehensive Income for the Year, Net of Taxation Total Comprehensive Income for the Year, Attributable to Shareholders of the Parent Company (41) (85) 159 (92) 2 12 (21) (8) 38 3 60 (96) (102) 168 60 450 AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 2019 STATEMENT OF CHANGES IN EQUITY FOR THE YEAR TO 30 JUNE 2019 SHARE CAPITAL SM HEDGE RESERVES SM FOREKON CURRENCY TRANSLATION RESERVE SM GENERAL RESERVES SM TOTAL FOUNITY SM NOTES 2.226 66 (13) .- (103) 270 (6) 264 2,176 270 (102) 168 197 (97) 1 Balance as at 1 July 2018 Net profit for the year Other comprehensive income for the year Total Comprehensive Income for the Year Transactions with Owners: Equity-settled share-based payments (net of taxation) Equity settlements of long-term incentive obligations Dividends on Ordinary Shares Total Transactions with Owners Balance as at 30 June 2010 3,17 12 16 (14) (248) (248) (87) 7 (14) (248) (255) 2,089 2.219 (31) (12) FOREIGN CURRENCY TRANSLATION RESERVE HEDGE RESERVES IV SHARE CAPITAL SM 2238 TOTAL EQUITY NOTES GENERAL RESERVES IM 9 (16) 0245) 300 1986 390 80 57 57 390 450 Balance as at 1 July 2017 Not profit for the year Other comprehensive income for the year Total Comprehensive income for the Year Transactions with Owners Equity - Daynents not Taxation gutytents of terminative obligations Dideos Share Total Transactions with Owners Balance as at 30 June 2013 3.17 tra (248) 21 2002 03 STATEMENT OF FINANCIAL POSITION AS AT 30 JUNE 2019 5 LOSS 7 22 81 48 1,343 570 75 187 4 68 2.253 8 56 1804 Current Assets Bank and short-term deposits Trade and other receivables Inventories Derivative financial assets Income taxation Other assets Total Current Assets Non-Current Assets Trade and other receivables Property, plant and equipment Intangible assets Investments in other entities Derivative financial assets Other assets Total Non-Current Assets Total Assets 6 9 10 11 64 5.258 TT 5.035 170 18 2 191 149 285 5.95 7750 5.593 7840 585 1372 307 Current abilities Trade and other payables Revenue in advance Interest-bearing tabi Derivative financial lates Provisions income taxation Other abilities Total Current Liabilities Non-Current Liabilities Revenue in advance 13 22 14 1322 431 1 177 32 105 25 240 2006 15 263 2.00 12 200 2.200 5 42 185 2.300 151 Total Non-Current Liabilities 38 2.14 3.000 5.667 Met Art STATEMENT OF CASH FLOWS FOR THE YEAR TO 30 JUNE 2019 2010 SM NOTES SM Cash Flows from Operating Activities Receipts from customers Payments to suppliers and employees Income tax paid Interest paid Interest received Net Cash Flow from Operating Activities 5,869 (4,835) (23) (71) 46 5,444 (4,307) (81) (63) 5 986 1,031 24 Cash Flows from Investing Activities Disposal of property, plant and equipment, intangibles and assets held for resale Distribution from associates Acquisition of property, plant and equipment and intangibles Interest-bearing asset payments Net Cash Flow from Investing Activities 13 7 (821) (82) 33 16 (809) (18) (883) (778) 347 (20) 17 Cash Flows from Financing Activities Interest-bearing liabilities drawdowns Rollover of foreign exchange contracts Equity settlements of long-term incentive obligations Interest-bearing liabilities payments Dividends on Ordinary Shares Net Cash Flow from Financing Activities Decrease in Cash and Cash Equivalents Cash and cash equivalents at the beginning of the year Cash and Cash Equivalents at the End of the Year 16 263 58 (14) (438) (260) (391) (288) 1.343 (329) (260) (279) 126) 1.360 1343 5 1055 Relates to Owostes on rollover of foreign exchange contracts that hedge exposures in other financial periods Cattan balances for the year to 30 June 2018 have been restated following the adoption of NZ IFRS 15 Revenue from Contracts with Du One page auditing Bullet points summary about 2019 financial results of Air New Zealand in terms of the questions below: a) What are the business activities of Air New Zealand Limited that you will need to understand to carry out a successful audit? Using information, you obtain about the company, and the industry it is in, come to an informed view as to the 'business' and 'industry' risk for this prospective client. Be sure to set out the basis (reasons) for your decision. b) Evaluate issues to do with (Self-review and (ii) Familiarity threats to independence that could potentially arise from performing a statutory audit on the financial statements of Air New Zealand. Explain why these issues could be a threat to the credibility of the financial statements and how those issues should be addressed before accepting the offer from OAG? c) Evaluate issues to do with (1) Advocacy and C) Intimidation threats to independence that could potentially arise from performing a statutory audit on the financial statements of Air New Zealand. Explain why these issues could be a threat to the credibility of the financial statements and how those issues should be addressed before accepting the offer from OAG? Note: for question (b) and (c), refer to the Professional Code of Ethics as appropriate. Keep in mind the ownership of Air New Zealand, the role of the Financial Markets Authority (FMA), legislation, XRB Auditing Standards and the Auditing Standards and Statements of the Auditor General d) What are the key accounting issues from your review of other sections in the annual reports and financial statements, including the accounting policies? Based on your understanding of the business and the accounting issues, what specialist skills and competencies will you need to carry out the audit? e) Identify "specific parties" who may rely on the work of the auditor and the audit firm. Also identify what remedies are available to those "specific parties" should they be dissatisfied with the standard of the audit work. Describe some conditions (with reference to existing legal precedent) in which they might be successful in any action taken. Note: the report can be found in Results AIR NEW ZEALAND GROUP STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR TO 30 JUNE 2019 2019 SM 2018 SM NOTE Net Profit for the Year 270 390 3 (9) 3 (6) Other Comprehensive Income: Items that will not be reclassified to profit or loss: Actuarial losses on defined benefit plans Taxation on above reserve movements Total items that will not be reclassified to profit or loss Items that may be reclassified subsequently to profit or loss: Changes in fair value of cash flow hedges Transfers to net profit from cash flow hedge reserve Net translation gain on investment in foreign operations Changes in cost of hedging reserve Taxation on above reserve movements Total items that may be reclassified subsequently to profit or loss Total Other Comprehensive Income for the Year, Net of Taxation Total Comprehensive Income for the Year, Attributable to Shareholders of the Parent Company (41) (85) 159 (92) 2 12 (21) (8) 38 3 60 (96) (102) 168 60 450 AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 2019 STATEMENT OF CHANGES IN EQUITY FOR THE YEAR TO 30 JUNE 2019 SHARE CAPITAL SM HEDGE RESERVES SM FOREKON CURRENCY TRANSLATION RESERVE SM GENERAL RESERVES SM TOTAL FOUNITY SM NOTES 2.226 66 (13) .- (103) 270 (6) 264 2,176 270 (102) 168 197 (97) 1 Balance as at 1 July 2018 Net profit for the year Other comprehensive income for the year Total Comprehensive Income for the Year Transactions with Owners: Equity-settled share-based payments (net of taxation) Equity settlements of long-term incentive obligations Dividends on Ordinary Shares Total Transactions with Owners Balance as at 30 June 2010 3,17 12 16 (14) (248) (248) (87) 7 (14) (248) (255) 2,089 2.219 (31) (12) FOREIGN CURRENCY TRANSLATION RESERVE HEDGE RESERVES IV SHARE CAPITAL SM 2238 TOTAL EQUITY NOTES GENERAL RESERVES IM 9 (16) 0245) 300 1986 390 80 57 57 390 450 Balance as at 1 July 2017 Not profit for the year Other comprehensive income for the year Total Comprehensive income for the Year Transactions with Owners Equity - Daynents not Taxation gutytents of terminative obligations Dideos Share Total Transactions with Owners Balance as at 30 June 2013 3.17 tra (248) 21 2002 03 STATEMENT OF FINANCIAL POSITION AS AT 30 JUNE 2019 5 LOSS 7 22 81 48 1,343 570 75 187 4 68 2.253 8 56 1804 Current Assets Bank and short-term deposits Trade and other receivables Inventories Derivative financial assets Income taxation Other assets Total Current Assets Non-Current Assets Trade and other receivables Property, plant and equipment Intangible assets Investments in other entities Derivative financial assets Other assets Total Non-Current Assets Total Assets 6 9 10 11 64 5.258 TT 5.035 170 18 2 191 149 285 5.95 7750 5.593 7840 585 1372 307 Current abilities Trade and other payables Revenue in advance Interest-bearing tabi Derivative financial lates Provisions income taxation Other abilities Total Current Liabilities Non-Current Liabilities Revenue in advance 13 22 14 1322 431 1 177 32 105 25 240 2006 15 263 2.00 12 200 2.200 5 42 185 2.300 151 Total Non-Current Liabilities 38 2.14 3.000 5.667 Met Art STATEMENT OF CASH FLOWS FOR THE YEAR TO 30 JUNE 2019 2010 SM NOTES SM Cash Flows from Operating Activities Receipts from customers Payments to suppliers and employees Income tax paid Interest paid Interest received Net Cash Flow from Operating Activities 5,869 (4,835) (23) (71) 46 5,444 (4,307) (81) (63) 5 986 1,031 24 Cash Flows from Investing Activities Disposal of property, plant and equipment, intangibles and assets held for resale Distribution from associates Acquisition of property, plant and equipment and intangibles Interest-bearing asset payments Net Cash Flow from Investing Activities 13 7 (821) (82) 33 16 (809) (18) (883) (778) 347 (20) 17 Cash Flows from Financing Activities Interest-bearing liabilities drawdowns Rollover of foreign exchange contracts Equity settlements of long-term incentive obligations Interest-bearing liabilities payments Dividends on Ordinary Shares Net Cash Flow from Financing Activities Decrease in Cash and Cash Equivalents Cash and cash equivalents at the beginning of the year Cash and Cash Equivalents at the End of the Year 16 263 58 (14) (438) (260) (391) (288) 1.343 (329) (260) (279) 126) 1.360 1343 5 1055 Relates to Owostes on rollover of foreign exchange contracts that hedge exposures in other financial periods Cattan balances for the year to 30 June 2018 have been restated following the adoption of NZ IFRS 15 Revenue from Contracts with Du One page auditing Bullet points summary about 2019 financial results of Air New Zealand in terms of the questions below: a) What are the business activities of Air New Zealand Limited that you will need to understand to carry out a successful audit? Using information, you obtain about the company, and the industry it is in, come to an informed view as to the 'business' and 'industry' risk for this prospective client. Be sure to set out the basis (reasons) for your decision. b) Evaluate issues to do with (Self-review and (ii) Familiarity threats to independence that could potentially arise from performing a statutory audit on the financial statements of Air New Zealand. Explain why these issues could be a threat to the credibility of the financial statements and how those issues should be addressed before accepting the offer from OAG? c) Evaluate issues to do with (1) Advocacy and C) Intimidation threats to independence that could potentially arise from performing a statutory audit on the financial statements of Air New Zealand. Explain why these issues could be a threat to the credibility of the financial statements and how those issues should be addressed before accepting the offer from OAG? Note: for question (b) and (c), refer to the Professional Code of Ethics as appropriate. Keep in mind the ownership of Air New Zealand, the role of the Financial Markets Authority (FMA), legislation, XRB Auditing Standards and the Auditing Standards and Statements of the Auditor General d) What are the key accounting issues from your review of other sections in the annual reports and financial statements, including the accounting policies? Based on your understanding of the business and the accounting issues, what specialist skills and competencies will you need to carry out the audit? e) Identify "specific parties" who may rely on the work of the auditor and the audit firm. Also identify what remedies are available to those "specific parties" should they be dissatisfied with the standard of the audit work. Describe some conditions (with reference to existing legal precedent) in which they might be successful in any action taken. Note: the report can be found in Results