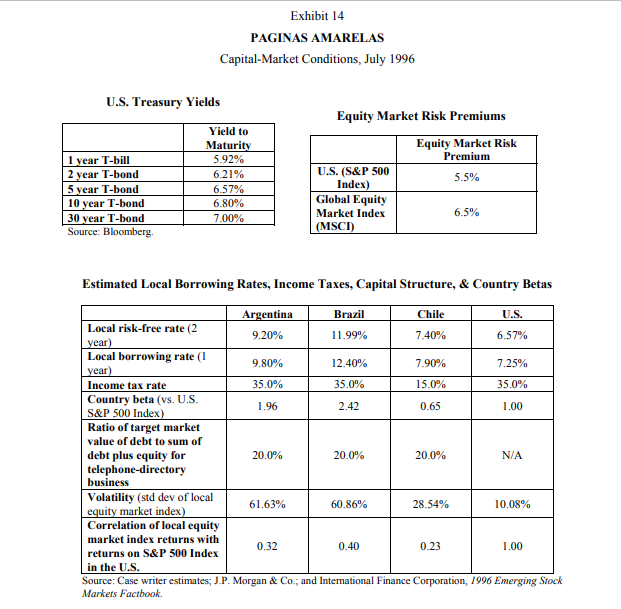

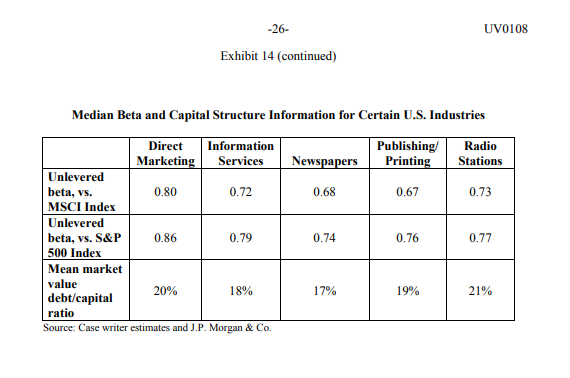

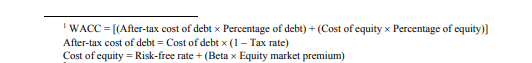

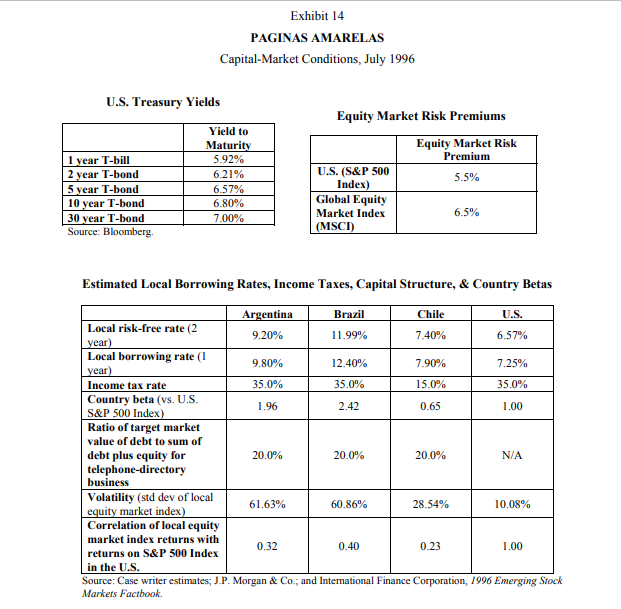

What are the calculations to arrive at the required rates of return (WACC) for the cash flows originating in Argentina, Brazil, and Chile from a local perspective and from a US $ perspective? See data below.

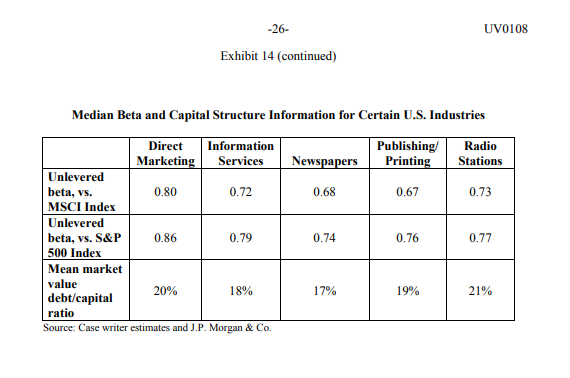

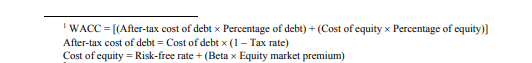

Exhibit 14 PAGINAS AMARELAS Capital Market Conditions, July 1996 U.S. Treasury Yields 1 year T-bill 2 year T-bond 5 year T-bond 10 year T-bond 30 year T-bond Source: Bloomberg. Yield to Maturity 5.92% 6.21% 6.57% 6.80% 7.00% Equity Market Risk Premiums Equity Market Risk Premium U.S. (S&P 500 5.5% Index) Global Equity Market Index 6.5% (MSCI) Estimated Local Borrowing Rates, Income Taxes, Capital Structure, & Country Betas Argentina Brazil Chile U.S. Local risk-free rate (2 9.20% 11.99% 7.40% 6.57% year) Local borrowing rate (1 9.80% 12.40% 7.90% 7.25% year) Income tax rate 35.0% 35.0% 15.0% 35.0% Country beta (vs. U.S. 1.96 2.42 0.65 1.00 S&P 500 Index) Ratio of target market value of debt to sum of debt plus equity for 20.0% 20.0% 20.0% N/A telephone-directory business Volatility std dev of local 61.63% 60.86% 28.54% 10.08% equity market index) Correlation of local equity market index returns with 0.32 0.40 0.23 1.00 returns on S&P 500 Index in the U.S. Source: Case writer estimates, J.P. Morgan & Co., and International Finance Corporation, 1996 Emerging Stock Markets Factbook. -26- UV0108 Exhibit 14 (continued) Median Beta and Capital Structure Information for Certain U.S. Industries Newspapers Publishing Printing Radio Stations 0.68 0.67 0.73 Direct Information Marketing Services Unlevered beta, vs. 0.80 0.72 MSCI Index Unlevered beta, vs. S&P 0.86 0.79 500 Index Mean market value 20% 18% debt/capital ratio Source: Case writer estimates and J.P. Morgan & Co. 0.74 0.76 0.77 17% 19% 21% WACC = [(After-tax cost of debt Percentage of debt) + (Cost of equity ~ Percentage of equity)] After-tax cost of debt Cost of debt x (1 Tax rate) Cost of equity = Risk-free rate +(Beta x Equity market premium) Exhibit 14 PAGINAS AMARELAS Capital Market Conditions, July 1996 U.S. Treasury Yields 1 year T-bill 2 year T-bond 5 year T-bond 10 year T-bond 30 year T-bond Source: Bloomberg. Yield to Maturity 5.92% 6.21% 6.57% 6.80% 7.00% Equity Market Risk Premiums Equity Market Risk Premium U.S. (S&P 500 5.5% Index) Global Equity Market Index 6.5% (MSCI) Estimated Local Borrowing Rates, Income Taxes, Capital Structure, & Country Betas Argentina Brazil Chile U.S. Local risk-free rate (2 9.20% 11.99% 7.40% 6.57% year) Local borrowing rate (1 9.80% 12.40% 7.90% 7.25% year) Income tax rate 35.0% 35.0% 15.0% 35.0% Country beta (vs. U.S. 1.96 2.42 0.65 1.00 S&P 500 Index) Ratio of target market value of debt to sum of debt plus equity for 20.0% 20.0% 20.0% N/A telephone-directory business Volatility std dev of local 61.63% 60.86% 28.54% 10.08% equity market index) Correlation of local equity market index returns with 0.32 0.40 0.23 1.00 returns on S&P 500 Index in the U.S. Source: Case writer estimates, J.P. Morgan & Co., and International Finance Corporation, 1996 Emerging Stock Markets Factbook. -26- UV0108 Exhibit 14 (continued) Median Beta and Capital Structure Information for Certain U.S. Industries Newspapers Publishing Printing Radio Stations 0.68 0.67 0.73 Direct Information Marketing Services Unlevered beta, vs. 0.80 0.72 MSCI Index Unlevered beta, vs. S&P 0.86 0.79 500 Index Mean market value 20% 18% debt/capital ratio Source: Case writer estimates and J.P. Morgan & Co. 0.74 0.76 0.77 17% 19% 21% WACC = [(After-tax cost of debt Percentage of debt) + (Cost of equity ~ Percentage of equity)] After-tax cost of debt Cost of debt x (1 Tax rate) Cost of equity = Risk-free rate +(Beta x Equity market premium)