What are the contractual hedging strategies available to Banbury to reduce the foreign exchange risk exposure and which strategy would you recommend?

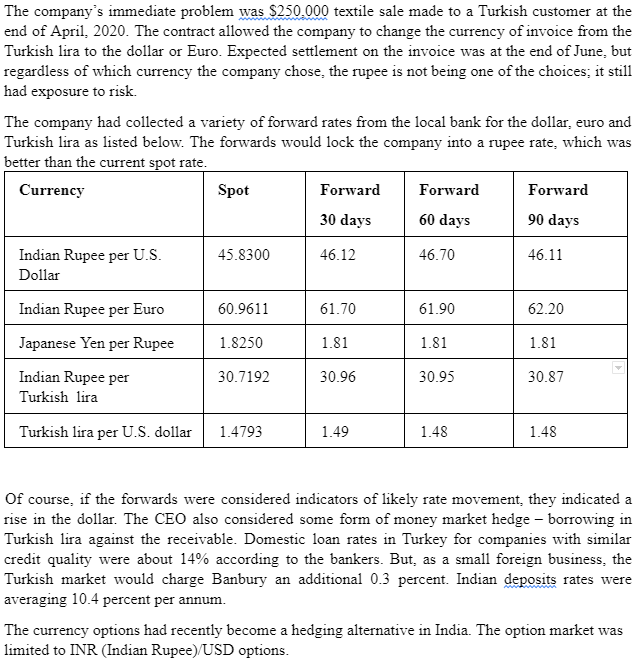

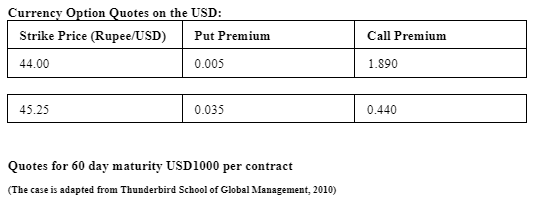

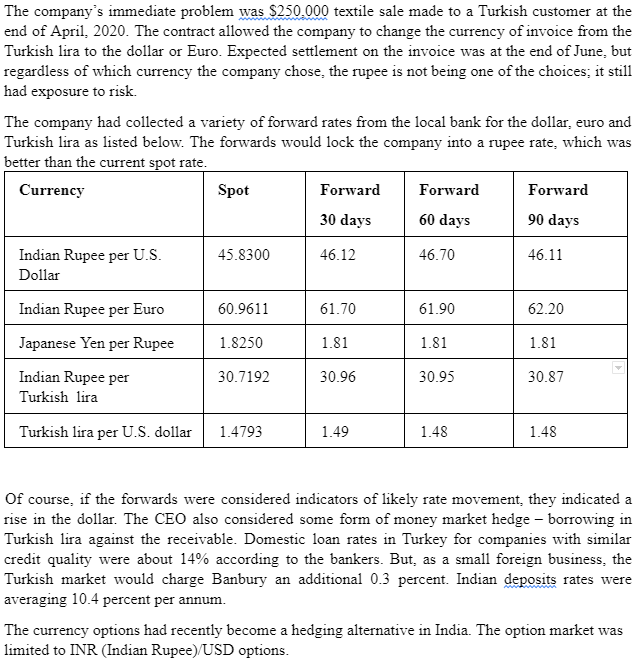

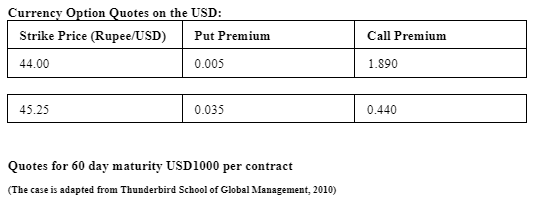

The company's immediate problem was $250.000 textile sale made to a Turkish customer at the end of April, 2020. The contract allowed the company to change the currency of invoice from the Turkish lira to the dollar or Euro. Expected settlement on the invoice was at the end of June, but regardless of which currency the company chose, the rupee is not being one of the choices; it still had exposure to risk The company had collected a variety of forward rates from the local bank for the dollar, euro and Turkish lira as listed below. The forwards would lock the company into a rupee rate, which was better than the current spot rate. Currency Spot Forward Forward Forward 30 days 60 days 90 days 45.8300 46.12 46.70 46.11 Indian Rupee per U.S. Dollar 60.9611 61.70 61.90 62.20 1.8250 1.81 1.81 1.81 Indian Rupee per Euro Japanese Yen per Rupee Indian Rupee per Turkish lira Turkish lira per U.S. dollar 30.7192 30.96 30.95 30.87 1.4793 1.49 1.48 1.48 Of course, if the forwards were considered indicators of likely rate movement, they indicated a rise in the dollar. The CEO also considered some form of money market hedge borrowing in Turkish lira against the receivable. Domestic loan rates in Turkey for companies with similar credit quality were about 14% according to the bankers. But, as a small foreign business, the Turkish market would charge Banbury an additional 0.3 percent. Indian deposits rates were averaging 10.4 percent per annum. The currency options had recently become a hedging alternative in India. The option market was limited to INR (Indian Rupee)/USD options. Currency Option Quotes on the USD: Strike Price (Rupee/USD) Put Premium 44.00 Call Premium 0.005 1.890 45.25 0.035 0.440 Quotes for 60 day maturity USD1000 per contract (The case is adapted from Thunderbird School of Global Management, 2010) The company's immediate problem was $250.000 textile sale made to a Turkish customer at the end of April, 2020. The contract allowed the company to change the currency of invoice from the Turkish lira to the dollar or Euro. Expected settlement on the invoice was at the end of June, but regardless of which currency the company chose, the rupee is not being one of the choices; it still had exposure to risk The company had collected a variety of forward rates from the local bank for the dollar, euro and Turkish lira as listed below. The forwards would lock the company into a rupee rate, which was better than the current spot rate. Currency Spot Forward Forward Forward 30 days 60 days 90 days 45.8300 46.12 46.70 46.11 Indian Rupee per U.S. Dollar 60.9611 61.70 61.90 62.20 1.8250 1.81 1.81 1.81 Indian Rupee per Euro Japanese Yen per Rupee Indian Rupee per Turkish lira Turkish lira per U.S. dollar 30.7192 30.96 30.95 30.87 1.4793 1.49 1.48 1.48 Of course, if the forwards were considered indicators of likely rate movement, they indicated a rise in the dollar. The CEO also considered some form of money market hedge borrowing in Turkish lira against the receivable. Domestic loan rates in Turkey for companies with similar credit quality were about 14% according to the bankers. But, as a small foreign business, the Turkish market would charge Banbury an additional 0.3 percent. Indian deposits rates were averaging 10.4 percent per annum. The currency options had recently become a hedging alternative in India. The option market was limited to INR (Indian Rupee)/USD options. Currency Option Quotes on the USD: Strike Price (Rupee/USD) Put Premium 44.00 Call Premium 0.005 1.890 45.25 0.035 0.440 Quotes for 60 day maturity USD1000 per contract (The case is adapted from Thunderbird School of Global Management, 2010)