Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What are the costs and risk of each alternative? Micca Metals, Inc. is a specialty materials and metals company located in Detroit, Michigan. The company

What are the costs and risk of each alternative?

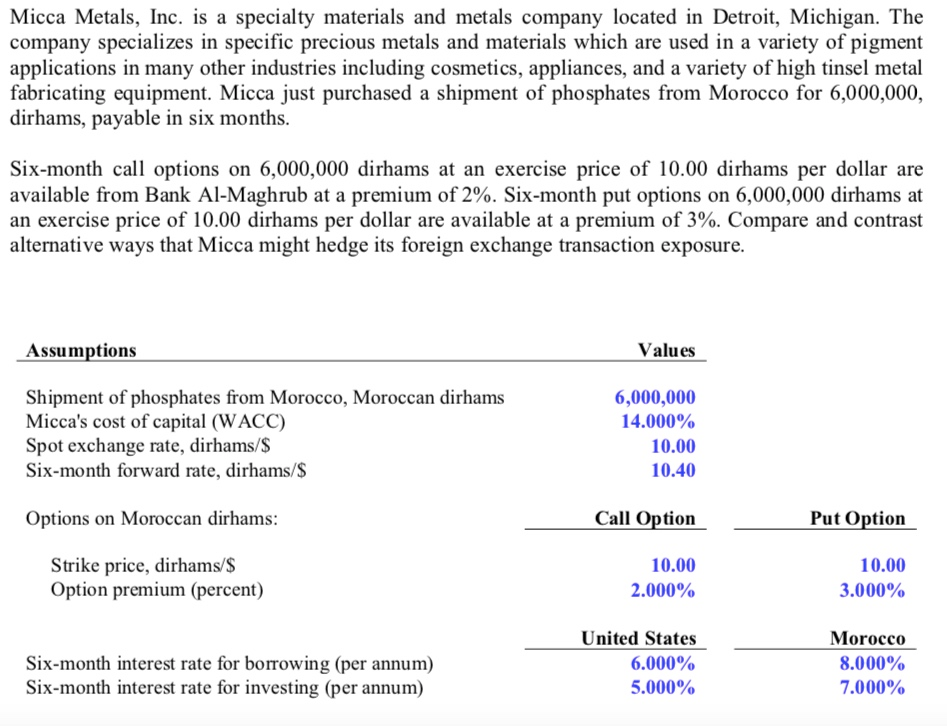

Micca Metals, Inc. is a specialty materials and metals company located in Detroit, Michigan. The company specializes in specific precious metals and materials which are used in a variety of pigment applications in many other industries including cosmetics, appliances, and a variety of high tinsel metal fabricating equipment. Micca just purchased a shipment of phosphates from Morocco for 6,000,000, dirhams, payable in six months. Six-month call options on 6,000,000 dirhams at an exercise price of 10.00 dirhams per dollar are available from Bank Al-Maghrub at a premium of 2%. Six-month put options on 6,000,000 dirhams at an exercise price of 10.00 dirhams per dollar are available at a premium of 3%. Compare and contrast alternative ways that Micca might hedge its foreign exchange transaction exposure. Assumptions Values Shipment of phosphates from Morocco, Moroccan dirhams Micca's cost of capital (WACC) Spot exchange rate, dirhams/$ Six-month forward rate, dirhams/$ 6,000,000 14.000% 10.00 10.40 Options on Moroccan dirhams: Call Option Put Option Strike price, dirhams/$ Option premium (percent) 10.00 2.000% 10.00 3.000% Six-month interest rate for borrowing (per annum) Six-month interest rate for investing (per annum) United States 6.000% 5.000% Morocco 8.000% 7.000%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started