Answered step by step

Verified Expert Solution

Question

1 Approved Answer

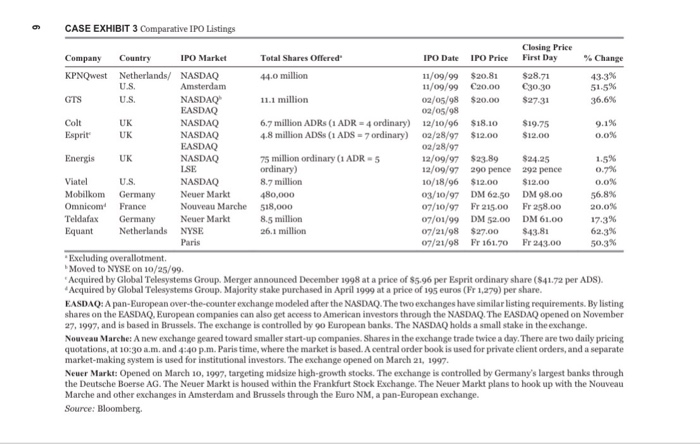

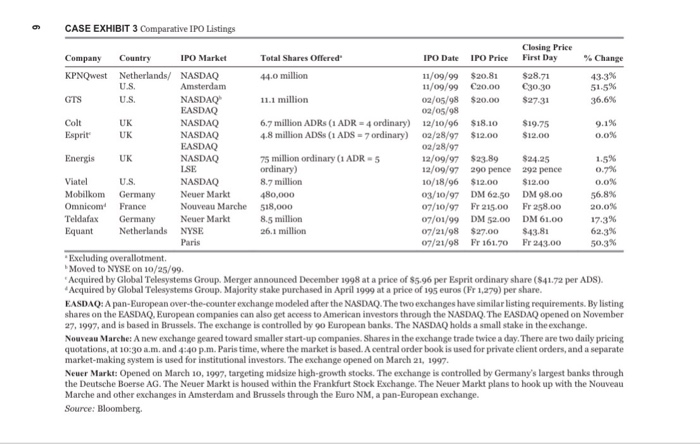

What are the costs of listing on the nasdaq? aCASE EXHIBIT 3 Comparative IPO Listings Closing Price First Day Company Country IPO Market IPO Date

What are the costs of listing on the nasdaq?

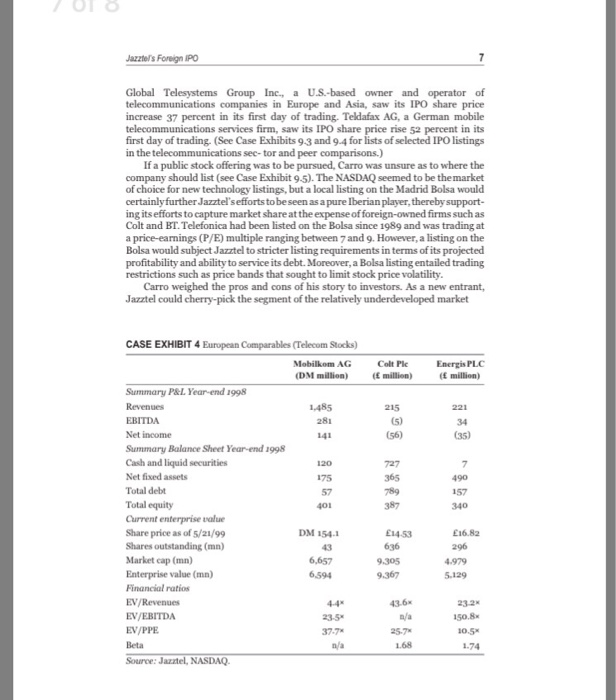

aCASE EXHIBIT 3 Comparative IPO Listings Closing Price First Day Company Country IPO Market IPO Date IPO Price % Change Total Shares Offered 440 million 11.1 million 6.7 million ADRs( ADR 4 ordinary) 12/10/96 $18.10 $19.75 KPNQwest Netherlands/ NASDAQ 11/o9/99 $20.81 11/09/99 20.00 30-30 02/05/98 $20.00 $2731 02/05/98 $28.71 51.5% 36.6% Esprit UK 4.8 million ADSs (1ADS 7 ordinary) o02/28/97 $12.00 $12.00 02/28/97 12/09/97 $23.89 $24.25 2/o9/97 290 pence 292 pence 10/18/96 $12.00 $12.00 03/10/97 DM 62.50 DM 98.00 07/1o/97 Fr 215.00 Fr 258.00 07/o1/99 DM 52.00 DM 61.00 07/21/98 $27.00 $43.8 07/21/98 Fr 161.70 Fr 243.00 Energis UK 75 million ordinary (1 ADR- 1.5% ordinary) 8.7 million Mobilkom GermanyNeues Omnicom France Teldafax Germany Neuer Markt Equnt Netherlands NYSE Nouveau Marche 518,000 20.0% 8.5 million 26.1 million 62.3% 50,3% Excluding overallotment. Moved to NYSE on 10/25/99 Acquired by Global Telesystems Group. Merger announced December 1998 at a price of $596 per Esprit ordinary share ($41.72 per ADS) Acquired by Global Telesystems Group. Majority stake purchased in April 1999 at a price of 195 euros (Fr 1,279 per share. EASDAQ: A pan-European over-the-counter exchange modeled after the NASDA The two exchanges have similar listing requirements. By listing shares on the EASDAQ, European companies can also get access to American investors through the NASDAQ. The EASDAQ opened on November 27, 1997, and is based in Brussels. The exchange is controlled by 90 European banks. The NASDAQ holds a small stake in the exchange Nouveau Marche: A new exchange geared toward smaller start-up companies. Shares in the exchange trade twice a day.There are two daily pricing quotations, at 10:30 a.m. and 4:40 p.m. Paris time, where the market is based. A central order book is used for private client orders, and a separate market-making system is used for institutional investors. The exchange opened on March 21, 1997 Neuer Markt: Opened on March 10, 1997, targeting midsize high-growth stocks. The exchange is controlled by Germany's largest banks through the Deutsche Boerse AG. The Neuer Markt is housed within the Frankfurt Stock Exchange. The Neuer Markt plans to hook up with the Nouveau Marche and other exchanges in Amsterdam and Brussels through the Euro NM, a pan-European exchange

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started