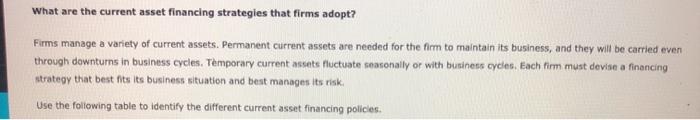

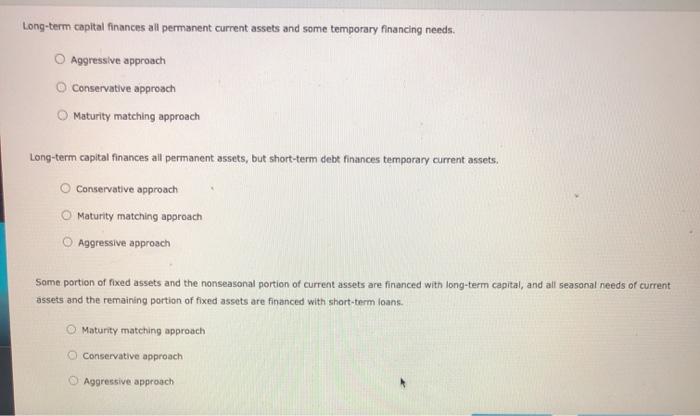

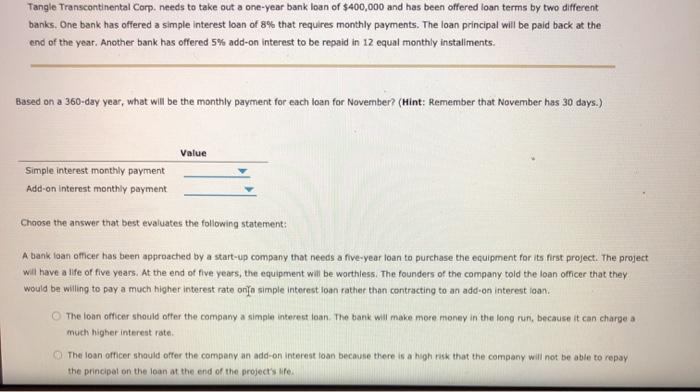

What are the current asset financing strategies that firms adopt? Firms manage a variety of current assets. Permanent current assets are needed for the firm to maintain its business, and they will be carried even through downturns in business cycles. Temporary current assets fluctuate seasonally or with business cycles. Each firm must devise a financing strategy that best fits its business situation and best manages its risk Use the following table to identify the different current asset financing policies. Long-term capital finances all permanent current assets and some temporary financing needs Aggressive approach Conservative approach Maturity matching approach Long-term capital finances all permanent assets, but short-term debt finances temporary current assets. Conservative approach Maturity matching approach Aggressive approach Some portion of fixed assets and the nonseasonal portion of current assets are financed with long-term capital, and all seasonal needs of current assets and the remaining portion of fixed assets are financed with short-term loans. Maturity matching approach Conservative approach Aggressive approach Tangle Transcontinental Corp. needs to take out a one-year bank loan of $400,000 and has been offered loan terms by two different banks. One bank has offered a simple interest loan of 8% that requires monthly payments. The loan principal will be paid back at the end of the year. Another bank has offered 5% add-on interest to be repaid in 12 equal monthly instaliments. Based on a 360-day year, what will be the monthly payment for each loan for November? (Hint: Remember that November has 30 days.) Value Simple interest monthly payment Add-on interest monthly payment Choose the answer that best evaluates the following statement: A tank toan officer has been approached by a start-up company that needs a five-year loan to purchase the equipment for its first project. The project will have a life of five years. At the end of five years, the equipment will be worthless. The founders of the company told the loan officer that they would be willing to pay a much higher interest rate ono simple interest toan rather than contracting to an add-on interest ioan. The loan officer should offer the company a simple interest tean. The bank will make more money in the long run, because it can charge a much higher interest rate The loan officer should offer the company an add-on interest loan because there is a high risk that the company will not be able to repay the principal on the loan at the end of the project's life What are the current asset financing strategies that firms adopt? Firms manage a variety of current assets. Permanent current assets are needed for the firm to maintain its business, and they will be carried even through downturns in business cycles. Temporary current assets fluctuate seasonally or with business cycles. Each firm must devise a financing strategy that best fits its business situation and best manages its risk Use the following table to identify the different current asset financing policies. Long-term capital finances all permanent current assets and some temporary financing needs Aggressive approach Conservative approach Maturity matching approach Long-term capital finances all permanent assets, but short-term debt finances temporary current assets. Conservative approach Maturity matching approach Aggressive approach Some portion of fixed assets and the nonseasonal portion of current assets are financed with long-term capital, and all seasonal needs of current assets and the remaining portion of fixed assets are financed with short-term loans. Maturity matching approach Conservative approach Aggressive approach Tangle Transcontinental Corp. needs to take out a one-year bank loan of $400,000 and has been offered loan terms by two different banks. One bank has offered a simple interest loan of 8% that requires monthly payments. The loan principal will be paid back at the end of the year. Another bank has offered 5% add-on interest to be repaid in 12 equal monthly instaliments. Based on a 360-day year, what will be the monthly payment for each loan for November? (Hint: Remember that November has 30 days.) Value Simple interest monthly payment Add-on interest monthly payment Choose the answer that best evaluates the following statement: A tank toan officer has been approached by a start-up company that needs a five-year loan to purchase the equipment for its first project. The project will have a life of five years. At the end of five years, the equipment will be worthless. The founders of the company told the loan officer that they would be willing to pay a much higher interest rate ono simple interest toan rather than contracting to an add-on interest ioan. The loan officer should offer the company a simple interest tean. The bank will make more money in the long run, because it can charge a much higher interest rate The loan officer should offer the company an add-on interest loan because there is a high risk that the company will not be able to repay the principal on the loan at the end of the project's life