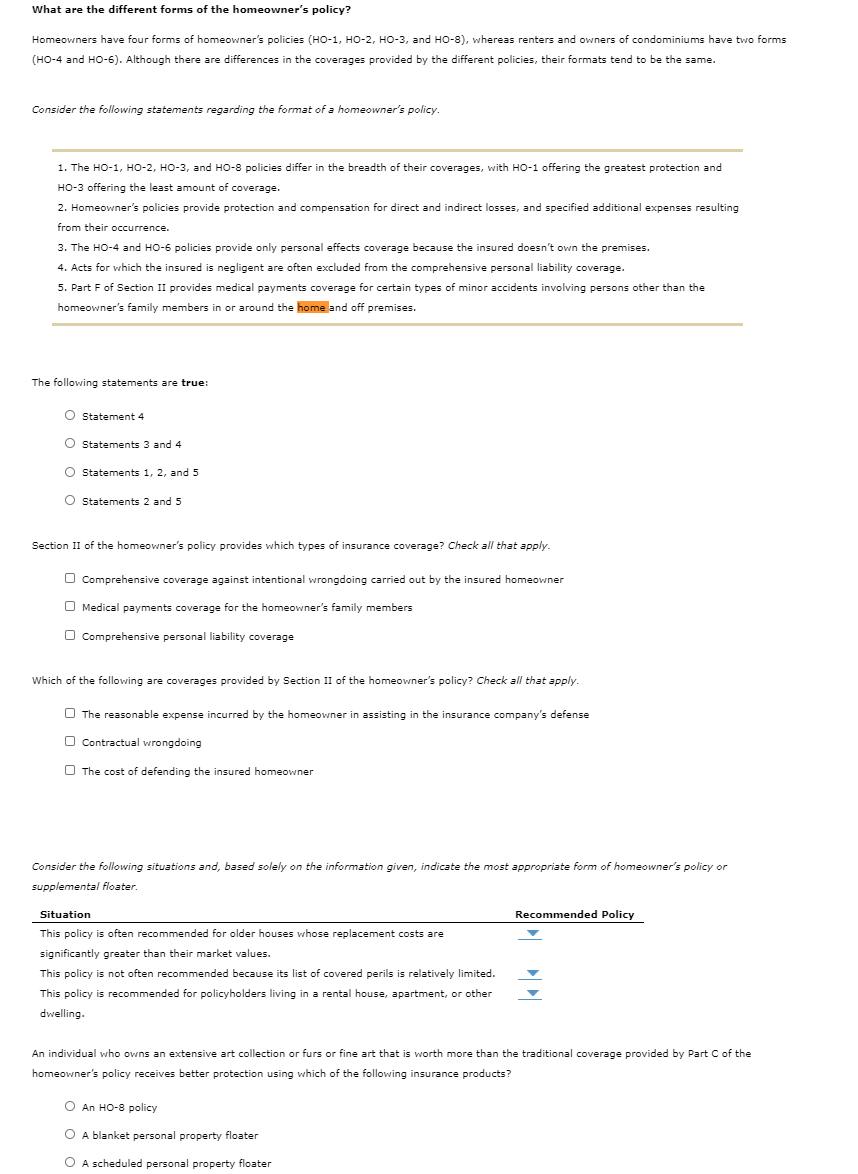

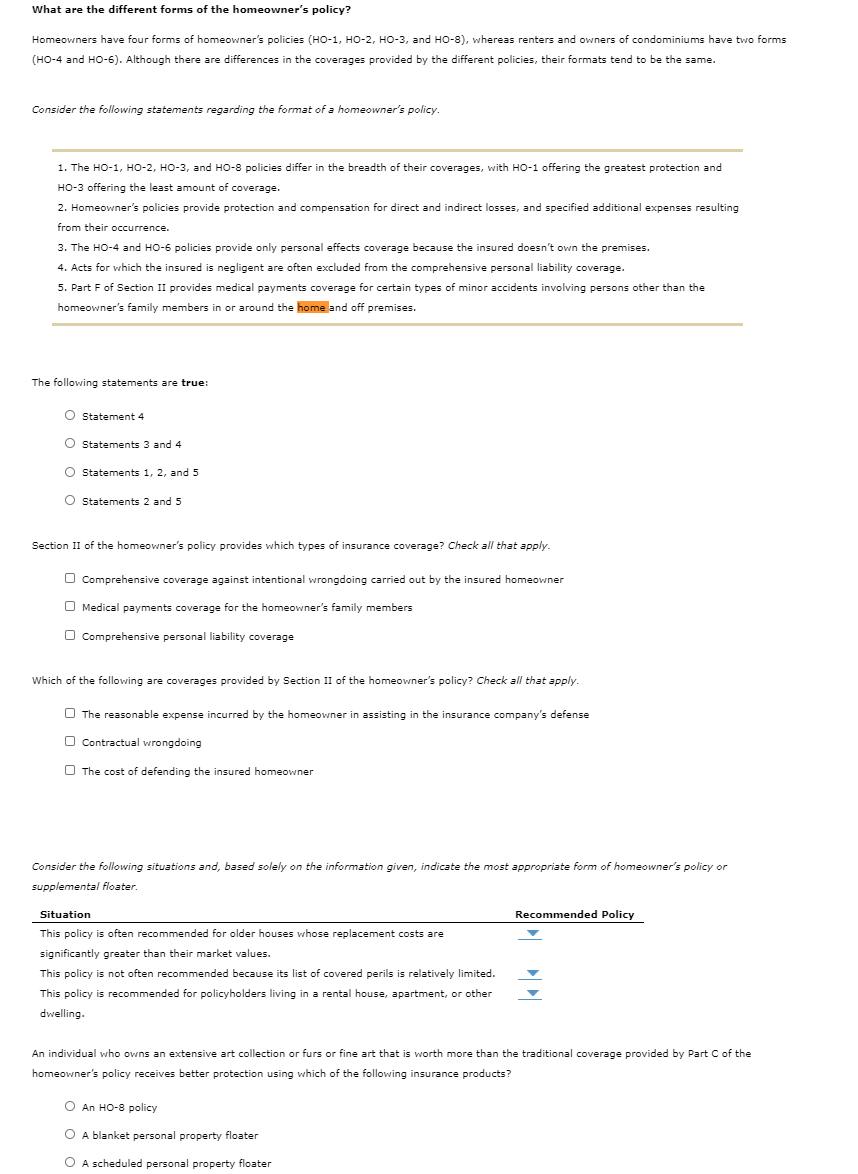

What are the different forms of the homeowner's policy? Homeowners have four forms of homeowner's policies (HO-1, HO-2, HO-3, and HO-8), whereas renters and owners of condominiums have two forms (HO-4 and HO-5). Although there are differences in the coverages provided by the different policies, their formats tend to be the same. Consider the following statements regarding the format of a homeowner's policy. 1. The HO-1, HO-2, HO-3, and HO-8 policies differ in the breadth of their coverages, with HO-1 offering the greatest protection and HO-3 offering the least amount of coverage. 2. Homeowner's policies provide protection and compensation for direct and indirect losses, and specified additional expenses resulting from their occurrence. 3. The HO-4 and HO-6 policies provide only personal effects coverage because the insured doesn't own the premises. 4. Acts for which the insured is negligent are often excluded from the comprehensive personal liability coverage. 5. Part F of Section II provides medical payments coverage for certain types of minor accidents involving persons other than the homeowner's family members in or around the home and off premises. The following statements are true: O Statement 4 O Statements 3 and 4 O Statements 1, 2, and 5 O Statements 2 and 5 Section II of the homeowner's policy provides which types of insurance coverage? Check all that apply. Comprehensive coverage against intentional wrongdoing carried out by the insured homeowner Medical payments coverage for the homeowner's family members O Comprehensive personal liability coverage Which of the following are coverages provided by Section II of the homeowner's policy? Check all that apply. The reasonable expense incurred by the homeowner in assisting in the insurance company's defense O Contractual wrongdoing The cost of defending the insured homeowner Consider the following situations and, based solely on the information given, indicate the most appropriate form of homeowner's policy or supplemental Floater. Recommended Policy Situation This policy is often recommended for older houses whose replacement costs are significantly greater than their market values. This policy is not often recommended because its list of covered perils is relatively limited. This policy is recommended for policyholders living in a rental house, apartment, or other dwelling. An individual who owns an extensive art collection or furs or fine art that is worth more than the traditional coverage provided by Part C of the homeowner's policy receives better protection using which of the following insurance products? O An HO-8 policy O A blanket personal property floater O A scheduled personal property floater What are the different forms of the homeowner's policy? Homeowners have four forms of homeowner's policies (HO-1, HO-2, HO-3, and HO-8), whereas renters and owners of condominiums have two forms (HO-4 and HO-5). Although there are differences in the coverages provided by the different policies, their formats tend to be the same. Consider the following statements regarding the format of a homeowner's policy. 1. The HO-1, HO-2, HO-3, and HO-8 policies differ in the breadth of their coverages, with HO-1 offering the greatest protection and HO-3 offering the least amount of coverage. 2. Homeowner's policies provide protection and compensation for direct and indirect losses, and specified additional expenses resulting from their occurrence. 3. The HO-4 and HO-6 policies provide only personal effects coverage because the insured doesn't own the premises. 4. Acts for which the insured is negligent are often excluded from the comprehensive personal liability coverage. 5. Part F of Section II provides medical payments coverage for certain types of minor accidents involving persons other than the homeowner's family members in or around the home and off premises. The following statements are true: O Statement 4 O Statements 3 and 4 O Statements 1, 2, and 5 O Statements 2 and 5 Section II of the homeowner's policy provides which types of insurance coverage? Check all that apply. Comprehensive coverage against intentional wrongdoing carried out by the insured homeowner Medical payments coverage for the homeowner's family members O Comprehensive personal liability coverage Which of the following are coverages provided by Section II of the homeowner's policy? Check all that apply. The reasonable expense incurred by the homeowner in assisting in the insurance company's defense O Contractual wrongdoing The cost of defending the insured homeowner Consider the following situations and, based solely on the information given, indicate the most appropriate form of homeowner's policy or supplemental Floater. Recommended Policy Situation This policy is often recommended for older houses whose replacement costs are significantly greater than their market values. This policy is not often recommended because its list of covered perils is relatively limited. This policy is recommended for policyholders living in a rental house, apartment, or other dwelling. An individual who owns an extensive art collection or furs or fine art that is worth more than the traditional coverage provided by Part C of the homeowner's policy receives better protection using which of the following insurance products? O An HO-8 policy O A blanket personal property floater O A scheduled personal property floater