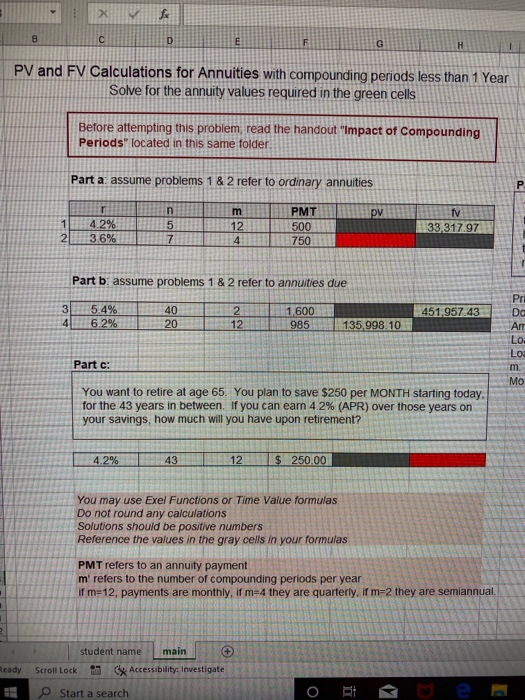

what are the formulas marked in red

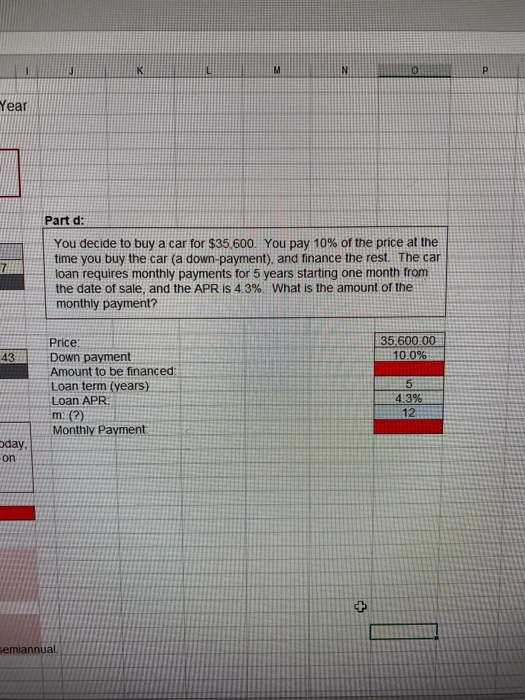

B Coba 5 . . CDF PV and FV Calculations for Annuities with compounding periods less than 1 year Solve for the annuity values required in the green ce Before attempting this problem, read the handout "Impact of Compounding Periods located in the same folder Parta assume problems 1&2 refer to ordinary annuities Em PMTM 12 4 750 You decide to buy a car for $35,600. You pay 10% of the price at the time you buy the cara downpayment and finance the rest. The car loan requires monthly payments for 5 years starting one month from the date of sale, and the APRS 43 What is the amount of the monthly payment Part bassume pro 162 refer to be due 35.600.00 549 45.242012985.135.998.10 Down payment Amount to be financed Loan term van SARAN Mon Payment OBSEN You want to retire Mage 66 You plan to save $250 per MONTH starting today for the 43 years in between you can eam 42 (PR) ever those years on your Savings, how much will you have upon retirement? 1220000 You may bol Functions of Te Value formulas Do round any c ons Solutions should be poste numbers Reference the values in the gray in your formulas PMT refers to annuty payment m refers to the murder of compounding periods per year 12. payments are monthly mi they w e re they are se we main Start a search PV and FV Calculations for Annuities with compounding periods less than 1 Year Solve for the annuity values required in the green cells Before attempting this problem, read the handout "Impact of Compounding Periods" located in this same folder. Part a assume problems 1 & 2 refer to ordinary annuities PMTP 500 33,317.97 3 695 750 Part bassume problems 1 & 2 refer to annuities due 5.4% 6,2% 40 20 451,957.43 1,600 985 1 35 998.10 Part c: Mo You want to retire at age 65. You plan to save $250 per MONTH starting today. for the 43 years in between. If you can eam 4.2% (APR) over those years on your savings, how much will you have upon retirement? $ 250.00 You may use Exel Functions or Time Value formulas Do not round any calculations Solutions should be positive numbers Reference the values in the gray cells in your formulas PMT refers to an annuity payment m' refers to the number of compounding periods per year if m= 12. payments are monthly. If m=4 they are quarterly, ir m2 they are semiannual. eady student name main Scroll Lock Accessibility Investigate Start a search Year Part d: You decide to buy a car for $35,600. You pay 10% of the price at the time you buy the car (a down-payment), and finance the rest. The car loan requires monthly payments for 5 years starting one month from the date of sale, and the APR is 43%. What is the amount of the monthly payment? 35,600.00 10094 42 Price: Down payment Amount to be financed: Loan term (years) Loan APR: m. (?) Monthly Payment 4.3% day. on semiannual