Answered step by step

Verified Expert Solution

Question

1 Approved Answer

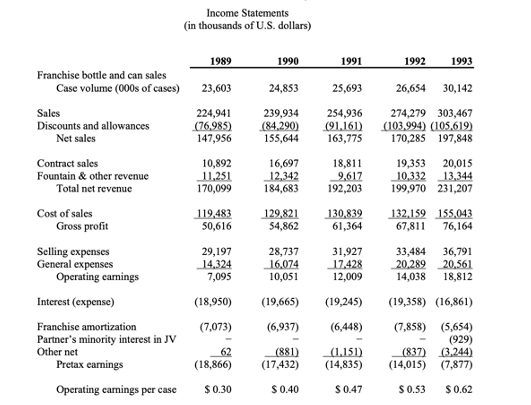

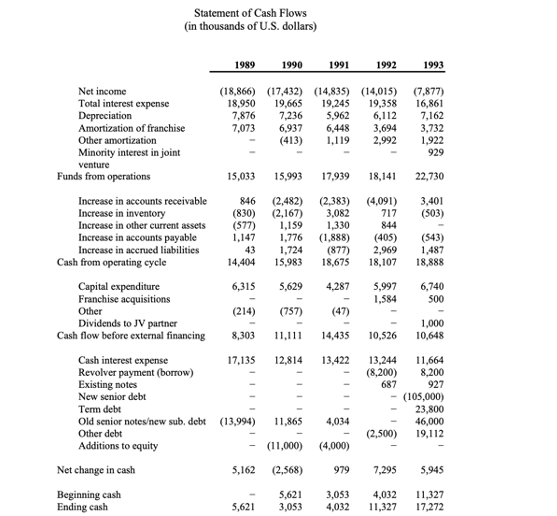

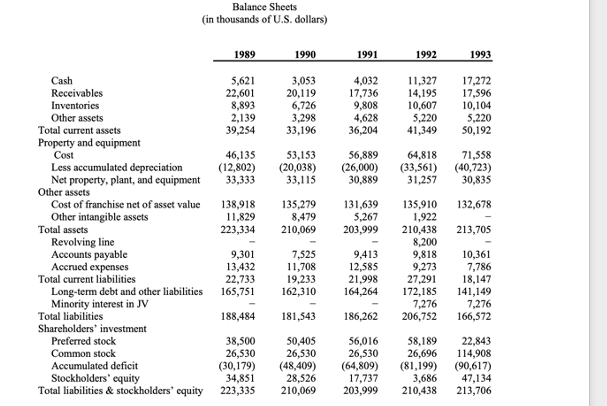

What are the free cash flows on the balance sheets? What is the growth rate of the cash flows? What is the WACC? Income Statements

What are the free cash flows on the balance sheets?

What is the growth rate of the cash flows?

What is the WACC?

Income Statements (in thousands of U.S. dollars) 1989 1990 1991 1992 1993 Franchise bottle and can sales Case volume (000s of cases) 23,603 24,853 25,693 26,654 30,142 Sales 224,941 239,934 254,936 274,279 303,467 Discounts and allowances (76,985) (84,290) (91,161) Net sales 147,956 155,644 163,775 (103,994) (105,619) 170,285 197,848 Contract sales 10,892 16,697 18,811 19,353 20,015 Fountain & other revenue 11,251 12,342 9,617 10,332 13,344 Total net revenue 170,099 184,683 192,203 199,970 231,207 Cost of sales 119,483 129,821 130,839 132,159 155,043 Gross profit 50,616 54,862 61,364 67,811 76,164 Selling expenses 29,197 28,737 31,927 33,484 36,791 General expenses 14,324 16,074 17,428 20,289 20,561 Operating earnings 7,095 10,051 12,009 14,038 18,812 Interest (expense) (18,950) (19,665) (19,245) (19,358) (16,861) Franchise amortization (7,073) (6,937) (6,448) (7,858) (5,654) Partner's minority interest in JV (929) Other net 62 Pretax earnings (18,866) (881) (17,432) (1,151) (837) (3,244) (14,835) (14,015) (7,877) Operating earnings per case $0.30 $0.40 $ 0.47 $ 0.53 $ 0.62

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The weighted average cost of capital WACC is the averag...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started