Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What are the Journal Entries for this? And the numbers that go with each entry. 23 24 25 January 27 GBI sent a $31,000 check

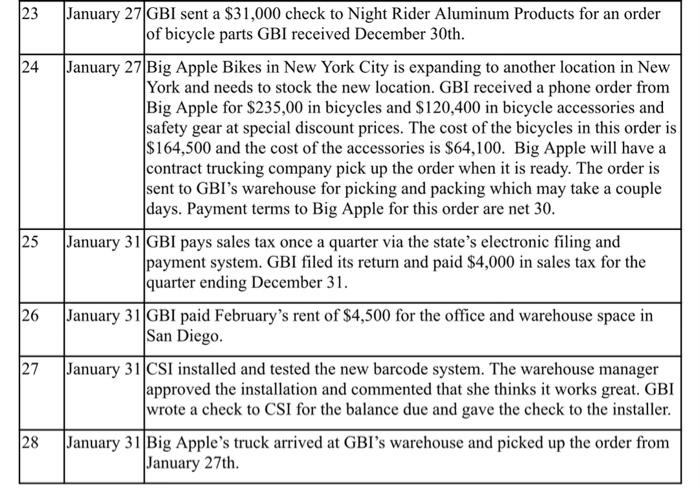

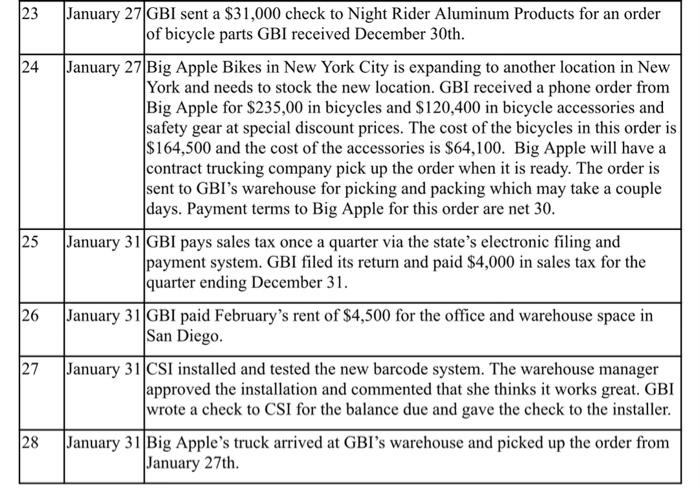

What are the Journal Entries for this? And the numbers that go with each entry.  23 24 25 January 27 GBI sent a $31,000 check to Night Rider Aluminum Products for an order of bicycle parts GBI received December 30th. January 27 Big Apple Bikes in New York City is expanding to another location in New York and needs to stock the new location. GBI received a phone order from Big Apple for $235,00 in bicycles and $120,400 in bicycle accessories and safety gear at special discount prices. The cost of the bicycles in this order is $164,500 and the cost of the accessories is $64,100. Big Apple will have a contract trucking company pick up the order when it is ready. The order is sent to GBI's warehouse for picking and packing which may take a couple days. Payment terms to Big Apple for this order are net 30. January 31 GBI pays sales tax once a quarter via the state's electronic filing and payment system. GBI filed its return and paid $4,000 in sales tax for the quarter ending December 31. January 31 GBI paid February's rent of $4,500 for the office and warehouse space in San Diego January 31 CSI installed and tested the new barcode system. The warehouse manager approved the installation and commented that she thinks it works great. GBI wrote a check to CSI for the balance due and gave the check to the installer January 31 Big Apple's truck arrived at GBI's warehouse and picked up the order from January 27th. 26 27 28

23 24 25 January 27 GBI sent a $31,000 check to Night Rider Aluminum Products for an order of bicycle parts GBI received December 30th. January 27 Big Apple Bikes in New York City is expanding to another location in New York and needs to stock the new location. GBI received a phone order from Big Apple for $235,00 in bicycles and $120,400 in bicycle accessories and safety gear at special discount prices. The cost of the bicycles in this order is $164,500 and the cost of the accessories is $64,100. Big Apple will have a contract trucking company pick up the order when it is ready. The order is sent to GBI's warehouse for picking and packing which may take a couple days. Payment terms to Big Apple for this order are net 30. January 31 GBI pays sales tax once a quarter via the state's electronic filing and payment system. GBI filed its return and paid $4,000 in sales tax for the quarter ending December 31. January 31 GBI paid February's rent of $4,500 for the office and warehouse space in San Diego January 31 CSI installed and tested the new barcode system. The warehouse manager approved the installation and commented that she thinks it works great. GBI wrote a check to CSI for the balance due and gave the check to the installer January 31 Big Apple's truck arrived at GBI's warehouse and picked up the order from January 27th. 26 27 28

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started