Answered step by step

Verified Expert Solution

Question

1 Approved Answer

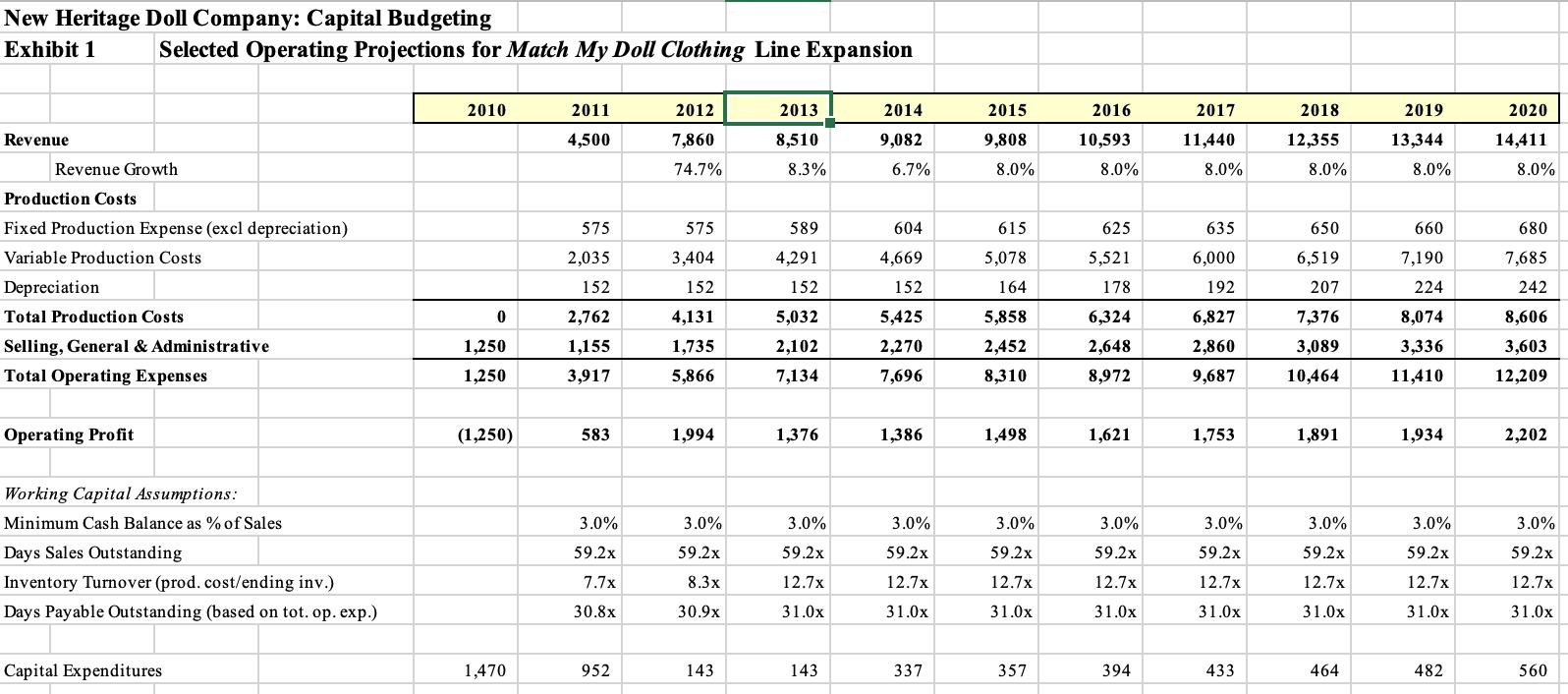

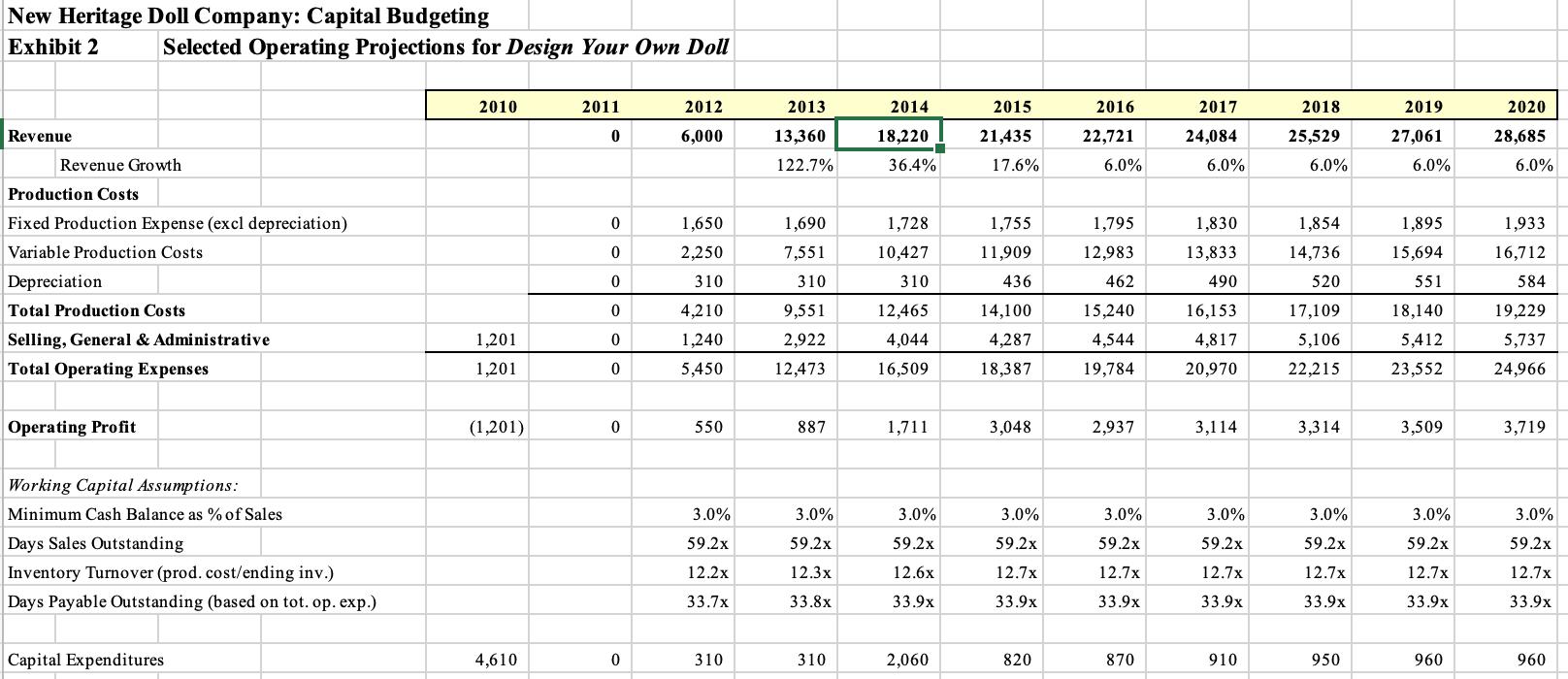

What are the NPV and IRR of both projects (Exhibit 1 and Exhibit 2) in the two Excel spreadsheets provided below? Show all work. New

What are the NPV and IRR of both projects (Exhibit 1 and Exhibit 2) in the two Excel spreadsheets provided below? Show all work.

New Heritage Doll Company: Capital Budgeting Exhibit 1 Revenue Selected Operating Projections for Match My Doll Clothing Line Expansion Revenue Growth Production Costs Fixed Production Expense (excl depreciation) Variable Production Costs Depreciation Total Production Costs Selling, General & Administrative Total Operating Expenses Operating Profit Working Capital Assumptions: Minimum Cash Balance as % of Sales Days Sales Outstanding Inventory Turnover (prod. cost/ending inv.) Days Payable Outstanding (based on tot. op. exp.) Capital Expenditures 2010 0 1,250 1,250 (1,250) 1,470 2011 4,500 575 2,035 152 2,762 1,155 3,917 583 3.0% 59.2x 7.7x 30.8x 952 2012 7,860 74.7% 575 3,404 152 4,131 1,735 5,866 1,994 3.0% 59.2x 8.3x 30.9x 143 2013 8,510 8.3% 589 4,291 152 5,032 2,102 7,134 1,376 3.0% 59.2x 12.7x 31.0x 143 2014 9,082 6.7% 604 4,669 152 5,425 2,270 7,696 1,386 3.0% 59.2x 12.7x 31.0x 337 2015 9,808 8.0% 615 5,078 164 5,858 2,452 8,310 1,498 3.0% 59.2x 12.7x 31.0x 357 2016 10,593 8.0% 625 5,521 178 6,324 2,648 8,972 1,621 3.0% 59.2x 12.7x 31.0x 394 2017 11,440 8.0% 635 6,000 192 6,827 2,860 9,687 1,753 3.0% 59.2x 12.7x 31.0x 433 2018 12,355 8.0% 650 6,519 207 7,376 3,089 10,464 1,891 3.0% 59.2x 12.7x 31.0x 464 2019 13,344 8.0% 660 7,190 224 8,074 3,336 11,410 1,934 3.0% 59.2x 12.7x 31.0x 482 2020 14,411 8.0% 680 7,685 242 8,606 3,603 12,209 2,202 3.0% 59.2x 12.7x 31.0x 560

Step by Step Solution

★★★★★

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

The irr of the project 1 Year profit 1 capital investment 2 net flow12 2010 1250 1470 2720 2011 583 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started