What are the Payn's

emergency ratio fund (6 months)

Current Retio

Monthly housing costs to monthly gross income ratio

monthly housing payments and other debt costs to monthly gross income ratio

savings ratio

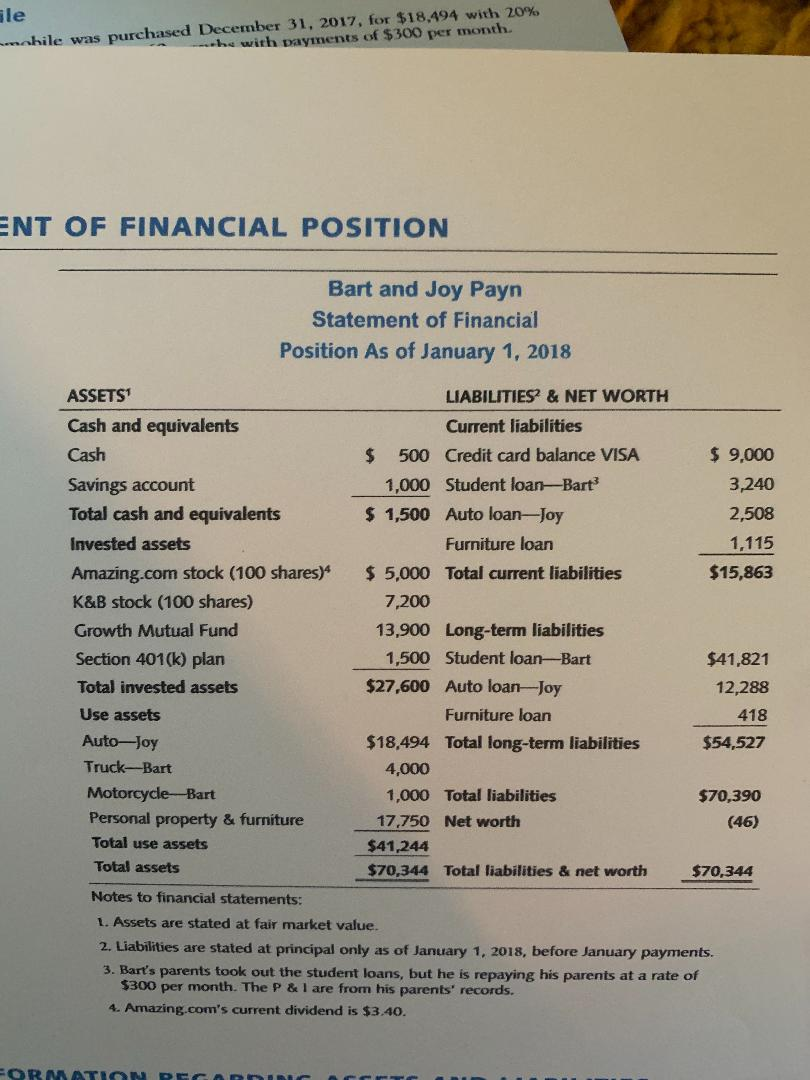

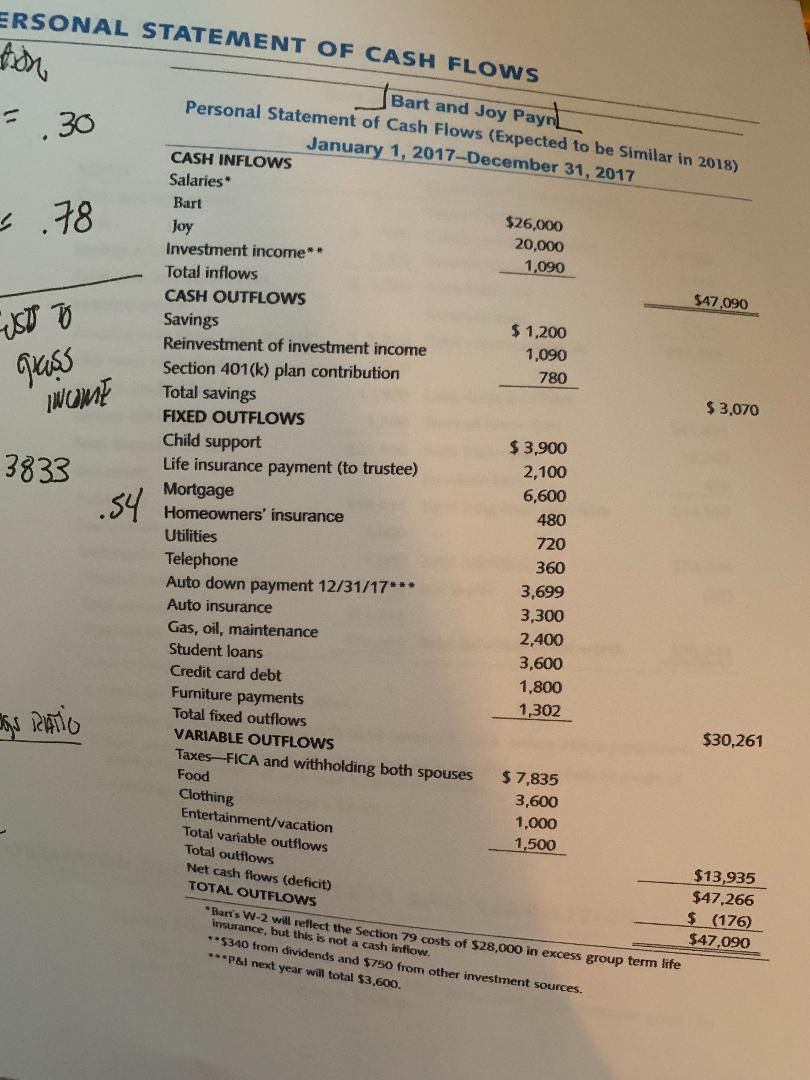

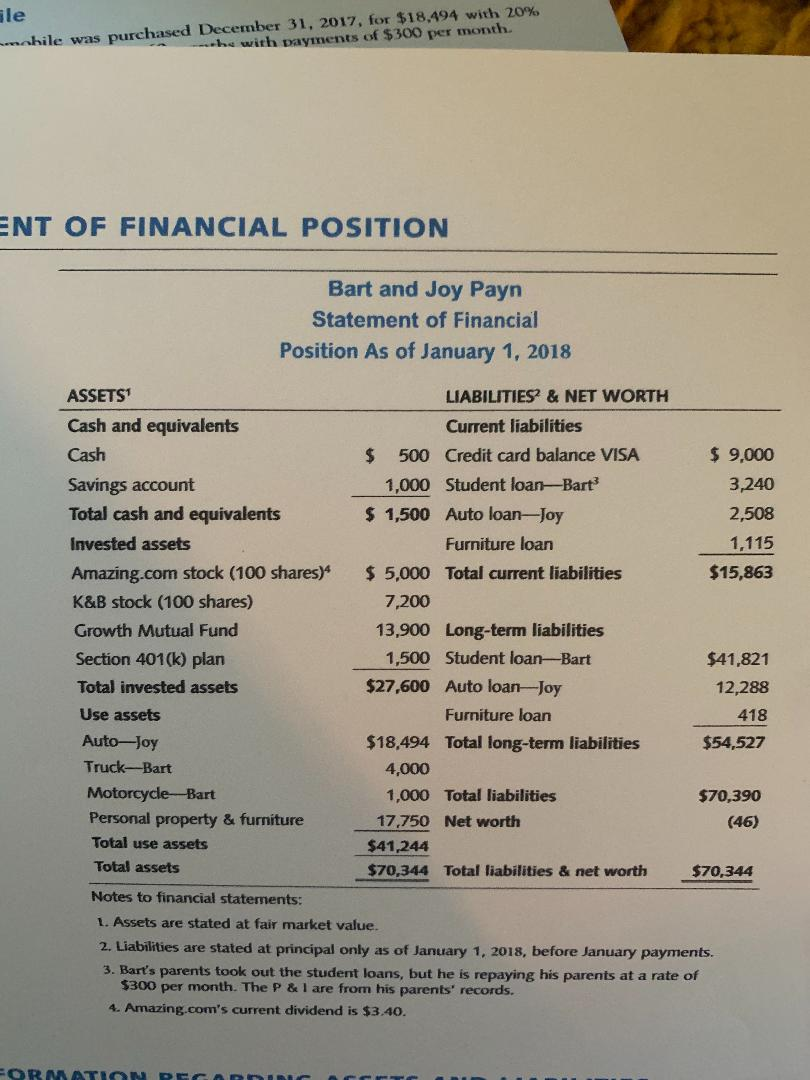

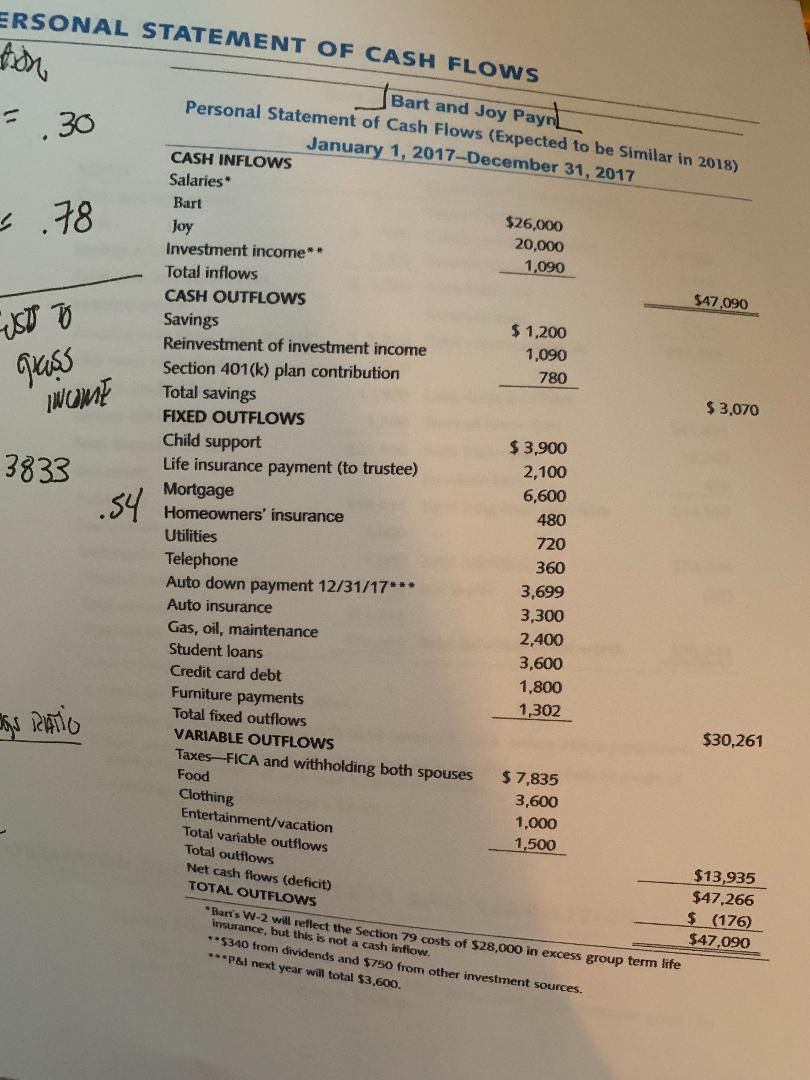

Fle nobile was purchased December 31, 2017, for $18,494 with 20% he with payments of $300 per month. ENT OF FINANCIAL POSITION Bart and Joy Payn Statement of Financial Position As of January 1, 2018 LIABILITIES & NET WORTH ASSETS Cash and equivalents Cash Savings account Total cash and equivalents Invested assets Amazing.com stock (100 shares) K&B stock (100 shares) Growth Mutual Fund Section 401(k) plan Total invested assets $ 9,000 3,240 2,508 1,115 $15,863 Current liabilities $ 500 Credit card balance VISA 1,000 Student loan-Bart? $ 1,500 Auto loan-Joy Furniture loan $ 5,000 Total current liabilities 7,200 13,900 Long-term liabilities 1,500 Student loan-Bart $27,600 Auto loan-Joy Furniture loan $18,494 Total long-term liabilities 4,000 1,000 Total liabilities 17,750 Net worth $41,244 $70,344 Total liabilities & net worth $41,821 12,288 418 $54,527 Use assets Auto-Joy Truck-Bart Motorcycle--Bart Personal property & furniture Total use assets Total assets $70,390 (46) $70,344 Notes to financial statements: 1. Assets are stated at fair market value. 2. Liabilities are stated at principal only as of January 1, 2018, before January payments. 3. Bart's parents took out the student loans, but he is repaying his parents at a rate of $300 per month. The P & I are from his parents' records. 4. Amazing.com's current dividend is $3.40. FORMATION PEGA ERSONAL STATEMENT OF CASH FLOWS Bart and Joy Payne Personal Statement of Cash Flows (Expected to be Similar in 2018) January 1, 2017--December 31, 2017 CASH INFLOWS 78 $26,000 20.000 1,090 $47.090 UST TO $ 1,200 1,090 WOME 780 $ 3,070 3833 Salaries Bart Joy Investment income* Total inflows CASH OUTFLOWS Savings Reinvestment of investment income Section 401(k) plan contribution Total savings FIXED OUTFLOWS Child support Life insurance payment (to trustee) Mortgage Homeowners' insurance Utilities Telephone Auto down payment 12/31/17*** Auto insurance Gas, oil, maintenance Student loans Credit card debt Furniture payments Total fixed outflows VARIABLE OUTFLOWS Taxes-FICA and withholding both spouses Food .54 $ 3,900 2,100 6,600 480 720 360 3,699 3,300 2,400 3.600 1.800 1,302 Igs Ratio $30,261 $ 7,835 3,600 1,000 1,500 Clothing Entertainment/vacation Total variable outflows Total outflows Net cash flows (deficit) TOTAL OUTFLOWS Bart's W-2 will reflect the Section 79 costs of $28,000 in excess group term life Insurance, but this is not a cash intlow **$340 from dividends and $750 from other investment sources. ***p&l next year will total $3,600 $13,935 $47,266 $ (176) $47,090 Fle nobile was purchased December 31, 2017, for $18,494 with 20% he with payments of $300 per month. ENT OF FINANCIAL POSITION Bart and Joy Payn Statement of Financial Position As of January 1, 2018 LIABILITIES & NET WORTH ASSETS Cash and equivalents Cash Savings account Total cash and equivalents Invested assets Amazing.com stock (100 shares) K&B stock (100 shares) Growth Mutual Fund Section 401(k) plan Total invested assets $ 9,000 3,240 2,508 1,115 $15,863 Current liabilities $ 500 Credit card balance VISA 1,000 Student loan-Bart? $ 1,500 Auto loan-Joy Furniture loan $ 5,000 Total current liabilities 7,200 13,900 Long-term liabilities 1,500 Student loan-Bart $27,600 Auto loan-Joy Furniture loan $18,494 Total long-term liabilities 4,000 1,000 Total liabilities 17,750 Net worth $41,244 $70,344 Total liabilities & net worth $41,821 12,288 418 $54,527 Use assets Auto-Joy Truck-Bart Motorcycle--Bart Personal property & furniture Total use assets Total assets $70,390 (46) $70,344 Notes to financial statements: 1. Assets are stated at fair market value. 2. Liabilities are stated at principal only as of January 1, 2018, before January payments. 3. Bart's parents took out the student loans, but he is repaying his parents at a rate of $300 per month. The P & I are from his parents' records. 4. Amazing.com's current dividend is $3.40. FORMATION PEGA ERSONAL STATEMENT OF CASH FLOWS Bart and Joy Payne Personal Statement of Cash Flows (Expected to be Similar in 2018) January 1, 2017--December 31, 2017 CASH INFLOWS 78 $26,000 20.000 1,090 $47.090 UST TO $ 1,200 1,090 WOME 780 $ 3,070 3833 Salaries Bart Joy Investment income* Total inflows CASH OUTFLOWS Savings Reinvestment of investment income Section 401(k) plan contribution Total savings FIXED OUTFLOWS Child support Life insurance payment (to trustee) Mortgage Homeowners' insurance Utilities Telephone Auto down payment 12/31/17*** Auto insurance Gas, oil, maintenance Student loans Credit card debt Furniture payments Total fixed outflows VARIABLE OUTFLOWS Taxes-FICA and withholding both spouses Food .54 $ 3,900 2,100 6,600 480 720 360 3,699 3,300 2,400 3.600 1.800 1,302 Igs Ratio $30,261 $ 7,835 3,600 1,000 1,500 Clothing Entertainment/vacation Total variable outflows Total outflows Net cash flows (deficit) TOTAL OUTFLOWS Bart's W-2 will reflect the Section 79 costs of $28,000 in excess group term life Insurance, but this is not a cash intlow **$340 from dividends and $750 from other investment sources. ***p&l next year will total $3,600 $13,935 $47,266 $ (176) $47,090