Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The current term-structure of risk-free rate is as follows. Term-structure in year 0 maturity (years) zero-rate (%) 1 2.5 3.0 A risk-free bond will

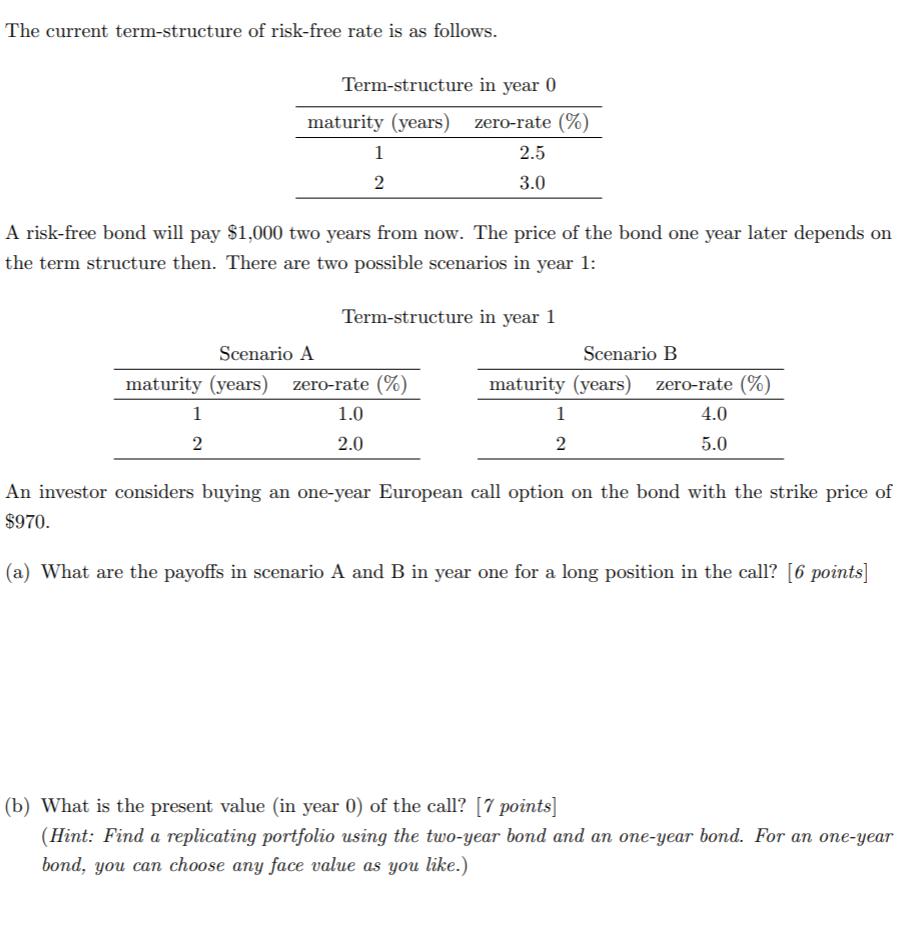

The current term-structure of risk-free rate is as follows. Term-structure in year 0 maturity (years) zero-rate (%) 1 2.5 3.0 A risk-free bond will pay $1,000 two years from now. The price of the bond one year later depends on the term structure then. There are two possible scenarios in year 1: Term-structure in year 1 Scenario A Scenario B maturity (years) zero-rate (%) maturity (years) zero-rate (%) 1 1.0 1 4.0 2 2.0 5.0 An investor considers buying an one-year European call option on the bond with the strike price of $970. (a) What are the payoffs in scenario A andB in year one for a long position in the call? [6 points] (b) What is the present value (in year 0) of the call? [7 points] (Hint: Find a replicating portfolio using the tuwo-year bond and an one-year bond. For an one-year bond, you can choose any face value as you like.)

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Term Structure in year 0 Maturity years Zero rate 1 25 2 30 Bond will Pay 1000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started