Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What are the STAFF EXPENSES, TOTAL EXPENSES and TOTAL PROVISION for the current year 2017 given the statement of profit or loss and the statement

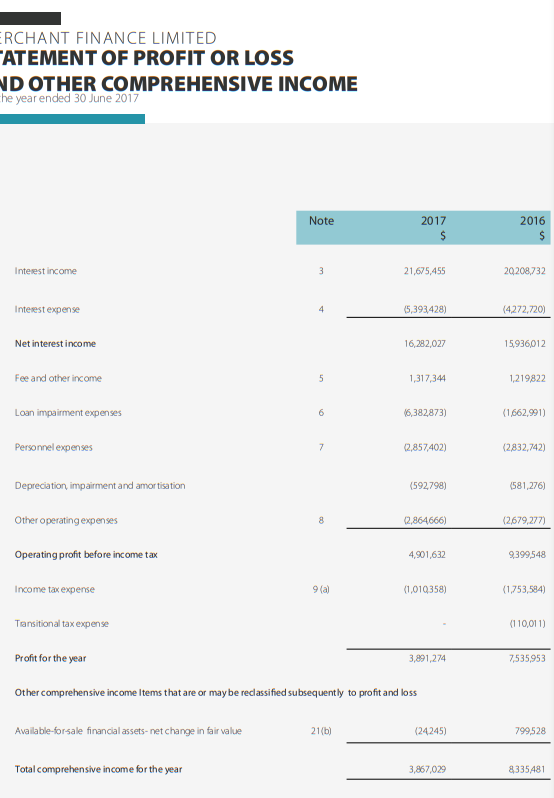

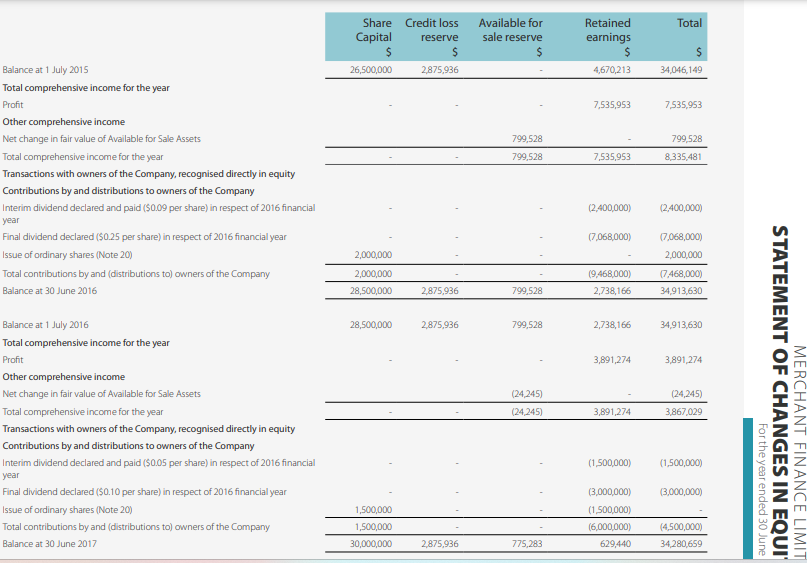

What are the STAFF EXPENSES, TOTAL EXPENSES and TOTAL PROVISION for the current year 2017 given the statement of profit or loss and the statement of financial position?

NOTE: current year (2017) is the first column of values.

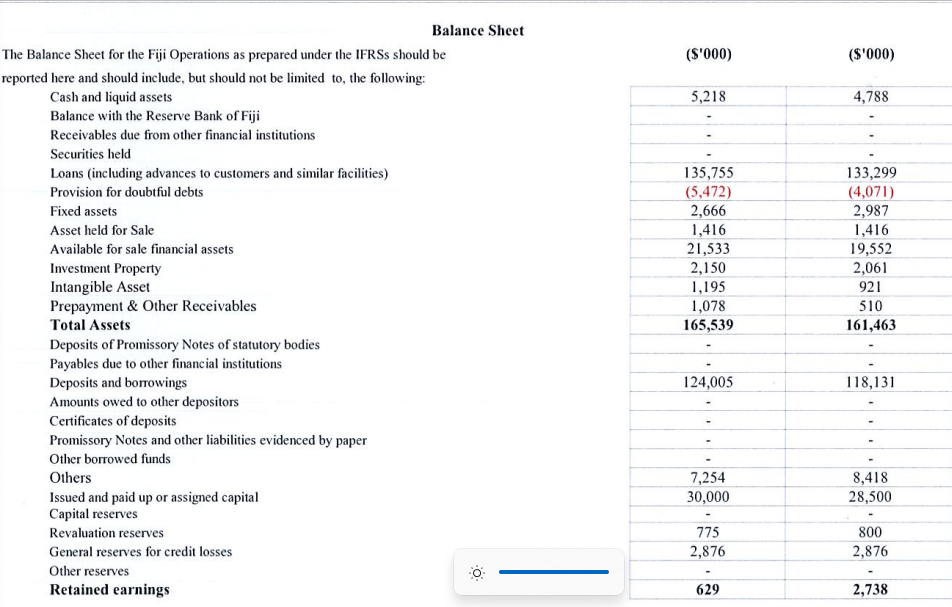

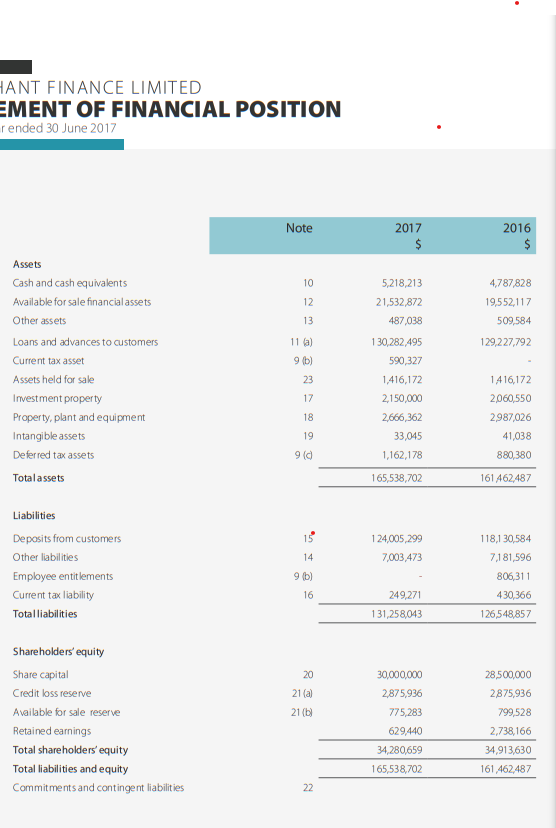

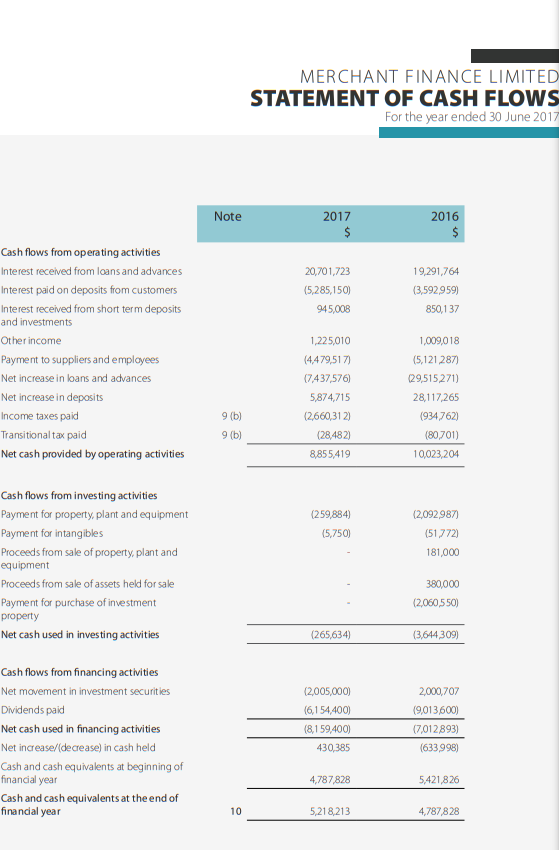

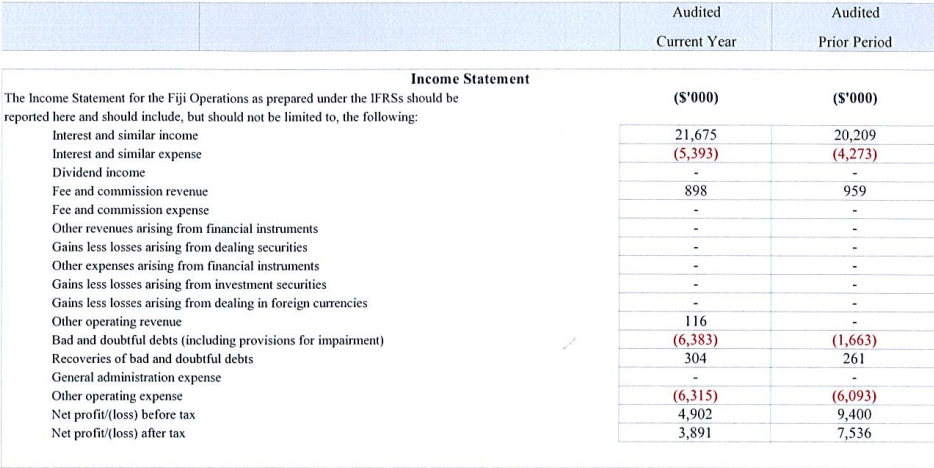

Balance Sheet The Balance Sheet for the Fiji Operations as prepared under the IFRSs should be ($000) reported here and should include, but should not be limited to, the following: Cash and liquid assets Balance with the Reserve Bank of Fiji Receivables due from other financial institutions Securities held Loans (including advances to customers and similar facilities) Provision for doubtful debts Fixed assets Asset held for Sale Available for sale financial assets Investment Property Intangible Asset Prepayment \& Other Receivables Total Assets Deposits of Promissory Notes of statutory bodies Payables due to other financial institutions Deposits and borrowings Amounts owed to other depositors Certificates of deposits Promissory Notes and other liabilities evidenced by paper Other borrowed funds Others Issued and paid up or assigned capital Capital reserves Revaluation reserves General reserves for credit losses Other reserves Retained earnings \begin{tabular}{|c|c|} \hline 5,218 & 4,788 \\ \hline- & - \\ \hline- & - \\ \hline 135,755 & - \\ \hline(5,472) & 133,299 \\ \hline 2,666 & (4,071) \\ \hline 1,416 & 2,987 \\ \hline 21,533 & 1,416 \\ \hline 2,150 & 19,552 \\ \hline 1,195 & 2,061 \\ \hline 1,078 & 921 \\ \hline 165,539 & 510 \\ \hline- & 161,463 \\ \hline- & - \\ \hline 124,005 & - \\ \hline- & 118,131 \\ \hline- & - \\ \hline- & - \\ \hline- & - \\ \hline 7,254 & - \\ \hline 30,000 & 8,418 \\ \hline- & 28,500 \\ \hline 775 & - \\ \hline 2,876 & 800 \\ \hline- & 2,876 \\ \hline 629 & - \\ \hline & 2,738 \\ \hline \end{tabular} IANT FINANCE LIMITED EMENT OF FINANCIAL POSITION rended 30 June 2017 MERCHANT FINANCE LIMITED STATEMENT OF CASH FLOWS For the year ended 30 June 201 Audited Audited Current Year Prior Period Income Statement The Income Statement for the Fiji Operations as prepared under the IFRSs should be reported here and should include, but should not be limited to, the following: Interest and similar income Interest and similar expense Dividend income Fee and commission revenue Fee and commission expense Other revenues arising from financial instruments Gains less losses arising from dealing securities Other expenses arising from financial instruments Gains less losses arising from investment securities Gains less losses arising from dealing in foreign currencies Other operating revenue Bad and doubtful debts (including provisions for impairment) Recoveries of bad and doubtful debts General administration expense Other operating expense Net profit/(loss) before tax Net profit/(loss) after tax \begin{tabular}{|c|c|} \hline 21,675 & 20,209 \\ \hline(5,393) & (4,273) \\ \hline- & - \\ \hline 898 & 959 \\ \hline- & - \\ \hline- & - \\ \hline- & - \\ \hline- & - \\ \hline- & - \\ \hline- & - \\ \hline(6,383) & - \\ \hline 304 & (1,663) \\ \hline- & 261 \\ \hline(6,315) & - \\ \hline 4,902 & (6,093) \\ \hline 3,891 & 9,400 \\ \hline & 7,536 \\ \hline \end{tabular} RCHANT FINANCE LIMITED ATEMENT OF PROFIT OR LOSS ND OTHER COMPREHENSIVE INCOME he year ended 30 June 2017 Interest income Intexst expense Net interest income Fee and other income Loan impairment expenses Personnel expenses Depreciation, impairment and amor tisation Other operating expenses Operating profit before income tax Income tax experse Tansitional tax expense Profit for the year Other comprehensive income Items that are or may be reclassified subsequently to profit and loss Balance at 1 July 2015 \begin{tabular}{rrrrrr} ShareCapital & Creditlossreserve & Availableforsalereserve & Retainedearnings & Total \\ $ & $ & $ & $ & $ \\ \hline 26,500,000 & 2,875,936 & - & 4,670,213 & 34,046,149 \\ \hline \end{tabular} Total comprehensive income for the year Profit Other comprehensive income Net change in fair value of Available for Sale Assets Total comprehensive income for the year \begin{tabular}{rrrr} & 799,528 & - & 799,528 \\ \hline- & 799,528 & 7,535,953 & 8,335,481 \\ \hline \end{tabular} Transactions with owners of the Company, recognised directly in equity Contributions by and distributions to owners of the Company Interim dividend declared and paid (\$0.09 per share) in respect of 2016 financial year Final dividend declared (\$0.25 per share) in respect of 2016 financial year Issue of ordinary shares (Note 20) Total contributions by and (distributions to) owners of the Company Balance at 30 June 2016 Balance at 1 July 2016 Total comprehensive income for the year Profit Other comprehensive income Net change in fair value of Available for Sale Assets Total comprehensive income for the year Transactions with owners of the Company, recognised directly in equity Contributions by and distributions to owners of the Company Interim dividend declared and paid ( $0.05 per share) in respect of 2016 financial year Final dividend declared ( $0.10 per share) in respect of 2016 financial year Issue of ordinary shares (Note 20) Total contributions by and (distributions to) owners of the Compary Balance at 30 June 2017 \begin{tabular}{rrrrr} & & - & (1,500,000) & (1,500,000) \\ & - & - & & \\ 1,500,000 & - & - & (1,5000,000) & (3,000,000) \\ \hline 1,500,000 & - & - & (6,000,000) & \\ \hline 30,000,000 & 2,875,936 & 775,283 & 629,440 & 34,280,659 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started