Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Minimize estate taxes. 2. Fund college education for the five grandchildren. 3. Set up a special needs trust for Ivan's future needs. 4.

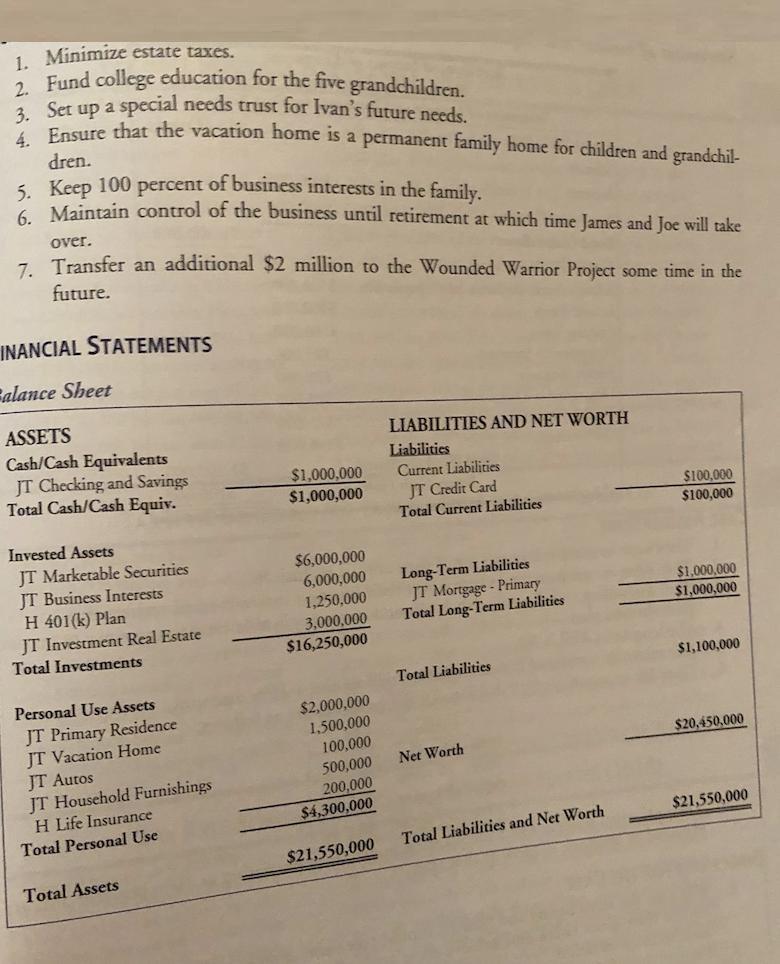

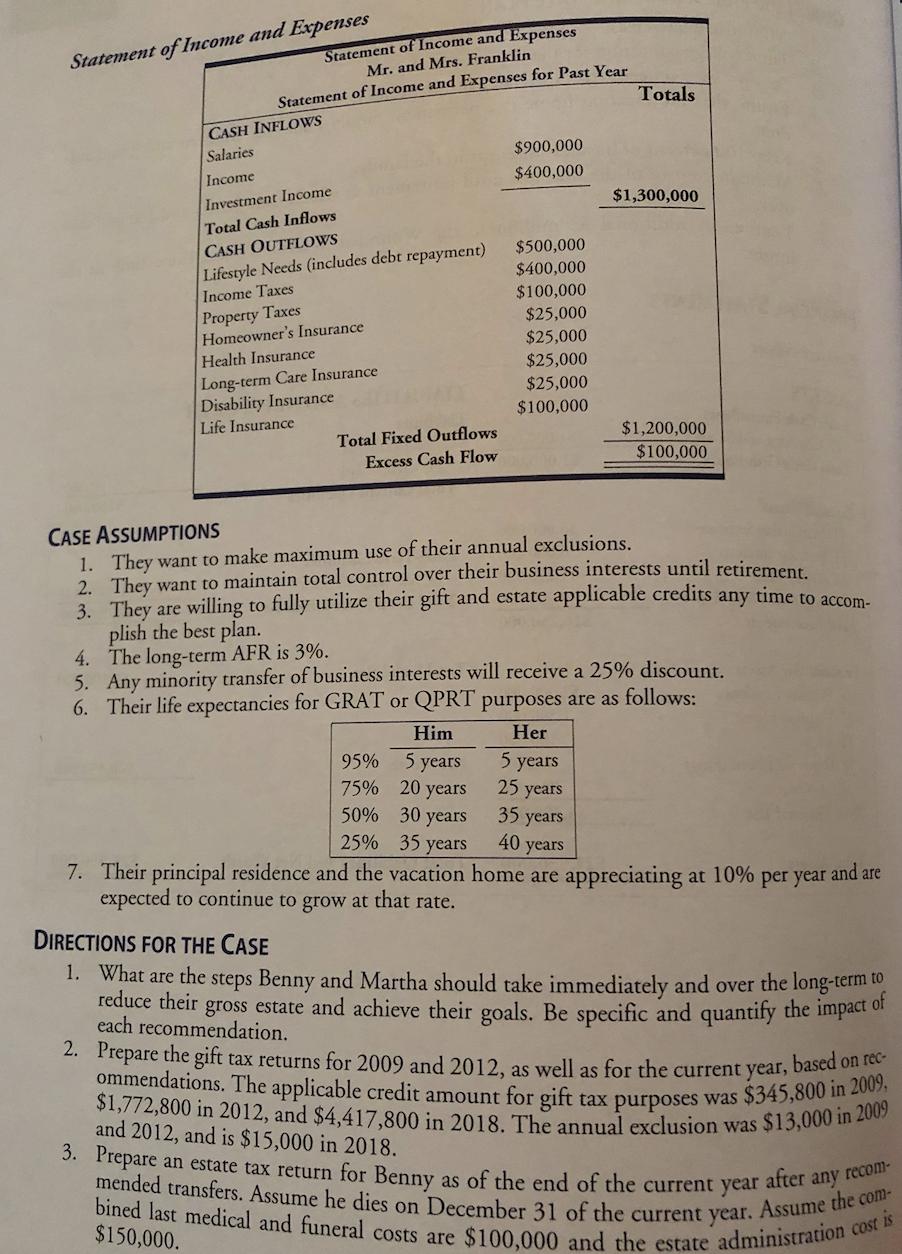

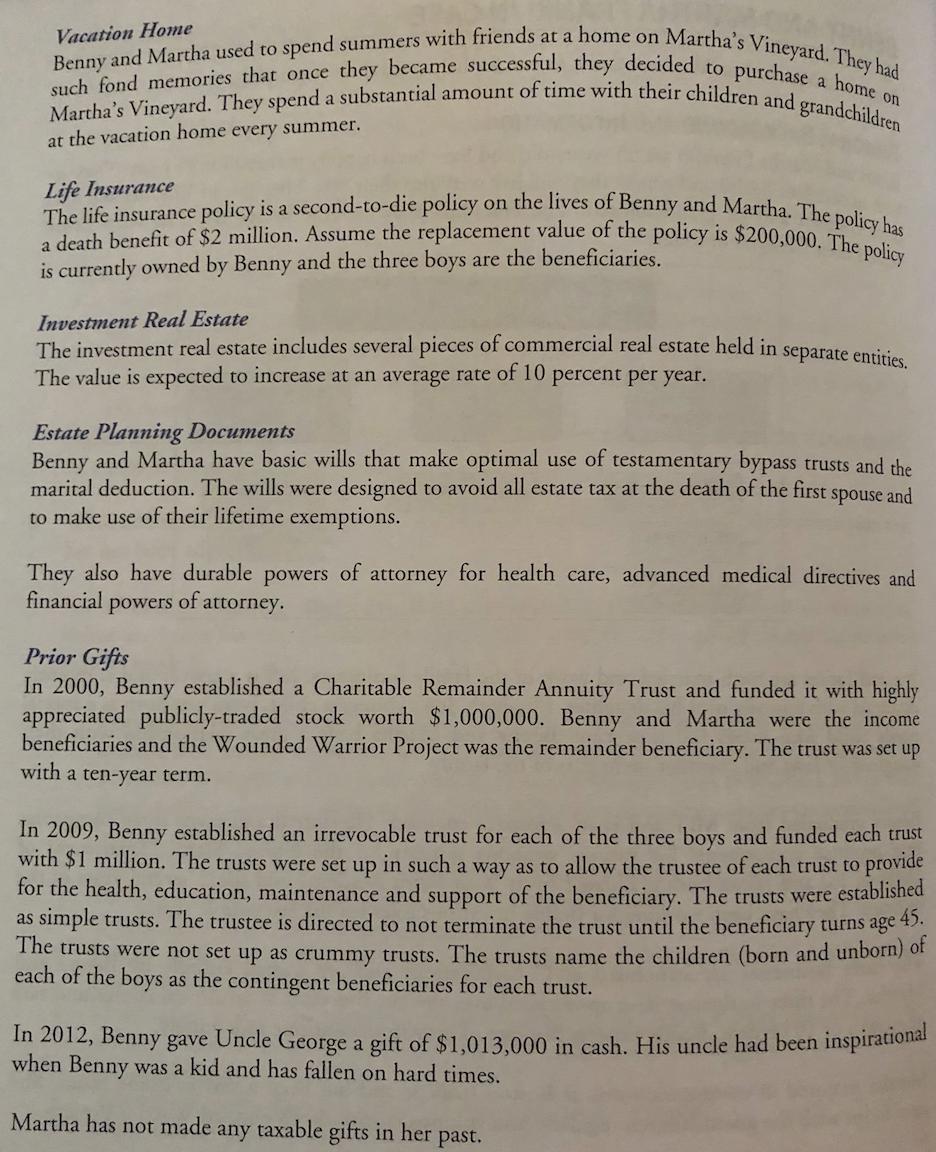

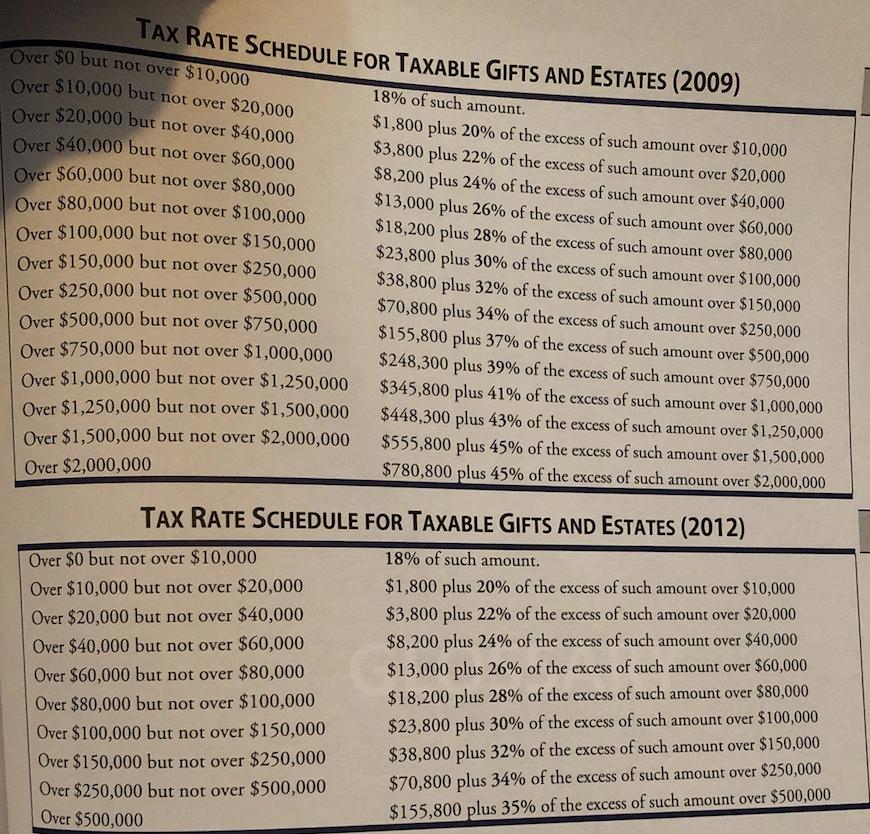

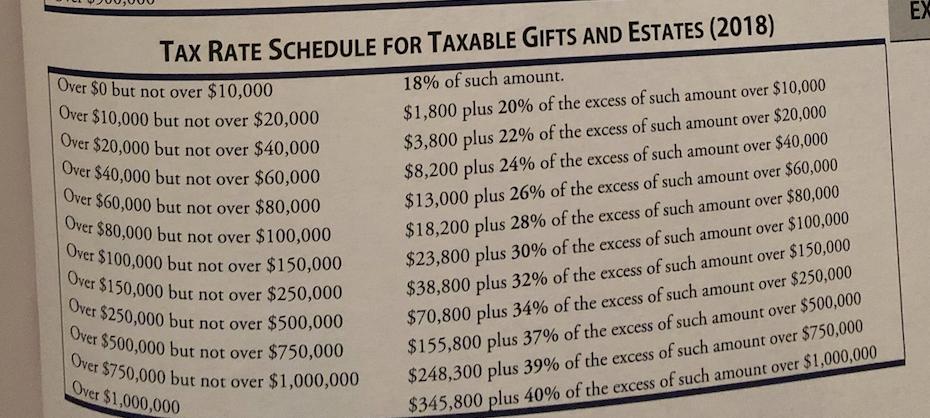

1. Minimize estate taxes. 2. Fund college education for the five grandchildren. 3. Set up a special needs trust for Ivan's future needs. 4. Ensure that the vacation home is a permanent family home for children and grandchil- dren. 5. Keep 100 percent of business interests in the family. 6. Maintain control of the business until retirement at which time James and Joe will take over. 7. Transfer an additional $2 million to the Wounded Warrior Project some time in the future. INANCIAL STATEMENTS alance Sheet ASSETS Cash/Cash Equivalents JT Checking and Savings Total Cash/Cash Equiv. Invested Assets JT Marketable Securities JT Business Interests H 401(k) Plan JT Investment Real Estate Total Investments Personal Use Assets JT Primary Residence JT Vacation Home JT Autos JT Household Furnishings H Life Insurance Total Personal Use Total Assets $1,000,000 $1,000,000 $6,000,000 6,000,000 1,250,000 3,000,000 $16,250,000 $2,000,000 1,500,000 100,000 500,000 200.000 $4,300,000 $21,550,000 LIABILITIES AND NET WORTH Liabilities Current Liabilities JT Credit Card Total Current Liabilities Long-Term Liabilities JT Mortgage - Primary Total Long-Term Liabilities Total Liabilities Net Worth Total Liabilities and Net Worth $100,000 $100,000 $1,000,000 $1,000,000 $1,100,000 $20,450,000 $21,550,000 Statement of Income and Expenses Mr. and Mrs. Franklin Statement of Income and Expenses for Past Year Statement of Income and Expenses CASH INFLOWS Salaries Income Investment Income Total Cash Inflows CASH OUTFLOWS Lifestyle Needs (includes debt repayment) Income Taxes Property Taxes Homeowner's Insurance Health Insurance Long-term Care Insurance Disability Insurance Life Insurance Total Fixed Outflows Excess Cash Flow $900,000 $400,000 $500,000 $400,000 $100,000 $25,000 $25,000 $25,000 $25,000 $100,000 Totals $1,300,000 $1,200,000 $100,000 CASE ASSUMPTIONS 1. They want to make maximum use of their annual exclusions. 2. They want to maintain total control over their business interests until retirement. 3. They are willing to fully utilize their gift and estate applicable credits any time to accom- plish the best plan. 4. The long-term AFR is 3%. 5. Any minority transfer of business interests will receive a 25% discount. 6. Their life expectancies for GRAT or QPRT purposes are as follows: Him Her 5 years 5 years 95% 75% 20 years 25 years 50% 30 years 25% 35 years 35 years 40 years 7. Their principal residence and the vacation home are appreciating at 10% per year and are expected to continue to grow at that rate. DIRECTIONS FOR THE CASE 1. What are the steps Benny and Martha should take immediately and over the long-term to reduce their gross estate and achieve their goals. Be specific and quantify the impact of each recommendation. 2. Prepare the gift tax returns for 2009 and 2012, as well as for the current year, based on rec- ommendations. The applicable credit amount for gift tax purposes was $345,800 in 2009, $1,772,800 in 2012, and $4,417,800 in 2018. The annual exclusion was $13,000 in 2009 and 2012, and is $15,000 in 2018. 3. Prepare an estate tax return for Benny as of the end of the current year after any recom- mended transfers. Assume he dies on December 31 of the current year. Assume the com- bined last medical and funeral costs are $100,000 and the estate administration cost is $150,000. Vacation Home such fond memories that once they became successful, they decided to purchase a home on Benny and Martha used to spend summers with friends at a home on Martha's Vineyard. They had Martha's Vineyard. They spend a substantial amount of time with their children and grandchildren at the vacation home every summer. Life Insurance The life insurance policy is a second-to-die policy on the lives of Benny and Martha. The policy has a death benefit of $2 million. Assume the replacement value of the policy is $200,000. The policy is currently owned by Benny and the three boys are the beneficiaries. Investment Real Estate The investment real estate includes several pieces of commercial real estate held in separate entities. The value is expected to increase at an average rate of 10 percent per year. Estate Planning Documents Benny and Martha have basic wills that make optimal use of testamentary bypass trusts and the marital deduction. The wills were designed to avoid all estate tax at the death of the first spouse and to make use of their lifetime exemptions. They also have durable powers of attorney for health care, advanced medical directives and financial powers of attorney. Prior Gifts In 2000, Benny established a Charitable Remainder Annuity Trust and funded it with highly appreciated publicly-traded stock worth $1,000,000. Benny and Martha were the income beneficiaries and the Wounded Warrior Project was the remainder beneficiary. The trust was set up with a ten-year term. In 2009, Benny established an irrevocable trust for each of the three boys and funded each trust with $1 million. The trusts were set up in such a way as to allow the trustee of each trust to provide for the health, education, maintenance and support of the beneficiary. The trusts were established as simple trusts. The trustee is directed to not terminate the trust until the beneficiary turns age 45. The trusts were not set up as crummy trusts. The trusts name the children (born and unborn) of each of the boys as the contingent beneficiaries for each trust. In 2012, Benny gave Uncle George a gift of $1,013,000 in cash. His uncle had been inspirational when Benny was a kid and has fallen on hard times. Martha has not made any taxable gifts in her past. TAX RATE SCHEDULE FOR TAXABLE GIFTS AND ESTATES (2009) Over $0 but not over $10,000 Over $10,000 but not over $20,000 Over $20,000 but not over $40,000 Over $40,000 but not over $60,000 Over $60,000 but not over $80,000 Over $80,000 but not over $100,000 Over $100,000 but not over $150,000 Over $150,000 but not over $250,000 Over $250,000 but not over $500,000 Over $500,000 but not over $750,000 Over $750,000 but not over $1,000,000 Over $1,000,000 but not over $1,250,000 Over $1,250,000 but not over $1,500,000 Over $1,500,000 but not over $2,000,000 Over $2,000,000 TAX RATE SCHEDULE Over $0 but not over $10,000 Over $10,000 but not over $20,000 Over $20,000 but not over $40,000 Over $40,000 but not over $60,000 Over $60,000 but not over $80,000 Over $80,000 but not over $100,000 Over $100,000 but not over $150,000 Over $150,000 but not over $250,000 Over $250,000 but not over $500,000 Over $500,000 18% of such amount. $1,800 plus 20% of the excess of such amount over $10,000 $3,800 plus 22% of the excess of such amount over $20,000 $8,200 plus 24% of the excess of such amount over $40,000 $13,000 plus 26% of the excess of such amount over $60,000 $18,200 plus 28% of the excess of such amount over $80,000 $23,800 plus 30% of the excess of such amount over $100,000 $38,800 plus 32% of the excess of such amount over $150,000 $70,800 plus 34% of the excess of such amount over $250,000 $155,800 plus 37% of the excess of such amount over $500,000 $248,300 plus 39% of the excess of such amount over $750,000 $345,800 plus 41% of the excess of such amount over $1,000,000 $448,300 plus 43% of the excess of such amount over $1,250,000 $555,800 plus 45% of the excess of such amount over $1,500,000 $780,800 plus 45% of the excess of such amount over $2,000,000 FOR TAXABLE GIFTS AND ESTATES (2012) 18% of such amount. $1,800 plus 20% of the excess of such amount over $10,000 $3,800 plus 22% of the excess of such amount over $20,000 $8,200 plus 24% of the excess of such amount over $40,000 $13,000 plus 26% of the excess of such amount over $60,000 $18,200 plus 28% of the excess of such amount over $80,000 $23,800 plus 30% of the excess of such amount over $100,000 $38,800 plus 32% of the excess of such amount over $150,000 $70,800 plus 34% of the excess of such amount over $250,000 $155,800 plus 35% of the excess of such amount over $500,000 TAX RATE SCHEDULE FOR TAXABLE GIFTS AND ESTATES (2018) Over $0 but not over $10,000 Over $10,000 but not over $20,000 Over $20,000 but not over $40,000 Over $40,000 but not over $60,000 Over $60,000 but not over $80,000 Over $80,000 but not over $100,000 Over $100,000 but not over $150,000 Over $150,000 but not over $250,000 Over $250,000 but not over $500,000 Over $500,000 but not over $750,000 Over $750,000 but not over $1,000,000 Over $1,000,000 18% of such amount. $1,800 plus 20% of the excess of such amount over $10,000 $3,800 plus 22% of the excess of such amount over $20,000 $8,200 plus 24% of the excess of such amount over $40,000 $13,000 plus 26% of the excess of such amount over $60,000 $18,200 plus 28% of the excess of such amount over $80,000 $23,800 plus 30% of the excess of such amount over $100,000 $38,800 plus 32% of the excess of such amount over $150,000 $70,800 plus 34% of the excess of such amount over $250,000 $155,800 plus 37% of the excess of such amount over $500,000 $248,300 plus 39% of the excess of such amount over $750,000 $345,800 plus 40% of the excess of such amount over $1,000,000 EX

Step by Step Solution

★★★★★

3.64 Rating (184 Votes )

There are 3 Steps involved in it

Step: 1

Given the complexity of the scenario and the specific details provided Ill break down each of the goals mentioned and provide more detailed steps for Benny and Martha to consider Please note that this ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started