Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What are the strongest arguments that Uber drivers should be classified as independent contractors? What are the strongest arguments that Uber drivers should be classified

- What are the strongest arguments that Uber drivers should be classified as independent contractors?

- What are the strongest arguments that Uber drivers should be classified as employees?

- Can you think of a third-classification that might better encompass Uber drivers? What kind of legal duties would those that hire these workers have?

4. Choose a country other than those discussed above. Spend a few minutes researching its approach to the idea of employment at will. What do you find?

5. The ADA applies to websites. This notes that Under Ninth Circuit precedent, web-only businesses are not covered by the ADA. However, websites that have a nexus to a physical place of public accommodation are covered. Does this rule make sense? Why or why not? Do you agree with how the court found this applies to Dominos?

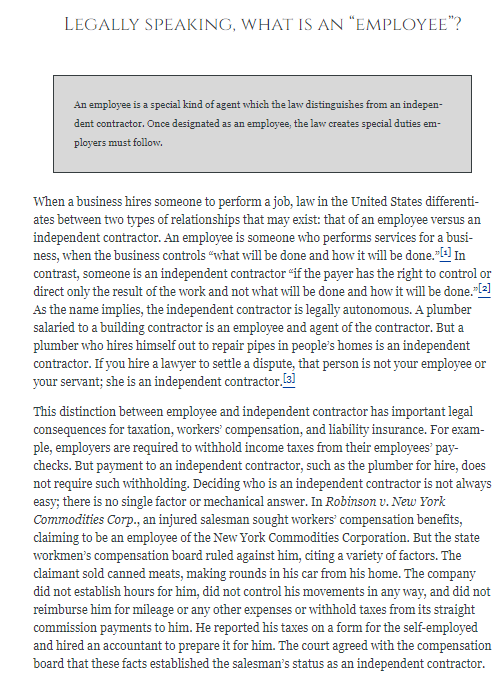

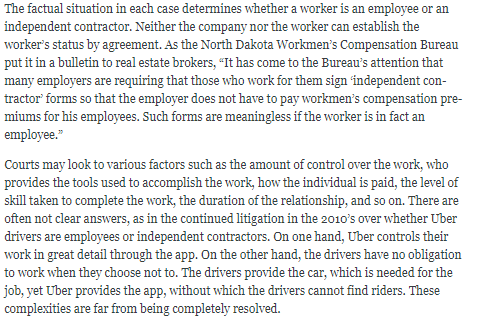

The factual situation in each case determines whether a worker is an employee or an independent contractor. Neither the company nor the worker can establish the worker's status by agreement. As the North Dakota Workmen's Compensation Bureau put it in a bulletin to real estate brokers, "It has come to the Bureau's attention that many employers are requiring that those who work for them sign 'independent contractor' forms so that the employer does not have to pay workmen's compensation premiums for his employees. Such forms are meaningless if the worker is in fact an employee." Courts may look to various factors such as the amount of control over the work, who provides the tools used to accomplish the work, how the individual is paid, the level of skill taken to complete the work, the duration of the relationship, and so on. There are often not clear answers, as in the continued litigation in the 2010's over whether Uber drivers are employees or independent contractors. On one hand, Uber controls their work in great detail through the app. On the other hand, the drivers have no obligation to work when they choose not to. The drivers provide the car, which is needed for the job, yet Uber provides the app, without which the drivers cannot find riders. These complexities are far from being completely resolved. WHAT ARE ALTERNATIVES TO EMPLOYMENT AT WILL? Countries around the world have a number of alternatives to the United States" "at will system. Countries outside the United States have developed a number of alternatives to employment at will. For example, - 'There is no 'at will' employment in Japan. Japanese law requires that termination of regular employment shall be considered objectively, deemed reasonable, and appropriate upon social convention, which is read rigidly in light of Japanese judicial precedent.". [1] - "In Germany, there is no such thing as "employment at will". By law, German employees must have written employment contracts that reflect the key aspects of the employment relationship (e.g., parties to the contract, work to be performed, gross salary and benefits, vacation, starting date of employment, place of performance, notice periods). [ [2] - 'There is no 'at will' employment in Canada. Dismissed employees are entitled to notice of termination or pay in lieu of notice, unless employment was terminated 'for cause'., [ [3] This means that United States companies operating overseas must be careful in how they approach the employment relationship. For instance, because firing an employee may be much more difficult than in the United States, taking extra care in the hiring process for employees may be warranted. There are pros and cons to the "at will" system versus these alternatives. Being able to fire an unproductive employee easily may help with business efficiency, yet having little job security outside a limited set of statutory protections brings great uncertainty to the lives of employees. Employers cannot disqualify an employee or job applicant because of disability as long as he or she can perform the essential functions of the job, with reasonable accommodation. Reasonable accommodation might include installing ramps for a wheelchair, establishing more flexible working hours, creating or modifying job assignments, and the like. Reasonable accommodation means that there is no undue hardship for the employer. The law does not offer uniform standards for identifying what may be an undue hardship other than the imposition on the employer of a "significant difficulty or expense." Cases will differ: the resources and situation of each particular employer relative to the cost or difficulty of providing the accommodation will be considered; relative cost, rather than some definite dollar amount, will be the issue. As with other areas of employment discrimination, job interviewers cannot ask questions about an applicant's disabilities before making a job offer; the interviewer may only ask whether the applicant can perform the work. Requirements for a medical exam are a violation of the ADA unless the exam is job related and required of all applicants for similar jobs. Employers may, however, use drug testing, although public employers are to some extent limited by the Fourth Amendment requirements of reasonableness. LEGALLY SPEAKING, WHAT IS AN "EMPLOYEE"? An employee is a special kind of agent which the law distinguishes from an independent contractor. Once designated as an employee, the law creates special duties employers must follow. When a business hires someone to perform a job, law in the United States differentiates between two types of relationships that may exist: that of an employee versus an independent contractor. An employee is someone who performs services for a business, when the business controls "what will be done and how it will be done.".[1] In contrast, someone is an independent contractor "if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done." [2] As the name implies, the independent contractor is legally autonomous. A plumber salaried to a building contractor is an employee and agent of the contractor. But a plumber who hires himself out to repair pipes in people's homes is an independent contractor. If you hire a lawyer to settle a dispute, that person is not your employee or your servant; she is an independent contractor.[3] This distinction between employee and independent contractor has important legal consequences for taxation, workers' compensation, and liability insurance. For example, employers are required to withhold income taxes from their employees' paychecks. But payment to an independent contractor, such as the plumber for hire, does not require such withholding. Deciding who is an independent contractor is not always easy; there is no single factor or mechanical answer. In Robinson v. New York Commodities Corp., an injured salesman sought workers' compensation benefits, claiming to be an employee of the New York Commodities Corporation. But the state workmen's compensation board ruled against him, citing a variety of factors. The claimant sold canned meats, making rounds in his car from his home. The company did not establish hours for him, did not control his movements in any way, and did not reimburse him for mileage or any other expenses or withhold taxes from its straight commission payments to him. He reported his taxes on a form for the self-employed and hired an accountant to prepare it for him. The court agreed with the compensation board that these facts established the salesman's status as an independent contractor. WHAT ARE REQUIREMENTS OF THE ADEA AND ADA? The ADEA protects against discrimination based on age, and the ADA protects against discrimination on the basis of disability. They are similar to, but different from Title VIL. THE AGE DISCRIMINATION IN EMPLOYMENT ACT The Age Discrimination in Employment Act (ADEA) of 1967 (amended in 1978 and again in 1986) prohibits discrimination based on age, and recourse to this law has been growing at a faster rate than any other federal antibias employment law. In particular, the act protects workers over forty years of age and prohibits forced retirement in most jobs because of age. Until 1987, federal law had permitted mandatory retirement at age seventy, but the 1986 amendments that took effect January 1, 1987, abolished the age ceiling except for a few jobs, such as firefighters, police officers, tenured university professors, and executives with annual pensions exceeding $44,000. Like Title VII, the law has a bona fide occupational qualification exception-for example, employers may set reasonable age limitations on certain high-stress jobs requiring peak physical condition. There are important differences between the ADEA and Title VII- it is more difficult to prove an age discrimination claim than a claim under Title VII, but those differences are beyond our scope. THE AMERICANS WITH DISABILITIES ACT The 1990 Americans with Disabilities Act (ADA) prohibits employers from discriminating on the basis of disability. A disabled person is someone with a physical or mental impairment that substantially limits a major life activity or someone who is regarded as having such an impairment. This definition includes people with mental illness, epilepsy, visual impairment, dyslexia, and AIDS. It also covers anyone who has recovered from alcoholism or drug addiction. It specifically does not cover people with pyromania, kleptomania, exhibitionism, or compulsive gambling

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started