What are the synergies that Mr. Tritschler hope to achieve through acquisition of Stay and Play Inc.

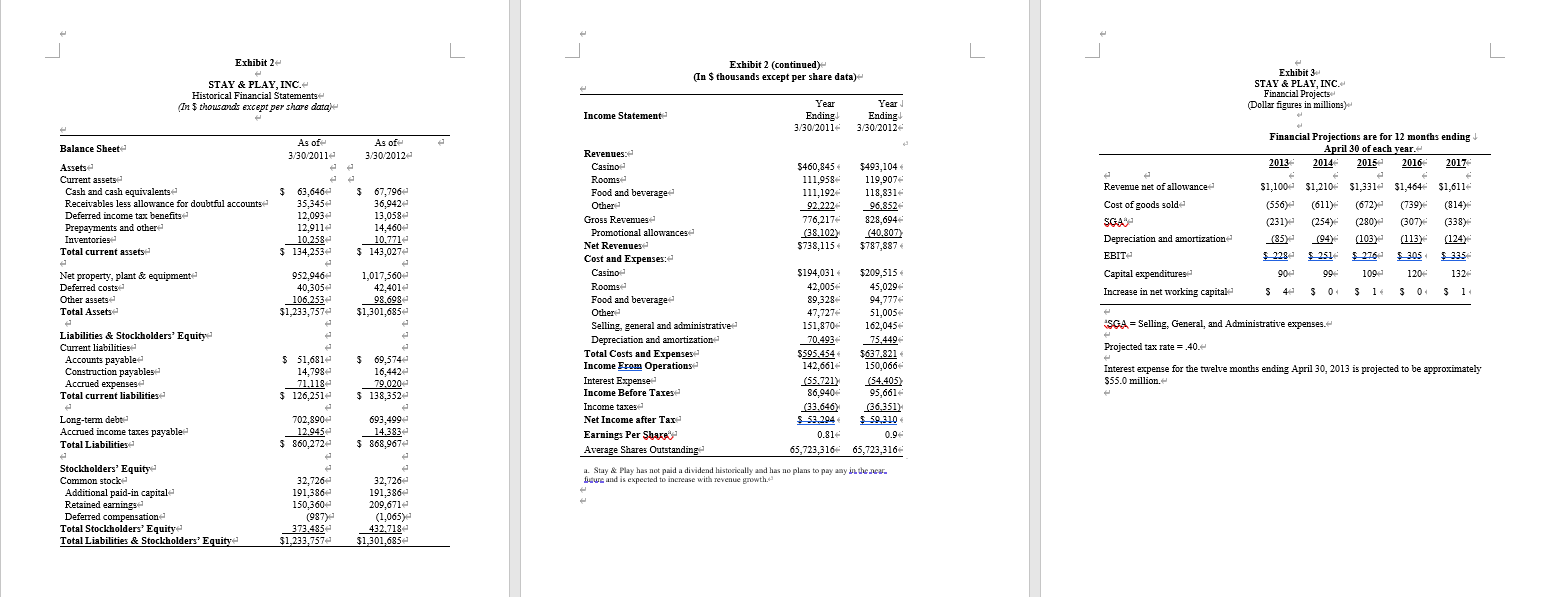

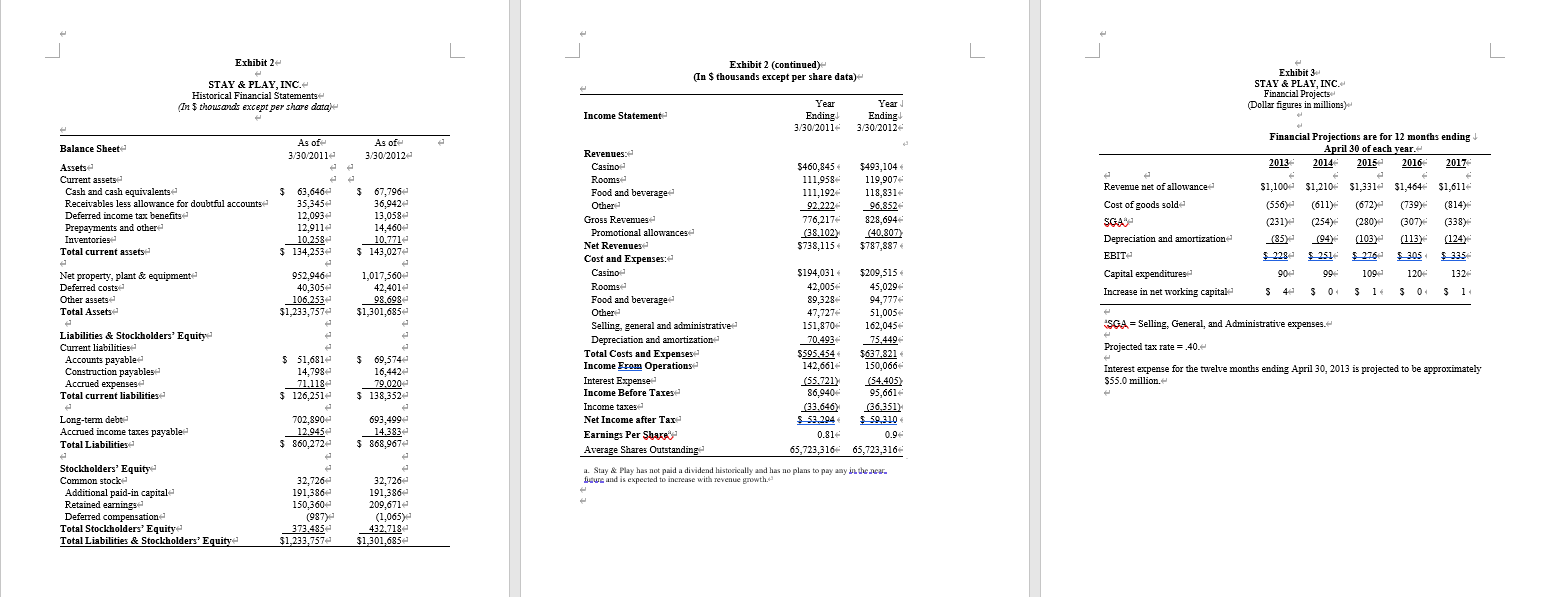

L L STAY & PLAY, INC. Exhibitle occupancy rates, and price increases that mirror general inflation. He also includes a one-time super-normal growth rate in 2012-2013 due to the opening of a new wing at the Gary facility. STAY & PLAY, INC. & , Memo TO: Wadsworth Tritschler It is now April 23, 2012. Ms. Hester Palme, the new president and CEO of Mt. Carmel Properties (Mt. Carmel) has asked Mr. Wadsworth Tritschler to evaluate Stay & Play, Inc. (Stay & Play) as a possible acquisition. The question for her is-should Mt. Carmel consider buying Stay & Play and, if so, at what price? (see Exhibit 1) Purchase of Stay & Play's world-class casino-hotels and other gambling properties could enhance Mt. Carmel's position in the gaming business. If Mt. Carmel buys the business, Mr. Tritschler believes net margins can be improved (relative to stand-alone projections) by taking advantage of Mt. Carmel's expertise in the industry and exploiting some economies of scale. That is, he is confident that pretax Selling, General and Administrative expense (SGA) can be reduced by 1 percent of revenue, compared to Stay & Play's stand-alone performance. (That is, Mr. Tritschler is confident that SGA can be reduced from 21% to 20% of revenue.) Savings in SGA might be even double this level (2 percent of revenue). However, cost of goods sold as a percent of sales appear to be in line with industry averages and Mr. Tritschler does not see much opportunity for improvement in that area. FROM Hester Palme SUBJECT: Stay & Play, Inc. DATE: April 15, 2012 Mt. Carmel Properties, Inc.- Mr. Tritschler does not anticipate being able to trim any assets or working capital from Stay & Play's balance sheets after the merger. The cash balance, for example, is considered by most industry analysts to be about average for a well run gaming company. Mt. Carmel is a publicly traded company that owns hotels (under the brand name Pascoe) across the U.S. and abroad. The Pascoe name is recognized internationally as synonymous with quality hotels. Prime hotels include the Pascoe Plaza (Atlanta), Pascoe Bristol (London) and the Pascoe Real (Rio de Janeiro). In addition, Mt. Cammel owns five casino hotels in New Jersey, one in Australia and one in Aruba. Mft. Carmel also owns 105 non-casino (i.e., non-gambling) hotels throughout the world. As we discussed yesterday, I will be making a presentation to the Board of Directors next week. Please draft a recommendation (covering the issues below) as to whether we should pursue a purchase of Stay & Play. I look forward to getting your thoughts. What is Stay & Play worth? We have not yet decided whether to pursue a purchase of assets or a purchase of equity, so provide me with both your calculations for enterprise value and equity value. Further, after five years, Mr. Tritschler expects net cash flow to grow at 5% per year in nominal terms. He also knows that the weighted average cost of capital for companies like Stay & Play is 13%. Mr. Tritschler knows that other suitors for Stay & Play might appear. To date none has. Is this lack of activity telling him that Stay & Play properties are viewed as likely to command "too high" a price? What if contemplated margin improvements fall short of expectations? These are some of the issues that Mr. Tritschler is juggling as he prepares his report for Palme. Stay & Play, Inc. Additionally, what should be our initial negotiating position on an all-cash price that we are willing to offer? Are there any advantages to negotiating for a stock-for-stock acquisition rather than an all-cash purchase? Stay & Play, Inc. owns and operates three world-class casino hotel resorts in Atlantic City and Las Vegas, a dockside casino and hotel in Florence, Mississippi, and a riverboat casino in Gary, Indiana. Exhibit 2 provides historical financial information for Stay & Play. According to one analyste Stay & Play, a privatal-held company, is considered a prime acquisition target because of the strategic location of its holdings and the kind of customers it attracts. The company controls two casinos in Atlantic City, a market that has been ignored by some major gambling companies but is now booming. Similarly Stay & Play has a foothold in the Chicago market with its location in Gary. Stay & Play also controls a Las Vegas casino, and its properties serve mid-market gamblers who usually do not patronize high-roller casinos. One question is whether market participants such as Stay & Play can compete effectively without the aid of powerful reservation systems deployed by larger hotel chains such as Mt. Carmel. Deal Considerations Exhibit 3 gives Mr. Tritschler's initial financial projections for Stay & Play as a stand- alone entity (i.e., the projections ignore any benefits of an acquisition by Mt. Carmel). Mr. Tritschler has forecast Stay & Play revenue growth based on capacity increases, an increase in Note: In doing any financial analysis, assumptions must be made. In analyzing this case, if the data do not fit the analysis perfectly, make reasonable assumptions. MGMT 413, Fall 2010 Say & Play MGMT 413, Fall 2010 Say & Play, line- MGMT 413, Fall 2010 Say & Play, L L L Exhibit 2 Exhibit 2 (continued) (In $ thousands except per share data) STAY & PLAY, INC. Historical Financial Statements (In 5 thousands except per share data) Exhibit 3 STAY & PLAY, INC. Financial Projects (Dollar figures in millions) Income Statement Year Ending 3/30/2011- Year Ending 3/30/2012 As of 3/30/2011 As of 3/30/2012 Financial Projections are for 12 months ending April 30 of each year. 2013 2014 2015 2016 2017 Balance Sheet Assets Current assets Cash and cash equivalents Receivables less allowance for doubtful accounts Deferred income tax benefits Prepayments and other Inventories Total current assets $ 63,646 35,345 12,093 12,911 10.258 $ 134,233 $ 67,796 36.9424 13,058 14,460 10.771 $ 143,027 $460,845 111,958 111,1924 92.222 776,217 (38.102) $738,115 $493,104 119,9074 118,831 96.852 828,694 (40.807) 5787,887 Revenue net of allowance Cost of goods sold SGAS Depreciation and amortization EBITA $1,100 $1,2104 $1,3314 $1,464 $1,6114 (556) (611) (672) (739) (814) (231) () (254) (280) (307) (338) (85) (94) (103) (113) (124) $ 251 $ 276 $305 $335 90- 99 109 120 132 S $ 0 $ 1 $ 04 3 1 Net property, plant & equipment Deferred costs Other assets Total Assets 952,946 40.3052 106.253 $1,233,757 1,017,560 42,401 98.698 $1,301,685 Capital expenditures Increase in net working capital Revenues: Casino Rooms Food and beverage Other Gross Revenues Promotional allowances Net Revenues Cost and Expenses: Casino Rooms Food and beverage Other Selling, general and administrative Depreciation and amortization Total Costs and Expenses Income From Operations Interest Expense Income Before Taxes Income taxes Net Income after Tax Earnings Per Share Average Shares Outstanding Liabilities & Stockholders' Equity Current liabilities Accounts payable Construction payables Accrued expenses Total current liabilities $ 51,681 14,798 71.118 $ 126,251 SGA = Selling, General, and Administrative expenses. Projected tax rate = 40.- Interest expense for the twelve months ending April 30, 2013 is projected to be approximately $55.0 million. $194,031 $209,515 42,005 45,029 89,328 94,777 47,727 51,005 151,870 162,0454 70.493 75.449 $595.454 5637,821 142,661 150,066 (55.721) (54,405) 86.940+ 95,661- (33.646) (36.351) ) $ 53.294 $ 59.3.10 0.81 0.9 65,723,316 65,723,316 $ 69.5744 16,442 79.020 $ 138,352 Long-term debt Accrued income taxes payable Total Liabilities 702,890.- 12.945 $ 860,272 693,499 14.383 $ 868,967 a. Stay & Play has not paid a dividend historically and has no plans to pay any in the New we and is expected to increase with revenue growth Stockholders' Equity Common stock Additional paid-in capital Retained earnings Deferred compensation Total Stockholders' Equity Total Liabilities & Stockholders' Equity 32,726 191,386 150,360 (987) 373.485 $1,233,7572 32,726 191,386 209,671 (1,065) 432.718 $1,301,685 L L STAY & PLAY, INC. Exhibitle occupancy rates, and price increases that mirror general inflation. He also includes a one-time super-normal growth rate in 2012-2013 due to the opening of a new wing at the Gary facility. STAY & PLAY, INC. & , Memo TO: Wadsworth Tritschler It is now April 23, 2012. Ms. Hester Palme, the new president and CEO of Mt. Carmel Properties (Mt. Carmel) has asked Mr. Wadsworth Tritschler to evaluate Stay & Play, Inc. (Stay & Play) as a possible acquisition. The question for her is-should Mt. Carmel consider buying Stay & Play and, if so, at what price? (see Exhibit 1) Purchase of Stay & Play's world-class casino-hotels and other gambling properties could enhance Mt. Carmel's position in the gaming business. If Mt. Carmel buys the business, Mr. Tritschler believes net margins can be improved (relative to stand-alone projections) by taking advantage of Mt. Carmel's expertise in the industry and exploiting some economies of scale. That is, he is confident that pretax Selling, General and Administrative expense (SGA) can be reduced by 1 percent of revenue, compared to Stay & Play's stand-alone performance. (That is, Mr. Tritschler is confident that SGA can be reduced from 21% to 20% of revenue.) Savings in SGA might be even double this level (2 percent of revenue). However, cost of goods sold as a percent of sales appear to be in line with industry averages and Mr. Tritschler does not see much opportunity for improvement in that area. FROM Hester Palme SUBJECT: Stay & Play, Inc. DATE: April 15, 2012 Mt. Carmel Properties, Inc.- Mr. Tritschler does not anticipate being able to trim any assets or working capital from Stay & Play's balance sheets after the merger. The cash balance, for example, is considered by most industry analysts to be about average for a well run gaming company. Mt. Carmel is a publicly traded company that owns hotels (under the brand name Pascoe) across the U.S. and abroad. The Pascoe name is recognized internationally as synonymous with quality hotels. Prime hotels include the Pascoe Plaza (Atlanta), Pascoe Bristol (London) and the Pascoe Real (Rio de Janeiro). In addition, Mt. Cammel owns five casino hotels in New Jersey, one in Australia and one in Aruba. Mft. Carmel also owns 105 non-casino (i.e., non-gambling) hotels throughout the world. As we discussed yesterday, I will be making a presentation to the Board of Directors next week. Please draft a recommendation (covering the issues below) as to whether we should pursue a purchase of Stay & Play. I look forward to getting your thoughts. What is Stay & Play worth? We have not yet decided whether to pursue a purchase of assets or a purchase of equity, so provide me with both your calculations for enterprise value and equity value. Further, after five years, Mr. Tritschler expects net cash flow to grow at 5% per year in nominal terms. He also knows that the weighted average cost of capital for companies like Stay & Play is 13%. Mr. Tritschler knows that other suitors for Stay & Play might appear. To date none has. Is this lack of activity telling him that Stay & Play properties are viewed as likely to command "too high" a price? What if contemplated margin improvements fall short of expectations? These are some of the issues that Mr. Tritschler is juggling as he prepares his report for Palme. Stay & Play, Inc. Additionally, what should be our initial negotiating position on an all-cash price that we are willing to offer? Are there any advantages to negotiating for a stock-for-stock acquisition rather than an all-cash purchase? Stay & Play, Inc. owns and operates three world-class casino hotel resorts in Atlantic City and Las Vegas, a dockside casino and hotel in Florence, Mississippi, and a riverboat casino in Gary, Indiana. Exhibit 2 provides historical financial information for Stay & Play. According to one analyste Stay & Play, a privatal-held company, is considered a prime acquisition target because of the strategic location of its holdings and the kind of customers it attracts. The company controls two casinos in Atlantic City, a market that has been ignored by some major gambling companies but is now booming. Similarly Stay & Play has a foothold in the Chicago market with its location in Gary. Stay & Play also controls a Las Vegas casino, and its properties serve mid-market gamblers who usually do not patronize high-roller casinos. One question is whether market participants such as Stay & Play can compete effectively without the aid of powerful reservation systems deployed by larger hotel chains such as Mt. Carmel. Deal Considerations Exhibit 3 gives Mr. Tritschler's initial financial projections for Stay & Play as a stand- alone entity (i.e., the projections ignore any benefits of an acquisition by Mt. Carmel). Mr. Tritschler has forecast Stay & Play revenue growth based on capacity increases, an increase in Note: In doing any financial analysis, assumptions must be made. In analyzing this case, if the data do not fit the analysis perfectly, make reasonable assumptions. MGMT 413, Fall 2010 Say & Play MGMT 413, Fall 2010 Say & Play, line- MGMT 413, Fall 2010 Say & Play, L L L Exhibit 2 Exhibit 2 (continued) (In $ thousands except per share data) STAY & PLAY, INC. Historical Financial Statements (In 5 thousands except per share data) Exhibit 3 STAY & PLAY, INC. Financial Projects (Dollar figures in millions) Income Statement Year Ending 3/30/2011- Year Ending 3/30/2012 As of 3/30/2011 As of 3/30/2012 Financial Projections are for 12 months ending April 30 of each year. 2013 2014 2015 2016 2017 Balance Sheet Assets Current assets Cash and cash equivalents Receivables less allowance for doubtful accounts Deferred income tax benefits Prepayments and other Inventories Total current assets $ 63,646 35,345 12,093 12,911 10.258 $ 134,233 $ 67,796 36.9424 13,058 14,460 10.771 $ 143,027 $460,845 111,958 111,1924 92.222 776,217 (38.102) $738,115 $493,104 119,9074 118,831 96.852 828,694 (40.807) 5787,887 Revenue net of allowance Cost of goods sold SGAS Depreciation and amortization EBITA $1,100 $1,2104 $1,3314 $1,464 $1,6114 (556) (611) (672) (739) (814) (231) () (254) (280) (307) (338) (85) (94) (103) (113) (124) $ 251 $ 276 $305 $335 90- 99 109 120 132 S $ 0 $ 1 $ 04 3 1 Net property, plant & equipment Deferred costs Other assets Total Assets 952,946 40.3052 106.253 $1,233,757 1,017,560 42,401 98.698 $1,301,685 Capital expenditures Increase in net working capital Revenues: Casino Rooms Food and beverage Other Gross Revenues Promotional allowances Net Revenues Cost and Expenses: Casino Rooms Food and beverage Other Selling, general and administrative Depreciation and amortization Total Costs and Expenses Income From Operations Interest Expense Income Before Taxes Income taxes Net Income after Tax Earnings Per Share Average Shares Outstanding Liabilities & Stockholders' Equity Current liabilities Accounts payable Construction payables Accrued expenses Total current liabilities $ 51,681 14,798 71.118 $ 126,251 SGA = Selling, General, and Administrative expenses. Projected tax rate = 40.- Interest expense for the twelve months ending April 30, 2013 is projected to be approximately $55.0 million. $194,031 $209,515 42,005 45,029 89,328 94,777 47,727 51,005 151,870 162,0454 70.493 75.449 $595.454 5637,821 142,661 150,066 (55.721) (54,405) 86.940+ 95,661- (33.646) (36.351) ) $ 53.294 $ 59.3.10 0.81 0.9 65,723,316 65,723,316 $ 69.5744 16,442 79.020 $ 138,352 Long-term debt Accrued income taxes payable Total Liabilities 702,890.- 12.945 $ 860,272 693,499 14.383 $ 868,967 a. Stay & Play has not paid a dividend historically and has no plans to pay any in the New we and is expected to increase with revenue growth Stockholders' Equity Common stock Additional paid-in capital Retained earnings Deferred compensation Total Stockholders' Equity Total Liabilities & Stockholders' Equity 32,726 191,386 150,360 (987) 373.485 $1,233,7572 32,726 191,386 209,671 (1,065) 432.718 $1,301,685