what are these awnsers?

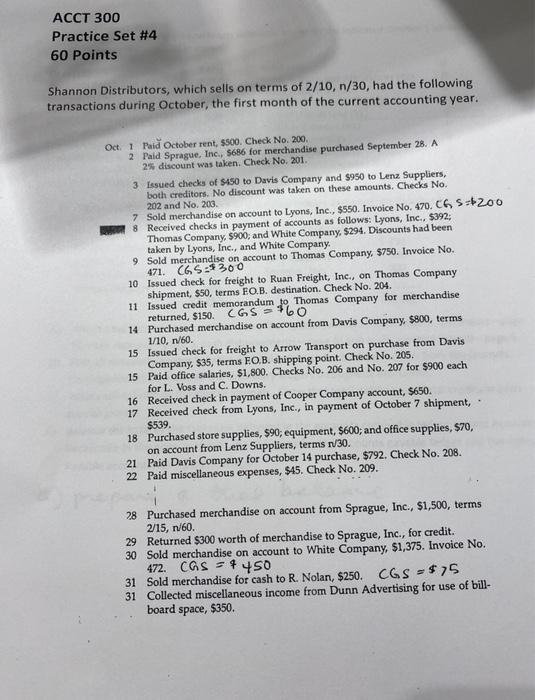

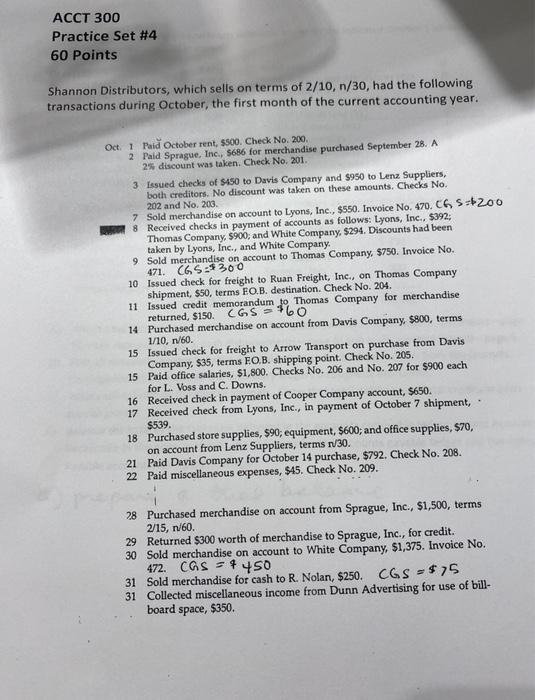

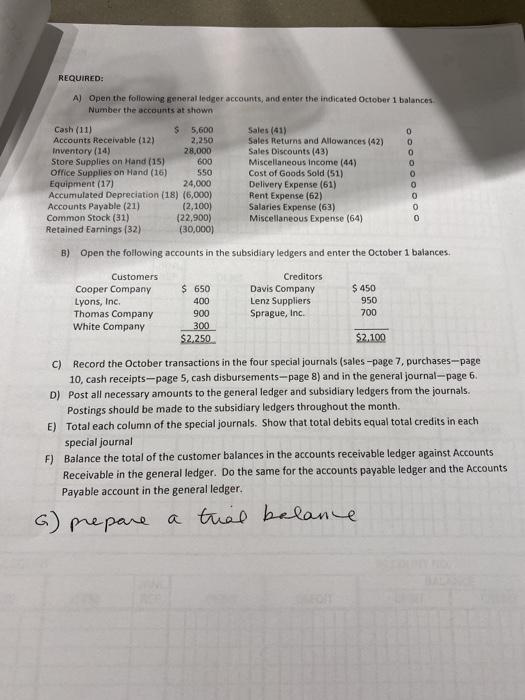

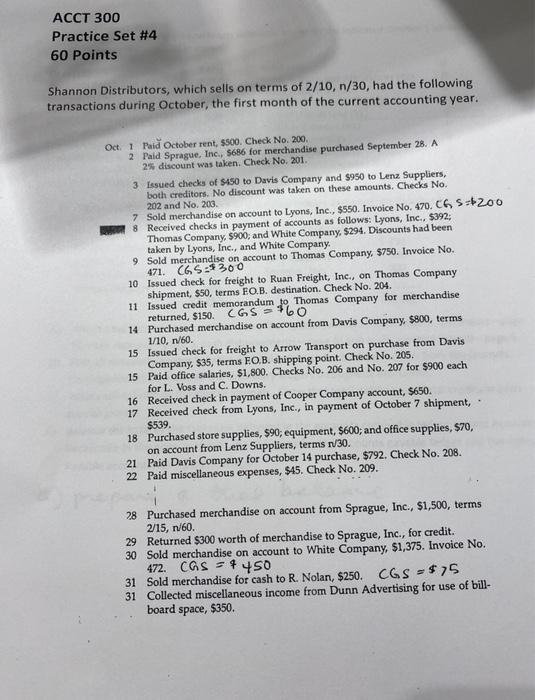

ACCT 300 Practice Set #4 60 Points Shannon Distributors, which sells on terms of 2/10, n/30, had the following transactions during October, the first month of the current accounting year. Oct. 1 Paid October rent, 500. Check No. 200 2 Paid Sprague, Inc., 5686 for merchandise purchased September 28. A 2% discount was taken. Check No. 201 3 Issued checks of $450 to Davis Company and 8950 to Lenz Suppliers, both creditors. No discount was taken on these amounts. Checks No. 202 and No. 203 7 Sold merchandise on account to Lyons, Inc., $550. Invoice No. 470. CG S:200 8 Received checks in payment of accounts as follows: Lyons, Inc. $392: Thomas Company, $900; and White Company, $294. Discounts had been taken by Lyons, Inc., and White Company 9 Sold merchandise on account to Thomas Company, $750. Invoice No. 471. CGS: 200 10 Issued check for freight to Ruan Freight, Inc., on Thomas Company shipment, $50, terms EO.B. destination. Check No. 204. 11 Issued credit memorandum to Thomas Company for merchandise returned, $150. CGS 560 14 Purchased merchandise on account from Davis Company, $800, terms 1/10, 1/60 15 Issued check for freight to Arrow Transport on purchase from Davis Company, $35, terms EO.B. shipping point. Check No. 205. 15 Paid office salaries, $1,800. Checks No. 206 and No. 207 for $900 each for L. Voss and C. Downs. 16 Received check in payment of Cooper Company account, $650. 17 Received check from Lyons, Inc., in payment of October 7 shipment, $539. 18 Purchased store supplies, $90, equipment, $600, and office supplies, $70, on account from Lenz Suppliers, terms 1 30. 21 Paid Davis Company for October 14 purchase, $792. Check No. 208. 22 Paid miscellaneous expenses, $45. Check No. 209. 28 Purchased merchandise on account from Sprague, Inc., $1,500, terms 2/15, 1/60 29 Returned $300 worth of merchandise to Sprague, Inc., for credit. 30 Sold merchandise on account to White Company, $1,375. Invoice No. 472. CAS = 450 31 Sold merchandise for cash to R. Nolan, $250. CGS - $75 31 Collected miscellaneous income from Dunn Advertising for use of bill- board space, $350. REQUIRED: A) Open the following general ledger accounts, and enter the indicated October 1 balances Number the accounts at shown Cash (11) $ 5,600 Accounts Receivable (12) 2,250 Inventory (14) 28,000 Store Supplies on Hand (15) 600 Office Supplies on Hand (16) $50 Equipment (17) 24,000 Accumulated Depreciation (18) (6,000) Accounts Payable (21) (2,100) Common Stock (31) (22,900) Retained Earnings (32) (30,000) Sales (41) Sales Returns and Allowances (42) Sales Discounts (43) Miscellaneous Income (44) Cost of Goods Sold (51) Delivery Expense (61) Rent Expense (62) Salaries Expense (63) Miscellaneous Expense (64) 0 0 0 0 0 0 0 0 B) Open the following accounts in the subsidiary ledgers and enter the October 1 balances. 300 Customers Creditors Cooper Company $ 650 Davis Company $ 450 Lyons, Inc. 400 Lenz Suppliers 950 Thomas Company 900 Sprague, Inc. 700 White Company $2,250 $2.100 C) Record the October transactions in the four special journals (sales -page 7, purchases-page 10, cash receipts-page 5, cash disbursements--page 8) and in the general journal-- page 6 D) Post all necessary amounts to the general ledger and subsidiary ledgers from the journals. Postings should be made to the subsidiary ledgers throughout the month. E) Total each column of the special journals. Show that total debits equal total credits in each special journal F) Balance the total of the customer balances in the accounts receivable ledger against Accounts Receivable in the general ledger. Do the same for the accounts payable ledger and the Accounts Payable account in the general ledger. a tral balance 6) prepare a ACCT 300 Practice Set #4 60 Points Shannon Distributors, which sells on terms of 2/10, n/30, had the following transactions during October, the first month of the current accounting year. Oct. 1 Paid October rent, 500. Check No. 200 2 Paid Sprague, Inc., 5686 for merchandise purchased September 28. A 2% discount was taken. Check No. 201 3 Issued checks of $450 to Davis Company and 8950 to Lenz Suppliers, both creditors. No discount was taken on these amounts. Checks No. 202 and No. 203 7 Sold merchandise on account to Lyons, Inc., $550. Invoice No. 470. CG S:200 8 Received checks in payment of accounts as follows: Lyons, Inc. $392: Thomas Company, $900; and White Company, $294. Discounts had been taken by Lyons, Inc., and White Company 9 Sold merchandise on account to Thomas Company, $750. Invoice No. 471. CGS: 200 10 Issued check for freight to Ruan Freight, Inc., on Thomas Company shipment, $50, terms EO.B. destination. Check No. 204. 11 Issued credit memorandum to Thomas Company for merchandise returned, $150. CGS 560 14 Purchased merchandise on account from Davis Company, $800, terms 1/10, 1/60 15 Issued check for freight to Arrow Transport on purchase from Davis Company, $35, terms EO.B. shipping point. Check No. 205. 15 Paid office salaries, $1,800. Checks No. 206 and No. 207 for $900 each for L. Voss and C. Downs. 16 Received check in payment of Cooper Company account, $650. 17 Received check from Lyons, Inc., in payment of October 7 shipment, $539. 18 Purchased store supplies, $90, equipment, $600, and office supplies, $70, on account from Lenz Suppliers, terms 1 30. 21 Paid Davis Company for October 14 purchase, $792. Check No. 208. 22 Paid miscellaneous expenses, $45. Check No. 209. 28 Purchased merchandise on account from Sprague, Inc., $1,500, terms 2/15, 1/60 29 Returned $300 worth of merchandise to Sprague, Inc., for credit. 30 Sold merchandise on account to White Company, $1,375. Invoice No. 472. CAS = 450 31 Sold merchandise for cash to R. Nolan, $250. CGS - $75 31 Collected miscellaneous income from Dunn Advertising for use of bill- board space, $350. REQUIRED: A) Open the following general ledger accounts, and enter the indicated October 1 balances Number the accounts at shown Cash (11) $ 5,600 Accounts Receivable (12) 2,250 Inventory (14) 28,000 Store Supplies on Hand (15) 600 Office Supplies on Hand (16) $50 Equipment (17) 24,000 Accumulated Depreciation (18) (6,000) Accounts Payable (21) (2,100) Common Stock (31) (22,900) Retained Earnings (32) (30,000) Sales (41) Sales Returns and Allowances (42) Sales Discounts (43) Miscellaneous Income (44) Cost of Goods Sold (51) Delivery Expense (61) Rent Expense (62) Salaries Expense (63) Miscellaneous Expense (64) 0 0 0 0 0 0 0 0 B) Open the following accounts in the subsidiary ledgers and enter the October 1 balances. 300 Customers Creditors Cooper Company $ 650 Davis Company $ 450 Lyons, Inc. 400 Lenz Suppliers 950 Thomas Company 900 Sprague, Inc. 700 White Company $2,250 $2.100 C) Record the October transactions in the four special journals (sales -page 7, purchases-page 10, cash receipts-page 5, cash disbursements--page 8) and in the general journal-- page 6 D) Post all necessary amounts to the general ledger and subsidiary ledgers from the journals. Postings should be made to the subsidiary ledgers throughout the month. E) Total each column of the special journals. Show that total debits equal total credits in each special journal F) Balance the total of the customer balances in the accounts receivable ledger against Accounts Receivable in the general ledger. Do the same for the accounts payable ledger and the Accounts Payable account in the general ledger. a tral balance 6) prepare a