Question

What benefits might Petrobras have obtained from cross-listing its shares on the NYSE? What might the costs be? Harvard Case: Drilling South: Petrobras Evaluates Pecom

What benefits might Petrobras have obtained from cross-listing its shares on the NYSE? What might the costs be?

Harvard Case: Drilling South: Petrobras Evaluates Pecom

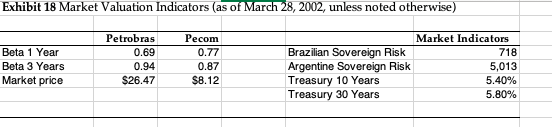

Let us value Pecom from the perspective of one of the holders of Petrobras ADRs. Assume a market beta of 0.9 for Pecom with respect to the global market. Assume market debt to assets at the time the beta is measured is 0.4. The Treasury rates in exhibit 18 are US Treasury rates. Assume the sovereign risks in exhibit 18 are the difference between the yield on the countrys dollar denominated sovereign debt and the US Treasury rates of the corresponding maturity. Assume the market risk premium is 7% and the expected return on Pecoms debt is 10%. Finally, assume that Petrobras believes a target debt to capital of 0.3 is appropriate after take over. State any additional assumptions you make in arriving at your answers.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started