- What comments, if any, about the companys system of internal control are included in managements report? In the independent auditors report?

- Who is primarily responsible for the system of internal controls - management of the auditors? Explain the responsibility of each with regard to internal control.

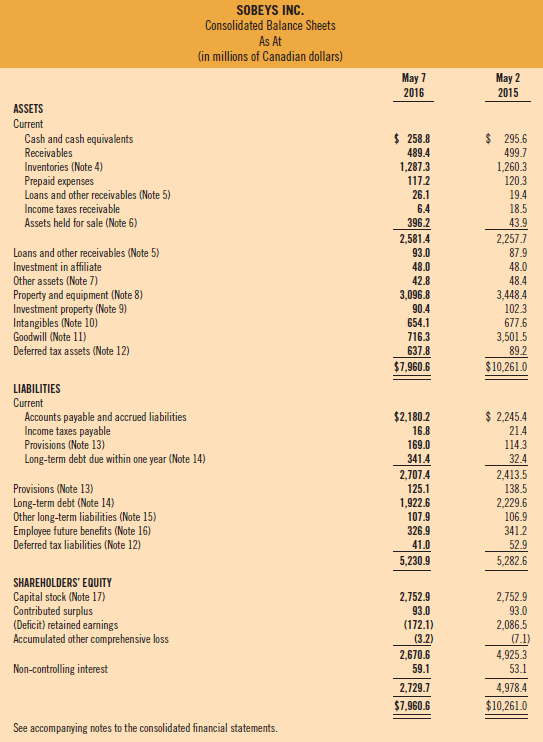

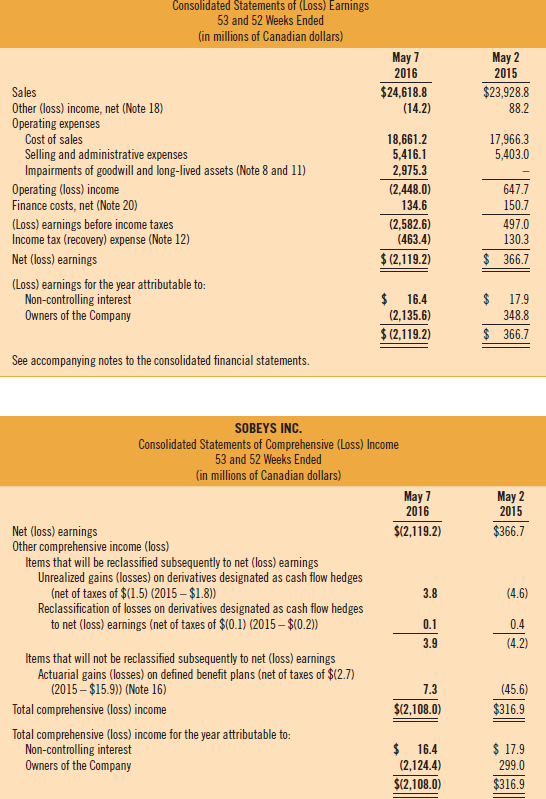

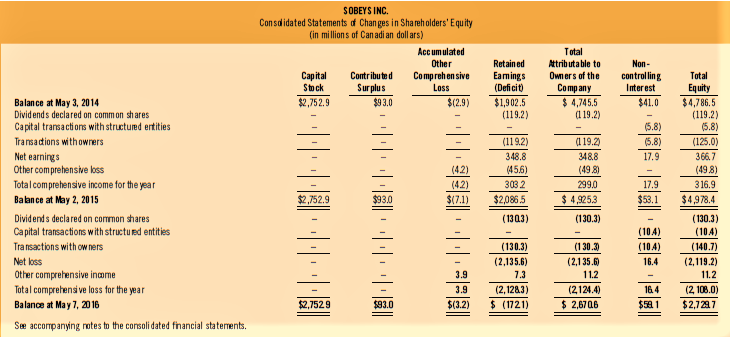

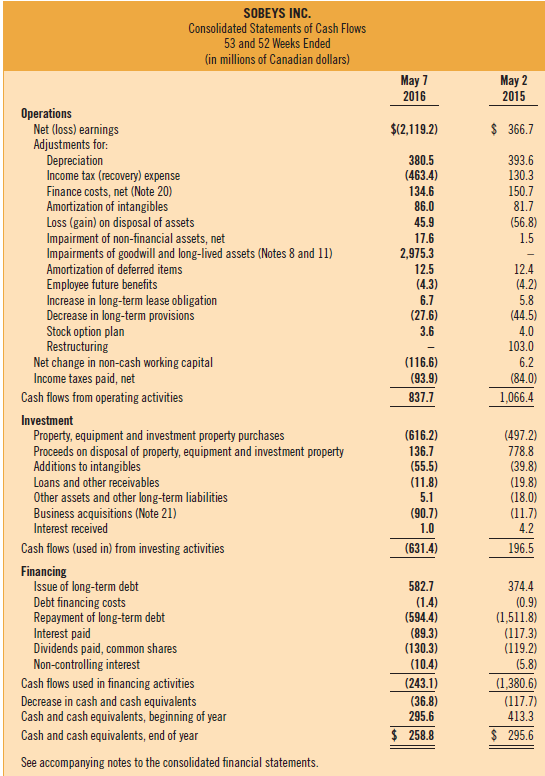

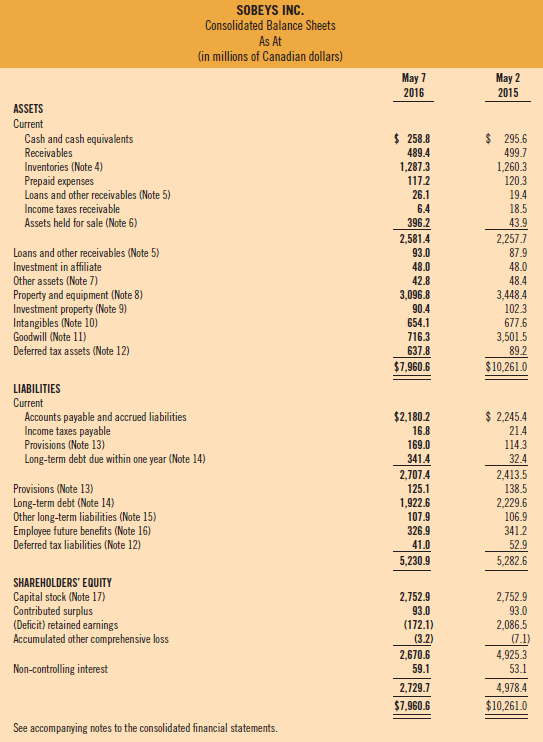

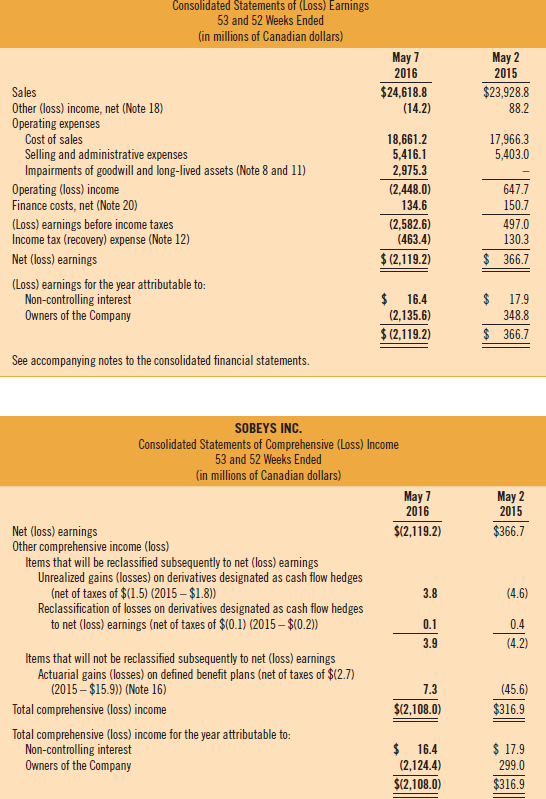

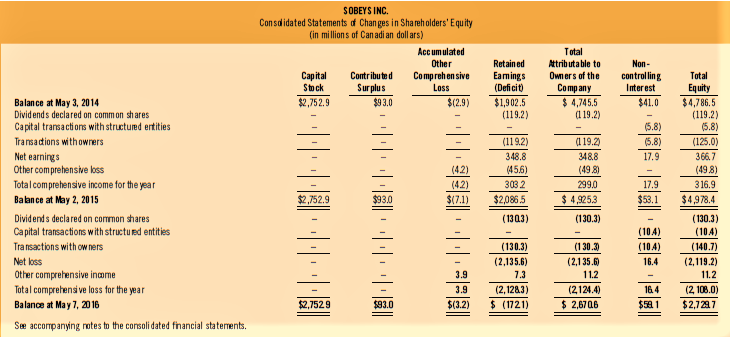

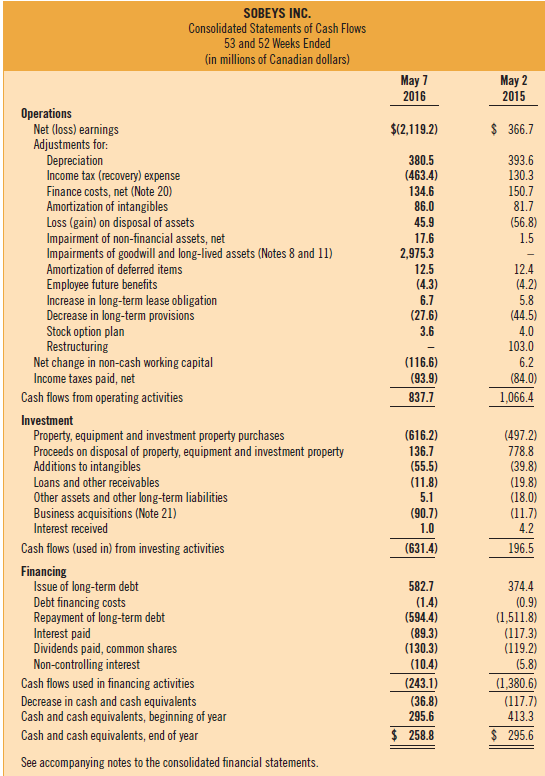

SOBEYS INC. Consolidated Balance Sheets As At (in millions of Canadian dollars) May 7 2016 May 2 2015 ASSETS Current Cash and cash equivalents Receivables Inventories (Note 4) Prepaid expenses Loans and other receivables (Note 5) Income taxes receivable Assets held for sale (Note 6) Loans and other receivables (Note 5) Investment in affiliate Other assets (Note 7) Property and equipment (Note 8) Investment property (Note 9) Intangibles (Note 10) Goodwill (Note 11) Deferred tax assets (Note 12) $ 258.8 489.4 1,287.3 117.2 26.1 6.4 396.2 2.581.4 93.0 48.0 42.8 3,096.8 90.4 654.1 716.3 637.8 $7,960.6 $ 295.6 499.7 1.260.3 120.3 19.4 18.5 43.9 2.257.7 87.9 48.0 48.4 3,448.4 102.3 677.6 3,501.5 892 $10,261.0 LIABILITIES Current Accounts payable and accrued liabilities Income taxes payable Provisions (Note 13) Long-term debt due within one year (Note 14) Provisions (Note 13) Long-term debt (Note 14) Other long-term liabilities (Note 15) Employee future benefits (Note 16) Deferred tax liabilities (Note 12) $2,180.2 16.8 169.0 341.4 2,707.4 125.1 1,922.6 107.9 326.9 41.0 5,230.9 $ 2,245.4 21.4 1143 32.4 2,413.5 138.5 2.229.6 106.9 3412 52.9 5,282.6 SHAREHOLDERS' EQUITY Capital stock (Note 17) Contributed surplus (Deficit) retained earnings Accumulated other comprehensive loss Non-controlling interest 2,752.9 93.0 (172.1) (3.2) 2,670.6 59.1 2,752.9 93.0 2,086.5 (7.1) 4,925.3 53.1 4,978.4 $10,261.0 2.729.7 $7,960.6 See accompanying notes to the consolidated financial statements. Consolidated Statements of (Loss) Earnings 53 and 52 Weeks Ended (in millions of Canadian dollars) May 7 2016 $24,618.8 (14.2) May 2 2015 $23,928.8 88.2 17,966.3 5,403.0 Sales Other (loss) income, net (Note 18) Operating expenses Cost of sales Selling and administrative expenses Impairments of goodwill and long-lived assets (Note 8 and 11) Operating (loss) income Finance costs, net (Note 20) (Loss) earnings before income taxes Income tax (recovery) expense (Note 12) Net (loss) earnings (Loss) earnings for the year attributable to: Non-controlling interest Owners of the Company 18,661.2 5,416.1 2,975.3 (2,448.0) 134.6 (2,582.6) (463.4) $(2,119.2) 647.7 150.7 497.0 130.3 $ 366.7 $ 16.4 (2,135.6) $(2,119.2) $ 17.9 348.8 $ 366.7 See accompanying notes to the consolidated financial statements. May 2 2015 $366.7 (4.6) SOBEYS INC. Consolidated Statements of Comprehensive (Loss) Income 53 and 52 Weeks Ended (in millions of Canadian dollars) May 7 2016 Net (loss) earnings $(2,119.2) Other comprehensive income (loss) Items that will be reclassified subsequently to net (loss) earings Unrealized gains (losses) on derivatives designated as cash flow hedges (net of taxes of $(1.5) (2015 - $1.8)) 3.8 Reclassification of losses on derivatives designated as cash flow hedges to net (Loss) earnings (net of taxes of $(0.1) (2015 $(0.2)) 0.1 3.9 Items that will not be reclassified subsequently to net (loss) earnings Actuarial gains (losses) on defined benefit plans (net of taxes of $(2.7) (2015 - $15.9)) (Note 16) 7.3 Total comprehensive (loss) income $(2,108.0) Total comprehensive (loss) income for the year attributable to: Non-controlling interest $ 16.4 Owners of the Company (2,124.4) $(2,108.0) 0.4 (4.2) (45.6) $316.9 $ 17.9 299.0 $316.9 SOBEYS INC. Consdidated Statements of Changes in Shareholders' Equity (in millions of Canadian dollars) Accumulated Other Capital Contributed Comprehensive Stock Surplus Loss $2,752.9 $93.0 $(2.9) Retained Eamings (Deficit) $1,902.5 (119.2) Total Attributable to Owners of the Company $ 4,745.5 (1 19.2) Non- controlling Interest $41.0 - (5.8) (5.8) 17.9 (1192) 348.8 (45.6) 3032 $2,086.5 (119.2 348.8 (49.8) 299.0 $ 4,9253 17.9 Total Equity $4,786.5 (119.2) (5.8) (125.0) 366.7 (49.8) 316.9 $4,978.4 (130.3) (104) (140.7) (2.119.2) $2,752.9 $93.0 Balance at May 3, 2014 Dividends declared on common shares Capital transactions with structured entities Transactions with owners Net earnings Other comprehensive loss Totalcomprehensive income for the year Balance at May 2, 2015 Dividends declared on common shares Capital transactions with structured entities Transactions with owners Net loss Other comprehensive income Total comprehensive loss for the year Balance at May 7, 2016 Se accompanying notes to the consolidated financial statements. $53.1 1.1.:||::-01 (1303) (130.3) (104) (104) 16.4 - || (1303) (2.135.6) 7.3 (2,1283) $ (1721) (130.3) (2,135.6) 112 (2124.4) $ 2,6706 112 16.4 $541 (2 108.0) $2,727 $2,7529 $ $(3.2) SOBEYS INC. Consolidated Statements of Cash Flows 53 and 52 Weeks Ended (in millions of Canadian dollars) May 7 2016 May 2 2015 $(2,119.2) $366.7 393.6 130.3 150.7 81.7 (56.8) 1.5 380.5 (463.4) 134.6 86.0 45.9 17.6 2,975.3 12.5 (4.3) 6.7 (27.6) 3.6 12.4 (4.2) 5.8 (44.5) 4.0 103.0 6.2 (116.6) (93.9) 837.7 (84.0) 1,066.4 Operations Net (loss) earnings Adjustments for: Depreciation Income tax (recovery) expense Finance costs, net (Note 20) Amortization of intangibles Loss (gain) on disposal of assets Impairment of non-financial assets, net Impairments of goodwill and long-lived assets (Notes 8 and 11) Amortization of deferred items Employee future benefits Increase in long-term lease obligation Decrease in long-term provisions Stock option plan Restructuring Net change in non-cash working capital Income taxes paid, net Cash flows from operating activities Investment Property, equipment and investment property purchases Proceeds on disposal of property, equipment and investment property Additions to intangibles Loans and other receivables Other assets and other long-term liabilities Business acquisitions (Note 21) Interest received Cash flows (used in) from investing activities Financing Issue of long-term debt Debt financing costs Repayment of long-term debt Interest paid Dividends paid, common shares Non-controlling interest Cash flows used in financing activities Decrease in cash and cash equivalents Cash and cash equivalents, beginning of year Cash and cash equivalents, end of year See accompanying notes to the consolidated financial statements. (616.2) 136.7 (55.5) (11.8) 5.1 (90.7) 1.0 (631.4) (497.2) 778.8 (39.8) (19.8) (18.0) (11.7) 4.2 196.5 582.7 (1.4) (594.4) (89.3) (130.3) (10.4) (243.1) (36.8) 295.6 $ 258.8 374.4 (0.9) (1,511.8) (117.3) (119.2) (5.8) (1,380.6) (117.7) 413.3 $ 295.6