Answered step by step

Verified Expert Solution

Question

1 Approved Answer

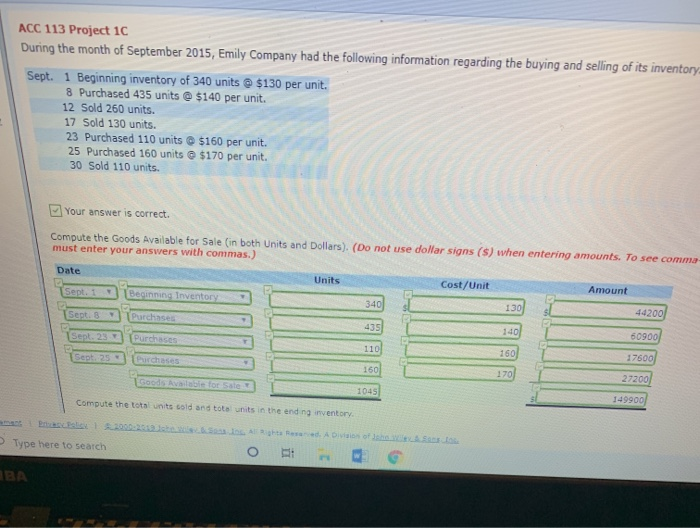

what did I do wrong? please explain ACC 113 Project 10 During the month of September 2015, Emily Company had the following information regarding the

what did I do wrong? please explain

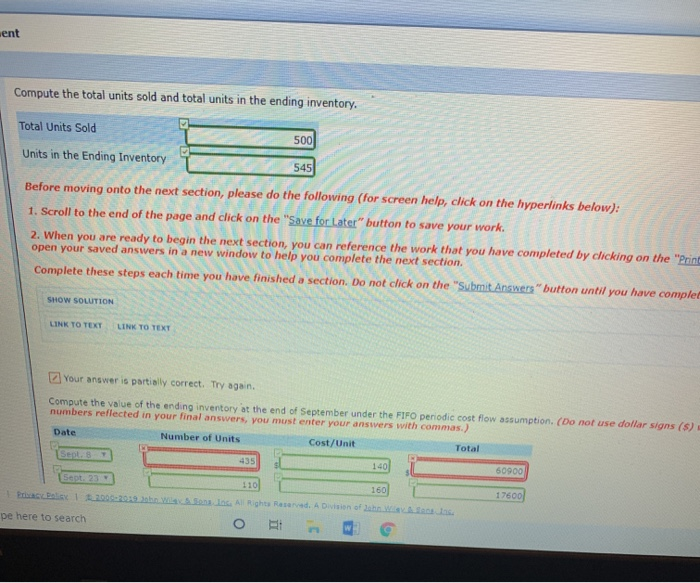

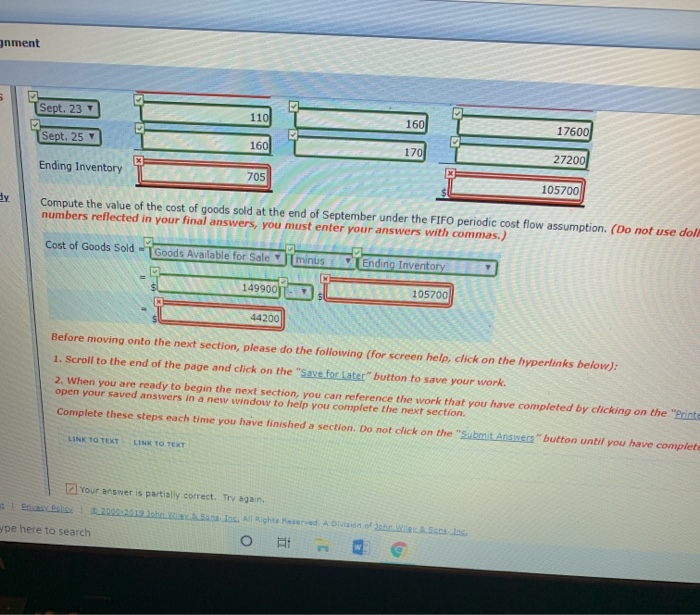

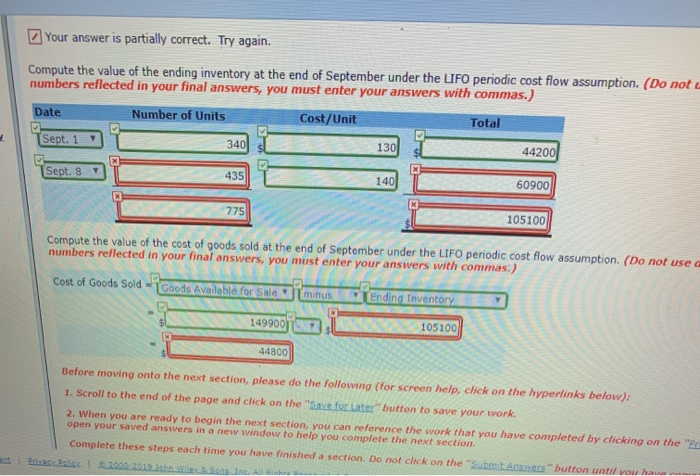

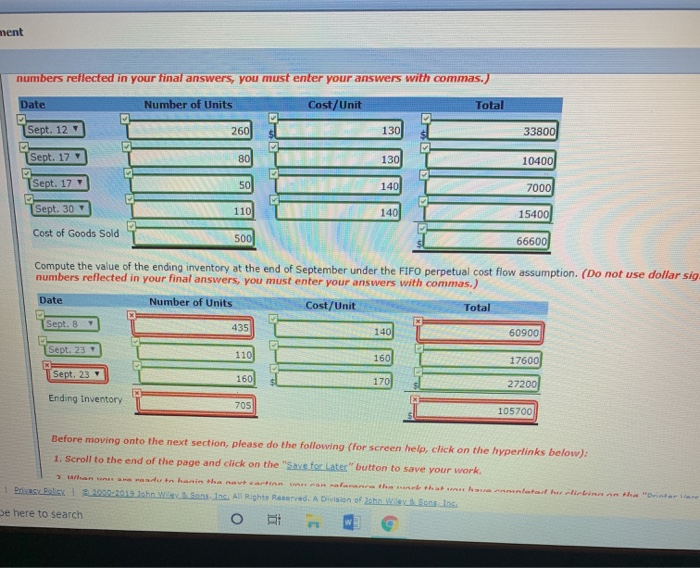

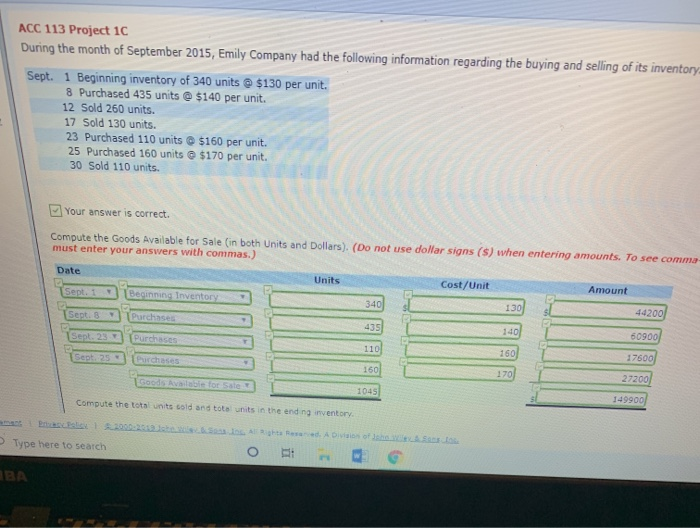

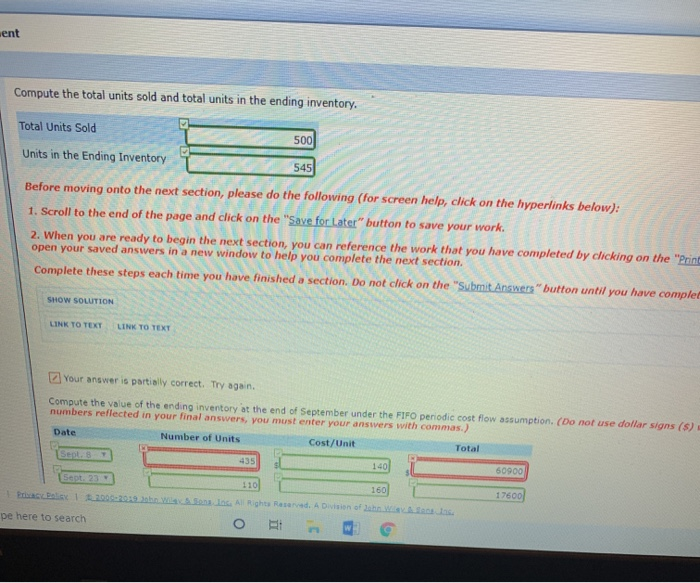

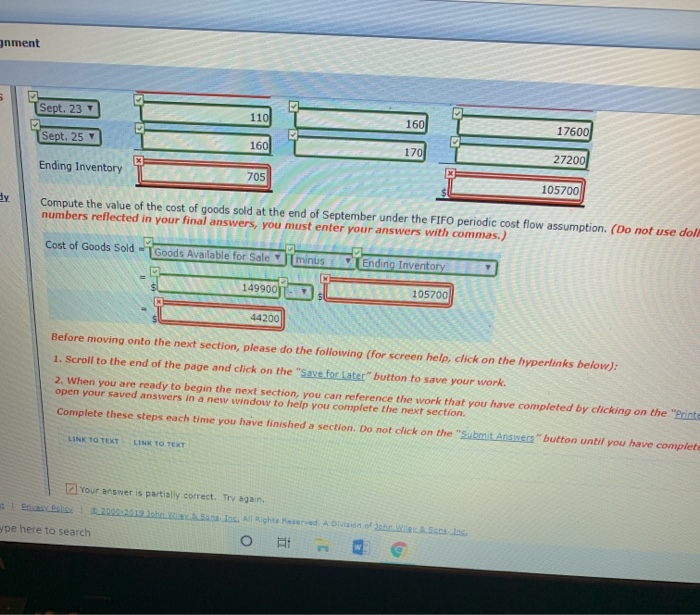

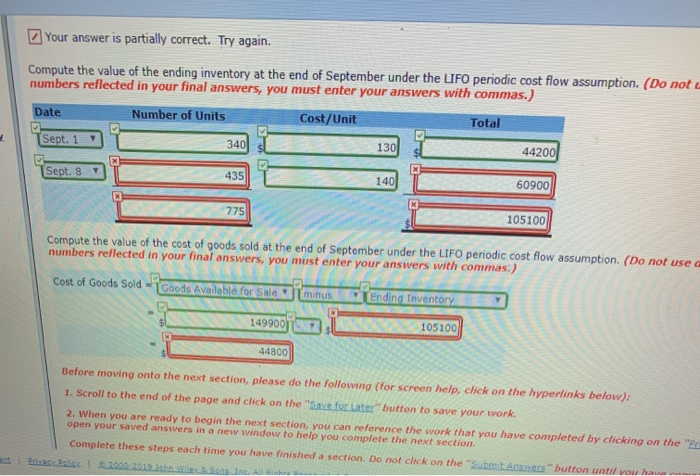

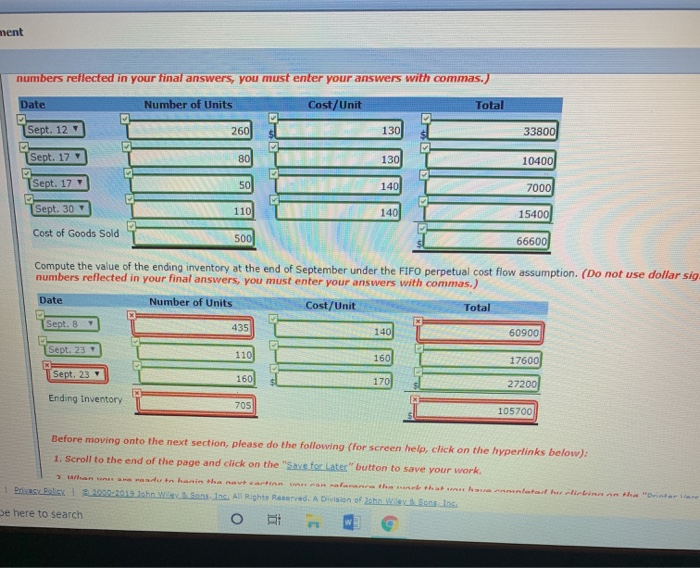

ACC 113 Project 10 During the month of September 2015, Emily Company had the following information regarding the buying and selling of its inventory Sept. 1 Beginning inventory of 340 units @ $130 per unit. 8 Purchased 435 units $140 per unit. 12 Sold 260 units. 17 Sold 130 units. 23 Purchased 110 units $160 per unit. 25 Purchased 160 units $170 per unit. 30 Sold 110 units. Your answer is correct. Compute the Goods Available for Sale (in both Units and Dollars). (Do not use dollar signs (s) when entering amounts. To see comma must enter your answers with commas.) Units Cost/Unit Amount Date Sept. 1 Sept. 8 Sept. 23 Seps 44200 60900 Beginning Inventory Purchases Purchases Carchases 17600 9 27200/ TGoods Available for sale ? 1045 149900 Compute the total units cold and tota units in the end ng entory. ht . A Divo OG Type here to search Compute the total units sold and total units in the ending inventory. Total Units Sold S 500 Units in the Ending Inventory SE545 Before moving onto the next section, please do the following (for screen help, click on the hyperlinks below): 1. Scroll to the end of the page and click on the "Save for Later" button to save your work. 2. When you are ready to begin the next section, you can reference the work that you have completed by clicking on the "Print open your saved answers in a new window to help you complete the next section. Complete these steps each time you have finished a section. Do not click on the "Submit Answers" button until you have complet SHOW SOLUTION LINK TO TEXT LINK TO TEXT Your answer is partially correct. Try again Compute the value of the ending inventory at the end of September under the FIFO periodic cost flow assumption. (Do not use dollar signs (5) numbers reflected in your final answers, you must enter your answers with commas.) Date Number of Units Cost/Unit Total Seot 8 50909 10 17600 Sept. 23 Privacy Police 1 200002039hn Wil 160) son Inc. All Rights Reserved. A Division of an as pe here to search ment Sept. 23 17600 Sept. 25 160 27200 Ending Inventory 705 105700 Compute the value of the cost of goods sold at the end of September under the FIFO periodic cost flow assumption. (Do not use doll numbers reflected in your final answers, you must enter your answers with commas.) Cost of Goods Sold - 1 Goods Available for Sale minus Ending Inventory 105700 14990011 44200 Before moving onto the next section, please do the following for screen hele, click on the hyperlinks below: 1. Scroll to the end of the page and click on the "Save for Later" button to save your work. 2. When you are ready to begin the next section, you can reference the work that you have completed by clicking on the "Print open your saved answers in a new window to help you complete the next section. Complete these steps each time you have finished a section. Do not click on the "Submit Answers" button until you have comples LINK TO TEXT LINK TO TEXT Your answer is partially correct. Try again. B B L 2000-2012 W i ns. All Rights Reserved. A Division of th pe here to search OW e Ice Your answer is partially correct. Try again. Compute the value of the ending inventory at the end of September under the LIFO periodic cost flow assumption. (Do not numbers reflected in your final answers, you must enter your answers with commas.) Date Number of Units Cost/Unit Total 340 130) 5 44200 435 60900 775 105100 Compute the value of the cost of goods sold at the end of September under the LIFO periodic cost flow assumption. (Do not use a numbers reflected in your final answers, you must enter your answers with commas:) Cost of Goods Sold Iminus Goods Available for Sale DU 149900 Ending Inventory 105100 44800 Before moving onto the next section, please do the following (for screen help, click on the hyperlinks below): 1. Scroll to the end of the page and click on the "Save for later button to save your work 2. When you are ready to begin the next section, you can reference the work that you have completed by clicking on the "Pn open your saved ansivers in a new window to help you complete the next section. Complete these steps each time you have finished a section. Do not click on the "Submit Answees button until you have Privas i 2000-200 W IncA . ment numbers reflected in your final answers, you must enter your answers with commas.) Date Number of Units Cost/Unit Total Sept. 121 T 260 130 33800 130 10400 Sept. 17 Sept. 17 80 50 TL 110 TS - 7000 - Sept. 30 Cost of Goods Sold 15400 1 500 66600 Compute the value of the ending inventory at the end of September under the FIFO perpetual cost flow assumption. (Do not use dollar sig numbers reflected in your final answers, you must enter your answers with commas.) Date Number of Units Cost/Unit Total Sept. 8 435 140 60900 Sept. 23 BE 17600 Sept. 23 27200 Ending Inventory 705 105700 Before moving onto the next section, please do the following (for screen help, click on the hyperlinks below): 1. Scroll to the end of the page and click on the "Save for later" button to save your work han at hanintharattin t hathu comentatod hur clictima antha "orintaram 1 Privas Bali 2000-2019hn Way Sons Inc. All Rights Reserved. A Division of the W o mens be here to search o

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started