What did I do wrong? Primarily on the worksheet

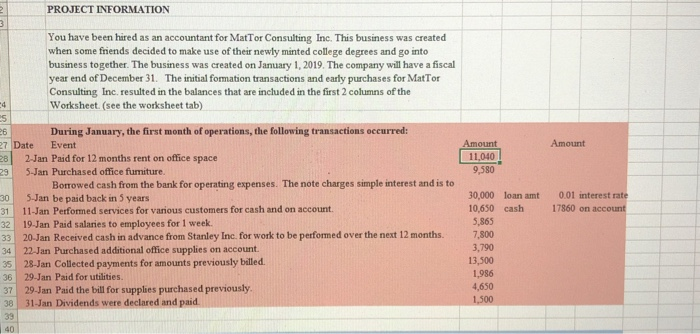

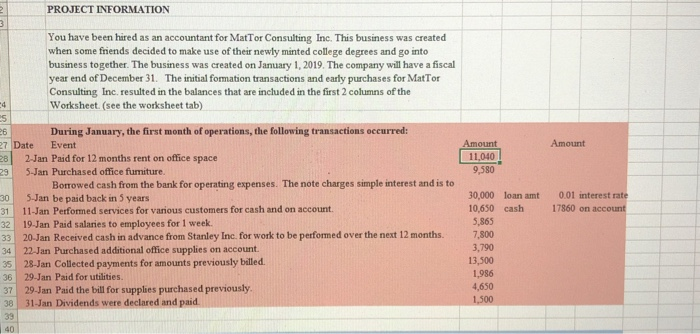

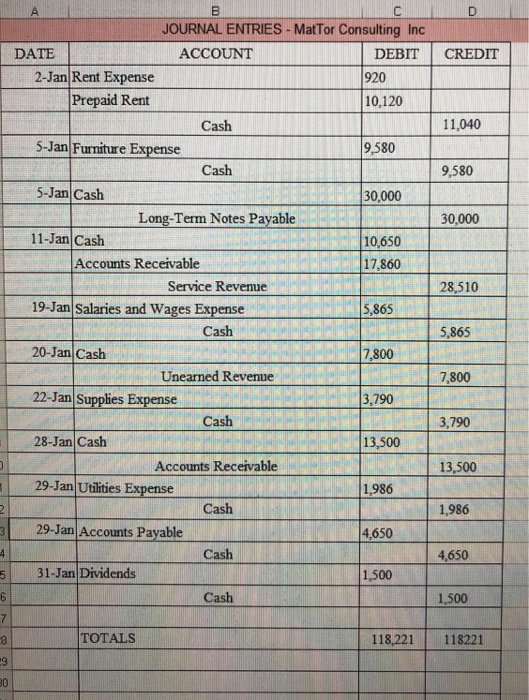

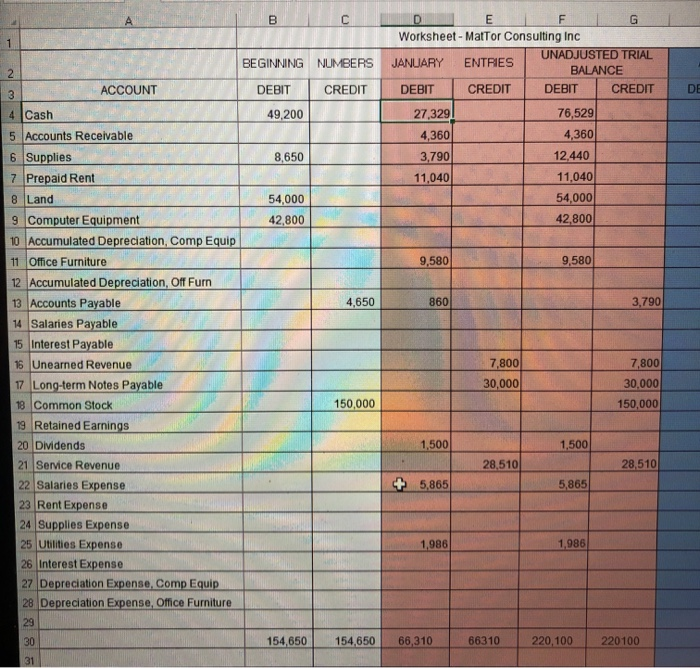

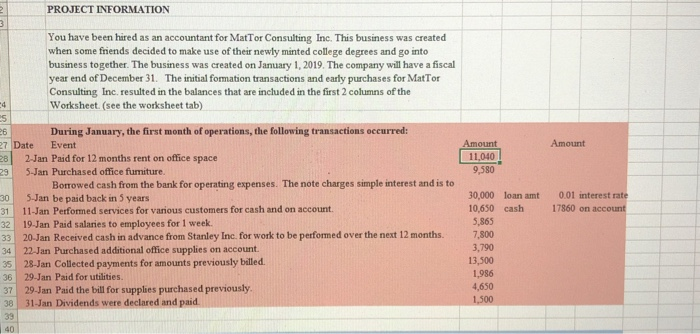

10 PROJECT INFORMATION 3 Amount You have been hired as an accountant for Mat Tor Consulting Inc. This business was created when some friends decided to make use of their newly minted college degrees and go into business together. The business was created on January 1, 2019. The company will have a fiscal year end of December 31. The initial formation transactions and early purchases for Mat Tor Consulting Inc, resulted in the balances that are included in the first 2 columns of the Worksheet (see the worksheet tab) S 26 During January, the first month of operations, the following transactions occurred: 27 Date Event Amount 28 2 Jan Paid for 12 months rent on office space 11,040 5-Jan Purchased office furniture. 9,580 Borrowed cash from the bank for operating expenses. The note charges simple interest and is to 5. Jan be paid back in 5 years 30,000 loan amt 31 11-Jan Performed services for various customers for cash and on account. 10,650 cash 19-Jan Paid salaries to employees for 1 week. 5,865 33 20-Jan Received cash in advance from Stanley Inc. for work to be performed over the next 12 months. 7.800 22-Jan Purchased additional office supplies on account. 3,790 35 28-Jan Collected payments for amounts previously billed. 13,500 36 29-Jan Paid for utilities 1,986 37 29-Jan Paid the bill for supplies purchased previously 4,650 38 31-Jan Dividends were declared and paid 1,500 39 30 0.01 interest rate 17860 on account 32 34 40 D CREDIT 11,040 9,580 30,000 28,510 A B JOURNAL ENTRIES - MatTor Consulting Inc DATE ACCOUNT DEBIT 2-Jan Rent Expense 920 Prepaid Rent 10,120 Cash 5-Jan Furniture Expense 9,580 Cash 5-Jan Cash 30,000 Long-Term Notes Payable 11-Jan Cash 10,650 Accounts Receivable 17,860 Service Revenue 19-Jan Salaries and Wages Expense Cash 20-Jan Cash 7,800 Unearned Revenue 22-Jan Supplies Expense 3,790 Cash 28-Jan Cash 13,500 Accounts Receivable 29-Jan Utilities Expense 1,986 Cash 29-Jan Accounts Payable 4,650 Cash 31-Jan Dividends 1,500 Cash 15,865 5,865 7,800 3,790 13,500 1,986 3 4 4,650 5 6 1,500 7 8 TOTALS 118,221 118221 9 80 B C G E F Worksheet - Mattor Consulting Inc UNADJUSTED TRIAL JANUARY ENTRIES BALANCE DEBIT CREDIT DEBIT CREDIT BEGINNING NUMBERS 2 ACCOUNT DEBIT CREDIT DE 3 49,200 4 Cash 5 Accounts Receivable 27,329 4,360 3,790 11,040 8,650 76,529 4,360 12.440 11,040 54,000 42,800 54,000 42,800 9,580 9,580 4,650 860 3,790 6 Supplies 7 Prepaid Rent 8 Land 9 Computer Equipment 10 Accumulated Depreciation, Comp Equip 11 Office Furniture 12 Accumulated Depreciation, Off Furn 13 Accounts Payable 14 Salaries Payable 15 Interest Payable 15 Unearned Revenue 17 Long-term Notes Payable 18 Common Stock 19 Retained Earnings 20 Dividends 21 Service Revenue 22 Salaries Expense 23 Rent Expense 24 Supplies Expense 25 Utilities Expense 26 Interest Expense 27 Depreciation Expense, Comp Equip 28 Depreciation Expense, Office Furniture 29 7,800 30,000 7,800 30,000 150,000 150,000 1,500 1,500 28,510 28,510 + 5,865 5,865 1,986 1,986 154,650 154,650 66,310 66310 220,100 220100 30 31