Answered step by step

Verified Expert Solution

Question

1 Approved Answer

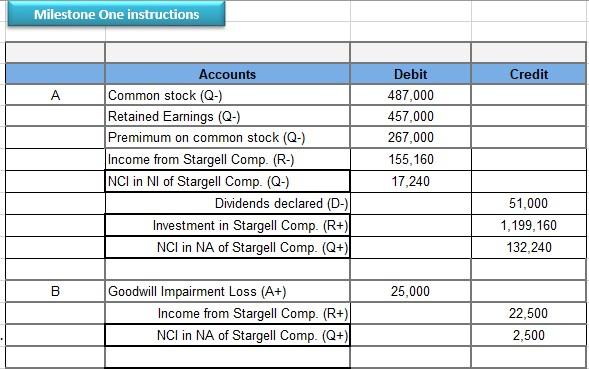

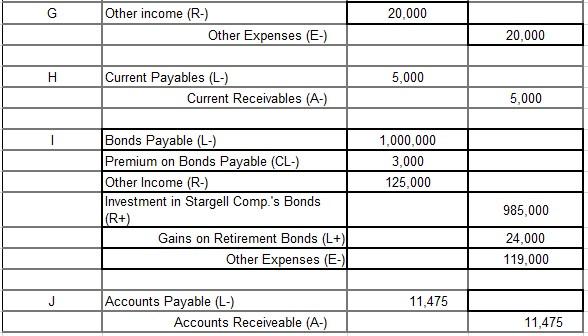

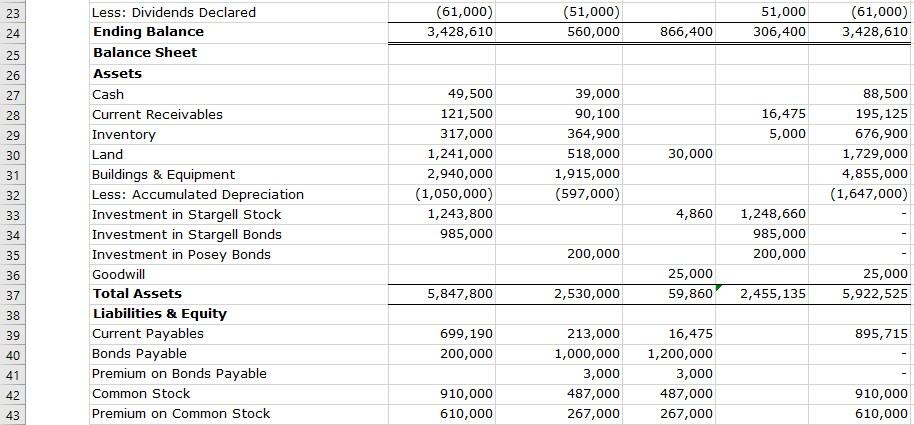

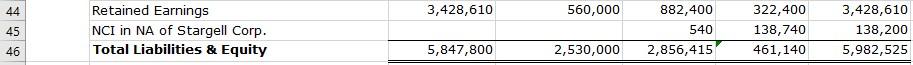

What do I do to get the the consolidation journal entries of $409,400 and $255,400 for the Net income? Can you all show me the

What do I do to get the the consolidation journal entries of $409,400 and $255,400 for the Net income? Can you all show me the step by step work that I must follow in order to get these values that you see on the Consolidation Worksheet for Net income, please?

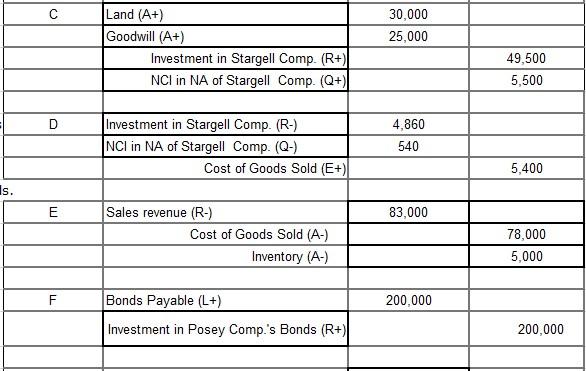

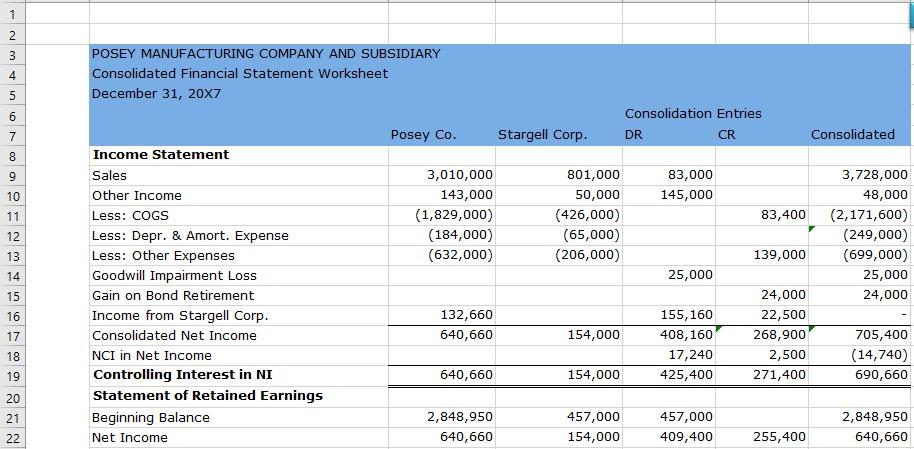

Milestone One instructions Credit Accounts Common stock (Q-) Retained Earnings (Q-) Premimum on common stock (Q-) Income from Stargell Comp. (R) NCI in Nl of Stargell Comp. (Q-) Dividends declared (D) Investment in Stargell Comp. (R+) NCI in NA of Stargell Comp. (Q+) Debit 487,000 457,000 267,000 155,160 17,240 51,000 1,199,160 132,240 B 25,000 Goodwill Impairment Loss (A+) Income from Stargell Comp. (R+) NCI in NA of Stargell Comp. (Q+) 22,500 2,500 C 30,000 25,000 Land (A+) Goodwill (A+) Investment in Stargell Comp. (R+) NCI in NA of Stargell Comp. (Q+) 49,500 5,500 D Investment in Stargell Comp. (R) NCI in NA of Stargell Comp. (Q-) Cost of Goods Sold (E+) 4,860 540 5,400 Is. E 83,000 Sales revenue (R-) Cost of Goods Sold (A-) Inventory (A) 78,000 5,000 F Bonds Payable (L+) 200,000 Investment in Posey Comp.'s Bonds (R+) 200,000 G 20,000 Other income (R-) Other Expenses (E-) 20,000 H 5,000 Current Payables (L-) Current Receivables (A-) 5,000 1,000,000 3,000 125,000 Bonds Payable (L-) Premium on Bonds Payable (CL-) Other Income (R-) Investment in Stargell Comp.'s Bonds (R+) Gains on Retirement Bonds (L+) Other Expenses (E-) 985,000 24,000 119,000 J 11,475 Accounts Payable (L-) Accounts Receiveable (A-) 11,475 1 1 2 3 4 5 POSEY MANUFACTURING COMPANY AND SUBSIDIARY Consolidated Financial Statement Worksheet December 31, 2007 6 Consolidation Entries DR CR Posey Co. Stargell Corp. Consolidated 7 8 B 9 83,000 145,000 10 11 3,010,000 143,000 (1,829,000) (184,000) (632,000) 801,000 50,000 (426,000) (65,000) (206,000) 83,400 12 3,728,000 48,000 (2,171,600) (249,000) (699,000) 25,000 24,000 13 139,000 14 25,000 Income Statement Sales Other Income Less: COGS Less: Depr. & Amort. Expense Less: Other Expenses Goodwill Impairment Loss Gain on Bond Retirement Income from Stargell Corp. Consolidated Net Income NCI in Net Income Controlling Interest in NI Statement of Retained Earnings Beginning Balance Net Income 16 in o 132,660 640,660 17 154,000 155,160 408,160 17,240 425,400 24,000 22,500 268,900 2,500 271,400 18 705,400 (14,740) 690,660 640,660 154,000 20 21 22 2,848,950 640,660 457,000 154,000 457,000 409,400 2,848,950 640,660 255,400 23 (61,000) 3,428,610 (51,000) 560,000 51,000 306,400 (61,000) 3,428,610 24 866,400 25 26 27 28 16,475 5,000 29 39,000 90,100 364,900 518,000 1,915,000 (597,000) 88,500 195,125 676,900 1,729,000 4,855,000 (1,647,000) 30 49,500 121,500 317,000 1,241,000 2,940,000 (1,050,000) 1,243,800 985,000 30,000 31 32 Less: Dividends Declared Ending Balance Balance Sheet Assets Cash Current Receivables Inventory Land Buildings & Equipment Less: Accumulated Depreciation Investment in Stargell Stock Investment in Stargell Bonds Investment in Posey Bonds Goodwill Total Assets Liabilities & Equity Current Payables Bonds Payable Premium on Bonds Payable Common Stock Premium on Common Stock 33 4,860 34 1,248,660 985,000 200,000 35 200,000 36 25,000 59,860 25,000 5,922,525 37 5,847,800 2,530,000 2,455,135 38 39 895,715 699,190 200,000 40 41 213,000 1,000,000 3,000 487,000 267,000 16,475 1,200,000 3,000 487,000 267,000 42 43 910,000 610,000 910,000 610,000 44 3,428,610 560,000 45 Retained Earnings NCI in NA of Stargell Corp. Total Liabilities & Equity 882,400 540 2,856,415 322,400 138,740 461,140 3,428,610 138,200 5,982,525 46 5,847,800 2,530,000 Milestone One instructions Credit Accounts Common stock (Q-) Retained Earnings (Q-) Premimum on common stock (Q-) Income from Stargell Comp. (R) NCI in Nl of Stargell Comp. (Q-) Dividends declared (D) Investment in Stargell Comp. (R+) NCI in NA of Stargell Comp. (Q+) Debit 487,000 457,000 267,000 155,160 17,240 51,000 1,199,160 132,240 B 25,000 Goodwill Impairment Loss (A+) Income from Stargell Comp. (R+) NCI in NA of Stargell Comp. (Q+) 22,500 2,500 C 30,000 25,000 Land (A+) Goodwill (A+) Investment in Stargell Comp. (R+) NCI in NA of Stargell Comp. (Q+) 49,500 5,500 D Investment in Stargell Comp. (R) NCI in NA of Stargell Comp. (Q-) Cost of Goods Sold (E+) 4,860 540 5,400 Is. E 83,000 Sales revenue (R-) Cost of Goods Sold (A-) Inventory (A) 78,000 5,000 F Bonds Payable (L+) 200,000 Investment in Posey Comp.'s Bonds (R+) 200,000 G 20,000 Other income (R-) Other Expenses (E-) 20,000 H 5,000 Current Payables (L-) Current Receivables (A-) 5,000 1,000,000 3,000 125,000 Bonds Payable (L-) Premium on Bonds Payable (CL-) Other Income (R-) Investment in Stargell Comp.'s Bonds (R+) Gains on Retirement Bonds (L+) Other Expenses (E-) 985,000 24,000 119,000 J 11,475 Accounts Payable (L-) Accounts Receiveable (A-) 11,475 1 1 2 3 4 5 POSEY MANUFACTURING COMPANY AND SUBSIDIARY Consolidated Financial Statement Worksheet December 31, 2007 6 Consolidation Entries DR CR Posey Co. Stargell Corp. Consolidated 7 8 B 9 83,000 145,000 10 11 3,010,000 143,000 (1,829,000) (184,000) (632,000) 801,000 50,000 (426,000) (65,000) (206,000) 83,400 12 3,728,000 48,000 (2,171,600) (249,000) (699,000) 25,000 24,000 13 139,000 14 25,000 Income Statement Sales Other Income Less: COGS Less: Depr. & Amort. Expense Less: Other Expenses Goodwill Impairment Loss Gain on Bond Retirement Income from Stargell Corp. Consolidated Net Income NCI in Net Income Controlling Interest in NI Statement of Retained Earnings Beginning Balance Net Income 16 in o 132,660 640,660 17 154,000 155,160 408,160 17,240 425,400 24,000 22,500 268,900 2,500 271,400 18 705,400 (14,740) 690,660 640,660 154,000 20 21 22 2,848,950 640,660 457,000 154,000 457,000 409,400 2,848,950 640,660 255,400 23 (61,000) 3,428,610 (51,000) 560,000 51,000 306,400 (61,000) 3,428,610 24 866,400 25 26 27 28 16,475 5,000 29 39,000 90,100 364,900 518,000 1,915,000 (597,000) 88,500 195,125 676,900 1,729,000 4,855,000 (1,647,000) 30 49,500 121,500 317,000 1,241,000 2,940,000 (1,050,000) 1,243,800 985,000 30,000 31 32 Less: Dividends Declared Ending Balance Balance Sheet Assets Cash Current Receivables Inventory Land Buildings & Equipment Less: Accumulated Depreciation Investment in Stargell Stock Investment in Stargell Bonds Investment in Posey Bonds Goodwill Total Assets Liabilities & Equity Current Payables Bonds Payable Premium on Bonds Payable Common Stock Premium on Common Stock 33 4,860 34 1,248,660 985,000 200,000 35 200,000 36 25,000 59,860 25,000 5,922,525 37 5,847,800 2,530,000 2,455,135 38 39 895,715 699,190 200,000 40 41 213,000 1,000,000 3,000 487,000 267,000 16,475 1,200,000 3,000 487,000 267,000 42 43 910,000 610,000 910,000 610,000 44 3,428,610 560,000 45 Retained Earnings NCI in NA of Stargell Corp. Total Liabilities & Equity 882,400 540 2,856,415 322,400 138,740 461,140 3,428,610 138,200 5,982,525 46 5,847,800 2,530,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started