what do I put on their Tax Return?

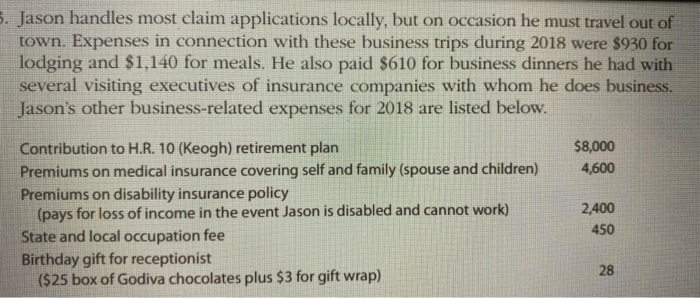

Practice Set Assignments Comprehensive Tax Return Problems PROBLEM 1 Jason R. and Jenni L. Dane are married and live at 13071 Sterling Drive, Marquette, MI 49866. Jason is a self-employed insurance claims adjuster (business activity code 524290), and Jenni is the dietitian for the local school district. They choose to file a joint tax return each year. 5. Jason handles most claim applications locally, but on occasion he must travel out of town. Expenses in connection with these business trips during 2018 were $930 for lodging and $1,140 for meals. He also paid $610 for business dinners he had with several visiting executives of insurance companies with whom he does business. Jason's other business-related expenses for 2018 are listed below. $8,000 4,600 Contribution to H.R. 10 (Keogh) retirement plan Premiums on medical insurance covering self and family (spouse and children) Premiums on disability insurance policy (pays for loss of income in the event Jason is disabled and cannot work) State and local occupation fee Birthday gift for receptionist ($25 box of Godiva chocolates plus $3 for gift wrap) 2,400 450 Practice Set Assignments Comprehensive Tax Return Problems PROBLEM 1 Jason R. and Jenni L. Dane are married and live at 13071 Sterling Drive, Marquette, MI 49866. Jason is a self-employed insurance claims adjuster (business activity code 524290), and Jenni is the dietitian for the local school district. They choose to file a joint tax return each year. 5. Jason handles most claim applications locally, but on occasion he must travel out of town. Expenses in connection with these business trips during 2018 were $930 for lodging and $1,140 for meals. He also paid $610 for business dinners he had with several visiting executives of insurance companies with whom he does business. Jason's other business-related expenses for 2018 are listed below. $8,000 4,600 Contribution to H.R. 10 (Keogh) retirement plan Premiums on medical insurance covering self and family (spouse and children) Premiums on disability insurance policy (pays for loss of income in the event Jason is disabled and cannot work) State and local occupation fee Birthday gift for receptionist ($25 box of Godiva chocolates plus $3 for gift wrap) 2,400 450