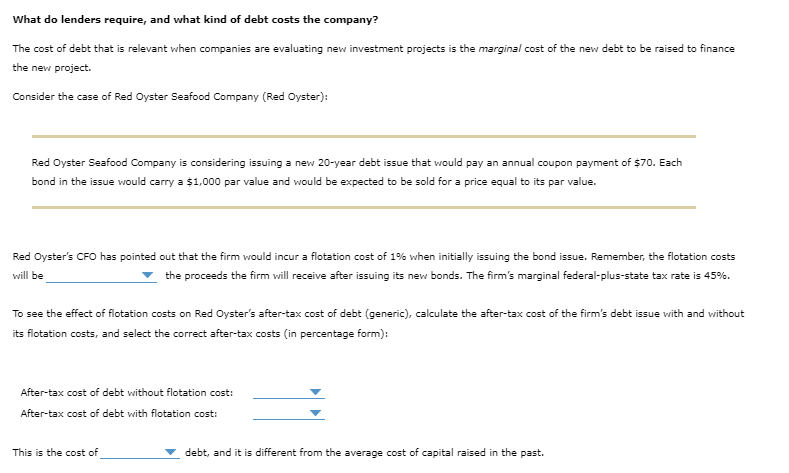

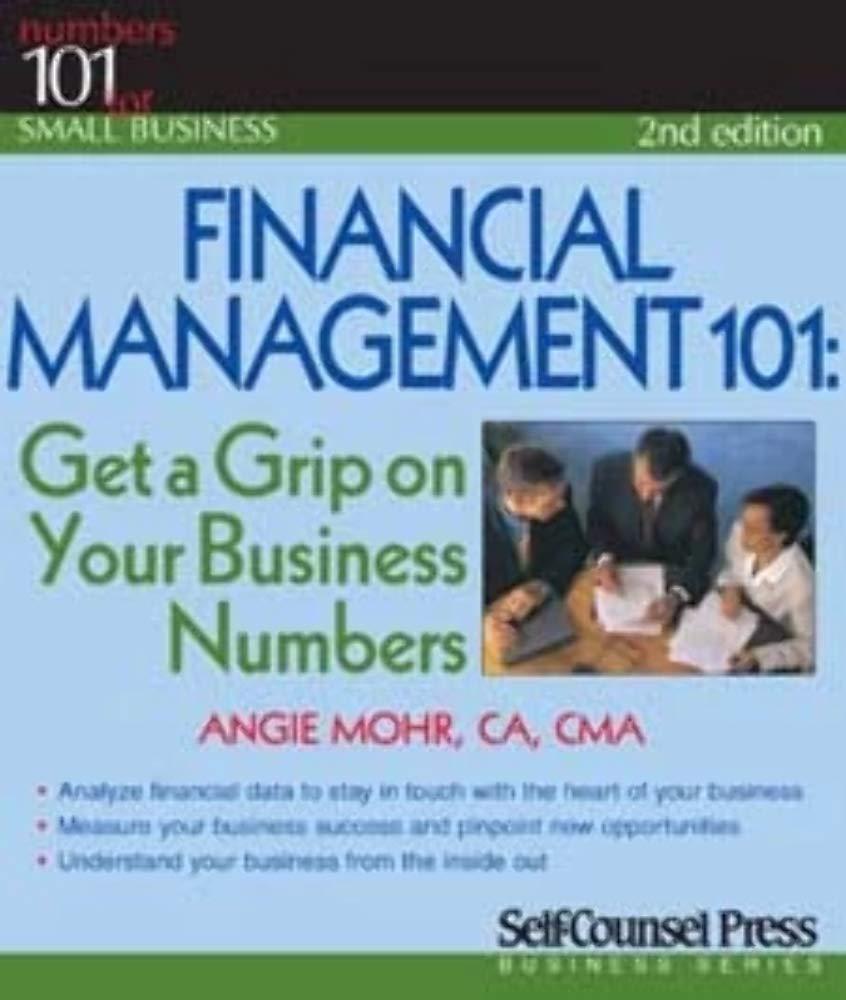

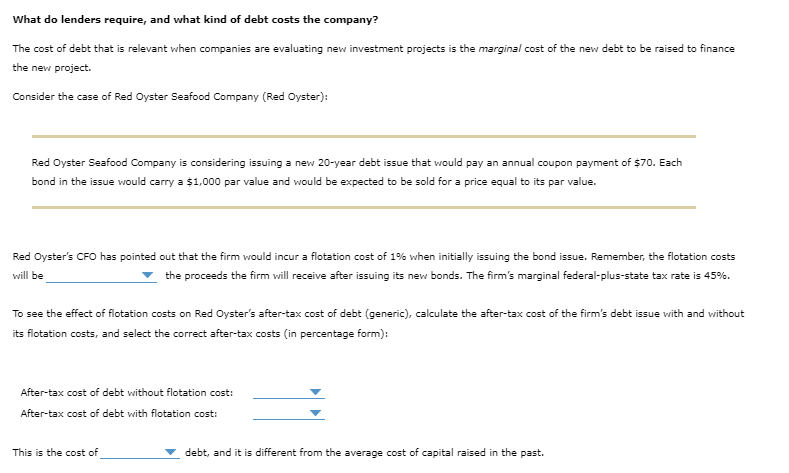

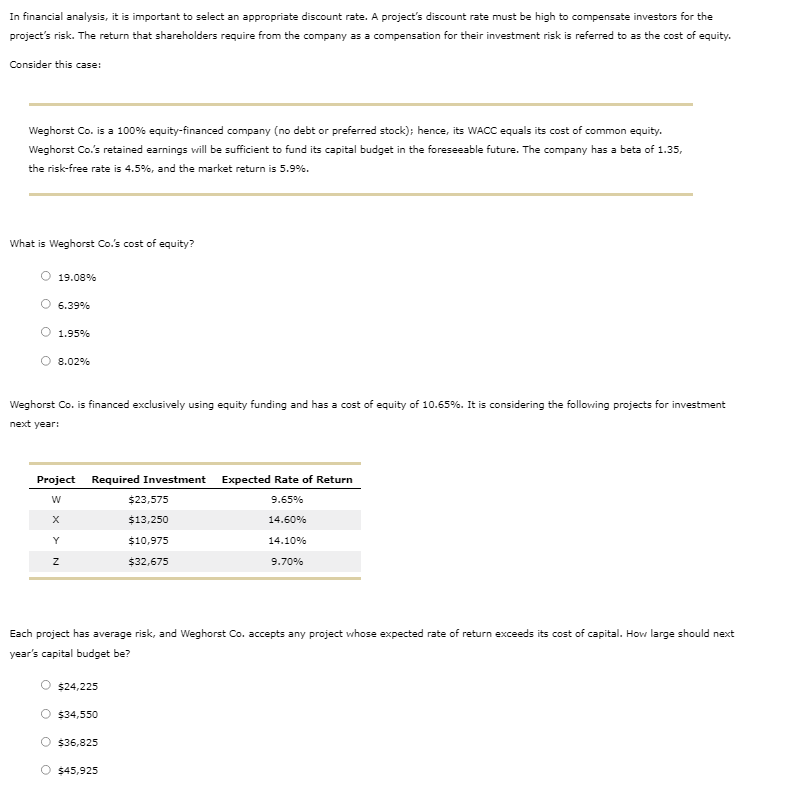

What do lenders require, and what kind of debt costs the company? The cost of debt that is relevant when companies are evaluating new investment projects is the marginal cost of the new debt to be raised to finance the new project. Consider the case of Red Oyster Seafood Company (Red Oyster): Red Oyster Seafood Company is considering issuing a new 20-year debt issue that would pay an annual coupon payment of $70. Each bond in the issue would carry a $1,000 par value and would be expected to be sold for a price equal to its par value. Red Oyster's CFO has pointed out that the firm would incur a flotation cost of 1% when initially issuing the bond issue. Remember, the flotation costs the proceeds the firm will receive after issuing its new bonds. The firm's marginal federal-plus-state tax rate is 45%. will be To see the effect of flotation costs on Red Oyster's after-tax cost of debt (generic), calculate the after-tax cost of the firm's debt issue with and without its flotation costs, and select the correct after-tax costs (in percentage form): After-tax cost of debt without flotation cost: After-tax cost of debt with flotation cost: This is the cost of debt, and it is different from the average cost of capital raised in the past. In financial analysis, it is important to select an appropriate discount rate. A project's discount rate must be high to compensate investors for the project's risk. The return that shareholders require from the company as a compensation for their investment risk is referred to as the cost of equity. Consider this case: Weghorst Co. is a 100% equity-financed company (no debt or preferred stock), hence, its WACC equals its cost of common equity. Weghorst Co's retained earnings will be sufficient to fund its capital budget in the foreseeable future. The company has a beta of 1.35, the risk-free rate is 4.5%, and the market return is 5.9%. What is Weghorst Co.'s cost of equity? 19.08% 6.39% 0 1.95% 8.02% Weghorst Co. is financed exclusively using equity funding and has a cost of equity of 10.65%. It is considering the following projects for investment next year: Project Required Investment $23,575 Expected Rate of Return 9.65% w X $13,250 14.60% Y $10,975 14.10% z $32,675 9.70% Each project has average risk, and Weghorst Co. accepts any project whose expected rate of return exceeds its cost of capital. How large should next year's capital budget be? 524,225 $34,550 536,825 $45,925