Question

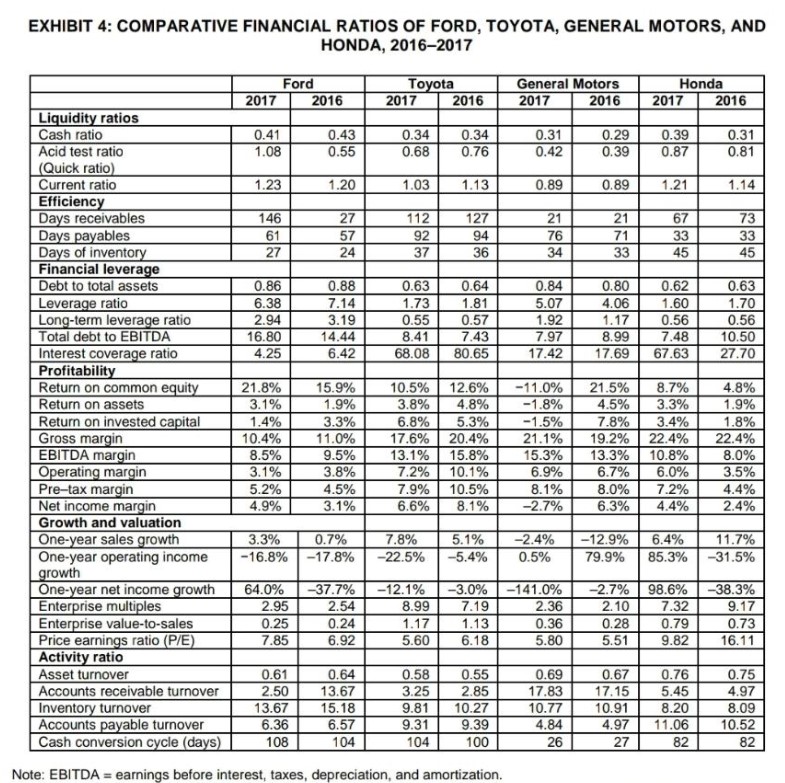

What do the current ratios in Exhibit 4 tell us about the four companies? 1. Current Ratio - Liquidity Ratio 2. Interest Coverage Ratio -

What do the current ratios in Exhibit 4 tell us about the four companies?

1. Current Ratio - Liquidity Ratio

2. Interest Coverage Ratio - Financial Leverage Ratio

What do the interest coverage ratios in Exhibit 4 tell us about the four companies?

3. Gross Margin - Profitability Ratio

What do the gross margin ratios in Exhibit 4 tell us about the four companies?

4. Days Receivable - Efficiency

What do the days receivable ratios in Exhibit 4 tell us about the four companies?

5. One Year Sales Growth - Growth and Valuation Ratios

What do the one-year sales growth ratios in Exhibit 4 tell us about the four companies?

6. Bonus, one mark. Based on your ratio analysis, would you recommend John Smith keep his investment in Ford?

YES

NO

WHY? (One sentence)

EXHIBIT 4: COMPARATIVE FINANCIAL RATIOS OF FORD, TOYOTA, GENERAL MOTORS, AND HONDA, 2016-2017 Ford Toyota General Motors Honda 2017 2016 2017 2016 2017 2016 2017 2016 Liquidity ratios Cash ratio 0.41 0.43 0.34 0.34 0.31 0.29 0.39 0.31 Acid test ratio 1.08 0.55 0.68 0.76 0.42 0.39 0.87 0.81 (Quick ratio) Current ratio 1.23 1.20 1.03 1.13 0.89 0.89 1.21 1.14 Efficiency Days receivables 146 27 112 127 21 21 67 73 Days payables 61 57 92 94 76 71 33 33 Days of inventory 27 24 37 36 34 33 45 45 Financial leverage Debt to total assets 0.86 0.88 0.63 0.64 0.84 0.80 0.62 0.63 Leverage ratio 6.38 7.14 1.73 1.81 5.07 4.06 1.60 1.70 Long-term leverage ratio 2.94 3.19 0.55 0.57 1.92 1.17 0.56 0.56 Total debt to EBITDA 16.80 14.44 8.41 7.43 7.97 8.99 7.48 10.50 Interest coverage ratio 4.25 6.42 68.08 80.65 17.42 17.69 67.63 27.70 Profitability Return on common equity 21.8% 15.9% 10.5% 12.6% -11.0% 21.5% 8.7% 4.8% Return on assets 3.1% 1.9% 3.8% 4.8% -1.8% 4.5% 3.3% 1.9% Return on invested capital 1.4% 3.3% 6.8% 5.3% -1.5% 7.8% 3.4% 1.8% Gross margin 10.4% 11.0% 17.6% 20.4% 21.1% 19.2% 22.4% 22.4% EBITDA margin 8.5% 9.5% 13.1% 15.8% Operating margin 3.1% 3.8% 7.2% 10.1% Pre-tax margin 5.2% 4.5% 7.9% 10.5% Net income margin 4.9% 3.1% 6.6% 8.1% 15.3% 13.3% 10.8% 6.9% 8.1% -2.7% 8.0% 6.7% 6.0% 3.5% 8.0% 7.2% 4.4% 6.3% 4.4% 2.4% Growth and valuation One-year sales growth 3.3% 0.7% 7.8% 5.1% One-year operating income -16.8% -17.8% -22.5% -5.4% -2.4% 0.5% -12.9% 6.4% 11.7% 79.9% 85.3% -31.5% growth One-year net income growth 64.0% -37.7% -12.1% -3.0% -141.0% -2.7% 98.6% -38.3% Enterprise multiples 2.95 2.54 8.99 7.19 2.36 2.10 7.32 9.17 Enterprise value-to-sales 0.25 0.24 1.17 1.13 0.36 0.28 0.79 0.73 Price earnings ratio (P/E) 7.85 6.92 5.60 6.18 5.80 5.51 9.82 16.11 Activity ratio Asset turnover 0.61 0.64 0.58 0.55 0.69 0.67 0.76 0.75 Accounts receivable turnover 2.50 13.67 3.25 2.85 17.83 17.15 5.45 4.97 Inventory turnover 13.67 15.18 9.81 10.27 10.77 10.91 8.20 8.09 Accounts payable turnover 6.36 6.57 9.31 9.39 4.84 4.97 11.06 10.52 Cash conversion cycle (days) 108 104 104 100 26 27 82 82 Note: EBITDA earnings before interest, taxes, depreciation, and amortization.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started