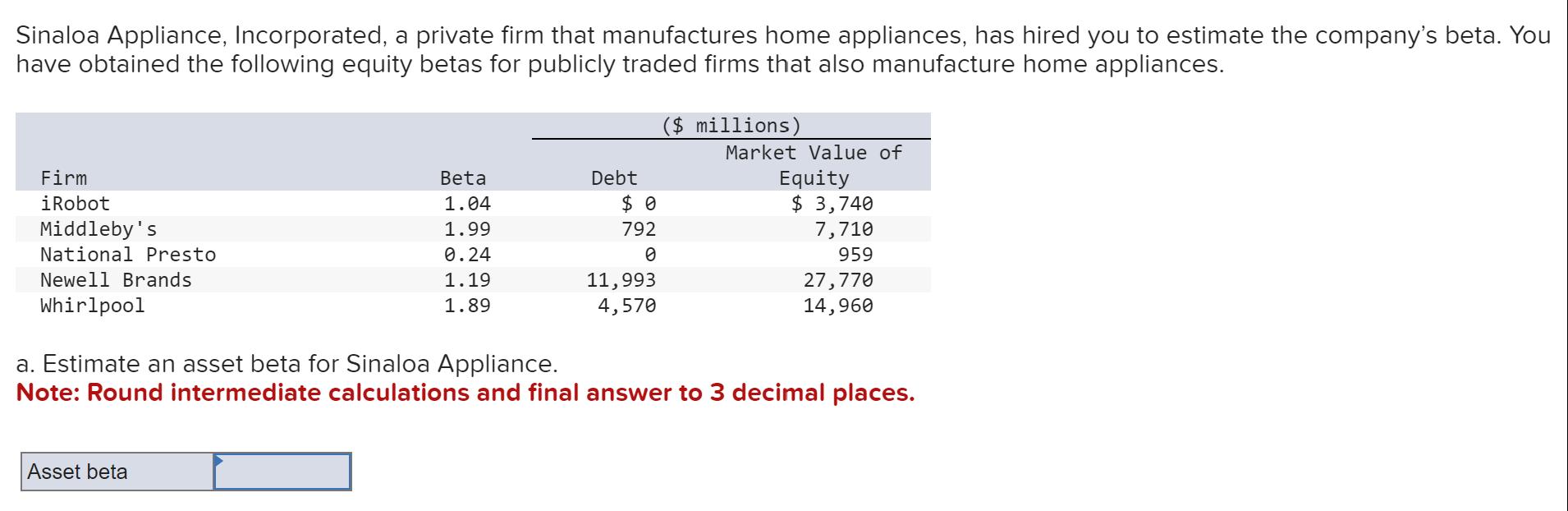

Sinaloa Appliance, Incorporated, a private firm that manufactures home appliances, has hired you to estimate the company's beta. You have obtained the following equity

Sinaloa Appliance, Incorporated, a private firm that manufactures home appliances, has hired you to estimate the company's beta. You have obtained the following equity betas for publicly traded firms that also manufacture home appliances. Firm iRobot Middleby's National Presto Newell Brands Whirlpool Beta Asset beta 1.04 1.99 0.24 1.19 1.89 Debt $0 792 0 11,993 4,570 ($ millions) Market Value of Equity $ 3,740 7,710 959 27,770 14,960 a. Estimate an asset beta for Sinaloa Appliance. Note: Round intermediate calculations and final answer to 3 decimal places.

Step by Step Solution

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

An Optimal is Capital structure debt and of that equity fi...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started