What does Horizontal Analysis for a compang tell us?

Can you help me determine the financial health and trajectory? What can we learn from this horizontal Analysis?

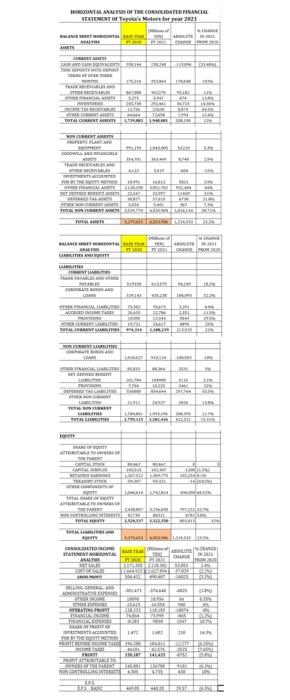

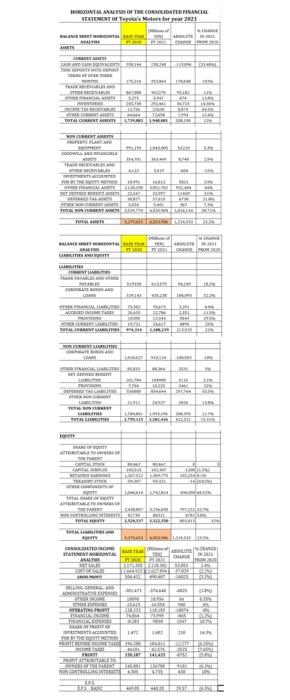

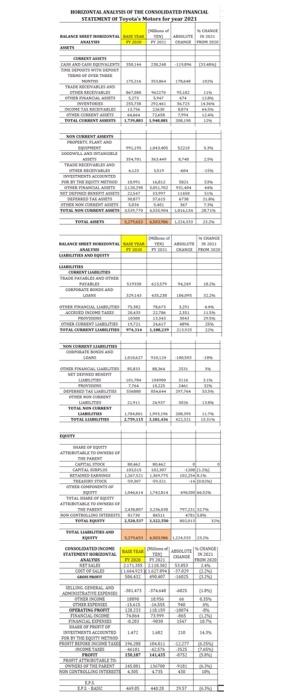

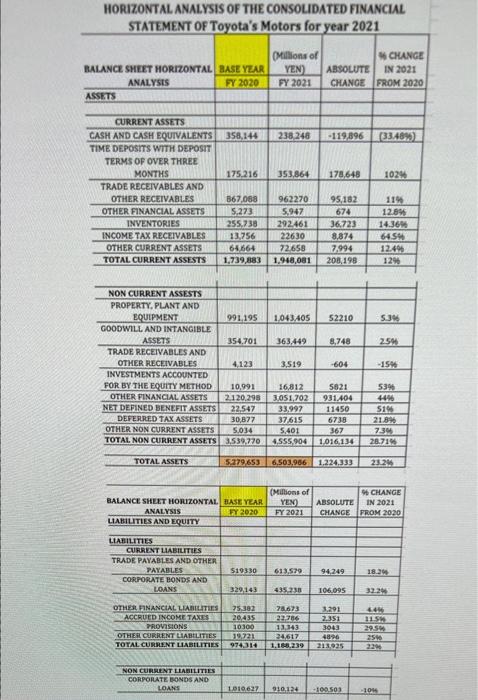

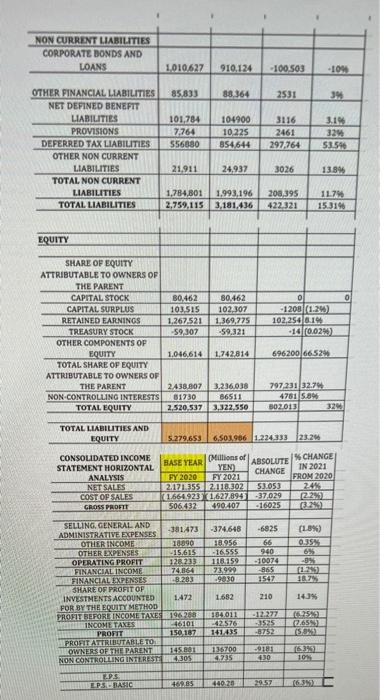

CONTAL ANALYSIS OF THE CONSOLIDATINANCIAL STATEMENT OF Toyota's for year 2001 ) TAWARTO YEN - MEL CREARE TOTAL GENERAL OR CRIT HOWELL IN 14 GERAL SET THEME TORRENT ALLERY SA BLADET INT USE TWW CINCONTRE 11 THA L! PERCETAKLUM A LEO CANAL REDERE RE ES ARE PARTY SH HIL AN AL FILE HIS TUSSEN DAN ELLER GE MALE SUT ACESTE . INA REPREHEHE TRICKS TO THAT 111 SELECTIE TI USE TOS NORTHERN TIC SONTAL ANALYSIS OF THE CONSOLIDATINANCIAL STATEMENT OF Toyota's for year 2021 LAERT SAMANTAL CENAR THERE INVENTE EMTA MAL . CURTA OGOWA 14 APGEETAREA ACEST NOM THERM LIN TORRENT WILL BE LANCER INT HAR TWY UCI INCONTRI 11 THEATRE BURAL GABBANT LABEL TRIBE PERTAKLUM MURIT BALER TOTAL LIRLARI CANAL EDIA MA RA CIR LEER 14 PANTE ST TL CALIDATION AUTEUR FATIMENTOROINE ALLY TI LES IEEE ISE IN GY AMSTER BESERIE UTISET INAISONS THAT TRELLES OS USE TOASE HOTELLIT TEL TH HORIZONTAL ANALYSIS OF THE CONSOLIDATED FINANCIAL STATEMENT OF Toyota's Motors for year 2021 BALANCE SHEET HORIZONTAL BASE YEAR ANALYSIS FY 2020 ASSETS Millions of CHANGE YEN) ABSOLUTE IN 2021 FY 2021 CHANGE FROM 2020 238,248 - 119,896 (33.40%) 353,864 178,648 1024 CURRENT ASSETS CASH AND CASH EQUIVALENTS 358,144 TIME DEPOSITS WITH DEPOSIT TERMS OF OVER THREE MONTHS 175,216 TRADE RECEIVABLES AND OTHER RECEIVABLES 367,068 OTHER FINANCIAL ASSETS 5.273 INVENTORIES 255.738 INCOME TAX RECEIVABLES 13.756 OTHER CURRENT ASSETS 64.664 TOTAL CURRENT ASSESTS 1,739,883 962270 5,947 292461 22630 72.658 1.948,081 95,182 674 36.723 8.874 7,994 208.198 114 12.04 14.36% 64.54 12.49 12% 1,043.405 52210 5.3% 363.449 8,748 25 NON CURRENT ASSESTS PROPERTY. PLANT AND EQUIPMENT 991,195 GOODWILL AND INTANGIBLE ASSETS 354.701 TRADE RECEIVABLES AND OTHER RECEIVABLES 4,123 INVESTMENTS ACCOUNTED FOR BY THE EQUITY METHOD 10,991 OTHER PINANCIAL ASSETS 2120,298 NET DEFINED BENEFIT ASSETS 22.547 DEFERRED TAX ASSETS 30,877 OTHER NON CURRENT ASSETS 5,034 TOTAL NON CURRENT ASSETS 3,539,770 3,519 -604 5395 16,812 3.051,702 33.997 37.615 5,401 4,555.904 5621 931.404 11450 6738 367 1016,134 5145 21.8% 7.34 28.714 TOTAL ASSETS 5279,653 6.503.986 1.224.333 23 24 (Millions of CHANGE BALANCE SHEET HORIZONTAL BASE YEAR YEN) ABSOLUTE IN 2021 ANALYSIS FY2020 FY 2021 CHANGE FROM 2020 LIABILITIES AND EQUITY LIABILITIES CURRENT LIABILITIES TRADE PAYABLES AND OTHER PAYABLES CORPORATE BONDS AND LOANS 519330 613.579 94,249 329143 435.238 106,095 OTHER FINANCIAL LIABILITIES ACCRUED INCOME TAXES PROVISIONS OTHER CURRENT LIABILITIES TOTAL CURRENT LIABILITIES 75382 20,435 10300 19.221 974314 78673 22386 13.143 24.617 3.291 2.351 3043 4896 213925 115 29.5 256 NON CURRENT LIABILITIES CORPORATE BONDS AND LOANS 1010627 910124 100 SOB 104 NON CURRENT LIABILITIES CORPORATE BONDS AND LOANS 1.010.627 910.124 100.503 -10W 85,833 88 364 2531 39 OTHER FINANCIAL LIABILITIES NET DEFINED BENEFIT LIABILITIES PROVISIONS DEFERRED TAX LIABILITIES OTHER NON CURRENT LIABILITIES TOTAL NON CURRENT LIABILITIES TOTAL LIABILITIES 101.784 7.764 556880 104900 10,225 854644 3116 2461 297.764 3.1% 32 53.560 21.911 24,937 3026 13.8% 1,784,801 1,993,196 2,759,1153,181,436 208 395 422321 117 15,319 EQUITY 0 SHARE OP EQUITY ATTRIBUTABLE TO OWNERS OF THE PARENT CAPITAL STOCK B0,462 80.462 CAPITAL SURPLUS 103.515 102,307 RETAINED EARNINGS 1.267.521 1.369,775 TREASURY STOCK -59.307 -59,321 OTHER COMPONENTS OF EQUITY 1,046,614 1.742,814 TOTAL SHARE OF EQUITY ATTRIBUTABLE TO OWNERS OF THE PARENT 2.438 807 3.236,038 NON-CONTROLLING INTERESTS 81730 86511 TOTAL EQUITY 2.520.5373,322.550 0 -1200 (1.26 102.250 0.1 -10 10.025) 696200/6652% 797231 32.76 4781 5.896 BO2013 320 TOTAL LIABILITIES AND EQUITY 5.279,653 6.503.966 1.224 333 23.2% CONSOLIDATED INCOME STATEMENT HORIZONTAL ANALYSIS NET SALES COST OF SALES GROSSPROETE BASE YEAR * CHANGE Millions of ABSOLUTE YEN) IN 2021 CHANGE FY 2020 FY 2021 FROM 2020 2.171.255.116.302 53.052 24% 1.664.923 1.627.899 -37029 2.295 506 432 490.407 16025 (3.23 (13%) 0.35% -381473 18990 -15615 12823 74.64 -8.28 -374,648 18.1956 -16.555 110159 73999 -9030 -6825 66 940 1007 865 1542 -0% (125 16.79 SELLING, GENERAL AND ADMINISTRATIVE EXPENSES OTHER INCOME OTHER EXPENSES OPERATING PROFIT FINANCIAL INCOME FINANCIAL EXPENSES SHARE OF PROFIT OF INVESTMENTS ACCOUNTED FOR BY THE EQUITY METHOD PROFITATEFORLINCOME TAXES INCOME TAXES PROFIT PROHIT ATTRIBUTABLE TO OWNERS OF THE PARENT NON CONTROLLING INTEREST 1.472 1.682 210 14 196288 16101 150.187 154.011 -42576 141435 -12223 1525 -8752 162519 2.659 (50 145 881 2305 135700 9181 430 16395 104 7.25 LPSERATIC 49.85 440.26 2057 16.39