Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What does it mean when it says deduct from business income to get to tax income and how should I know what to deduct and

What does it mean when it says deduct from business income to get to tax income and how should I know what to deduct and what to include in exclusions? Can you explain how to solve this and breakdown what I asked above.

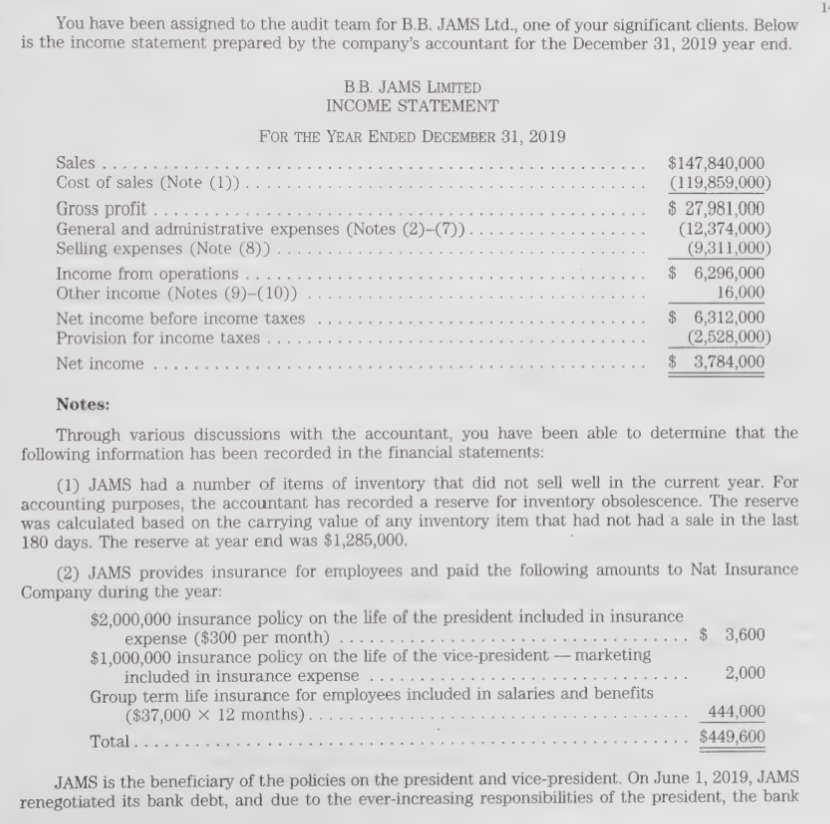

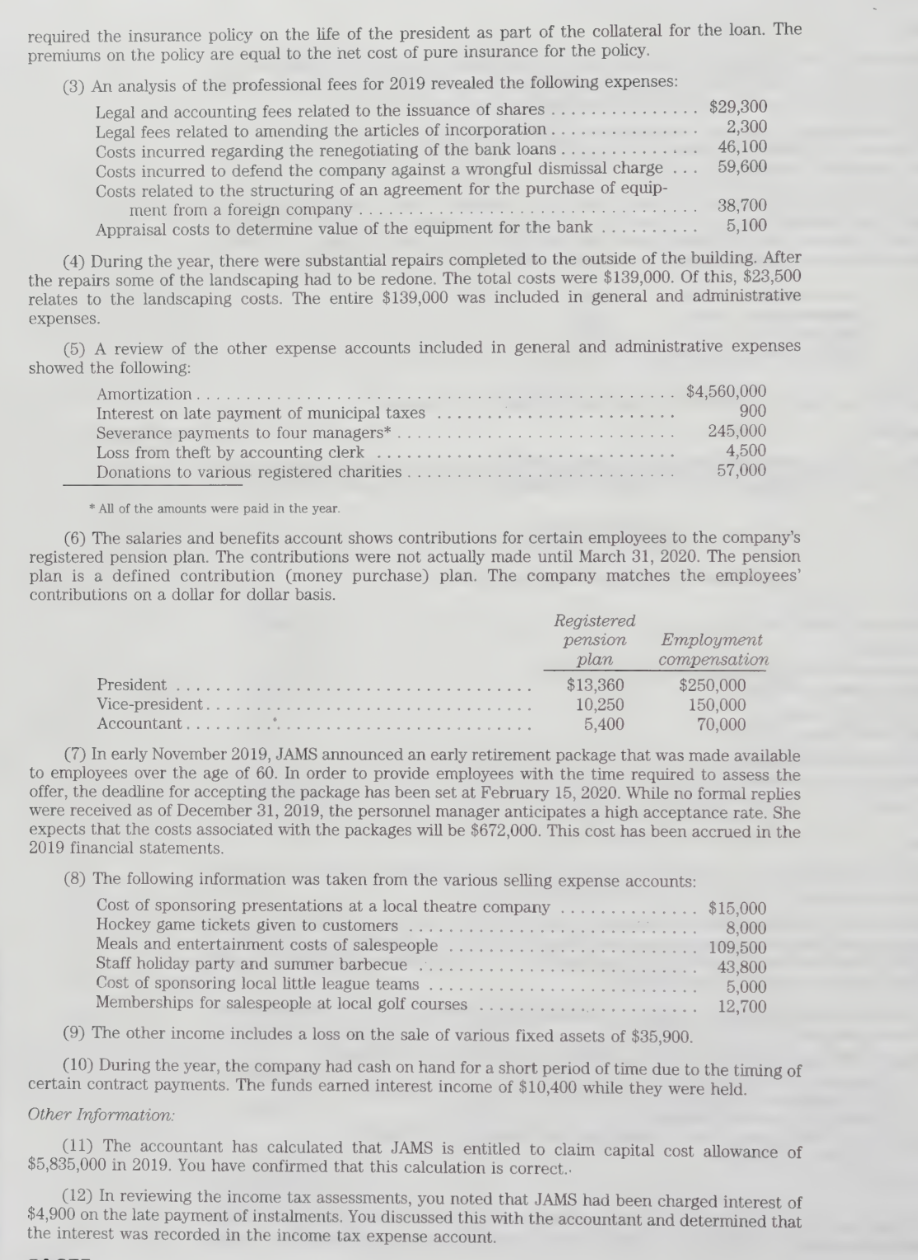

You have been assigned to the audit team for B.B. JAMS Ltd., one of your significant clients. Below is the income statement prepared by the company's accountant for the December 31, 2019 year end. Notes: Through various discussions with the accountant, you have been able to determine that the following information has been recorded in the financial statements: (1) JAMS had a number of items of inventory that did not sell well in the current year. For accounting purposes, the accountant has recorded a reserve for inventory obsolescence. The reserve was calculated based on the carrying value of any inventory item that had not had a sale in the last 180 days. The reserve at year end was $1,285,000. (2) JAMS provides insurance for employees and paid the following amounts to Nat Insurance Company during the year: $2,000,000 insurance policy on the life of the president included in insurance $1,000,000 insurance policy on the life of the vice-president - marketing included in insurance expense ,2,000 Group term life insurance for employees included in salaries and benefits ($37,00012 months ) 444,000 Total $449,600 JAMS is the beneficiary of the policies on the president and vice-president. On June 1, 2019, JAMS renegotiated its bank debt, and due to the ever-increasing responsibilities of the president, the bank required the insurance policy on the life of the president as part of the collateral for the loan. The premiums on the policy are equal to the net cost of pure insurance for the policy. (4) During the year, there were substantial repairs completed to the outside of the building. After the repairs some of the landscaping had to be redone. The total costs were $139,000. Of this, $23,500 relates to the landscaping costs. The entire $139,000 was included in general and administrative expenses. (5) A review of the other expense accounts included in general and administrative expenses showar the following. *All of the amounts were paid in the year. (6) The salaries and benefits account shows contributions for certain employees to the company's registered pension plan. The contributions were not actually made until March 31,2020. The pension plan is a defined contribution (money purchase) plan. The company matches the employees' contributions on a dollar for dollar basis. (7) In early November 2019, JAMS announced an early retirement package that was made available to employees over the age of 60 . In order to provide employees with the time required to assess the offer, the deadline for accepting the package has been set at February 15, 2020. While no formal replies were received as of December 31, 2019, the personnel manager anticipates a high acceptance rate. She expects that the costs associated with the packages will be $672,000. This cost has been accrued in the 2019 financial statements. (8) The following information was taken from the various selling exnense announte. (9) The other income includes a loss on the sale of various fixed assets of $35,900. (10) During the year, the company had cash on hand for a short period of time due to the timing of certain contract payments. The funds earned interest income of $10,400 while they were held. Other Information: (11) The accountant has calculated that JAMS is entitled to claim capital cost allowance of $5,835,000 in 2019 . You have confirmed that this calculation is correct.. (12) In reviewing the income tax assessments, you noted that JAMS had been charged interest of $4,900 on the late payment of instalments. You discussed this with the accountant and determined that the interest was recorded in the income tax expense account. Based on the information that you have obtained, your manager has asked you to calculate the income from business for tax purposes for JAMS for December 31, 2019. He also wants you to show all calculations whether or not they seem relevant to the final answer and comment on all items omitted from the calculation

You have been assigned to the audit team for B.B. JAMS Ltd., one of your significant clients. Below is the income statement prepared by the company's accountant for the December 31, 2019 year end. Notes: Through various discussions with the accountant, you have been able to determine that the following information has been recorded in the financial statements: (1) JAMS had a number of items of inventory that did not sell well in the current year. For accounting purposes, the accountant has recorded a reserve for inventory obsolescence. The reserve was calculated based on the carrying value of any inventory item that had not had a sale in the last 180 days. The reserve at year end was $1,285,000. (2) JAMS provides insurance for employees and paid the following amounts to Nat Insurance Company during the year: $2,000,000 insurance policy on the life of the president included in insurance $1,000,000 insurance policy on the life of the vice-president - marketing included in insurance expense ,2,000 Group term life insurance for employees included in salaries and benefits ($37,00012 months ) 444,000 Total $449,600 JAMS is the beneficiary of the policies on the president and vice-president. On June 1, 2019, JAMS renegotiated its bank debt, and due to the ever-increasing responsibilities of the president, the bank required the insurance policy on the life of the president as part of the collateral for the loan. The premiums on the policy are equal to the net cost of pure insurance for the policy. (4) During the year, there were substantial repairs completed to the outside of the building. After the repairs some of the landscaping had to be redone. The total costs were $139,000. Of this, $23,500 relates to the landscaping costs. The entire $139,000 was included in general and administrative expenses. (5) A review of the other expense accounts included in general and administrative expenses showar the following. *All of the amounts were paid in the year. (6) The salaries and benefits account shows contributions for certain employees to the company's registered pension plan. The contributions were not actually made until March 31,2020. The pension plan is a defined contribution (money purchase) plan. The company matches the employees' contributions on a dollar for dollar basis. (7) In early November 2019, JAMS announced an early retirement package that was made available to employees over the age of 60 . In order to provide employees with the time required to assess the offer, the deadline for accepting the package has been set at February 15, 2020. While no formal replies were received as of December 31, 2019, the personnel manager anticipates a high acceptance rate. She expects that the costs associated with the packages will be $672,000. This cost has been accrued in the 2019 financial statements. (8) The following information was taken from the various selling exnense announte. (9) The other income includes a loss on the sale of various fixed assets of $35,900. (10) During the year, the company had cash on hand for a short period of time due to the timing of certain contract payments. The funds earned interest income of $10,400 while they were held. Other Information: (11) The accountant has calculated that JAMS is entitled to claim capital cost allowance of $5,835,000 in 2019 . You have confirmed that this calculation is correct.. (12) In reviewing the income tax assessments, you noted that JAMS had been charged interest of $4,900 on the late payment of instalments. You discussed this with the accountant and determined that the interest was recorded in the income tax expense account. Based on the information that you have obtained, your manager has asked you to calculate the income from business for tax purposes for JAMS for December 31, 2019. He also wants you to show all calculations whether or not they seem relevant to the final answer and comment on all items omitted from the calculation Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started