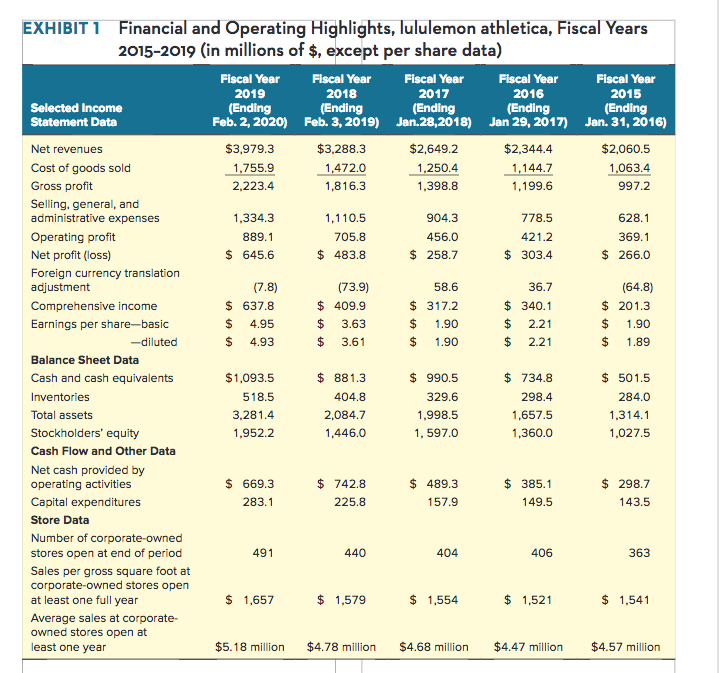

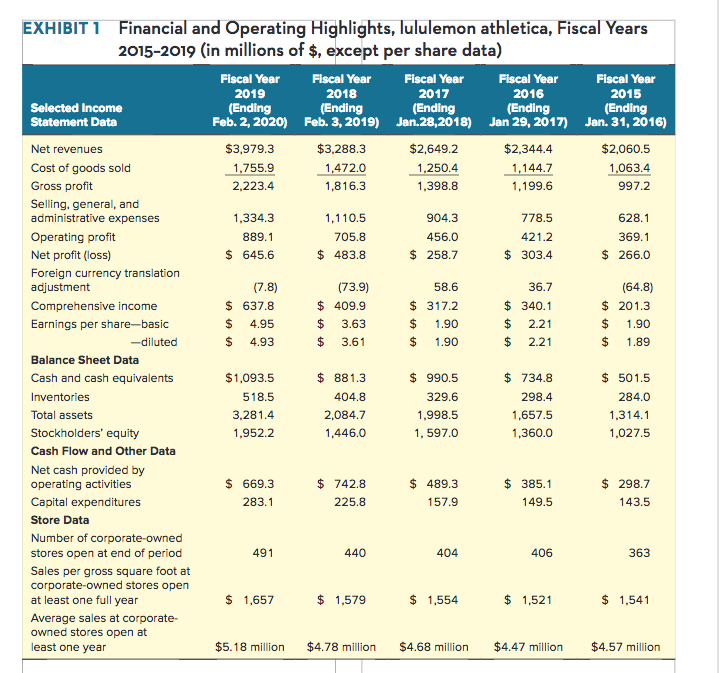

What does the data reveal about the operating and financial performance of lululemon? What aspects are impressive? Need improving? Calculate the compound average growth rates for certain financial measures as well.

EXHIBIT 1 Financial and Operating Highlights, lululemon athletica, Fiscal Years 2015-2019 (in millions of $, except per share data) Fiscal Year Fiscal Year Fiscal Year Fiscal Year Fiscal Year 2019 2018 2017 2016 2015 Selected Income (Ending (Ending (Ending (Ending (Ending Statement Data Feb. 2, 2020) Feb 3, 2019) Jan.28,2018) Jan 29, 2017) Jan. 31, 2016) Net revenues $3,979.3 $3,288.3 $2,649.2 $2,344.4 $2,060.5 Cost of goods sold 1.755.9 1,472.0 1.250.4 1,144.7 1,063.4 Gross profit 2,223.4 1,816.3 1.398.8 1,199.6 997.2 Selling, general, and administrative expenses 1.334.3 1,110.5 904.3 778.5 628.1 Operating profit 889.1 705.8 456.0 421.2 369.1 Net profit (loss) $ 645.6 $ 483.8 $ 258.7 $ 303.4 $ 266.0 Foreign currency translation adjustment (7.8) (73.9) 58.6 36.7 (64.8) Comprehensive income $ 637.8 $ 409.9 $ 317.2 $ 340.1 $ 201.3 Earnings per share-basic $ 4.95 $ 3.63 $ 1.90 $ 2.21 $ 1.90 -diluted $ 4.93 $ 3.61 $ 1.90 $ 2.21 $ 1.89 Balance Sheet Data Cash and cash equivalents $1,093.5 $ 881.3 $ 990.5 $ 734.8 $ 501.5 Inventories 518.5 404.8 329.6 298.4 284.0 Total assets 3,281.4 2,084.7 1,998.5 1,657.5 1,314.1 Stockholders' equity 1.952.2 1,446.0 1,597.0 1,360.0 1,027.5 Cash Flow and Other Data Net cash provided by operating activities $ 669.3 $ 742.8 $ 489,3 $ 385.1 $ 298.7 Capital expenditures 283.1 225.8 157.9 149.5 143.5 Store Data Number of corporate-owned stores open at end of period 491 440 404 363 Sales per gross square foot at corporate-owned stores open at least one full year $ 1,657 $ 1,579 $ 1,554 $ 1,521 $ 1,541 Average sales at corporate- owned stores open at least one year $5.18 million $4.78 million $4.68 million $4.47 million $4.57 million 406 EXHIBIT 1 Financial and Operating Highlights, lululemon athletica, Fiscal Years 2015-2019 (in millions of $, except per share data) Fiscal Year Fiscal Year Fiscal Year Fiscal Year Fiscal Year 2019 2018 2017 2016 2015 Selected Income (Ending (Ending (Ending (Ending (Ending Statement Data Feb. 2, 2020) Feb 3, 2019) Jan.28,2018) Jan 29, 2017) Jan. 31, 2016) Net revenues $3,979.3 $3,288.3 $2,649.2 $2,344.4 $2,060.5 Cost of goods sold 1.755.9 1,472.0 1.250.4 1,144.7 1,063.4 Gross profit 2,223.4 1,816.3 1.398.8 1,199.6 997.2 Selling, general, and administrative expenses 1.334.3 1,110.5 904.3 778.5 628.1 Operating profit 889.1 705.8 456.0 421.2 369.1 Net profit (loss) $ 645.6 $ 483.8 $ 258.7 $ 303.4 $ 266.0 Foreign currency translation adjustment (7.8) (73.9) 58.6 36.7 (64.8) Comprehensive income $ 637.8 $ 409.9 $ 317.2 $ 340.1 $ 201.3 Earnings per share-basic $ 4.95 $ 3.63 $ 1.90 $ 2.21 $ 1.90 -diluted $ 4.93 $ 3.61 $ 1.90 $ 2.21 $ 1.89 Balance Sheet Data Cash and cash equivalents $1,093.5 $ 881.3 $ 990.5 $ 734.8 $ 501.5 Inventories 518.5 404.8 329.6 298.4 284.0 Total assets 3,281.4 2,084.7 1,998.5 1,657.5 1,314.1 Stockholders' equity 1.952.2 1,446.0 1,597.0 1,360.0 1,027.5 Cash Flow and Other Data Net cash provided by operating activities $ 669.3 $ 742.8 $ 489,3 $ 385.1 $ 298.7 Capital expenditures 283.1 225.8 157.9 149.5 143.5 Store Data Number of corporate-owned stores open at end of period 491 440 404 363 Sales per gross square foot at corporate-owned stores open at least one full year $ 1,657 $ 1,579 $ 1,554 $ 1,521 $ 1,541 Average sales at corporate- owned stores open at least one year $5.18 million $4.78 million $4.68 million $4.47 million $4.57 million 406