Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What does the Price to Earnings (P/E) Ratio measure? Comment on the ratios calculated above for Carters PLC and explain what the ratios tell us

What does the Price to Earnings (P/E) Ratio measure? Comment on the ratios calculated above for Carters PLC and explain what the ratios tell us about the company financial performance and its prospects. Explain the reasons for the change in the ratio and use the information from the case study to inform your answer. Up to 175 words.

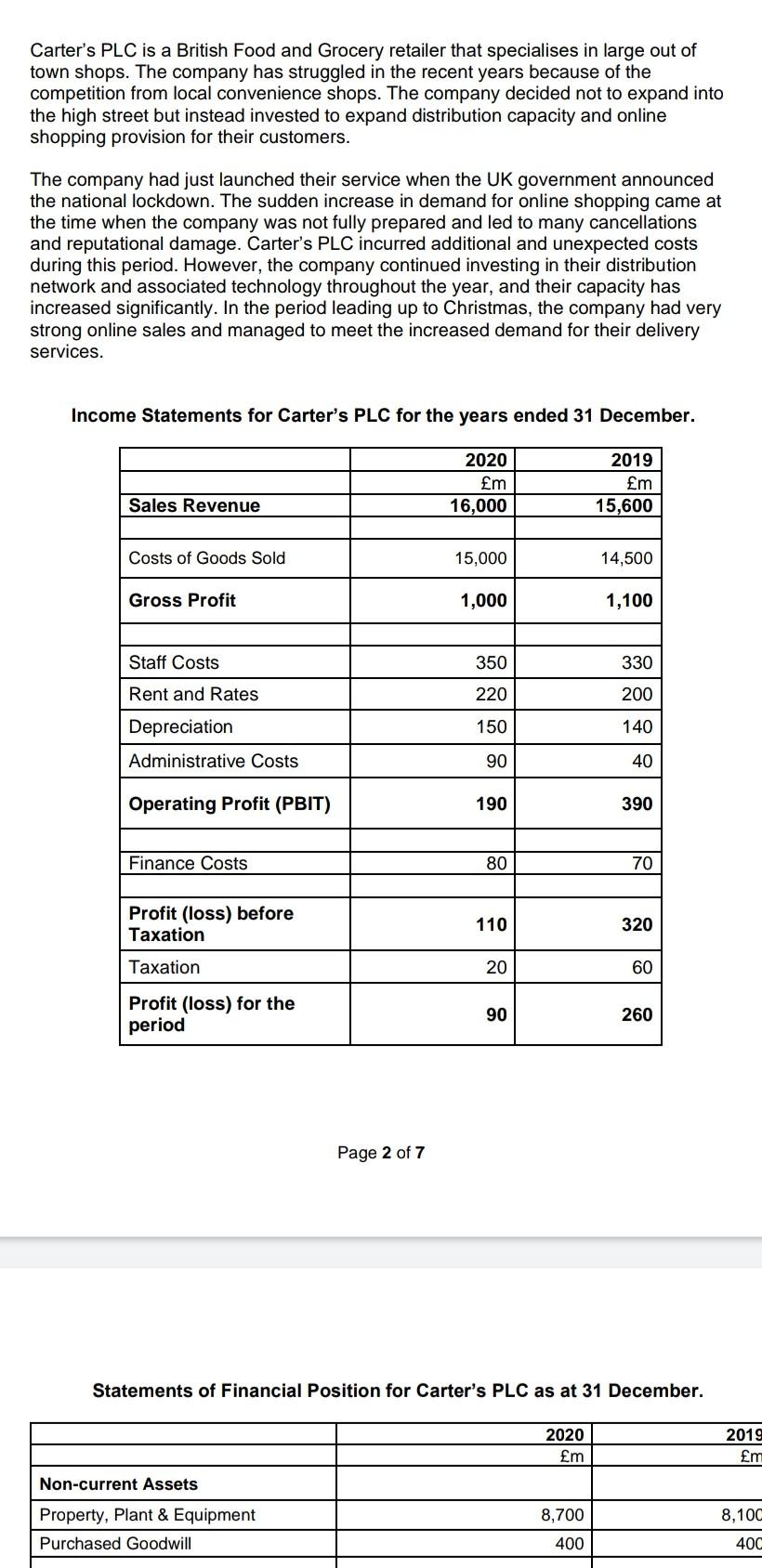

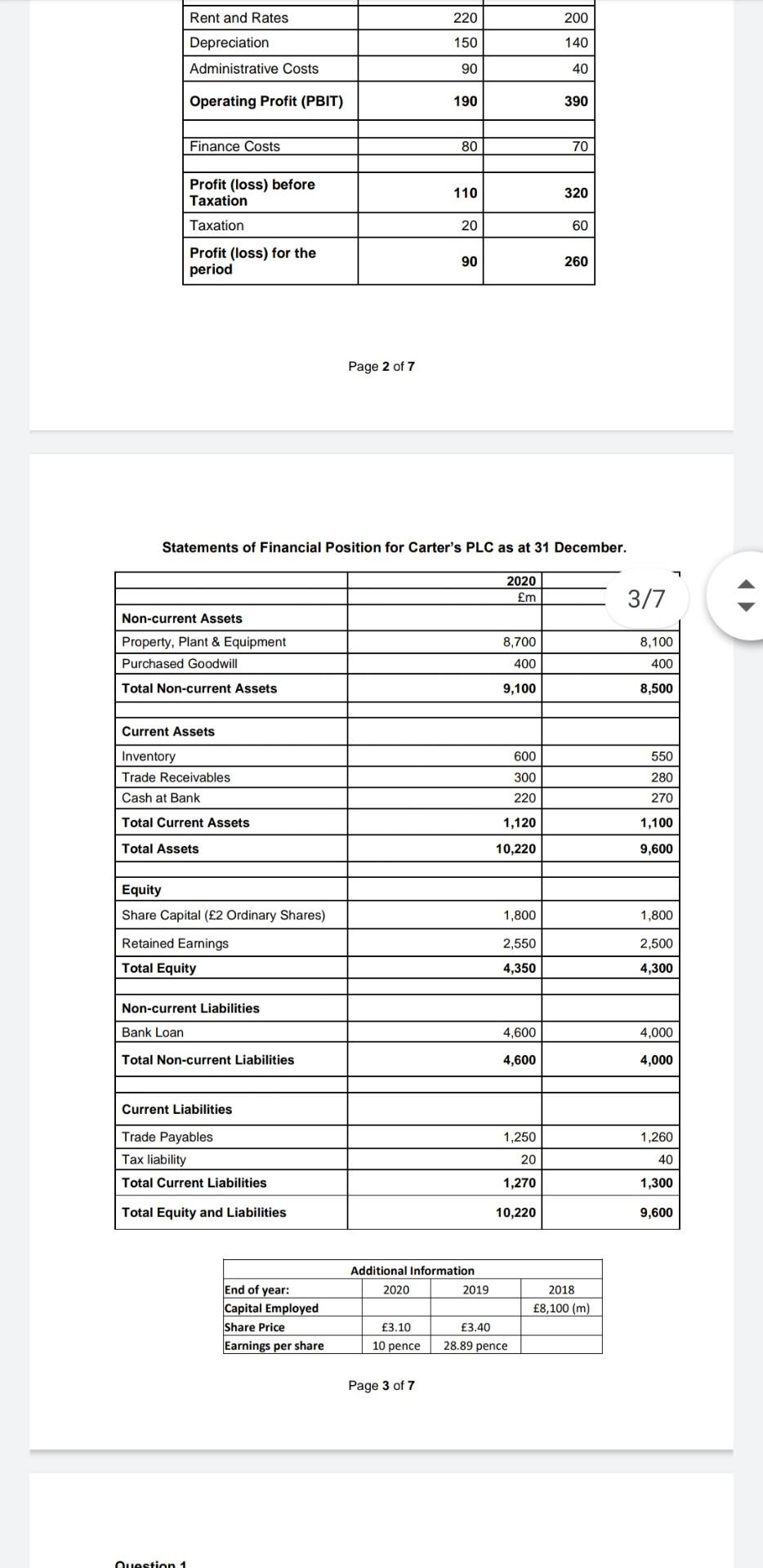

Carter's PLC is a British Food and Grocery retailer that specialises in large out of town shops. The company has struggled in the recent years because of the competition from local convenience shops. The company decided not to expand into the high street but instead invested to expand distribution capacity and online shopping provision for their customers. The company had just launched their service when the UK government announced the national lockdown. The sudden increase in demand for online shopping came at the time when the company was not fully prepared and led to many cancellations and reputational damage. Carter's PLC incurred additional and unexpected costs during this period. However, the company continued investing in their distribution network and associated technology throughout the year, and their capacity has increased significantly. In the period leading up to Christmas, the company had very strong online sales and managed to meet the increased demand for their delivery services. Income Statements for Carter's PLC for the years ended 31 December. 2020 m 16,000 2019 m 15,600 Sales Revenue Costs of Goods Sold 15,000 14,500 Gross Profit 1,000 1,100 Staff Costs 350 330 Rent and Rates 220 200 Depreciation 150 140 Administrative Costs 90 40 Operating Profit (PBIT) 190 390 Finance Costs 80 70 Profit (loss) before Taxation 110 320 Taxation 20 60 Profit (loss) for the period 90 260 Page 2 of 7 Statements of Financial Position for Carter's PLC as at 31 December. 2020 m 2019 m Non-current Assets 8,700 Property, Plant & Equipment Purchased Goodwill 8,100 40C 400 Rent and Rates 220 200 Depreciation 150 140 Administrative Costs 90 40 Operating Profit (PBIT) 190 390 Finance Costs 80 70 Profit (loss) before Taxation 110 320 Taxation 20 60 Profit (loss) for the period 90 260 Page 2 of 7 Statements of Financial Position for Carter's PLC as at 31 December. 2020 m 3/7 Non-current Assets Property, Plant & Equipment Purchased Goodwill 8,700 8,100 400 400 Total Non-current Assets 9,100 8,500 Current Assets Inventory Trade Receivables Cash at Bank 600 300 550 280 270 220 Total Current Assets 1,120 1,100 Total Assets 10,220 9,600 Equity Share Capital (2 Ordinary Shares) 1,800 1,800 2,550 2,500 Retained Earnings Total Equity 4,350 4,300 Non-current Liabilities Bank Loan 4,600 4,000 Total Non-current Liabilities 4,600 4,000 Current Liabilities 1,250 1,260 Trade Payables Tax liability Total Current Liabilities 20 40 1,270 1,300 Total Equity and Liabilities 10,220 9,600 Additional Information 2020 2019 2018 8,100 (m) End of year: Capital Employed Share Price Earnings per share 3.10 3.40 28.89 pence 10 pence Page 3 of 7 Ouestion 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started