what else am i missing?

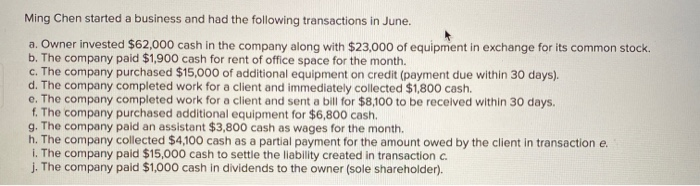

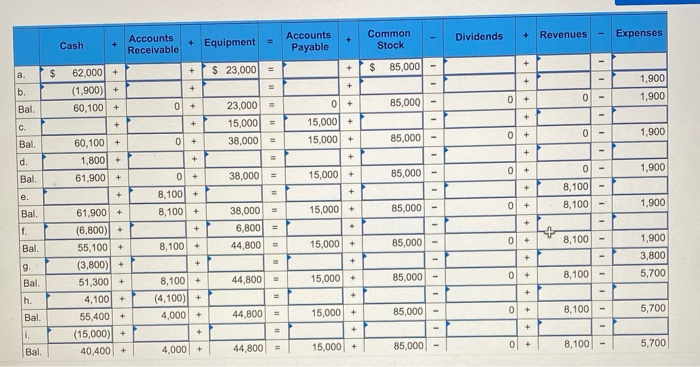

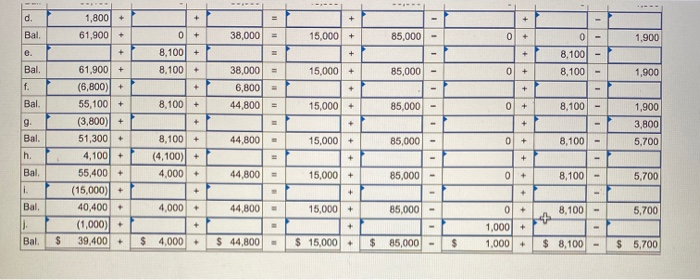

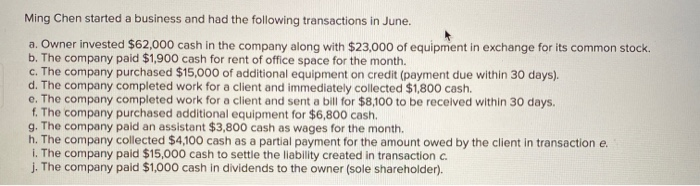

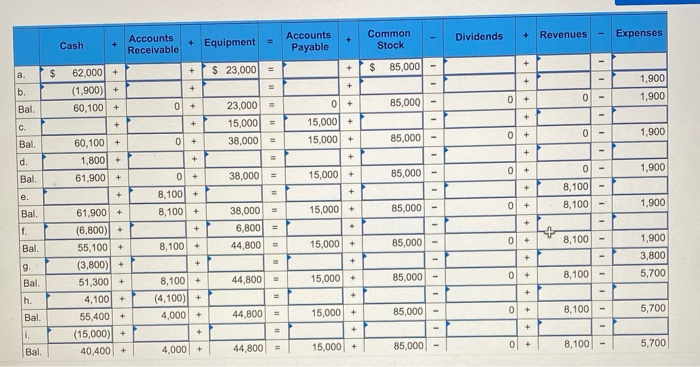

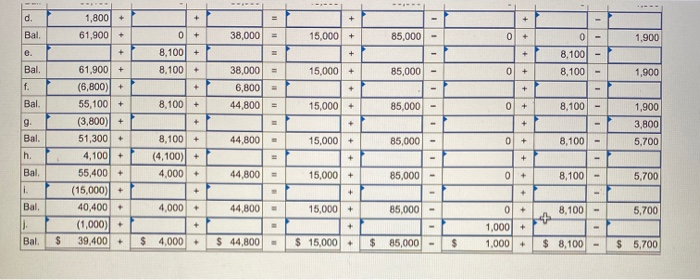

Ming Chen started a business and had the following transactions in June. a. Owner invested $62,000 cash in the company along with $23,000 of equipment in exchange for its common stock. b. The company paid $1,900 cash for rent of office space for the month. c. The company purchased $15,000 of additional equipment on credit (payment due within 30 days). d. The company completed work for a client and immediately collected $1,800 cash. e. The company completed work for a client and sent a bill for $8,100 to be received within 30 days. f. The company purchased additional equipment for $6,800 cash. g. The company paid an assistant $3,800 cash as wages for the month. h. The company collected $4,100 cash as a partial payment for the amount owed by the client in transaction e. 1. The company paid $15,000 cash to settle the liability created in transaction c. j. The company paid $1,000 cash in dividends to the owner (sole shareholder). Dividends + Revenues - Expenses Common Stock + Accounts Receivable Cash Accounts Payable + Equipment + + + $ $ $ 23,000) = + 85,000 + 1,900 + + b. 62,000 (1,900) 60,100 + + 0 + 0 1,900 01 + 01 + 85,000 Bal + + + 23,000 = 15,000 = 38,000 c. 15,000 + 15,000 + 0 + 0 1.900 Bal. + 0 85,000 + + + d. 60,100 + 1,800 61,900 0 + 1,900 Bal + 0 + 38,000 = 85,000 15,000 + 810l + + + e. 8,100 + 8,100 + 8,100 8,100 0 85,000 + 1,900 15,000 + + Bal. f. Bal + + 38,000 = 6,800 44,800 + 0 15,000 85,000 8,100 + 8,100 + 1,900 3,800 5,700 + 9 0 + 61,900 + (6,800) 55,100 + (3,800) + 51,300 + 4,100 55,400 (15,000) + 40.400 + 8,100 Bal 85,000 15,000 + IIIIIIIII 44,800 - + h. + 8,100+ (4,100) + 4,000 +++++++ 0 + 85,000 Bal. 8,100 + 44,800 + 5,700 15,000 + + + 1. + 0 44,800 85,000 15,000 + Bal. 8,100 4,000 + 5,700 d. + + 1,800 + 61,900 + Bal 38,000 = 15,000 + 85,000 0 0 1,900 0 + 8,100 + ++++ + + + + e. + + 8,100 8,100 Bal. 8.100 + = 15,000 + 85,000 0 1,900 38,000 6,800 f. + + + Bal. + 8,100 + 44,800 = 15,000 + 85,000 0 + 8,100 + + + g Bal 1,900 3,800 5,700 !!!!!!!!!!! 44,800 - 15,000 + 85,000 0 + 8,100 61.900 + (6,800) 55,100 (3,800) + 51,300 + 4,100 + 55,400 + (15,000) 40,400 + (1,000) 39,400 + 8,100 + (4,100) + 4.000 h. Bal + + + 44,800 = 15,000 + 85,000 01 + 8,100 - 5,700 i. + + + + Bal 4,000 44,800 - 85,000 - 0 + 8,100 - 15,000+ + 5,700 + Bal $ 1,000 + 1,000 $ 4,000 + $ 44,800 $ 15,000+ $ 85,000 $ + $ 8,100 - $ 5,700