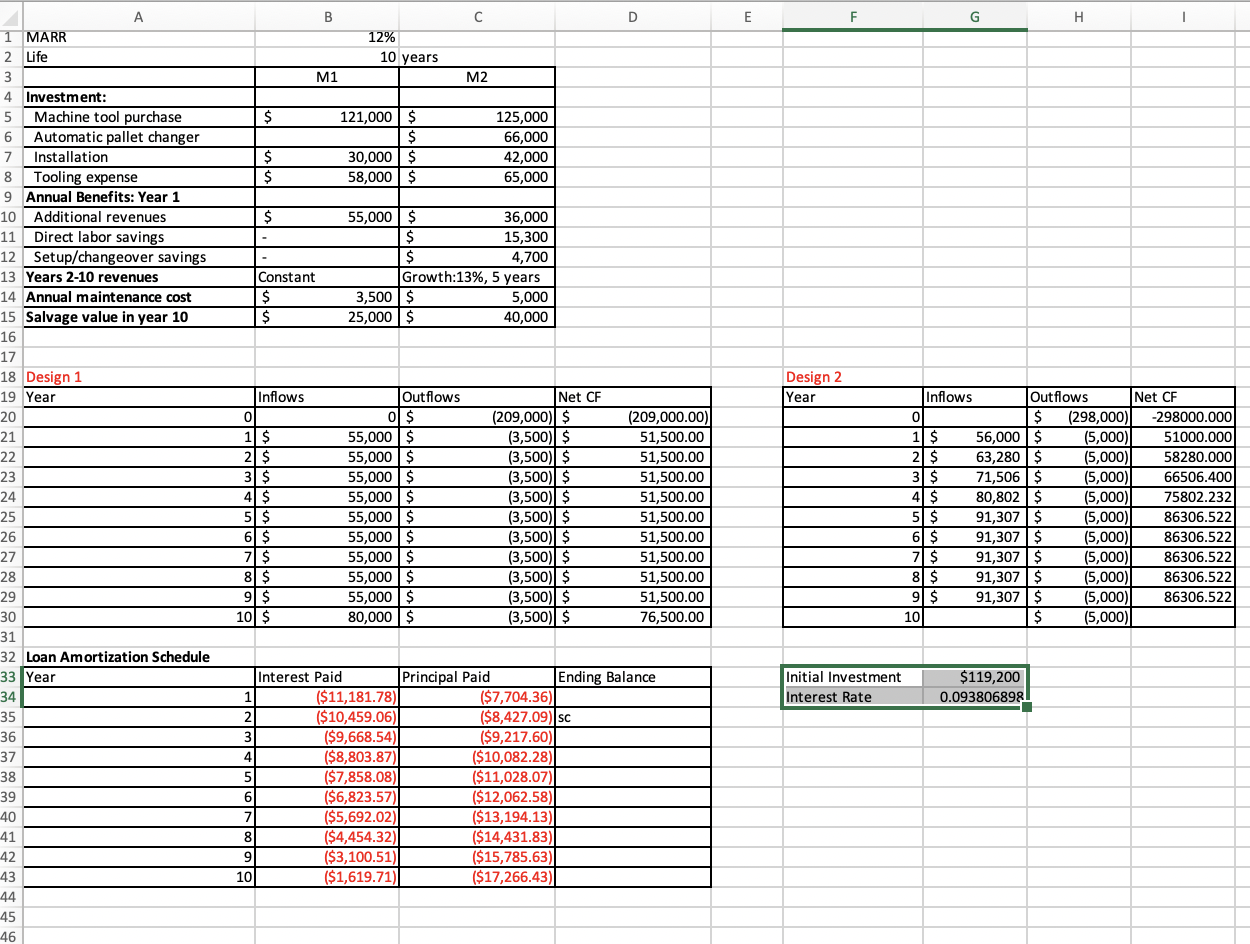

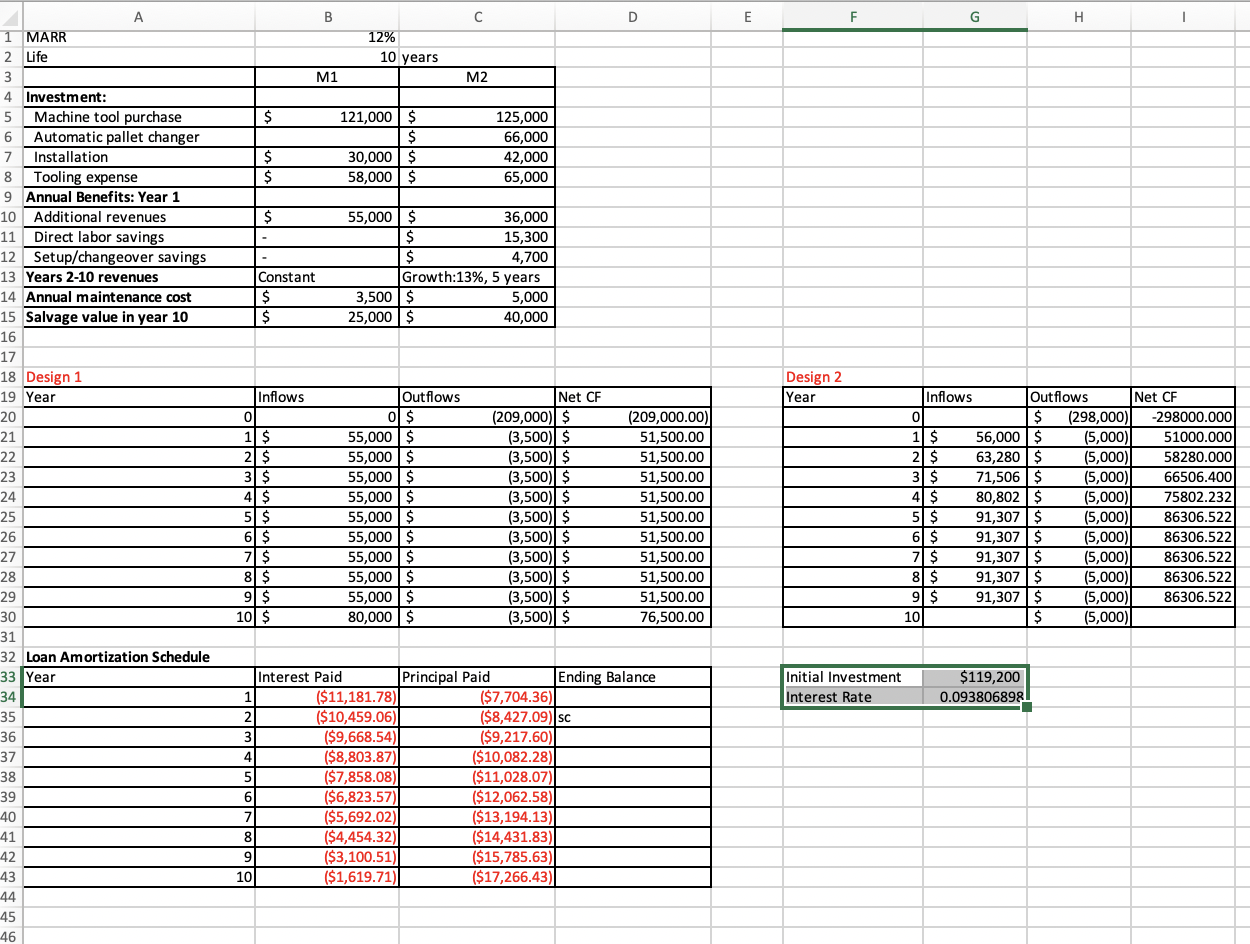

What excel formulas makw the initial investment $119,200 and the interest rate to be 0.093806898?

\begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline A & B & C & D & E & F & G & H & I \\ \hline MARR & 12% & & & & & & & \\ \hline Life & 10 & years & & & & & & \\ \hline & M1 & M2 & & & & & & \\ \hline Investment: & & & & & & & & \\ \hline Machine tool purchase & 121,000 & 125,000 & & & & & & \\ \hline Automatic pallet changer & & 66,000 & & & & & & \\ \hline Installation & 30,000 & 42,000 & & & & & & \\ \hline Tooling expense & 58,000 & 65,000 & & & & & & \\ \hline Annual Benefits: Year 1 & & & & & & & & \\ \hline Additional revenues & 55,000 & 36,000 & & & & & & \\ \hline Direct labor savings & - & 15,300 & & & & & & \\ \hline Setup/changeover savings & - & 4,700 & & & & & & \\ \hline Years 2-10 revenues & Constant & Growth:13\%, 5 years & & & & & & \\ \hline Annual maintenance cost & 3,500 & \begin{tabular}{|ll|} $ & 5,000 \\ \end{tabular} & & & & & & \\ \hline Salvage value in year 10 & 25,000 & 40,000 & & & & & & \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline Design 1 & & & & & Design 2 & & & \\ \hline Year & Inflows & Outflows & Net CF & & Year & Inflows & Outflows & Net CF \\ \hline 0 & 0 & (209,000) & (209,000.00) & & 0 & & $(298,000) & -298000.000 \\ \hline 1 & 55,000 & (3,500) & 51,500.00 & & 1 & 56,000 & (5,000) & 51000.000 \\ \hline 2 & 55,000 & (3,500) & 51,500.00 & & 2 & 63,280 & (5,000) & 58280.000 \\ \hline 3 & 55,000 & (3,500) & 51,500.00 & & 3 & 71,506 & (5,000) & 66506.400 \\ \hline 4 & 55,000 & (3,500) & 51,500.00 & & 4 & 80,802 & (5,000) & 75802.232 \\ \hline 5 & 55,000 & (3,500) & 51,500.00 & & 5 & 91,307 & (5,000) & 86306.522 \\ \hline 6 & 55,000 & (3,500) & 51,500.00 & & 6 & 91,307 & (5,000) & 86306.522 \\ \hline 7 & 55,000 & (3,500) & 51,500.00 & & 7 & 91,307 & (5,000) & 86306.522 \\ \hline 8 & 55,000 & (3,500) & 51,500.00 & & 8 & 91,307 & (5,000) & 86306.522 \\ \hline 9 & 55,000 & (3,500) & 51,500.00 & & 9 & 91,307 & (5,000) & 86306.522 \\ \hline 10 & 80,000 & (3,500) & 76,500.00 & & 10 & & (5,000) & \\ \hline & & & & & & & & \\ \hline \multicolumn{9}{|l|}{ Loan Amortization Schedule } \\ \hline Year & Interest Paid & Principal Paid & Ending Balance & & Initial Investment & $119,200 & & \\ \hline 1 & ($11,181.78) & ($7,704.36) & & & Interest Rate & 0.093806898 & & \\ \hline 2 & ($10,459.06) & ($8,427.09) & sc & & & & & \\ \hline 3 & ($9,668.54) & ($9,217.60) & & & & & & \\ \hline 4 & ($8,803.87) & ($10,082.28) & & & & & & \\ \hline 5 & ($7,858.08) & ($11,028.07) & & & & & & \\ \hline 6 & ($6,823.57) & ($12,062.58) & & & & & & \\ \hline 7 & ($5,692.02) & ($13,194.13) & & & & & & \\ \hline 8 & ($4,454.32) & ($14,431.83) & & & & & & \\ \hline 9 & ($3,100.51) & ($15,785.63) & & & & & & \\ \hline 10 & ($1,619.71) & ($17,266.43) & & & & & & \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline A & B & C & D & E & F & G & H & I \\ \hline MARR & 12% & & & & & & & \\ \hline Life & 10 & years & & & & & & \\ \hline & M1 & M2 & & & & & & \\ \hline Investment: & & & & & & & & \\ \hline Machine tool purchase & 121,000 & 125,000 & & & & & & \\ \hline Automatic pallet changer & & 66,000 & & & & & & \\ \hline Installation & 30,000 & 42,000 & & & & & & \\ \hline Tooling expense & 58,000 & 65,000 & & & & & & \\ \hline Annual Benefits: Year 1 & & & & & & & & \\ \hline Additional revenues & 55,000 & 36,000 & & & & & & \\ \hline Direct labor savings & - & 15,300 & & & & & & \\ \hline Setup/changeover savings & - & 4,700 & & & & & & \\ \hline Years 2-10 revenues & Constant & Growth:13\%, 5 years & & & & & & \\ \hline Annual maintenance cost & 3,500 & \begin{tabular}{|ll|} $ & 5,000 \\ \end{tabular} & & & & & & \\ \hline Salvage value in year 10 & 25,000 & 40,000 & & & & & & \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline Design 1 & & & & & Design 2 & & & \\ \hline Year & Inflows & Outflows & Net CF & & Year & Inflows & Outflows & Net CF \\ \hline 0 & 0 & (209,000) & (209,000.00) & & 0 & & $(298,000) & -298000.000 \\ \hline 1 & 55,000 & (3,500) & 51,500.00 & & 1 & 56,000 & (5,000) & 51000.000 \\ \hline 2 & 55,000 & (3,500) & 51,500.00 & & 2 & 63,280 & (5,000) & 58280.000 \\ \hline 3 & 55,000 & (3,500) & 51,500.00 & & 3 & 71,506 & (5,000) & 66506.400 \\ \hline 4 & 55,000 & (3,500) & 51,500.00 & & 4 & 80,802 & (5,000) & 75802.232 \\ \hline 5 & 55,000 & (3,500) & 51,500.00 & & 5 & 91,307 & (5,000) & 86306.522 \\ \hline 6 & 55,000 & (3,500) & 51,500.00 & & 6 & 91,307 & (5,000) & 86306.522 \\ \hline 7 & 55,000 & (3,500) & 51,500.00 & & 7 & 91,307 & (5,000) & 86306.522 \\ \hline 8 & 55,000 & (3,500) & 51,500.00 & & 8 & 91,307 & (5,000) & 86306.522 \\ \hline 9 & 55,000 & (3,500) & 51,500.00 & & 9 & 91,307 & (5,000) & 86306.522 \\ \hline 10 & 80,000 & (3,500) & 76,500.00 & & 10 & & (5,000) & \\ \hline & & & & & & & & \\ \hline \multicolumn{9}{|l|}{ Loan Amortization Schedule } \\ \hline Year & Interest Paid & Principal Paid & Ending Balance & & Initial Investment & $119,200 & & \\ \hline 1 & ($11,181.78) & ($7,704.36) & & & Interest Rate & 0.093806898 & & \\ \hline 2 & ($10,459.06) & ($8,427.09) & sc & & & & & \\ \hline 3 & ($9,668.54) & ($9,217.60) & & & & & & \\ \hline 4 & ($8,803.87) & ($10,082.28) & & & & & & \\ \hline 5 & ($7,858.08) & ($11,028.07) & & & & & & \\ \hline 6 & ($6,823.57) & ($12,062.58) & & & & & & \\ \hline 7 & ($5,692.02) & ($13,194.13) & & & & & & \\ \hline 8 & ($4,454.32) & ($14,431.83) & & & & & & \\ \hline 9 & ($3,100.51) & ($15,785.63) & & & & & & \\ \hline 10 & ($1,619.71) & ($17,266.43) & & & & & & \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline \end{tabular}