Answered step by step

Verified Expert Solution

Question

1 Approved Answer

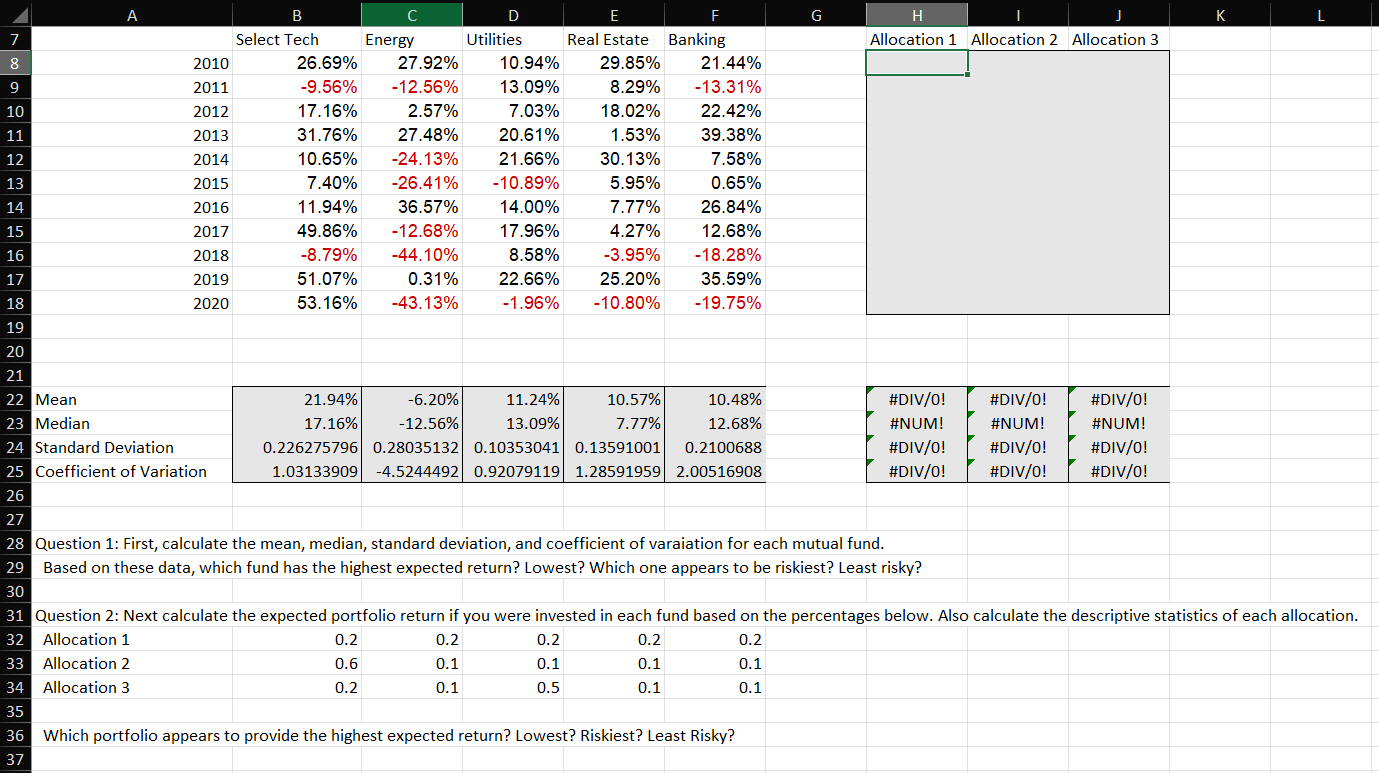

What formula do I need to use here? (Excel) Allocation for calculating expected portfolio return if you were invested in each fund based on the

What formula do I need to use here? (Excel) Allocation for calculating expected portfolio return if you were invested in each fund based on the percentages listed.

I know this is an unconventional request, but thank you.

G K L H Allocation 1 Allocation 2 Allocation 3 7 8 9 10 11 12 13 14 15 B D Select Tech Energy Utilities Real Estate Banking 2010 26.69% 27.92% 10.94% 29.85% 21.44% 2011 -9.56% -12.56% 13.09% 8.29% -13.31% 2012 17.16% 2.57% 7.03% 18.02% 22.42% 2013 31.76% 27.48% 20.61% 1.53% 39.38% 2014 10.65% -24.13% 21.66% 30.13% 7.58% 2015 7.40% -26.41% -10.89% 5.95% 0.65% 2016 11.94% 36.57% 14.00% 7.77% 26.84% 2017 49.86% -12.68% 17.96% 4.27% 12.68% 2018 -8.79% -44.10% 8.58% -3.95% -18.28% 2019 51.07% 0.31% 22.66% 25.20% 35.59% 2020 53.16% -43.13% -1.96% -10.80% -19.75% 16 17 18 19 20 21 22 Mean 21.94% -6.20% 11.24% 10.57% 10.48% #DIV/0! #DIV/0! #DIV/0! 23 Median 17.16% -12.56% 13.09% 7.77% 12.68% #NUM! #NUM! #NUM! 24 Standard Deviation 0.226275796 0.28035132 0.10353041 0.13591001 0.2100688 #DIV/0! #DIV/0! #DIV/0! 25 Coefficient of Variation 1.03133909 -4.5244492 0.92079119 1.28591959 2.00516908 #DIV/0! #DIV/0! #DIV/0! 26 27 28 Question 1: First, calculate the mean, median, standard deviation, and coefficient of varaiation for each mutual fund. 29 Based on these data, which fund has the highest expected return? Lowest? Which one appears to be riskiest? Least risky? 30 31 Question 2: Next calculate the expected portfolio return if you were invested in each fund based on the percentages below. Also calculate the descriptive statistics of each allocation. 32 Allocation 1 0.2 0.2 0.2 0.2 0.2 33 Allocation 2 0.6 0.1 0.1 0.1 0.1 34 Allocation 3 0.2 0.1 0.5 0.1 0.1 35 36 Which portfolio appears to provide the highest expected return? Lowest? Riskiest? Least Risky? 37 G K L H Allocation 1 Allocation 2 Allocation 3 7 8 9 10 11 12 13 14 15 B D Select Tech Energy Utilities Real Estate Banking 2010 26.69% 27.92% 10.94% 29.85% 21.44% 2011 -9.56% -12.56% 13.09% 8.29% -13.31% 2012 17.16% 2.57% 7.03% 18.02% 22.42% 2013 31.76% 27.48% 20.61% 1.53% 39.38% 2014 10.65% -24.13% 21.66% 30.13% 7.58% 2015 7.40% -26.41% -10.89% 5.95% 0.65% 2016 11.94% 36.57% 14.00% 7.77% 26.84% 2017 49.86% -12.68% 17.96% 4.27% 12.68% 2018 -8.79% -44.10% 8.58% -3.95% -18.28% 2019 51.07% 0.31% 22.66% 25.20% 35.59% 2020 53.16% -43.13% -1.96% -10.80% -19.75% 16 17 18 19 20 21 22 Mean 21.94% -6.20% 11.24% 10.57% 10.48% #DIV/0! #DIV/0! #DIV/0! 23 Median 17.16% -12.56% 13.09% 7.77% 12.68% #NUM! #NUM! #NUM! 24 Standard Deviation 0.226275796 0.28035132 0.10353041 0.13591001 0.2100688 #DIV/0! #DIV/0! #DIV/0! 25 Coefficient of Variation 1.03133909 -4.5244492 0.92079119 1.28591959 2.00516908 #DIV/0! #DIV/0! #DIV/0! 26 27 28 Question 1: First, calculate the mean, median, standard deviation, and coefficient of varaiation for each mutual fund. 29 Based on these data, which fund has the highest expected return? Lowest? Which one appears to be riskiest? Least risky? 30 31 Question 2: Next calculate the expected portfolio return if you were invested in each fund based on the percentages below. Also calculate the descriptive statistics of each allocation. 32 Allocation 1 0.2 0.2 0.2 0.2 0.2 33 Allocation 2 0.6 0.1 0.1 0.1 0.1 34 Allocation 3 0.2 0.1 0.5 0.1 0.1 35 36 Which portfolio appears to provide the highest expected return? Lowest? Riskiest? Least Risky? 37Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started