Answered step by step

Verified Expert Solution

Question

1 Approved Answer

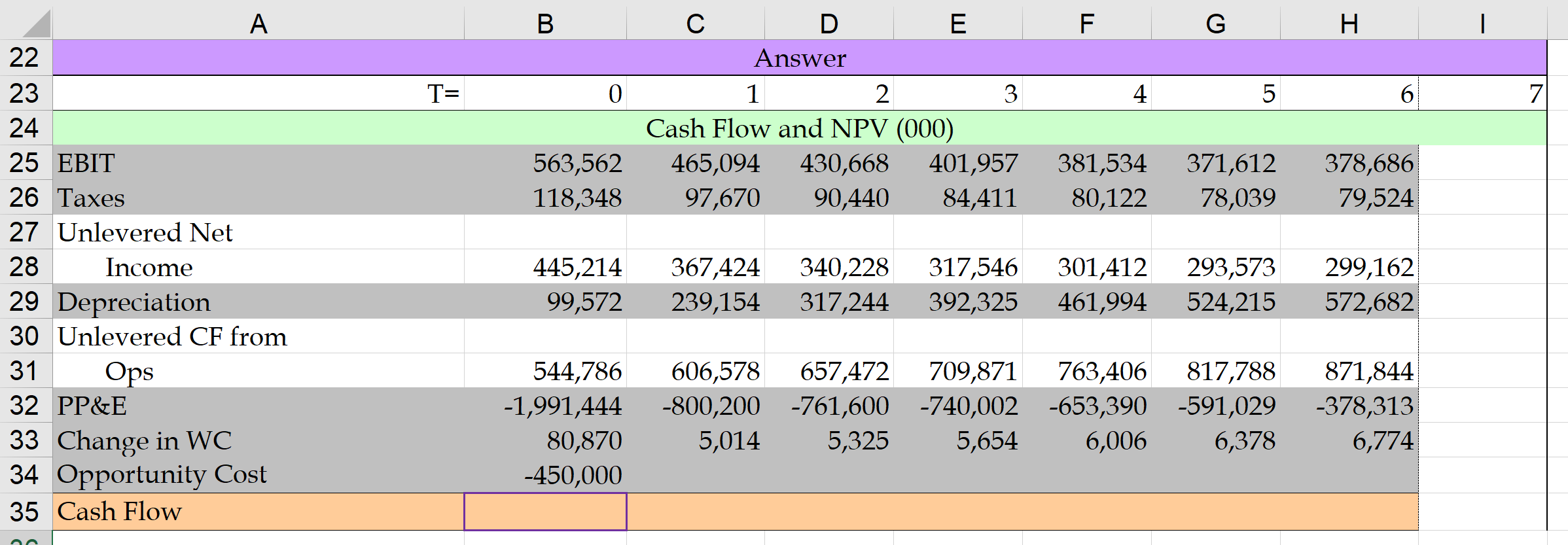

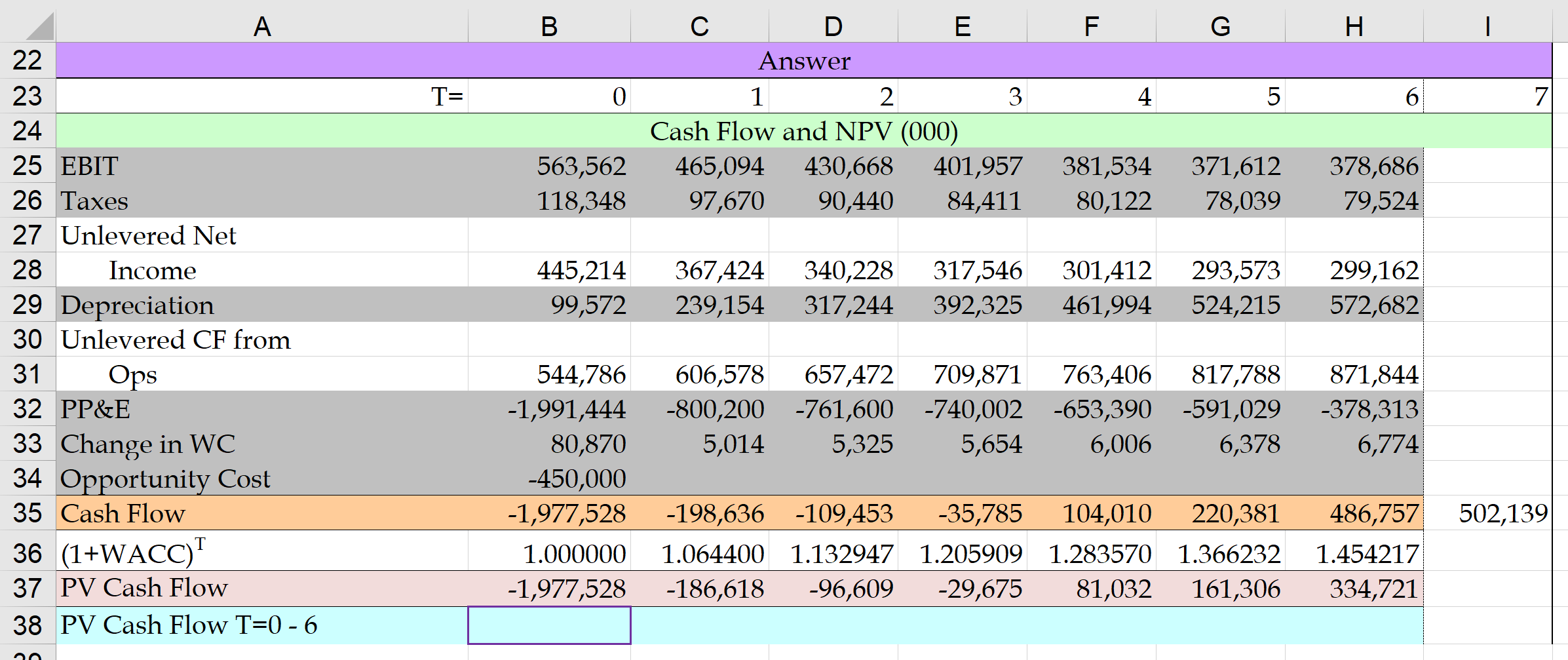

What formula goes in cell B35? What goes in cell I35? As a reminder, cash flows are assumed to grow by 3.16% after 2027. (Avoid

What formula goes in cell B35?

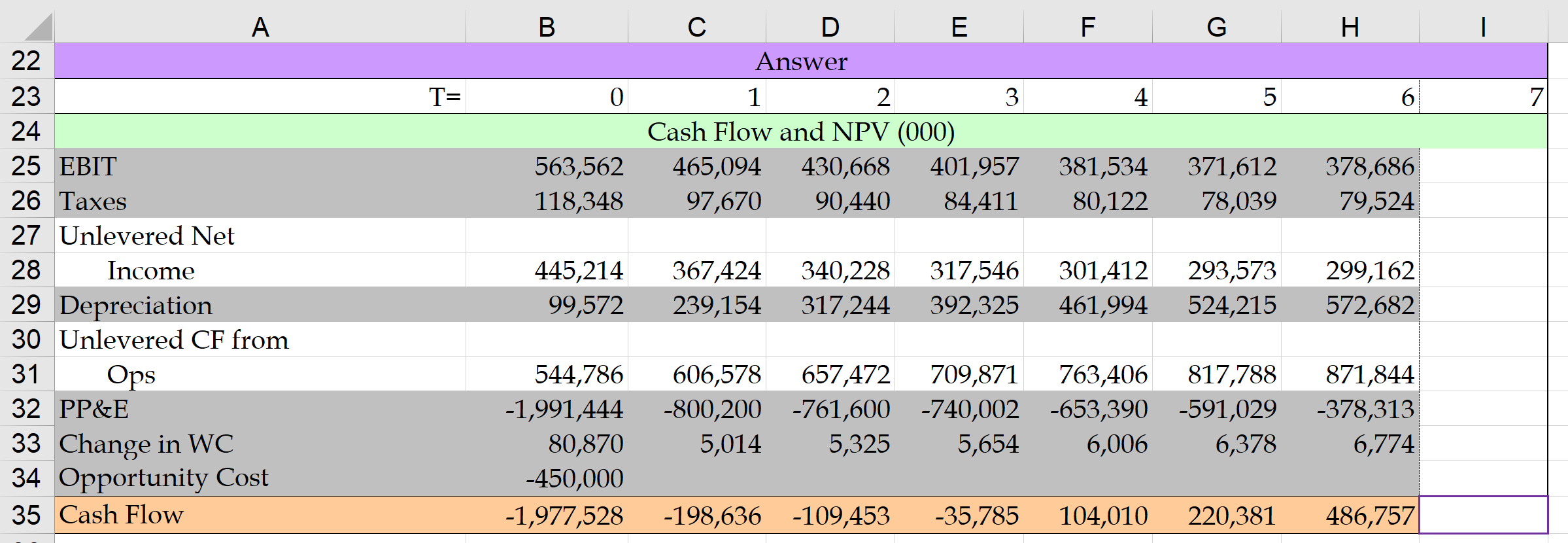

What goes in cell I35? As a reminder, cash flows are assumed to grow by 3.16% after 2027. (Avoid unnecessary spaces in answer.)

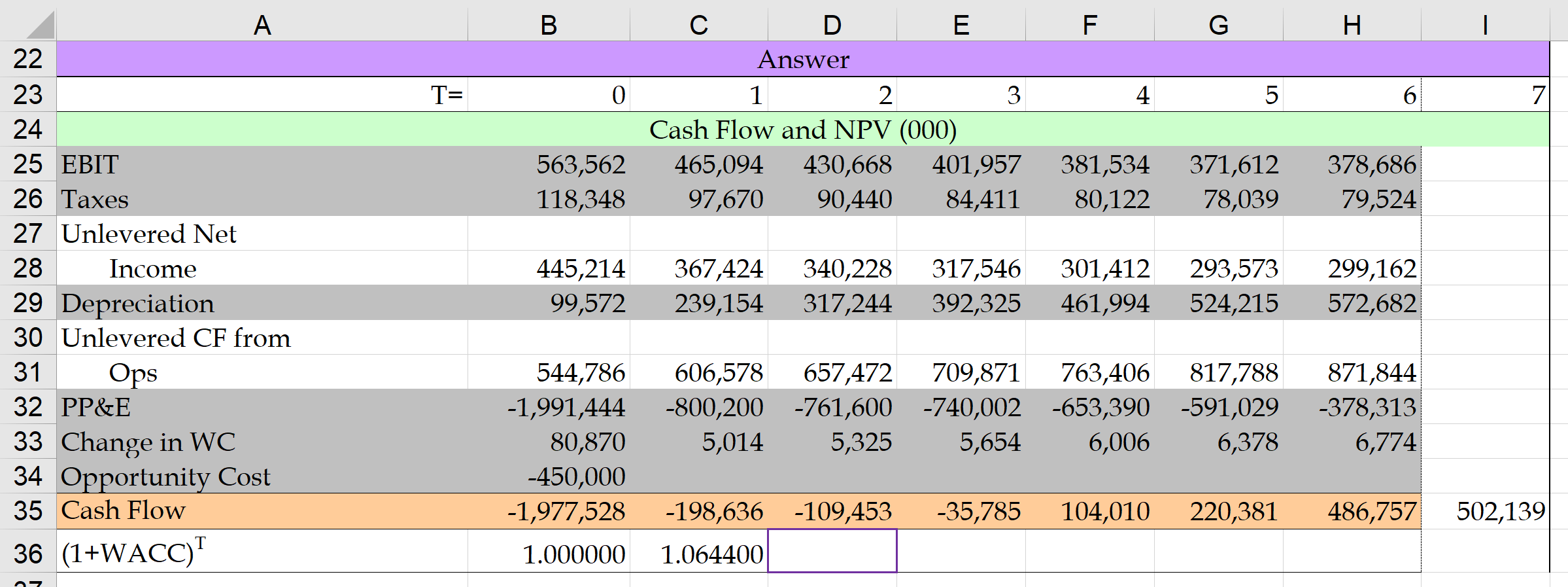

What is the formula for cell D36?

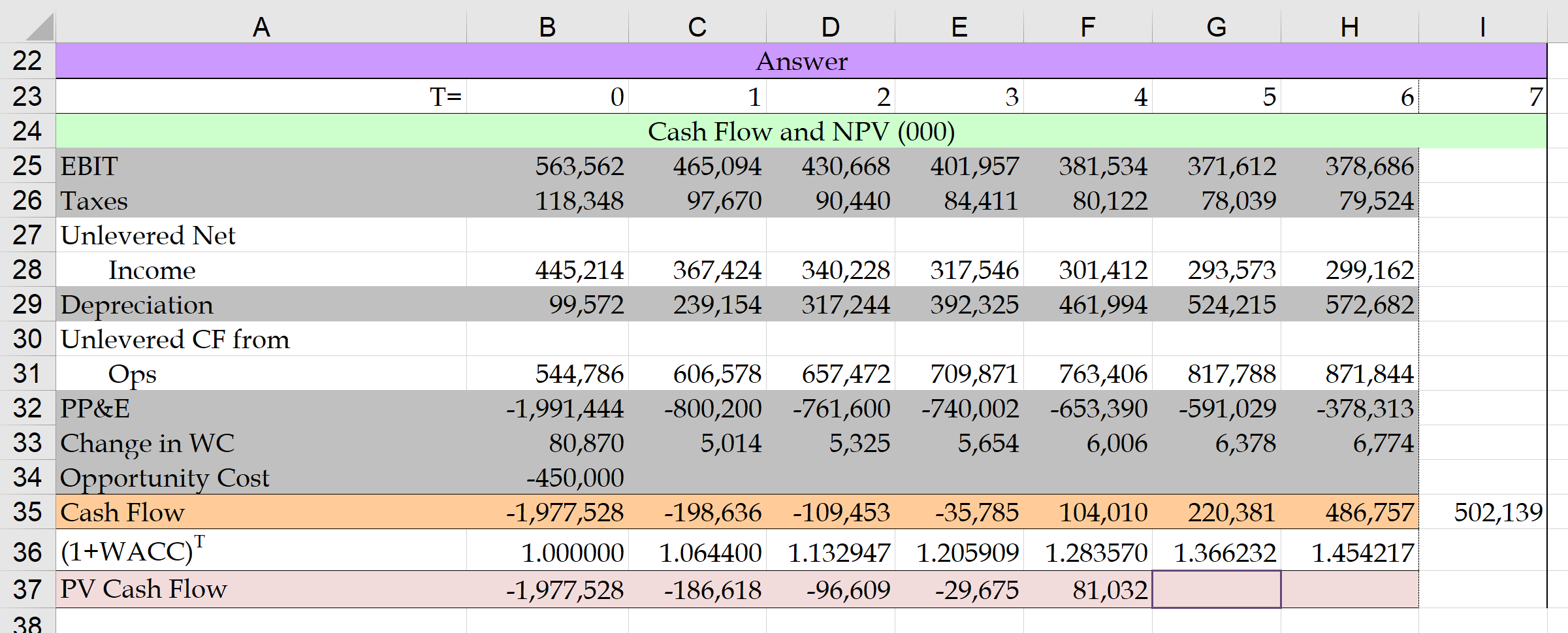

What is the formula in cell G37?

What is the formula in cell B38?

B F G H T= 0 4 5 6 7 D E Answer 1 2 3 Cash Flow and NPV (000) 465,094 430,668 401,957 97,670 90,440 84,411 563,562 118,348 381,534 80,122 371,612 78,039 378,686 79,524 A 22 23 24 25 EBIT 26 Taxes 27 Unlevered Net Income 29 Depreciation 30 Unlevered CF from 31 Ops 32 PP&E 33 Change in WC 34 Opportunity Cost 35 Cash Flow 28 445,214 99,572 367,424 239,154 340,228 317,244 317,546 392,325 301,412 461,994 293,573 524,215 299,162 572,682 544,786 -1,991,444 80,870 -450,000 606,578 657,472 709,871 763,406 817,788 -800,200 -761,600 -740,002 -653,390 -591,029 5,014 5,325 5,654 6,006 6,378 871,844 -378,313 6,774 An B F G H | T= 0 4 5 6 7 E Answer 1 2 3 Cash Flow and NPV (000) 465,094 430,668 401,957 97,670 90,440 84,411 563,562 118,348 381,534 80,122 371,612 78,039 378,686 79,524 A 22 23 24 25 EBIT 26 Taxes 27 Unlevered Net 28 Income 29 Depreciation 30 Unlevered CF from 31 Ops 32 PP&E 33 Change in WC 34 Opportunity Cost 35 Cash Flow 445,214 99,572 367,424 239,154 340,228 317,244 317,546 392,325 301,412 461,994 293,573 524,215 299,162 572,682 544,786 -1,991,444 80,870 -450,000 -1,977,528 606,578 657,472 709,871 763,406 817,788 -800,200 -761,600 -740,002 -653,390 -591,029 5,014 5,325 5,654 6,006 6,378 871,844 -378,313 6,774 -198,636 -109,453 -35,785 104,010 220,381 486,757 B F G H I T= 0 4 5 6 7 D E Answer 1 2 3 Cash Flow and NPV (000) 465,094 430,668 401,957 97,670 90,440 84,411 563,562 118,348 381,534 80,122 371,612 78,039 378,686 79,524 A 22 23 24 25 EBIT 26 Taxes 27 Unlevered Net 28 Income 29 Depreciation 30 Unlevered CF from 31 Ops 32 PP&E 33 Change in WC 34 Opportunity Cost 35 Cash Flow 36 (1+WACC)? 445,214 99,572 367,424 239,154 340,228 317,244 317,546 392,325 301,412 461,994 293,573 524,215 299,162 572,682 606,578 657,472 709,871 763,406 -800,200 -761,600 -740,002 -653,390 5,014 5,325 5,654 6,006 817,788 -591,029 6,378 871,844 -378,313 6,774 544,786 -1,991,444 80,870 -450,000 -1,977,528 1.000000 -198,636 -109,453 -35,785 104,010 220,381 486,757 502,139 1.064400 B F G H T= 0 4 5 6 7 C D E Answer 1 2 3 Cash Flow and NPV (000) 465,094 430,668 401,957 97,670 90,440 84,411 563,562 118,348 381,534 80,122 371,612 78,039 378,686 79,524 A 22 23 24 25 EBIT 26 Taxes 27 Unlevered Net 28 Income 29 Depreciation 30 Unlevered CF from 31 Ops 32 PP&E 33 Change in WC 34 Opportunity Cost 35 Cash Flow 36 (1+WACC) 37 PV Cash Flow 445,214 99,572 367,424 239,154 340,228 317,244 317,546 392,325 301,412 461,994 293,573 524,215 299,162 572,682 606,578 657,472 709,871 763,406 817,788 -800,200 -761,600 -740,002 -653,390 -591,029 5,014 5,325 5,654 6,006 6,378 871,844 -378,313 6,774 544,786 -1,991,444 80,870 -450,000 -1,977,528 1.000000 -1,977,528 502,139 -198,636 -109,453 -35,785 104,010 220,381 1.064400 1.132947 1.205909 1.283570 1.366232 -186,618 -96,609 -29,675 81,032 486,757 1.454217 38 B F G H | T= 0 4 5 6 7 D E Answer 1 2 3 Cash Flow and NPV (000) 465,094 430,668 401,957 97,670 90,440 84,411 563,562 118,348 381,534 80,122 371,612 78,039 378,686 79,524 445,214 99,572 367,424 239,154 340,228 317,244 317,546 392,325 301,412 461,994 293,573 524,215 299,162 572,682 A 22 23 24 25 EBIT 26 Taxes 27 Unlevered Net 28 Income 29 Deprecialion 30 Unlevered CF from 31 Ops 32 PP&E 33 Change in WC 34 Opportunity Cost 35 Cash Flow 36 (1+WACC) 37 PV Cash Flow 38 PV Cash Flow T=0 - 6 606,578 657,472 709,871 763,406 -800,200 -761,600 -740,002 -653,390 5,014 5,325 5,654 6,006 817,788 -591,029 6,378 871,844 -378,313 6,774 544,786 -1,991,444 80,870 -450,000 -1,977,528 1.000000 -1,977,528 502,139 -198,636 -109,453 -35,785 104,010 220,381 1.064400 1.132947 1.205909 1.283570 1.366232 -186,618 -96,609 -29,675 81,032 161,306 486,757 1.454217 334,721 no

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started