What formula should i use to solve for this? Not math wise but cell wise in excel

What formula should i use to solve for this? Not math wise but cell wise in excel

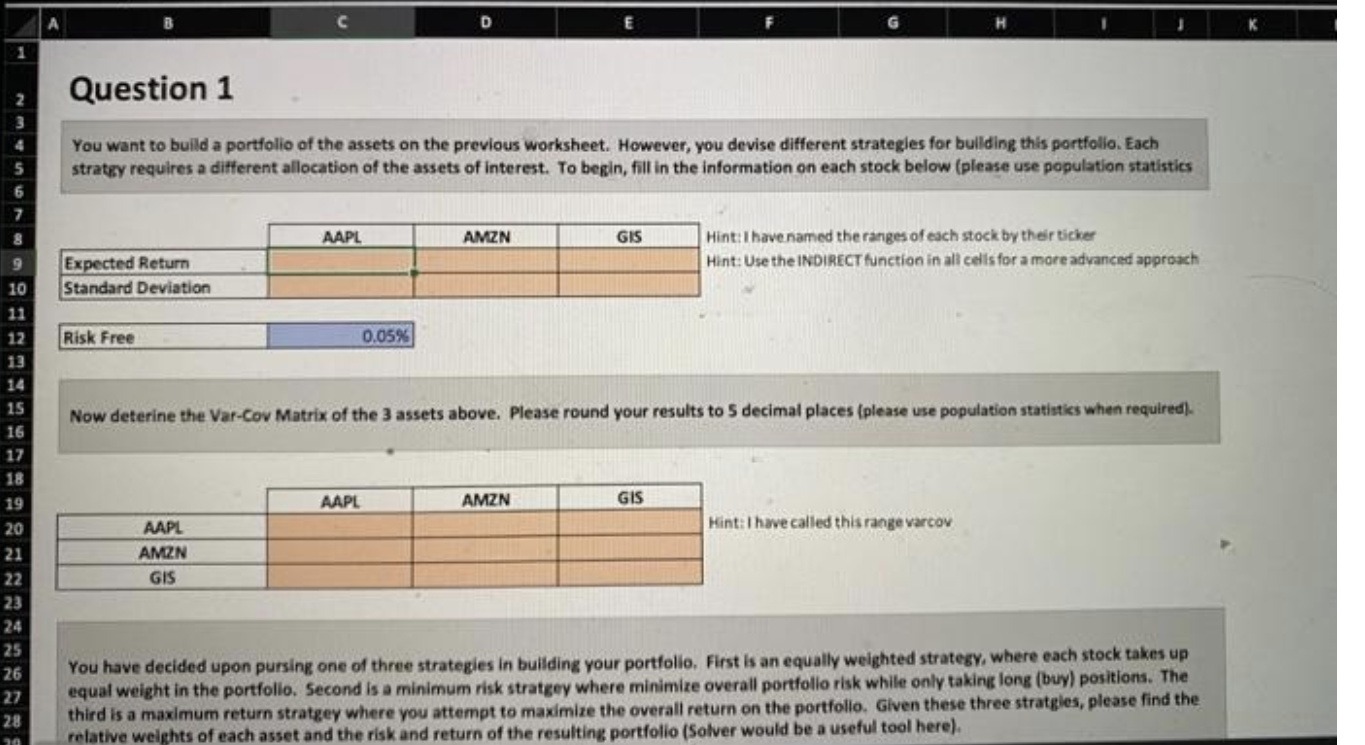

You want to build a portfolio of the assets on the previous worksheet. However, you devise different strategles for bullding this portfolio. Each stratey requires a different allocation of the assets of interest. To begin, fill in the information on each stock below (please use population statistics Hint: I have named the ranges of each stock by their ticker Hint: Use the INDIRECT function in all celis for a more advanced approach Risk Free 0.05% Now deterine the Var-Cov Matrix of the 3 assets above. Please round your results to 5 decimal places (please use population statistics when required). Hintilhave called this range varcov You have decided upon pursing one of three strategies in building your portfolio. First is an equally weighted strategy, where each stock takes up equal weight in the portfolio. Second is a minimum risk stratgey where minimize overall portfollo risk while only taking long (buy) positions. The third is a maximum return stratgey where you attempt to maximize the overall return on the portfollo. Given these three stratgies, please find the relative weights of each asset and the risk and return of the resulting portfolio (Solver would be a useful tool here). You want to build a portfolio of the assets on the previous worksheet. However, you devise different strategles for bullding this portfolio. Each stratey requires a different allocation of the assets of interest. To begin, fill in the information on each stock below (please use population statistics Hint: I have named the ranges of each stock by their ticker Hint: Use the INDIRECT function in all celis for a more advanced approach Risk Free 0.05% Now deterine the Var-Cov Matrix of the 3 assets above. Please round your results to 5 decimal places (please use population statistics when required). Hintilhave called this range varcov You have decided upon pursing one of three strategies in building your portfolio. First is an equally weighted strategy, where each stock takes up equal weight in the portfolio. Second is a minimum risk stratgey where minimize overall portfollo risk while only taking long (buy) positions. The third is a maximum return stratgey where you attempt to maximize the overall return on the portfollo. Given these three stratgies, please find the relative weights of each asset and the risk and return of the resulting portfolio (Solver would be a useful tool here)

What formula should i use to solve for this? Not math wise but cell wise in excel

What formula should i use to solve for this? Not math wise but cell wise in excel