What formulas on the formula sheet

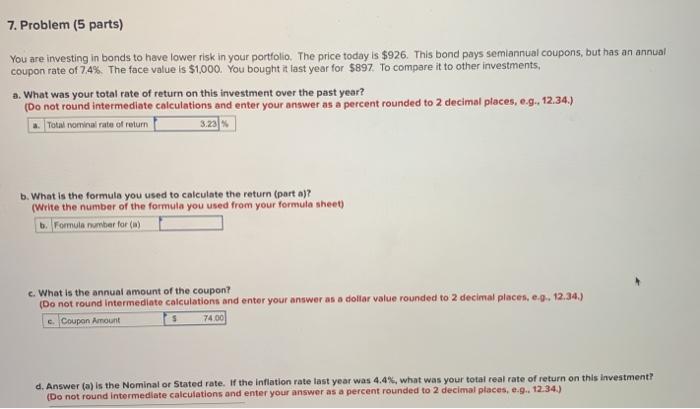

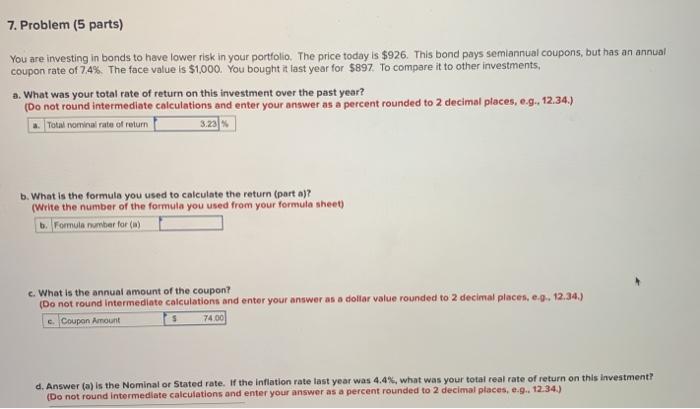

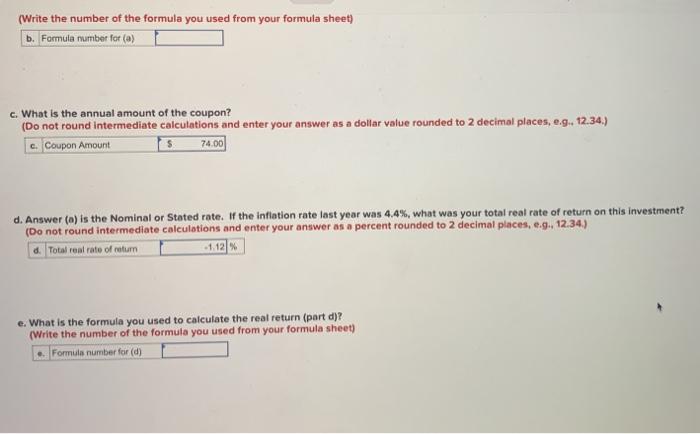

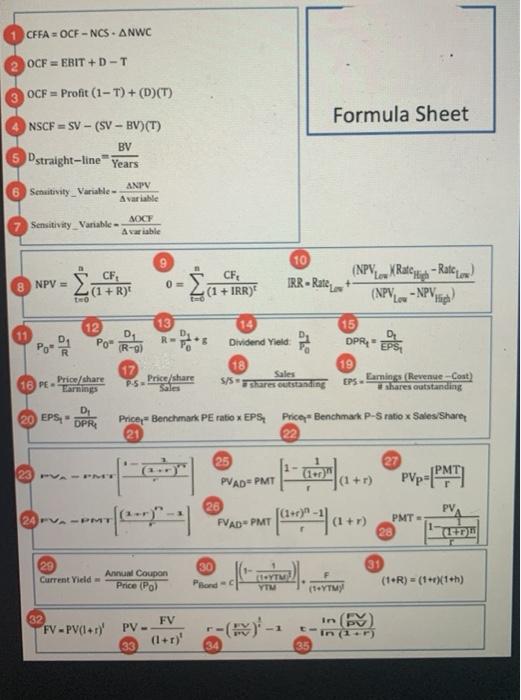

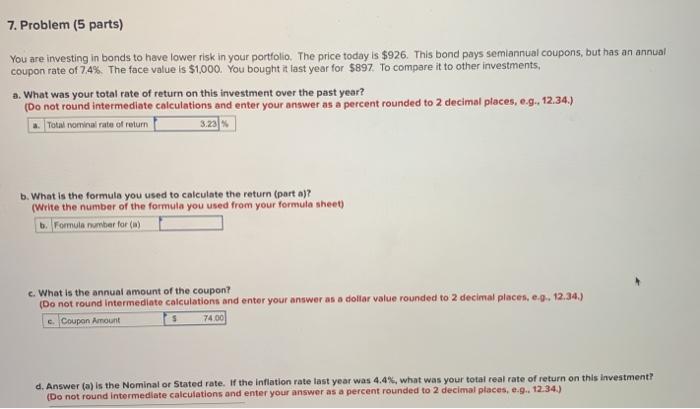

7. Problem (5 parts) You are investing in bonds to have lower risk in your portfolio. The price today is $926. This bond pays semiannual coupons, but has an annual coupon rate of 7,4%. The face value is $1,000. You bought it last year for $897 To compare it to other investments, a. What was your total rate of return on this investment over the past year? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 12.34.) Total rotiraj rate of return 3.20 b. What is the formula you used to calculate the return (part o)? (write the number of the formula you used from your formula sheet) b. Formula combat for c. What is the annual amount of the coupon? (Do not round intermediate calculations and enter your answer as a dollar value rounded to 2 decimal places, c.9. 12.34.) Coupon Amount 74.00 d. Answer (a) is the Nominal or Stated rate. If the inflation rate last year was 4.4%, what was your total real rate of return on this investment (Do not round Intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e... 12.34.) (Write the number of the formula you used from your formula sheet) b. Formula number fot () c. What is the annual amount of the coupon? (Do not round Intermediate calculations and enter your answer as a dollar value rounded to 2 decimal places, e.g. 12.34.) c. Coupon Amount 5 74.00 d. Answer (a) is the Nominal or Stated rate. If the inflation rate last year was 4.4%, what was your total real rate of return on this investment? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e... 12.34.) d. Total roal rate of column -1.12 e. What is the formula you used to calculate the real return (part d)? (Write the number of the formula you used from your formula sheet) .. Formula number for (d) CFFA OCF - NCS - ANWC OCFERIT +D-T OCF = Profit (1-T)+(DCT) Formula Sheet NSCFSV - - (SV BV)(T) BV Dstraight-line Years Sensitivity_ Variable ANTV Avariable Sensitivity Variable AOC Avariable 10 8 NPV = CF, (1 + R)" O- CF, (1 + IRR) IRR-Rates (NPV (NPV-NPV Dividend Yield 13 11 Po- R (R-02 12 Price share Price/share 16 PE P.5 Earnings 15 DPR EPSE 19 EPS- Earnings Revenue-Cost) shares outstanding 18 Sales 5/5 shares outstanding 20 EPS- DPR Price Benchmark PE ratio x EPS Price Benchmark P-S ratio x Sales/Share 21 22 25 27 23 PM Gier PVADEPMT (1+r) PVp[PM PV 24 V-PM 26 PVADEPMT PMT= 28 29 Current Yield Anul Coupon Price Pol 30 Bond (YTM YTU (1+YTMY (1+R) = (1+r)(1+h) 32 FV-PV(+1) FV PV- (1+r)' 33 in (1) 34 35