Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What further questions would you have regarding the credit before arriving at an accept/reject decision? CASE QUESTOR, INC. 16 Catherine Logan was president of Questor,

What further questions would you have regarding the credit before arriving at an accept/reject decision?

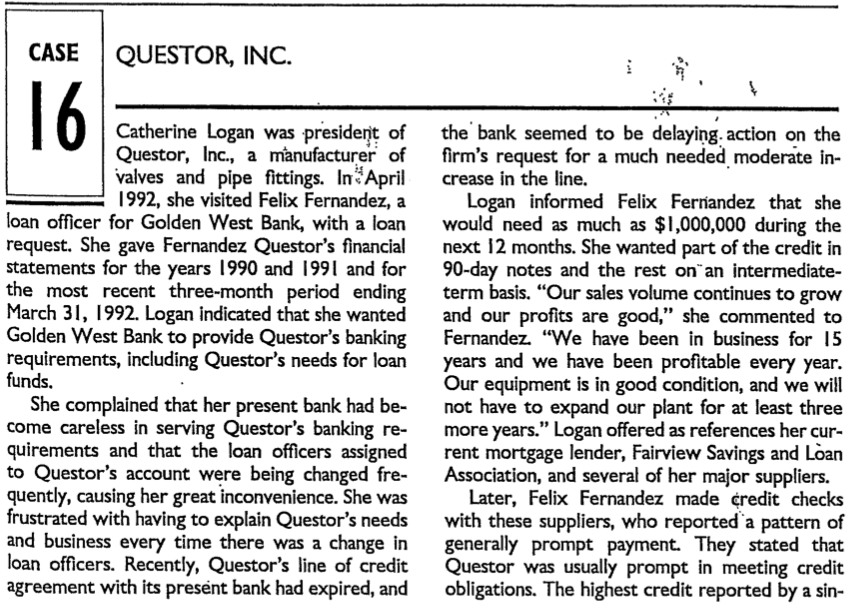

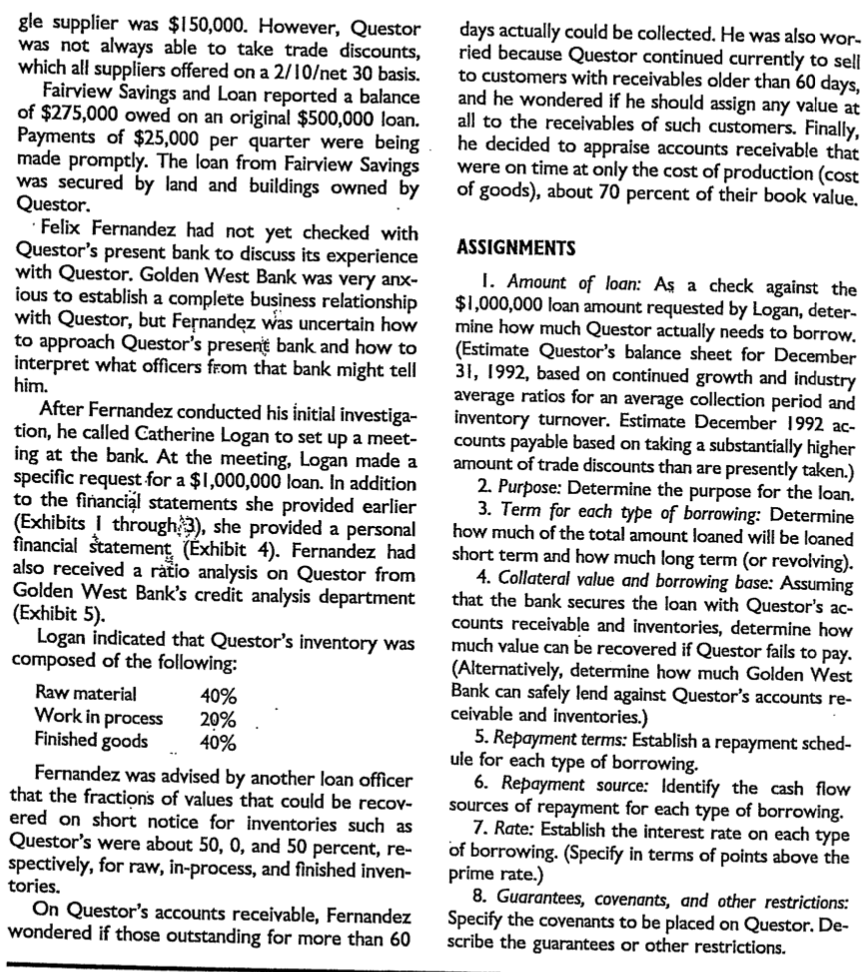

CASE QUESTOR, INC. 16 Catherine Logan was president of Questor, Inc., a manufacturer of valves and pipe fittings. In April 1992, she visited Felix Fernandez, a loan officer for Golden West Bank, with a loan request. She gave Fernandez Questor's financial statements for the years 1990 and 1991 and for the most recent three-month period ending March 31, 1992. Logan indicated that she wanted Golden West Bank to provide Questor's banking requirements, including Questor's needs for loan funds. She complained that her present bank had be- come careless in serving Questor's banking re- quirements and that the loan officers assigned to Questor's account were being changed fre- quently, causing her great inconvenience. She was frustrated with having to explain Questor's needs and business every time there was a change in loan officers. Recently, Questor's line of credit agreement with its present bank had expired, and the bank seemed to be delaying action on the firm's request for a much needed moderate in- crease in the line. Logan informed Felix Fernandez that she would need as much as $1,000,000 during the next 12 months. She wanted part of the credit in 90-day notes and the rest on an intermediate- term basis. "Our sales volume continues to grow and our profits are good," she commented to Fernandez "We have been in business for 15 years and we have been profitable every year. Our equipment is in good condition, and we will not have to expand our plant for at least three more years. Logan offered as references her cur- rent mortgage lender, Fairview Savings and Loan Association, and several of her major suppliers. Later, Felix Fernandez made credit checks with these suppliers, who reported a pattern of generally prompt payment. They stated that Questor was usually prompt in meeting credit obligations. The highest credit reported by a sin- days actually could be collected. He was also wor- ried because Questor continued currently to sell to customers with receivables older than 60 days, and he wondered if he should assign any value at all to the receivables of such customers. Finally, he decided to appraise accounts receivable that were on time at only the cost of production (cost of goods), about 70 percent of their book value. gle supplier was $150,000. However, Questor was not always able to take trade discounts, which all suppliers offered on a 2/10et 30 basis. Fairview Savings and Loan reported a balance of $275,000 owed on an original $500,000 loan. Payments of $25,000 per quarter were being made promptly. The loan from Fairview Savings was secured by land and buildings owned by Questor. Felix Fernandez had not yet checked with Questor's present bank to discuss its experience with Questor. Golden West Bank was very anx- ious to establish a complete business relationship with Questor, but Fernandez was uncertain how to approach Questor's present bank and how to interpret what officers from that bank might tell him. After Fernandez conducted his initial investiga- tion, he called Catherine Logan to set up a meet- ing at the bank. At the meeting, Logan made a specific request for a $1,000,000 loan. In addition to the financial statements she provided earlier (Exhibits ! through 3), she provided a personal financial statement (Exhibit 4). Fernandez had also received a ratio analysis on Questor from Golden West Bank's credit analysis department (Exhibit 5). Logan indicated that Questor's inventory was composed of the following: Raw material 40% 20% Finished goods 40% Fernandez was advised by another loan officer that the fractions of values that could be recor- ered on short notice for inventories such as Questor's were about 50, 0, and 50 percent, re- spectively, for raw, in-process, and finished inven- tories. On Questor's accounts receivable, Fernandez wondered if those outstanding for more than 60 ASSIGNMENTS I. Amount of loan: As a check against the $1,000,000 loan amount requested by Logan, deter- mine how much Questor actually needs to borrow. (Estimate Questor's balance sheet for December 31, 1992, based on continued growth and industry average ratios for an average collection period and inventory turnover. Estimate December 1992 ac- counts payable based on taking a substantially higher amount of trade discounts than are presently taken.) 2. Purpose: Determine the purpose for the loan. 3. Term for each type of borrowing: Determine how much of the total amount loaned will be loaned short term and how much long term (or revolving). 4. Collateral value and borrowing base: Assuming that the bank secures the loan with Questor's ac- counts receivable and inventories, determine how much value can be recovered if Questor fails to pay. (Alternatively, determine how much Golden West Bank can safely lend against Questor's accounts re- ceivable and inventories.) 5. Repayment terms: Establish a repayment sched- ule for each type of borrowing. 6. Repayment source: Identify the cash flow sources of repayment for each type of borrowing. 7. Rate: Establish the interest rate on each type of borrowing. (Specify in terms of points above the prime rate.) 8. Guarantees, covenants, and other restrictions: Specify the covenants to be placed on Questor. De- scribe the guarantees or other restrictions. Work in process CASE QUESTOR, INC. 16 Catherine Logan was president of Questor, Inc., a manufacturer of valves and pipe fittings. In April 1992, she visited Felix Fernandez, a loan officer for Golden West Bank, with a loan request. She gave Fernandez Questor's financial statements for the years 1990 and 1991 and for the most recent three-month period ending March 31, 1992. Logan indicated that she wanted Golden West Bank to provide Questor's banking requirements, including Questor's needs for loan funds. She complained that her present bank had be- come careless in serving Questor's banking re- quirements and that the loan officers assigned to Questor's account were being changed fre- quently, causing her great inconvenience. She was frustrated with having to explain Questor's needs and business every time there was a change in loan officers. Recently, Questor's line of credit agreement with its present bank had expired, and the bank seemed to be delaying action on the firm's request for a much needed moderate in- crease in the line. Logan informed Felix Fernandez that she would need as much as $1,000,000 during the next 12 months. She wanted part of the credit in 90-day notes and the rest on an intermediate- term basis. "Our sales volume continues to grow and our profits are good," she commented to Fernandez "We have been in business for 15 years and we have been profitable every year. Our equipment is in good condition, and we will not have to expand our plant for at least three more years. Logan offered as references her cur- rent mortgage lender, Fairview Savings and Loan Association, and several of her major suppliers. Later, Felix Fernandez made credit checks with these suppliers, who reported a pattern of generally prompt payment. They stated that Questor was usually prompt in meeting credit obligations. The highest credit reported by a sin- days actually could be collected. He was also wor- ried because Questor continued currently to sell to customers with receivables older than 60 days, and he wondered if he should assign any value at all to the receivables of such customers. Finally, he decided to appraise accounts receivable that were on time at only the cost of production (cost of goods), about 70 percent of their book value. gle supplier was $150,000. However, Questor was not always able to take trade discounts, which all suppliers offered on a 2/10et 30 basis. Fairview Savings and Loan reported a balance of $275,000 owed on an original $500,000 loan. Payments of $25,000 per quarter were being made promptly. The loan from Fairview Savings was secured by land and buildings owned by Questor. Felix Fernandez had not yet checked with Questor's present bank to discuss its experience with Questor. Golden West Bank was very anx- ious to establish a complete business relationship with Questor, but Fernandez was uncertain how to approach Questor's present bank and how to interpret what officers from that bank might tell him. After Fernandez conducted his initial investiga- tion, he called Catherine Logan to set up a meet- ing at the bank. At the meeting, Logan made a specific request for a $1,000,000 loan. In addition to the financial statements she provided earlier (Exhibits ! through 3), she provided a personal financial statement (Exhibit 4). Fernandez had also received a ratio analysis on Questor from Golden West Bank's credit analysis department (Exhibit 5). Logan indicated that Questor's inventory was composed of the following: Raw material 40% 20% Finished goods 40% Fernandez was advised by another loan officer that the fractions of values that could be recor- ered on short notice for inventories such as Questor's were about 50, 0, and 50 percent, re- spectively, for raw, in-process, and finished inven- tories. On Questor's accounts receivable, Fernandez wondered if those outstanding for more than 60 ASSIGNMENTS I. Amount of loan: As a check against the $1,000,000 loan amount requested by Logan, deter- mine how much Questor actually needs to borrow. (Estimate Questor's balance sheet for December 31, 1992, based on continued growth and industry average ratios for an average collection period and inventory turnover. Estimate December 1992 ac- counts payable based on taking a substantially higher amount of trade discounts than are presently taken.) 2. Purpose: Determine the purpose for the loan. 3. Term for each type of borrowing: Determine how much of the total amount loaned will be loaned short term and how much long term (or revolving). 4. Collateral value and borrowing base: Assuming that the bank secures the loan with Questor's ac- counts receivable and inventories, determine how much value can be recovered if Questor fails to pay. (Alternatively, determine how much Golden West Bank can safely lend against Questor's accounts re- ceivable and inventories.) 5. Repayment terms: Establish a repayment sched- ule for each type of borrowing. 6. Repayment source: Identify the cash flow sources of repayment for each type of borrowing. 7. Rate: Establish the interest rate on each type of borrowing. (Specify in terms of points above the prime rate.) 8. Guarantees, covenants, and other restrictions: Specify the covenants to be placed on Questor. De- scribe the guarantees or other restrictions. Work in processStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started