Answered step by step

Verified Expert Solution

Question

1 Approved Answer

what gain or loss is to be recognized in 2025 profit or loss shall be 4. On July 1,2023, GOLDFINCH Company issued its bonds payable

what gain or loss is to be recognized in 2025 profit or loss shall be

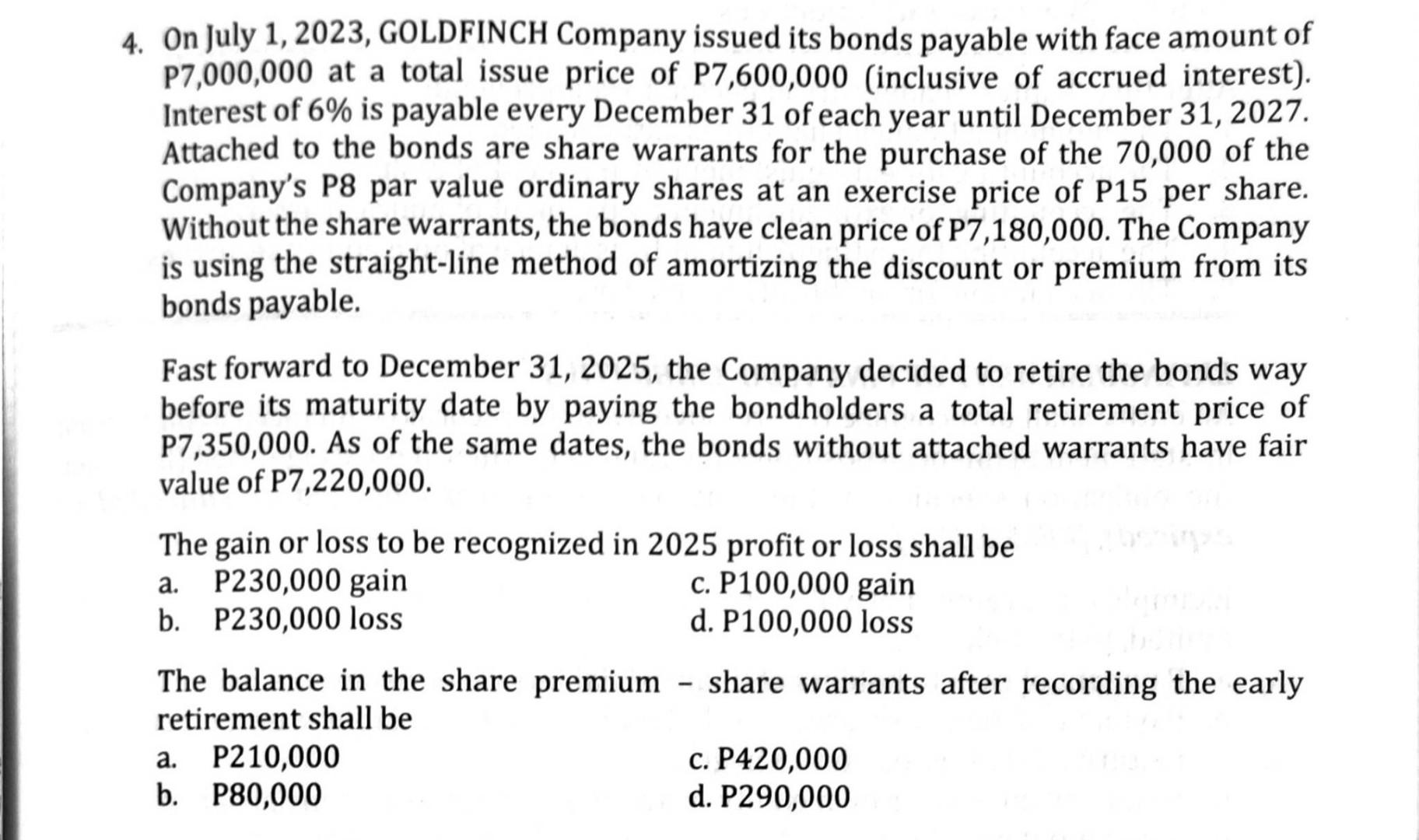

4. On July 1,2023, GOLDFINCH Company issued its bonds payable with face amount of P7,000,000 at a total issue price of P7,600,000 (inclusive of accrued interest). Interest of 6% is payable every December 31 of each year until December 31, 2027. Attached to the bonds are share warrants for the purchase of the 70,000 of the Company's P8 par value ordinary shares at an exercise price of P15 per share. Without the share warrants, the bonds have clean price of P7,180,000. The Company is using the straight-line method of amortizing the discount or premium from its bonds payable. Fast forward to December 31, 2025, the Company decided to retire the bonds way before its maturity date by paying the bondholders a total retirement price of P7,350,000. As of the same dates, the bonds without attached warrants have fair value of P7,220,000. The gain or loss to be recognized in 2025 profit or loss shall be a. P230,000 gain c. P100,000 gain b. P230,000 loss d. P100,000 loss The balance in the share premium - share warrants after recording the early retirement shall be a. P210,000 c. P420,000 b. P80,000 d. P290,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started