Question

What happened to BlackBerry: Zombie stock or comeback king? What happened to Blackberry? The company, once the most valuable in Canada, has effectively been a

What happened to BlackBerry: Zombie stock or comeback king?

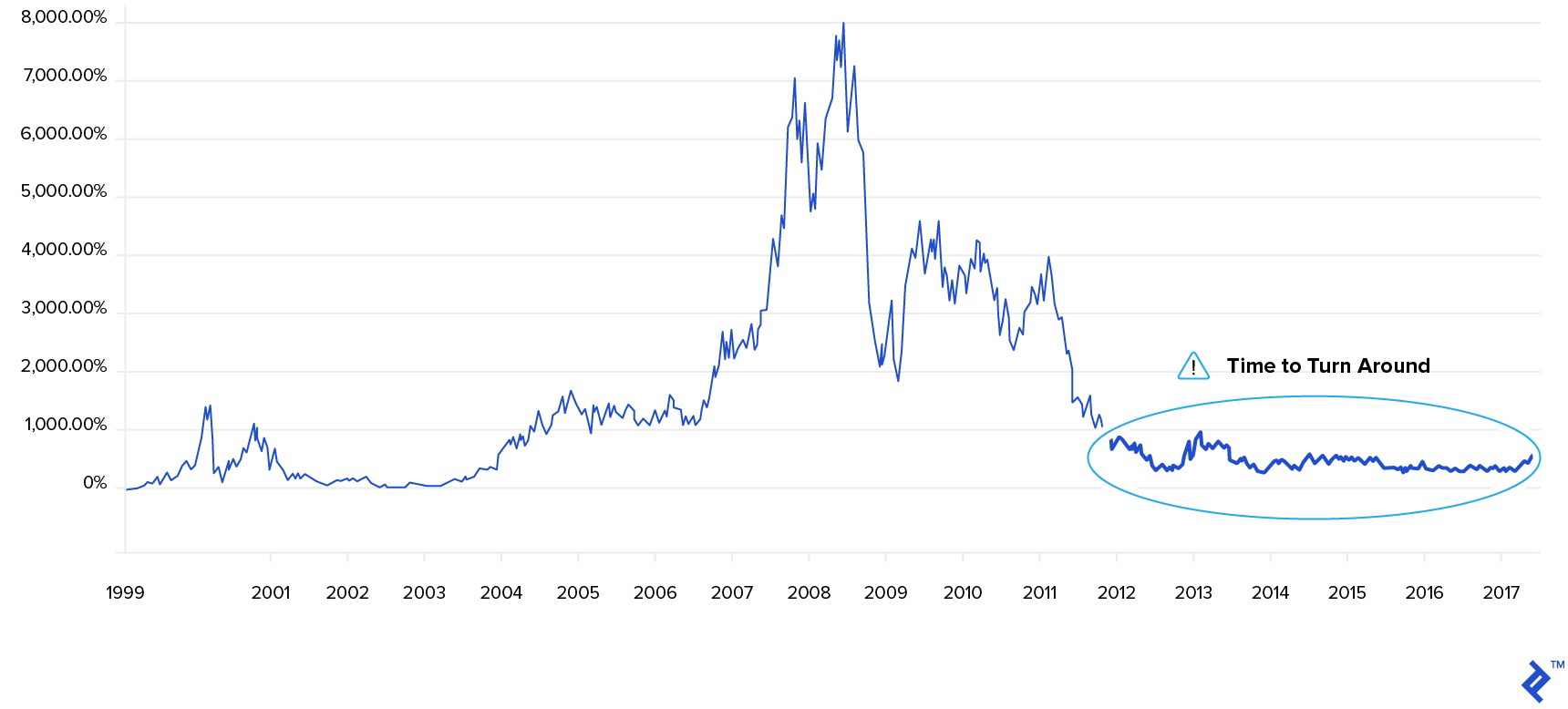

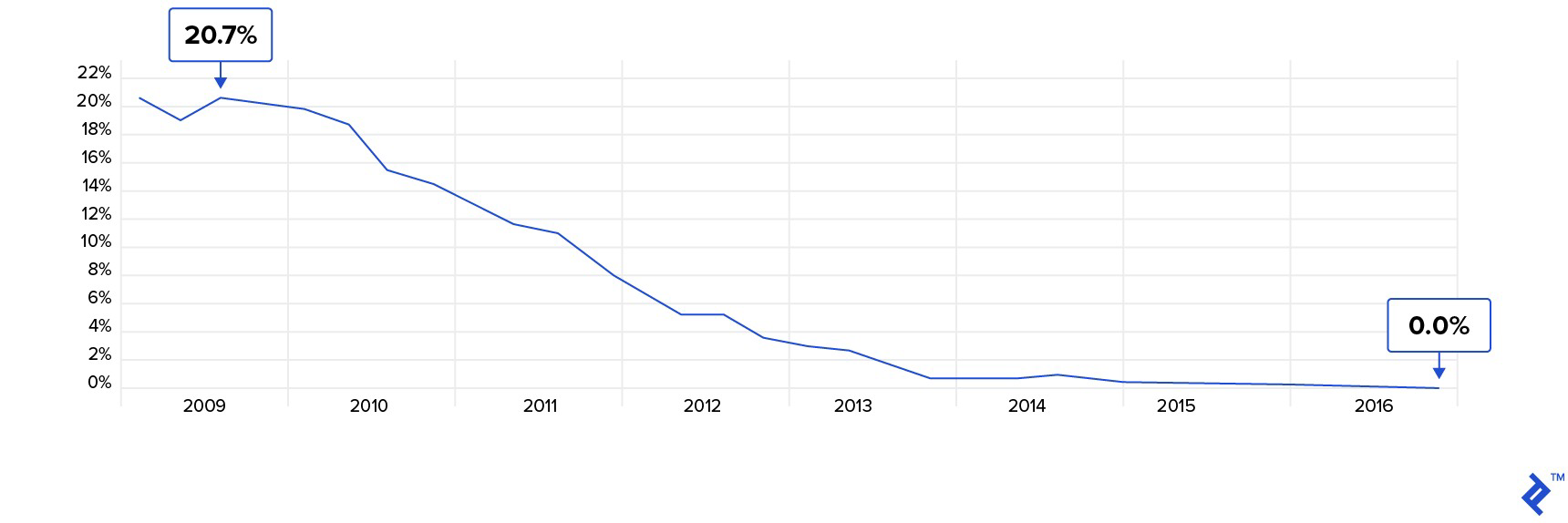

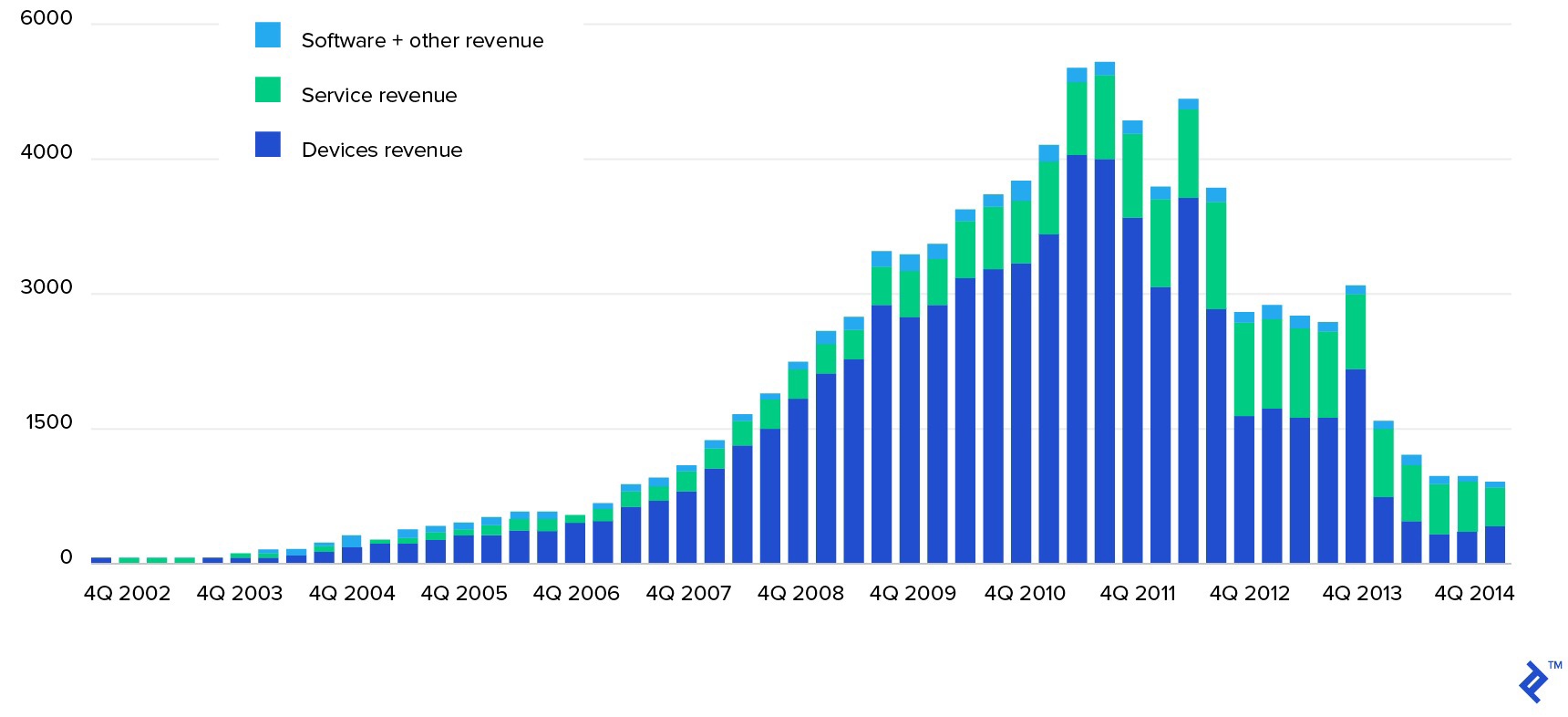

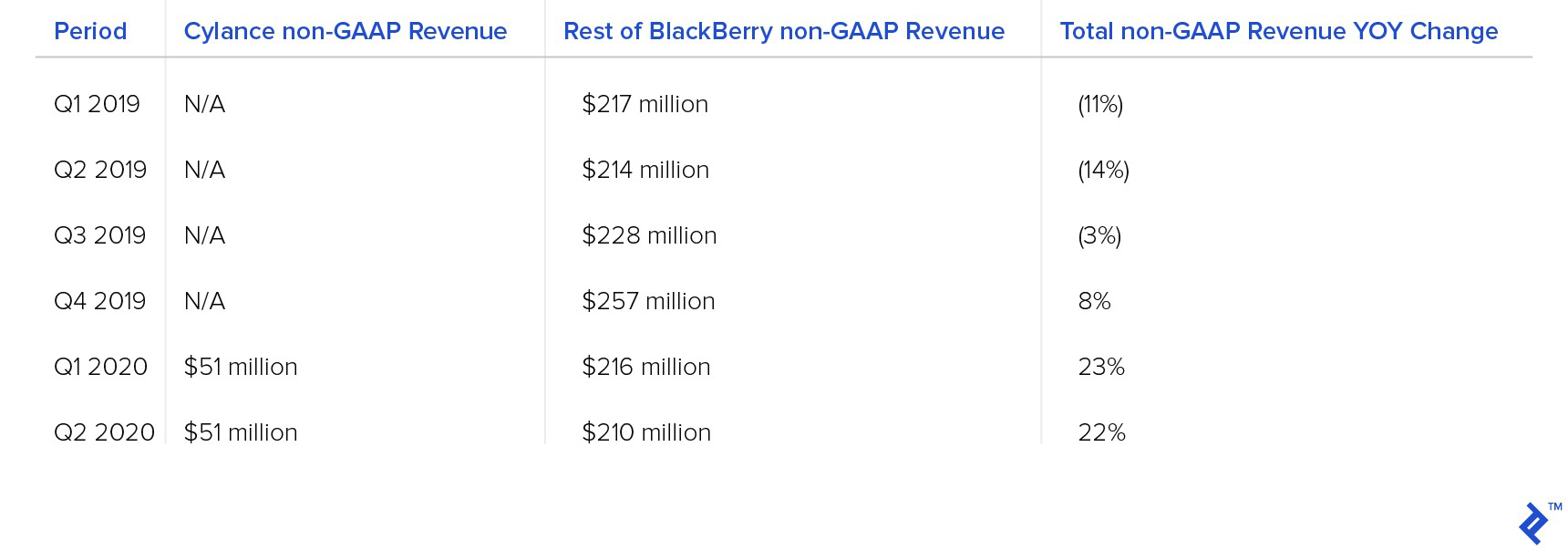

What happened to Blackberry? The company, once the most valuable in Canada, has effectively been a zombie stock for a while. Is the picture painted by the stock a fair one, particularly for a company whose revenues are up 20% YoY? Much has been written over the years about what happened to BlackBerry. The company, once briefly the most valuable company in Canada, has effectively been struggling for a long time, with its stock hovering flat around the $10 mark, effectively a zombie stock. The Q2 2019 earnings release has done little to help: the company missed estimates, sparking a new sell-off and another wave of articles. Is the picture painted by the stock a fair one, particularly for a company whose revenues are up 20% YoY? It belies all the changes that have taken place in the company in the last 10 years, including hiring a new CEO, its pivot towards reinventing itself as a software company, and its efforts to become "the world's largest and most trusted AI-cybersecurity company" and acquiring Cylance, an innovative and successful company in the booming cybersecurity space.

The recent history of the company makes for an interesting case study on how a hardware company can stay alive and become a more modern software company and on how a company that was presumed to be a dead man walking can turn (or perhaps, fail to turn) its fortunes. It is also, in some ways, a cautionary tale about the importance of perception.

BlackBerry Stock Price Evolution

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started