WHAT HAPPENS TO ROE FOR FIRM U AND FIRM L IF EBIT FALLS TO $2,000? WHAT DOES THIS IMPLY ABOUT THE IMPACT OF LEVERAGE ON RISK AND RETURN?

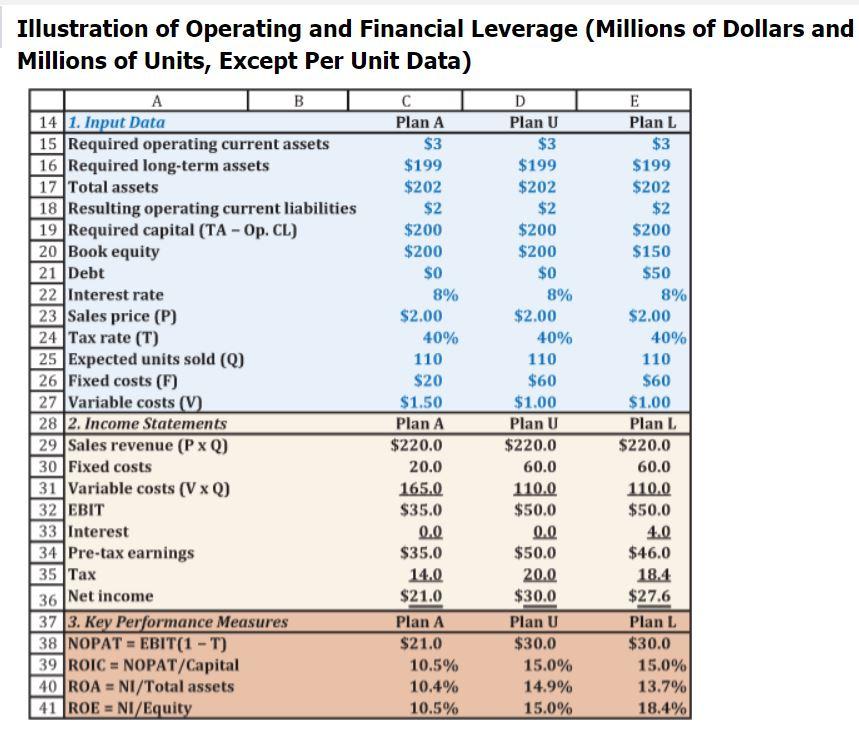

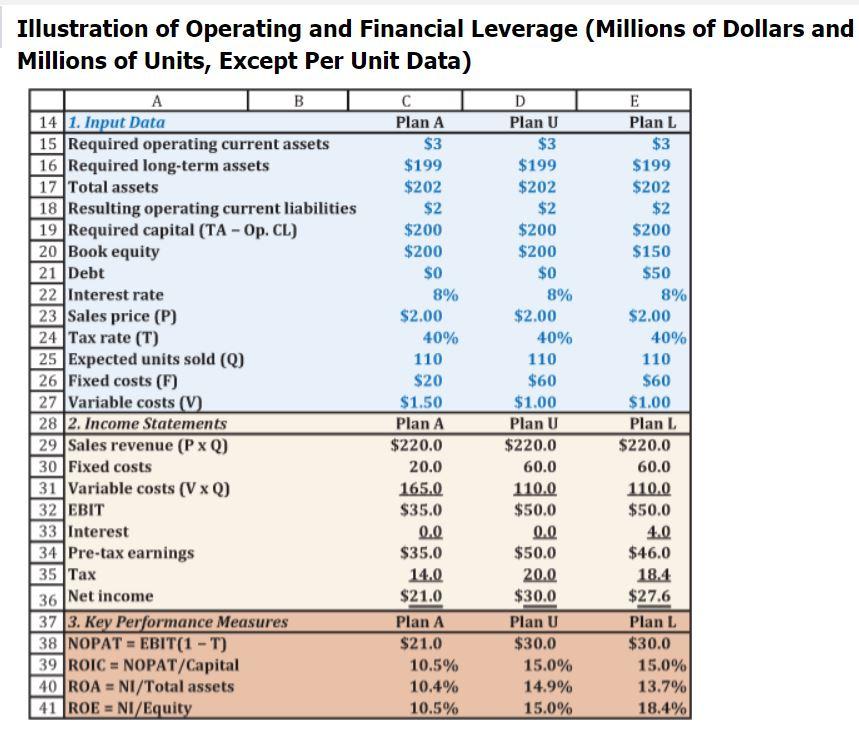

$3 $2 $2 $2.00 Illustration of Operating and Financial Leverage (Millions of Dollars and Millions of Units, Except Per Unit Data) A B C D E 14 1. Input Data Plan A Plan U Plan L 15 Required operating current assets $3 $3 16 Required long-term assets $199 $199 $199 17 Total assets $202 $202 $202 18 Resulting operating current liabilities $2 19 Required capital (TA - Op. CL) $200 $200 $200 20 Book equity $200 $200 $150 21 Debt $0 $0 $50 22 Interest rate 8% 8% 8% 23 Sales price (P) $2.00 $2.00 24 Tax rate (T) 40% 40% 40% 25 Expected units sold (Q) 110 110 110 26 Fixed costs (F) $20 $60 $60 27 Variable costs (V) $1.50 $1.00 $1.00 28 2. Income Statements Plan A Plan U Plan L 29 Sales revenue (PxQ) $220.0 $220.0 $220.0 30 Fixed costs 20.0 60.0 60.0 31 Variable costs (V xQ) 165.0 110.0 110.0 32 EBIT $35.0 $50.0 $50.0 33 Interest 0.0 0.0 4.0 34 Pre-tax earnings $35.0 $50.0 $46.0 35 Tax 20.0 18.4 36 Net income $21.0 $30.0 $27.6 37 3. Key Performance Measures Plan A Plan U Plan L 38 NOPAT = EBIT(1 - T) $21.0 $30.0 $30.0 39 ROIC = NOPAT/Capital 10.5% 15.0% 15.0% 40 ROA = NI/Total assets 10.4% 14.9% 13.7% 41 ROE = NI/Equity 10.5% 15.0% 18.4% 14.0 $3 $2 $2 $2.00 Illustration of Operating and Financial Leverage (Millions of Dollars and Millions of Units, Except Per Unit Data) A B C D E 14 1. Input Data Plan A Plan U Plan L 15 Required operating current assets $3 $3 16 Required long-term assets $199 $199 $199 17 Total assets $202 $202 $202 18 Resulting operating current liabilities $2 19 Required capital (TA - Op. CL) $200 $200 $200 20 Book equity $200 $200 $150 21 Debt $0 $0 $50 22 Interest rate 8% 8% 8% 23 Sales price (P) $2.00 $2.00 24 Tax rate (T) 40% 40% 40% 25 Expected units sold (Q) 110 110 110 26 Fixed costs (F) $20 $60 $60 27 Variable costs (V) $1.50 $1.00 $1.00 28 2. Income Statements Plan A Plan U Plan L 29 Sales revenue (PxQ) $220.0 $220.0 $220.0 30 Fixed costs 20.0 60.0 60.0 31 Variable costs (V xQ) 165.0 110.0 110.0 32 EBIT $35.0 $50.0 $50.0 33 Interest 0.0 0.0 4.0 34 Pre-tax earnings $35.0 $50.0 $46.0 35 Tax 20.0 18.4 36 Net income $21.0 $30.0 $27.6 37 3. Key Performance Measures Plan A Plan U Plan L 38 NOPAT = EBIT(1 - T) $21.0 $30.0 $30.0 39 ROIC = NOPAT/Capital 10.5% 15.0% 15.0% 40 ROA = NI/Total assets 10.4% 14.9% 13.7% 41 ROE = NI/Equity 10.5% 15.0% 18.4% 14.0