What has the Snack Shop done to try to contend with its new competitor? What else can they do? Should they make the decision to

What has the Snack Shop done to try to contend with its new competitor? What else can they do? Should they make the decision to accept FoodFunds? Should they try to compete for some other way? Should they consider a new coffee vendor? What recommendations would you make to maintain/improve profitability and strategically compete against the new rival (and existing competitors)? What recommendations would you make to improve operations in the areas of staffing, marketing, inventory management, facilities management, internal controls, and accounting? In the broadest sense, is running the Snack Shop a worthwhile endeavor for the BSC? What other information/data might be helpful from the Snack Shop in order to facilitate your recommendations?

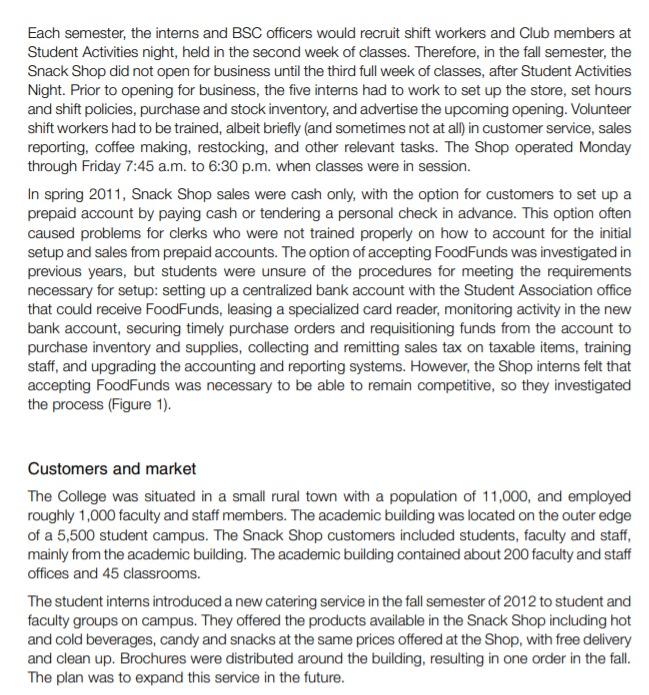

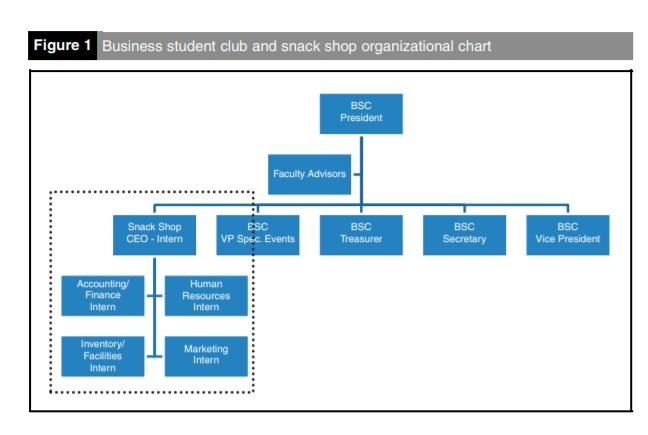

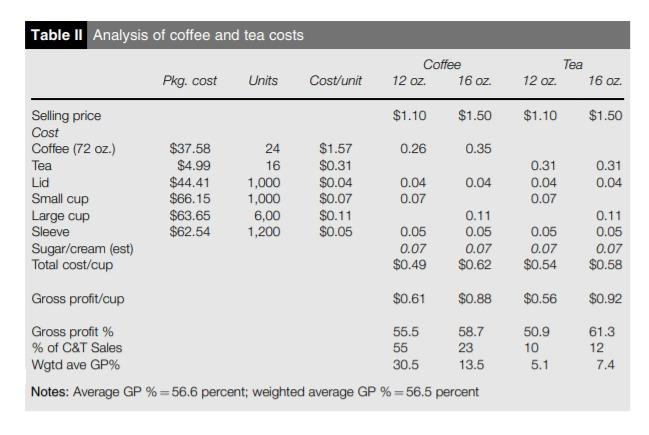

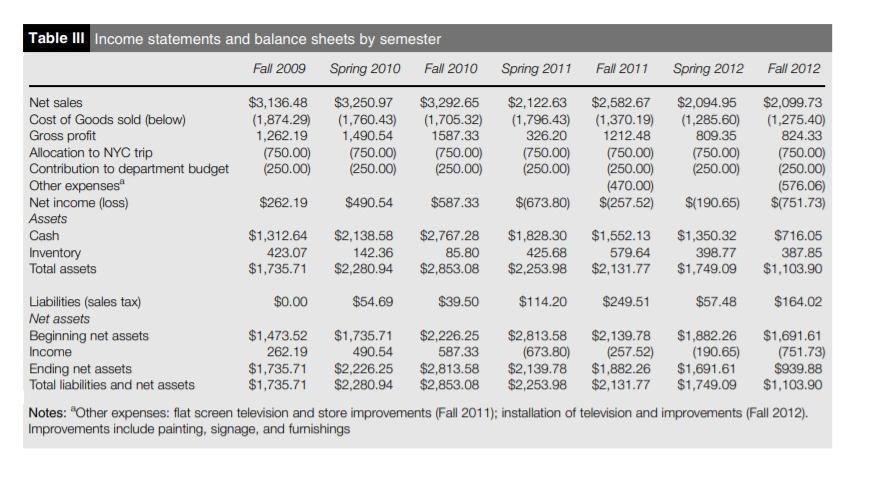

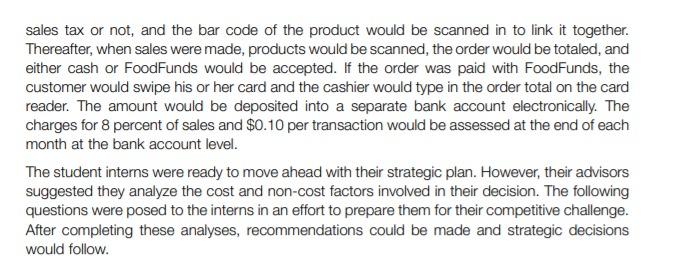

Overview The Snack Shop, a student-run convenience store was located in the academic building housing the Business Department of a small US College campus. The store ran under the umbrella of a student organization - The Business Student Club (BSC). The BSC was chartered and recognized on campus by the Student Association for more than 40 years, and received limited funding for its activities. The Snack Shop was a major continuous source of income for the BSC for over 30 years. The Snack Shop was managed by a set of five student interns per semester, under the advisement of faculty members from the Business Department. The internship titles were CEO, Inventory/Facilities, Finance, Human Resources, and Marketing. The store was staffed by student volunteers, most of whom were members of the BSC. In order to maintain its status as an internship site, the Shop had to be run as an independent business. The Shop was required to make a contribution each semester to the Business Department budget to simulate rent and overhead costs. Each semester the Snack Shop budget included a $750 allocation to the BSC to help offset the cost of its annual educational trip to New York City, with any remaining profit going toward improvements in the facilities. Any shortfall would come from accumulated net assets. In addition to dealing with the general challenges of running a business, the interns were expected to continuously improve and evolve the Shop so that it would be sustainable as a learning lab for the Business Department The Snack Shop was located on the third floor of the building housing the Business Department and several other academic major departments. For at least 30 years, the Shop's only competitors in the building were vending machines. These machines were located in lounge areas on the first and third floors until 1998. In 1998, the third floor lounge was converted into classroom space, leaving only the machines on the first floor. Over the years, the offerings from vending machines varied, including paper cup coffee and hot drinks, canned and bottled beverages, candy, snacks, and even ice cream treats. The machines took cash, until the mid-2000s, when the machines were retooled to also accept student debit cards called FoodFunds. The College offered this cash-free option that allowed students, faculty and staff to add funds to their College ID card. FoodFunds were also accepted in many restaurants and stores in the local community for student convenience. Local vendors hoped to realize an increase in sales when they formed an agreement with the College to accept FoodFunds. In spring 2011, the College signed an agreement with an internationally known coffee company and opened a store and coffee shop on the first floor of the academic building that housed the Snack Shop. This College-run and staffed store started selling the name brand coffee as well as other food, snacks and convenience items Monday through Friday 9:00 to 5:00. FoodFunds, cash, and credit card were accepted. The layout of the store included several tables and chairs and a large flat screen television for customers of this new location. The new store was fully operational and open for business at the start of the spring 2011 semester. Each semester, the interns and BSC officers would recruit shift workers and Club members at Student Activities night, held in the second week of classes. Therefore, in the fall semester, the Snack Shop did not open for business until the third full week of classes, after Student Activities Night. Prior to opening for business, the five interns had to work to set up the store, set hours and shift policies, purchase and stock inventory, and advertise the upcoming opening. Volunteer shift workers had to be trained, albeit briefly (and sometimes not at all) in customer service, sales reporting, coffee making, restocking, and other relevant tasks. The Shop operated Monday through Friday 7:45 a.m. to 6:30 p.m. when classes were in session. In spring 2011, Snack Shop sales were cash only, with the option for customers to set up a prepaid account by paying cash or tendering a personal check in advance. This option often caused problems for clerks who were not trained properly on how to account for the initial setup and sales from prepaid accounts. The option of accepting FoodFunds was investigated in previous years, but students were unsure of the procedures for meeting the requirements necessary for setup: setting up a centralized bank account with the Student Association office that could receive FoodFunds, leasing a specialized card reader, monitoring activity in the new bank account, securing timely purchase orders and requisitioning funds from the account to purchase inventory and supplies, collecting and remitting sales tax on taxable items, training staff, and upgrading the accounting and reporting systems. However, the Shop interns felt that accepting FoodFunds was necessary to be able to remain competitive, so they investigated the process (Figure 1). Customers and market The College was situated in a small rural town with a population of 11,000, and employed roughly 1,000 faculty and staff members. The academic building was located on the outer edge of a 5,500 student campus. The Snack Shop customers included students, faculty and staff, mainly from the academic building. The academic building contained about 200 faculty and staff offices and 45 classrooms. The student interns introduced a new catering service in the fall semester of 2012 to student and faculty groups on campus. They offered the products available in the Snack Shop including hot and cold beverages, candy and snacks at the same prices offered at the Shop, with free delivery and clean up. Brochures were distributed around the building, resulting in one order in the fall. The plan was to expand this service in the future. Figure 1 Business student club and snack shop organizational chart BSC President Faculty Advisors Snack Shop CEO - Intern ESC VP Spec. Events BSC Treasurer BSC Secretary BSC Vice President Accounting Finance Intern Human Resources Intern Inventory Facilities Intern Marketing Intern Products The Snack Shop offered a limited range of snacks, beverages and convenience items for its customers. Table I shows the major product categories, average selling prices, percent of sales, and the gross profit percentages for each product category. The four major categories consisted of coffee and tea (cost analysis in Table II), bottled and canned beverages (water, soda, energy and sports drinks, etc.), snacks and candy (chips, cookies, granola bars, chocolate bars, gum, etc.), and other (donuts, bagels, yogurt, fruit, ramen, macaroni and cheese, etc.). Most inventory items were purchased at local grocery or bulk food stores (using a sales tax- exempt certificate) and then resold, collecting sales tax on taxable items. Due to health code regulations, the Shop could not cook or prepare food on the premises, nor could they sell items that had to be maintained at a certain temperature. Refrigerated and frozen items were allowed. School supplies could not be sold due to an exclusive contract granted to the College bookstore and its affiliates. Since coffee and tea sales were the only combined cost products sold, an analysis of their costs is included. Competitors While several College-run competitors on campus offered convenience food and beverages, the most direct competitor was the international chain located in the same building as the Snack Table Product categories, sales mix, and gross profit percentages Average selling Percent of Average gross Category price total sales profit percent Coffee and tea $1.24 17 57 Bottled and canned beverages $1.50 48 55 Snacks and candy $1.00 29 38 Other $1.25 6 29 Total 100.0 Note: The gross profit percentages do not factor in product expiration or spoilage, incidental supplies, unrecorded sales, or theft Table II Analysis of coffee and tea costs Coffee 12 oz. 16 oz. Tea Pkg. cost Units Cost/unit 12 oz. 16 oz. $1.10 $1.50 $1.10 $1.50 0.26 0.35 0.04 Selling price Cost Coffee (72 oz.) Tea Lid Small cup Large cup Sleeve Sugar/cream (est) Total cost/cup $37.58 $4.99 $44.41 $66.15 $63.65 $62.54 24 16 1,000 1,000 6,00 1,200 $1.57 $0.31 $0.04 $0.07 $0.11 $0.05 0.31 0.04 0.04 0.07 0.31 0.04 0.07 0.05 0.07 $0.49 0.11 0.05 0.07 $0.62 0.05 0.07 $0.54 0.11 0.05 0.07 $0.58 $0.56 $0.92 Gross profit/cup $0.61 $0.88 Gross profit % 55.5 58.7 % of C&T Sales 55 23 Wgtd ave GP% 30.5 13.5 Notes: Average GP %= 56.6 percent; weighted average GP %= 56.5 percent 50.9 10 5.1 61.3 12 7.4 Shop. The coffee and fresh baked goods of the chains enjoyed brand recognition and marketing investment. The College-run competitors all accepted cash, FoodFunds, and credit cards. Even though the competitors' prices were higher than the Snack Shop's, the convenience of being able to use cards (in most cases funded by parents) rather than cash could be seen as a competitive advantage. Off-campus competitors included local grocery stores and a family owned full service convenience store within walking distance of the College. These competitors were licensed to sell alcoholic beverages in addition to food and convenience items. The Snack Shop Marketing interns were responsible for monitoring the competition and adjusting selling prices and product offerings at the Shop. The interns were also charged with designing advertising and promotional materials and developing sales promotions such as combination deals, punch cards, and other strategies to increase sales. Market research conducted by these interns revealed that FoodFunds was a major reason that students did not frequent the Shop, even though they would have liked to support a student-run business rather than a College-run store. Surveys also indicated a demand for catering for group meetings, and the Shop responded accordingly. Facilities The Snack Shop was located in a 15' by 20 interior room. The room's only window was in the door, and large black board covered most of one of the walls. A working sink was installed by the College so that coffee could be made and pots could be cleaned. The Shop had an older desktop PC with internet access and an outdated, nonworking electronic cash register. Sales were recorded on spreadsheets and the cash register was used as a cash box only. A locking safe was tucked under one of the tables in the back corner of the room. The Finance intern held the key to the safe. A professional grade coffee maker and serving carafes were provided by the coffee vendor, a local alumni-run company that formerly held the coffee vending contracts on campus. If the Shop ever decided to use a different coffee vendor or purchase coffee and supplies independently, coffee makers and carafes would have to be purchased at an approximate cost of $200.00. A small glass-front beverage refrigerator, snack shelves, a closed storage cabinet and utility tables also filled the space. One table with four chairs was provided for customers. A large flat screen television with cable access hung above the coffee area. When closed, the door to the Snack Shop was locked, with keys held by the interns, and one kept in the Business Department office for emergency purposes. Operations and Internal Controls Each day the sales spreadsheet was totaled and the cash drawer was counted (leaving $75.00 starting cash in the drawer). Sales per the spreadsheet were compared to actual cash receipts and cash over or short was recorded. Overages or shortages were investigated. In general, major shortages could be traced to emergency inventory purchases using register cash, and major overages could be traced to prepaid account deposits not included in the sales spreadsheet. No other major overages or shortages were noted. At the end of each day, the person closing the shop prepared the daily sales, prepaid activity, and cash over/short report and placed the cash receipts in the safe in the Shop. On Monday morning the Finance intern deposited the previous week's receipts (the on-campus office where their account was held was closed before the Snack Shop closed on Friday). The average number of transactions (customers) per day was 17, with an average purchase of $2.00; therefore sales averaged $34 daily and $170 weekly. The CEO and Inventory/Facilities interns were responsible for purchases of inventory and supplies. They purchased most items from local discount chains and grocery stores, purchasing sale items whenever possible. In the past, interns charged purchases on their personal credit cards and submitted receipts for reimbursement to the Finance intern. Due to tighter internal controls on campus, the College had begun requiring all purchases be procured by purchase order from the centralized Student Association bank account, with payment made directly to vendors. Coffee, tea, and supplies were procured from a local supplier that granted them a 15 percent discount because of their student club status. They also supplied the Shop with a professional grade coffee maker, serving carafes, counter racks and organizers, and a sign advertising the coffee brand name. Inventory costs were maintained at current cost - with costs being updated each time a new purchase was made. A periodic inventory method was followed. Cost of sales were not calculated and recorded until the end of each semester when physical inventory on hand was counted and costs were assigned. Costs of incidental supplies (such as napkins, plastic ware), spoilage, expiration, unrecorded sales and theft were charged to cost of goods sold at semester end. The Finance intern prepared end-of-semester financial statements (see Table II). Strategic challenge The BSC was at an important juncture of its history. Due to the opening of the well-known international coffee chain in its building, the Snack Shop must compete in order to survive. This new competitor had a negative impact on the Snack Shop's spring 2011 sales and profits, and would continue to do so unless the Shop rose to this strategic challenge. One strategic move considered by the Shop was accepting FoodFunds. Based on market research conducted by students in the Department, FoodFunds would significantly impact a student's choice to shop at the Snack Shop and support a student organization rather than the College-run store. With the acceptance of FoodFunds, the Shop hoped to triple customer traffic. The number of daily transactions was estimated to increase from 17 to 50. The estimated dollar value of each transaction would remain at $2.00. The average number of full business days per semester was estimated to be 60 for analysis purposes. The cost of accepting FoodFunds was a combination of fixed and variable costs. The card scanner/reader cost $30.00 per month to lease. Each transaction using FoodFunds would cost $0.10. In addition, there was an 8 percent fee for each sale on FoodFunds (8% x sales price). The $30.00 per month charge on the reader would have to be paid even when the store was closed for winter and summer breaks in order to keep the account active. The introduction of FoodFunds into the Snack Shop would require the students to purchase an electronic cash register with barcode scanning capability. The cost of a suitable register with a service contract was $650. Every product would be entered into the register's software, capturing the beginning inventory quantity, the selling price per unit, whether it was subject to Table III Income statements and balance sheets by semester Fall 2009 Spring 2010 Fall 2010 Spring 2011 Fall 2011 Spring 2012 Fall 2012 Net sales $3,136.48 $3,250.97 $3,292.65 $2,122.63 $2,582.67 $2,094.95 $2,099.73 Cost of Goods sold (below) (1,874.29) (1,760.43) (1.705.32) (1.796.43) (1,370.19) (1,285.60) (1,275.40) Gross profit 1,262.19 1,490.54 1587.33 326.20 1212.48 809.35 824.33 Allocation to NYC trip (750.00) (750.00) (750.00) (750.00) (750.00) (750.00) (750.00) Contribution to department budget (250.00) (250.00) (250.00) (250.00) (250.00) (250.00) (250.00) Other expenses (470.00) (576.06) Net income (loss) $262.19 $490.54 $587.33 $(673.80) $(257.52) $(190.65) $(751.73) Assets Cash $1,312.64 $2,138.58 $2,767.28 $1,828.30 $1,552.13 $1,350.32 $716.05 Inventory 423.07 142.36 85.80 425.68 579.64 398.77 387.85 Total assets $1,735.71 $2,280.94 $2,853.08 $2,253.98 $2,131.77 $1,749.09 $1,103.90 Liabilities (sales tax) $0.00 $54.69 $39.50 $114.20 $249.51 $57.48 $164.02 Net assets Beginning net assets $1,473.52 $1,735.71 $2,226.25 $2,813.58 $2,139.78 $1,882.26 $1,691.61 Income 262.19 490.54 587.33 (673.80) (257.52) (190.65) (751.73) Ending net assets $1,735.71 $2,226.25 $2,813.58 $2,139.78 $1,882.26 $1,691.61 $939.88 Total liabilities and net assets $1,735.71 $2,280.94 $2,853.08 $2,253.98 $2,131.77 $1,749.09 $1,103.90 Notes: "Other expenses: flat screen television and store improvements (Fall 2011); installation of television and improvements (Fall 2012). Improvements include painting, signage, and furnishings sales tax or not, and the bar code of the product would be scanned in to link it together. Thereafter, when sales were made, products would be scanned, the order would be totaled, and either cash or FoodFunds would be accepted. If the order was paid with FoodFunds, the customer would swipe his or her card and the cashier would type in the order total on the card reader. The amount would be deposited into a separate bank account electronically. The charges for 8 percent of sales and $0.10 per transaction would be assessed at the end of each month at the bank account level. The student interns were ready to move ahead with their strategic plan. However, their advisors suggested they analyze the cost and non-cost factors involved in their decision. The following questions were posed to the interns in an effort to prepare them for their competitive challenge. After completing these analyses, recommendations could be made and strategic decisions would follow. Overview The Snack Shop, a student-run convenience store was located in the academic building housing the Business Department of a small US College campus. The store ran under the umbrella of a student organization - The Business Student Club (BSC). The BSC was chartered and recognized on campus by the Student Association for more than 40 years, and received limited funding for its activities. The Snack Shop was a major continuous source of income for the BSC for over 30 years. The Snack Shop was managed by a set of five student interns per semester, under the advisement of faculty members from the Business Department. The internship titles were CEO, Inventory/Facilities, Finance, Human Resources, and Marketing. The store was staffed by student volunteers, most of whom were members of the BSC. In order to maintain its status as an internship site, the Shop had to be run as an independent business. The Shop was required to make a contribution each semester to the Business Department budget to simulate rent and overhead costs. Each semester the Snack Shop budget included a $750 allocation to the BSC to help offset the cost of its annual educational trip to New York City, with any remaining profit going toward improvements in the facilities. Any shortfall would come from accumulated net assets. In addition to dealing with the general challenges of running a business, the interns were expected to continuously improve and evolve the Shop so that it would be sustainable as a learning lab for the Business Department The Snack Shop was located on the third floor of the building housing the Business Department and several other academic major departments. For at least 30 years, the Shop's only competitors in the building were vending machines. These machines were located in lounge areas on the first and third floors until 1998. In 1998, the third floor lounge was converted into classroom space, leaving only the machines on the first floor. Over the years, the offerings from vending machines varied, including paper cup coffee and hot drinks, canned and bottled beverages, candy, snacks, and even ice cream treats. The machines took cash, until the mid-2000s, when the machines were retooled to also accept student debit cards called FoodFunds. The College offered this cash-free option that allowed students, faculty and staff to add funds to their College ID card. FoodFunds were also accepted in many restaurants and stores in the local community for student convenience. Local vendors hoped to realize an increase in sales when they formed an agreement with the College to accept FoodFunds. In spring 2011, the College signed an agreement with an internationally known coffee company and opened a store and coffee shop on the first floor of the academic building that housed the Snack Shop. This College-run and staffed store started selling the name brand coffee as well as other food, snacks and convenience items Monday through Friday 9:00 to 5:00. FoodFunds, cash, and credit card were accepted. The layout of the store included several tables and chairs and a large flat screen television for customers of this new location. The new store was fully operational and open for business at the start of the spring 2011 semester. Each semester, the interns and BSC officers would recruit shift workers and Club members at Student Activities night, held in the second week of classes. Therefore, in the fall semester, the Snack Shop did not open for business until the third full week of classes, after Student Activities Night. Prior to opening for business, the five interns had to work to set up the store, set hours and shift policies, purchase and stock inventory, and advertise the upcoming opening. Volunteer shift workers had to be trained, albeit briefly (and sometimes not at all) in customer service, sales reporting, coffee making, restocking, and other relevant tasks. The Shop operated Monday through Friday 7:45 a.m. to 6:30 p.m. when classes were in session. In spring 2011, Snack Shop sales were cash only, with the option for customers to set up a prepaid account by paying cash or tendering a personal check in advance. This option often caused problems for clerks who were not trained properly on how to account for the initial setup and sales from prepaid accounts. The option of accepting FoodFunds was investigated in previous years, but students were unsure of the procedures for meeting the requirements necessary for setup: setting up a centralized bank account with the Student Association office that could receive FoodFunds, leasing a specialized card reader, monitoring activity in the new bank account, securing timely purchase orders and requisitioning funds from the account to purchase inventory and supplies, collecting and remitting sales tax on taxable items, training staff, and upgrading the accounting and reporting systems. However, the Shop interns felt that accepting FoodFunds was necessary to be able to remain competitive, so they investigated the process (Figure 1). Customers and market The College was situated in a small rural town with a population of 11,000, and employed roughly 1,000 faculty and staff members. The academic building was located on the outer edge of a 5,500 student campus. The Snack Shop customers included students, faculty and staff, mainly from the academic building. The academic building contained about 200 faculty and staff offices and 45 classrooms. The student interns introduced a new catering service in the fall semester of 2012 to student and faculty groups on campus. They offered the products available in the Snack Shop including hot and cold beverages, candy and snacks at the same prices offered at the Shop, with free delivery and clean up. Brochures were distributed around the building, resulting in one order in the fall. The plan was to expand this service in the future. Figure 1 Business student club and snack shop organizational chart BSC President Faculty Advisors Snack Shop CEO - Intern ESC VP Spec. Events BSC Treasurer BSC Secretary BSC Vice President Accounting Finance Intern Human Resources Intern Inventory Facilities Intern Marketing Intern Products The Snack Shop offered a limited range of snacks, beverages and convenience items for its customers. Table I shows the major product categories, average selling prices, percent of sales, and the gross profit percentages for each product category. The four major categories consisted of coffee and tea (cost analysis in Table II), bottled and canned beverages (water, soda, energy and sports drinks, etc.), snacks and candy (chips, cookies, granola bars, chocolate bars, gum, etc.), and other (donuts, bagels, yogurt, fruit, ramen, macaroni and cheese, etc.). Most inventory items were purchased at local grocery or bulk food stores (using a sales tax- exempt certificate) and then resold, collecting sales tax on taxable items. Due to health code regulations, the Shop could not cook or prepare food on the premises, nor could they sell items that had to be maintained at a certain temperature. Refrigerated and frozen items were allowed. School supplies could not be sold due to an exclusive contract granted to the College bookstore and its affiliates. Since coffee and tea sales were the only combined cost products sold, an analysis of their costs is included. Competitors While several College-run competitors on campus offered convenience food and beverages, the most direct competitor was the international chain located in the same building as the Snack Table Product categories, sales mix, and gross profit percentages Average selling Percent of Average gross Category price total sales profit percent Coffee and tea $1.24 17 57 Bottled and canned beverages $1.50 48 55 Snacks and candy $1.00 29 38 Other $1.25 6 29 Total 100.0 Note: The gross profit percentages do not factor in product expiration or spoilage, incidental supplies, unrecorded sales, or theft Table II Analysis of coffee and tea costs Coffee 12 oz. 16 oz. Tea Pkg. cost Units Cost/unit 12 oz. 16 oz. $1.10 $1.50 $1.10 $1.50 0.26 0.35 0.04 Selling price Cost Coffee (72 oz.) Tea Lid Small cup Large cup Sleeve Sugar/cream (est) Total cost/cup $37.58 $4.99 $44.41 $66.15 $63.65 $62.54 24 16 1,000 1,000 6,00 1,200 $1.57 $0.31 $0.04 $0.07 $0.11 $0.05 0.31 0.04 0.04 0.07 0.31 0.04 0.07 0.05 0.07 $0.49 0.11 0.05 0.07 $0.62 0.05 0.07 $0.54 0.11 0.05 0.07 $0.58 $0.56 $0.92 Gross profit/cup $0.61 $0.88 Gross profit % 55.5 58.7 % of C&T Sales 55 23 Wgtd ave GP% 30.5 13.5 Notes: Average GP %= 56.6 percent; weighted average GP %= 56.5 percent 50.9 10 5.1 61.3 12 7.4 Shop. The coffee and fresh baked goods of the chains enjoyed brand recognition and marketing investment. The College-run competitors all accepted cash, FoodFunds, and credit cards. Even though the competitors' prices were higher than the Snack Shop's, the convenience of being able to use cards (in most cases funded by parents) rather than cash could be seen as a competitive advantage. Off-campus competitors included local grocery stores and a family owned full service convenience store within walking distance of the College. These competitors were licensed to sell alcoholic beverages in addition to food and convenience items. The Snack Shop Marketing interns were responsible for monitoring the competition and adjusting selling prices and product offerings at the Shop. The interns were also charged with designing advertising and promotional materials and developing sales promotions such as combination deals, punch cards, and other strategies to increase sales. Market research conducted by these interns revealed that FoodFunds was a major reason that students did not frequent the Shop, even though they would have liked to support a student-run business rather than a College-run store. Surveys also indicated a demand for catering for group meetings, and the Shop responded accordingly. Facilities The Snack Shop was located in a 15' by 20 interior room. The room's only window was in the door, and large black board covered most of one of the walls. A working sink was installed by the College so that coffee could be made and pots could be cleaned. The Shop had an older desktop PC with internet access and an outdated, nonworking electronic cash register. Sales were recorded on spreadsheets and the cash register was used as a cash box only. A locking safe was tucked under one of the tables in the back corner of the room. The Finance intern held the key to the safe. A professional grade coffee maker and serving carafes were provided by the coffee vendor, a local alumni-run company that formerly held the coffee vending contracts on campus. If the Shop ever decided to use a different coffee vendor or purchase coffee and supplies independently, coffee makers and carafes would have to be purchased at an approximate cost of $200.00. A small glass-front beverage refrigerator, snack shelves, a closed storage cabinet and utility tables also filled the space. One table with four chairs was provided for customers. A large flat screen television with cable access hung above the coffee area. When closed, the door to the Snack Shop was locked, with keys held by the interns, and one kept in the Business Department office for emergency purposes. Operations and Internal Controls Each day the sales spreadsheet was totaled and the cash drawer was counted (leaving $75.00 starting cash in the drawer). Sales per the spreadsheet were compared to actual cash receipts and cash over or short was recorded. Overages or shortages were investigated. In general, major shortages could be traced to emergency inventory purchases using register cash, and major overages could be traced to prepaid account deposits not included in the sales spreadsheet. No other major overages or shortages were noted. At the end of each day, the person closing the shop prepared the daily sales, prepaid activity, and cash over/short report and placed the cash receipts in the safe in the Shop. On Monday morning the Finance intern deposited the previous week's receipts (the on-campus office where their account was held was closed before the Snack Shop closed on Friday). The average number of transactions (customers) per day was 17, with an average purchase of $2.00; therefore sales averaged $34 daily and $170 weekly. The CEO and Inventory/Facilities interns were responsible for purchases of inventory and supplies. They purchased most items from local discount chains and grocery stores, purchasing sale items whenever possible. In the past, interns charged purchases on their personal credit cards and submitted receipts for reimbursement to the Finance intern. Due to tighter internal controls on campus, the College had begun requiring all purchases be procured by purchase order from the centralized Student Association bank account, with payment made directly to vendors. Coffee, tea, and supplies were procured from a local supplier that granted them a 15 percent discount because of their student club status. They also supplied the Shop with a professional grade coffee maker, serving carafes, counter racks and organizers, and a sign advertising the coffee brand name. Inventory costs were maintained at current cost - with costs being updated each time a new purchase was made. A periodic inventory method was followed. Cost of sales were not calculated and recorded until the end of each semester when physical inventory on hand was counted and costs were assigned. Costs of incidental supplies (such as napkins, plastic ware), spoilage, expiration, unrecorded sales and theft were charged to cost of goods sold at semester end. The Finance intern prepared end-of-semester financial statements (see Table II). Strategic challenge The BSC was at an important juncture of its history. Due to the opening of the well-known international coffee chain in its building, the Snack Shop must compete in order to survive. This new competitor had a negative impact on the Snack Shop's spring 2011 sales and profits, and would continue to do so unless the Shop rose to this strategic challenge. One strategic move considered by the Shop was accepting FoodFunds. Based on market research conducted by students in the Department, FoodFunds would significantly impact a student's choice to shop at the Snack Shop and support a student organization rather than the College-run store. With the acceptance of FoodFunds, the Shop hoped to triple customer traffic. The number of daily transactions was estimated to increase from 17 to 50. The estimated dollar value of each transaction would remain at $2.00. The average number of full business days per semester was estimated to be 60 for analysis purposes. The cost of accepting FoodFunds was a combination of fixed and variable costs. The card scanner/reader cost $30.00 per month to lease. Each transaction using FoodFunds would cost $0.10. In addition, there was an 8 percent fee for each sale on FoodFunds (8% x sales price). The $30.00 per month charge on the reader would have to be paid even when the store was closed for winter and summer breaks in order to keep the account active. The introduction of FoodFunds into the Snack Shop would require the students to purchase an electronic cash register with barcode scanning capability. The cost of a suitable register with a service contract was $650. Every product would be entered into the register's software, capturing the beginning inventory quantity, the selling price per unit, whether it was subject to Table III Income statements and balance sheets by semester Fall 2009 Spring 2010 Fall 2010 Spring 2011 Fall 2011 Spring 2012 Fall 2012 Net sales $3,136.48 $3,250.97 $3,292.65 $2,122.63 $2,582.67 $2,094.95 $2,099.73 Cost of Goods sold (below) (1,874.29) (1,760.43) (1.705.32) (1.796.43) (1,370.19) (1,285.60) (1,275.40) Gross profit 1,262.19 1,490.54 1587.33 326.20 1212.48 809.35 824.33 Allocation to NYC trip (750.00) (750.00) (750.00) (750.00) (750.00) (750.00) (750.00) Contribution to department budget (250.00) (250.00) (250.00) (250.00) (250.00) (250.00) (250.00) Other expenses (470.00) (576.06) Net income (loss) $262.19 $490.54 $587.33 $(673.80) $(257.52) $(190.65) $(751.73) Assets Cash $1,312.64 $2,138.58 $2,767.28 $1,828.30 $1,552.13 $1,350.32 $716.05 Inventory 423.07 142.36 85.80 425.68 579.64 398.77 387.85 Total assets $1,735.71 $2,280.94 $2,853.08 $2,253.98 $2,131.77 $1,749.09 $1,103.90 Liabilities (sales tax) $0.00 $54.69 $39.50 $114.20 $249.51 $57.48 $164.02 Net assets Beginning net assets $1,473.52 $1,735.71 $2,226.25 $2,813.58 $2,139.78 $1,882.26 $1,691.61 Income 262.19 490.54 587.33 (673.80) (257.52) (190.65) (751.73) Ending net assets $1,735.71 $2,226.25 $2,813.58 $2,139.78 $1,882.26 $1,691.61 $939.88 Total liabilities and net assets $1,735.71 $2,280.94 $2,853.08 $2,253.98 $2,131.77 $1,749.09 $1,103.90 Notes: "Other expenses: flat screen television and store improvements (Fall 2011); installation of television and improvements (Fall 2012). Improvements include painting, signage, and furnishings sales tax or not, and the bar code of the product would be scanned in to link it together. Thereafter, when sales were made, products would be scanned, the order would be totaled, and either cash or FoodFunds would be accepted. If the order was paid with FoodFunds, the customer would swipe his or her card and the cashier would type in the order total on the card reader. The amount would be deposited into a separate bank account electronically. The charges for 8 percent of sales and $0.10 per transaction would be assessed at the end of each month at the bank account level. The student interns were ready to move ahead with their strategic plan. However, their advisors suggested they analyze the cost and non-cost factors involved in their decision. The following questions were posed to the interns in an effort to prepare them for their competitive challenge. After completing these analyses, recommendations could be made and strategic decisions would followStep by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started