what i have there is right so far but could you please help me find the missing information for these two

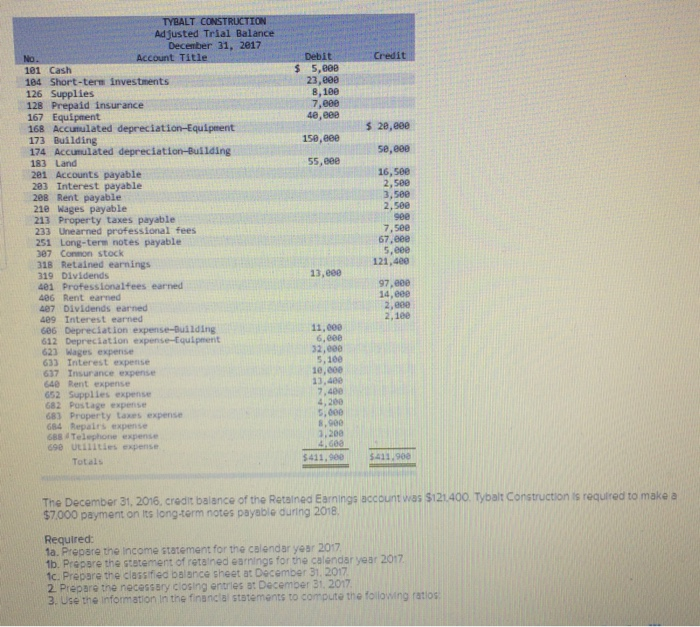

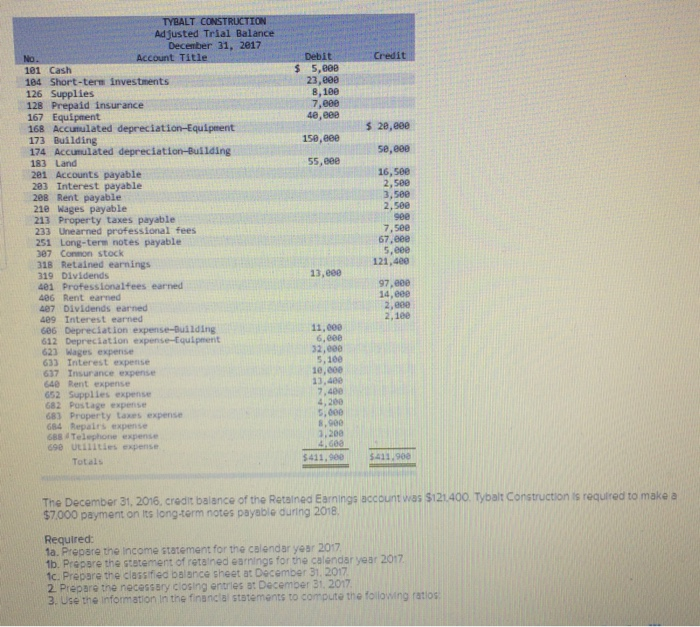

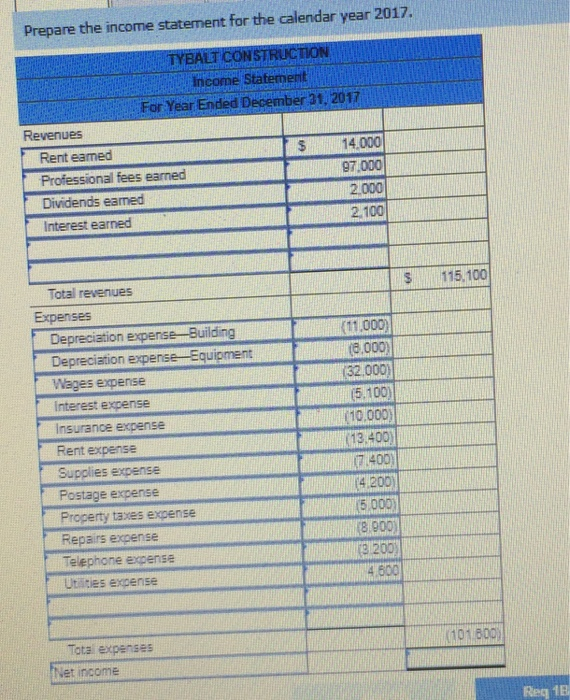

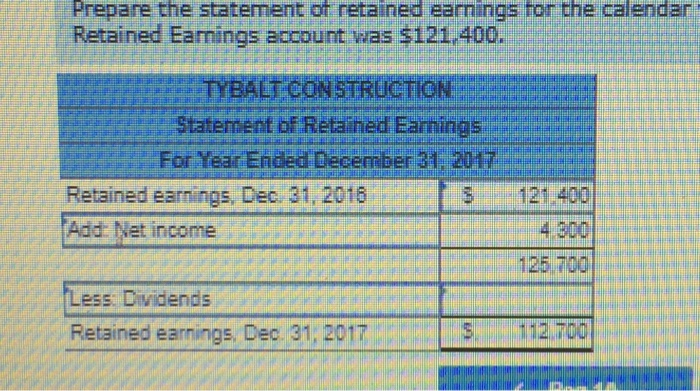

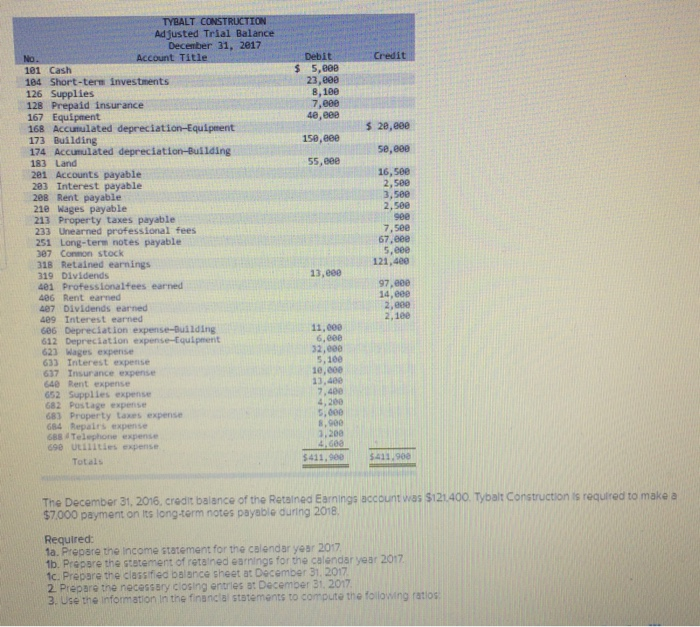

Adjusted Trial Balance Decenber 31, 2817 it s 5,ee0 23,800 8,100 7,806 46,888 181 Cash 184 Short-term investments 126 Supplies 128 Prepaid insurance 167 Equipment 168 Accunulated depreciation-Equipment 173 Building 174 Accumulated depreciation-Building 183 Land 281 Accounts payable 283 Interest payable 288 Rent payable 218 Wages payable 213 Property taxes payable s 28,800 158,660 58,800 55,888 16,500 2, 580 3,580 2,500 900 7,580 67.88e 5,ee0 121,480 233 Unearned professional fees 251 Long-term notes payable 307 Conmon stock 318 Retained earnings 319 Dividends 401 Professionalfees earned 13,000 97,e00 14,809 2,800 2,100 486 Rent earned 487 Dividends earned 409 Interest earned 686 Depreciation expense-Building 11,000 6,ee8 32,ee0 s,100 1e,000 13,400 7,400 4,200 E,000 s,900 3,200 612 Depreciation expense-tquipment 623 Wages expense 633 Interest expense 637 Insurance expense 40 Rent expense 652 Supplles expense 682 Postage expense 683 Property Laes expense 684 Repairs expense 688 Telephone expense 69e tilities expense 5411.908 $411,90e Totals The December 31, 2016, credit balance of the Retained Earnings account was $121400. Tybalt Construction is requred to make a $7000 payment on its long-term notes payable during 2018 Required: 1a. Prepare the income statement for the calendar yesr 2017 1b. Prepare the statement of retalned earmings for the calendar year 2017 1c. Prepare the classified balance sheet at December 31. 2017 2 Prepare tne necessary closing entries at Decemper 31. 2017 3. Use the information in the financlal statements to compute the folowing ratios Prepare the income statement for the calendar year 2017. TYBALT CONSTRUCTION Income Statement For Year Ended Deember 31, 2017 Revenues S14.000 97.000 2.000 2.100 Rent eamed Professional fees earned Dividends eaned Interest earned S 115.100 Total revenues (11.000) (8,000) 32 000) 5.100) (10,000) (13.400) 7 400) 4.200) 5,000) 8 900) 3 200) 4 600 Depreciation expense Building Depreciation expense Equipment Interest expense Insurance expense Rent expense Supplies expense Property taxes expense Repairs expense Telephone expense Utcies excense Total expenses Net income (101 600) Req 1B Frepare the statement of reta ned eaminos for the calenda Retained Earnings account was $121.400. Statement of Retained Eaningsee Retained earnings, Dec 31, 2018 Add: Net income 121 400 4.300 125 700 LesE D vidends 5.112 700 Retained earnings, Dec 31, 2017