Question

what I need from the following walmart financial statements; 1) Common sized financial statements(vertical Analysis) 2) Ratio analysis (3 years) 3) Analysis of financial position

what I need from the following walmart financial statements; 1) Common sized financial statements(vertical Analysis) 2) Ratio analysis (3 years) 3) Analysis of financial position (Balance sheet) 4) Analysis of operations (Income Statements) 5) Analysis of changes in cash (Cash flow Statement) 6) 1-2 Recommendations regarding operations (Income Statement) 7) 1-2 Recommendations regarding Financial condition (Balance Sheet) 8) Identify a negative trend or an area that could be improved. Make specific recommendations to address that area. Consider possible negative consequences. How would you expect financial results to be impacted as a result of your recommendation? NOTE: Recommendations will not be evaluated if they are right or wrong for the business but rather if the recommendations make financial sense. Will the recommendations address the problem you have identified or the area that needs improvement. This is my final presentation due on coming thrusday so please answer in detail.

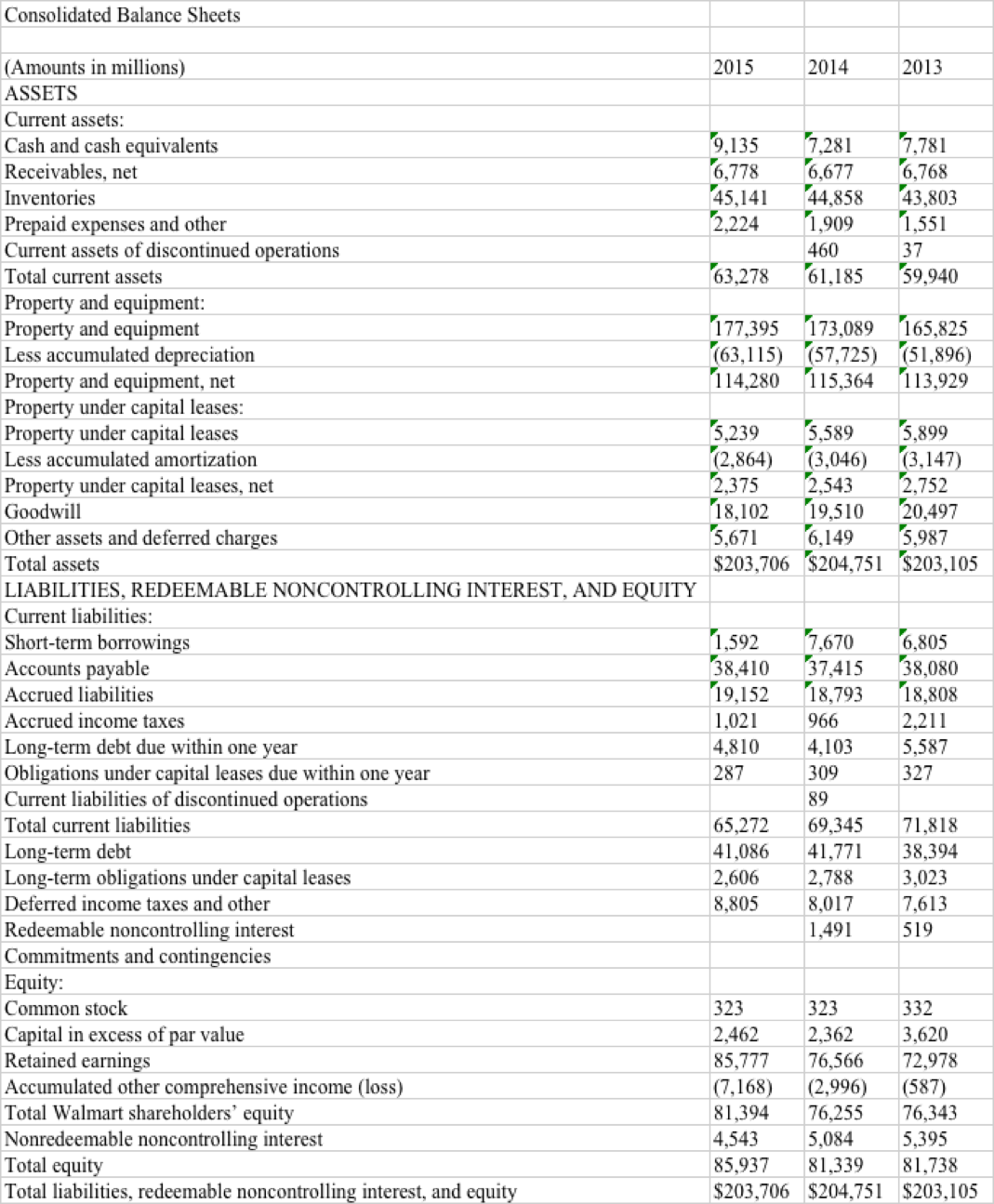

Consolidated Balance Sheets (Amounts in millions 2015 2014 2013 ASSETS Current assets: Cash and cash equivalents 9,135 17,281 1,781 Receivables, net 6,778 6,677 6,768 Inventories 45,141 44,858 43,803 Prepaid expenses and other 2,224 1,909 1,551 Current assets of discontinued operations 460 37 Total current assets 63278 61,185 59,940 Proper and equipment: Property and equipment 177,395 173,089 165,825 Less accumulated depreciation (63,115) (57,725) (51,896) Property and equipment, net 114280 115364 113,929 Property under capital leases: Property under capital leases 3,239 5,589 5,899 Less accumulated amortization (2,864) (3,046) (3,147) Property under capital leases, net 2,375 2,543 2,752 Goodw 18,102 19,510 20,497 Other assets and deferred charges 5,671 6,149 5,987 Total assets $203,706 $204,751 $203,105 LIABILITIES, REDEEMABLE NONCONTROLLING INTEREST, AND EQUITY Current liabilities: Short-term borrowings 1,592 1,670 6,805 Accounts payable 38410 37415 38080 Accrued liabilities 19,152 18,793 18,808 Accrued income taxes 1,021 966 2211 Long-term debt due within one year 4,810 4,103 5587 Obligations under capital leases due within one year 287 309 327 Current liabilities of discontinued operations 89 Total current liabilities 65272 69345 71,818 Long-term debt 41086 41771 38,394 Longterm obligations under capital leases 2,606 2,788 3,023 Deferred income taxes and other 8,805 8,017 17,613 Redeemable noncontrolling interest 1,491 519 Commitments and contingencies Equi Common stock 323 323 332 Capital in excess of par value 2,462 2362 3,620 Retained earnings 85,777 76,566 72,978 Accumulated other comprehensive income (loss) (7,168) (2,996) (587 Total Walmart shareholders' equity 81,394 76,255 76,343 I Nonredeemable noncontrolling interest 4,543 5,084 5,395 Total equit 85937 81339 81,738 Total liabilities, redeemable noncontrolling interest, and equity $203,706 $204,751 $203,10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started