- What impact will Brissons decision to manufacture MS-7 have on the cost structure of Stimgro for Carmichael?

- Should Amanda Tellford do anything at this stage?

- What alternatives are open to Amanda Tellford?

- What are the advantages and disadvantages of each alternative?

- What is the cost structure for Stimgro and the margin?

- Since Stimgro is very profitable, with a good margin, why does it matter if the cost of MS-7 increases?

Main Question:

- As Amanda Tellford, what alternatives would you consider regarding MS-7? Which alternative would you pursue and how would you go about it?

PLEASE ANSWER QUESTIONS 2 THROUGH 7.

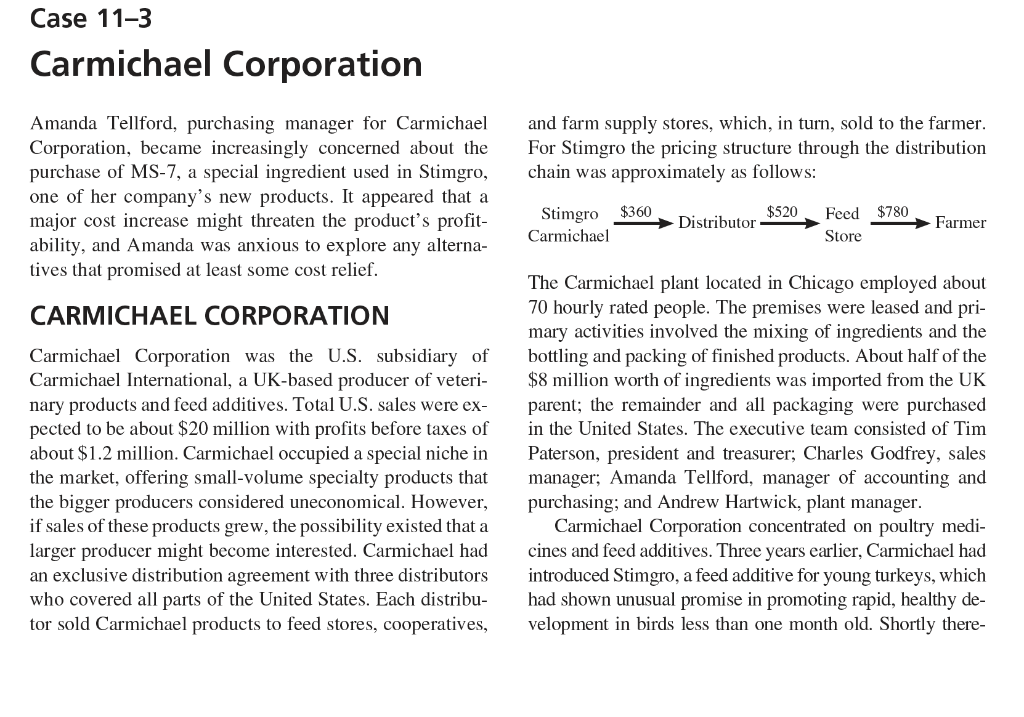

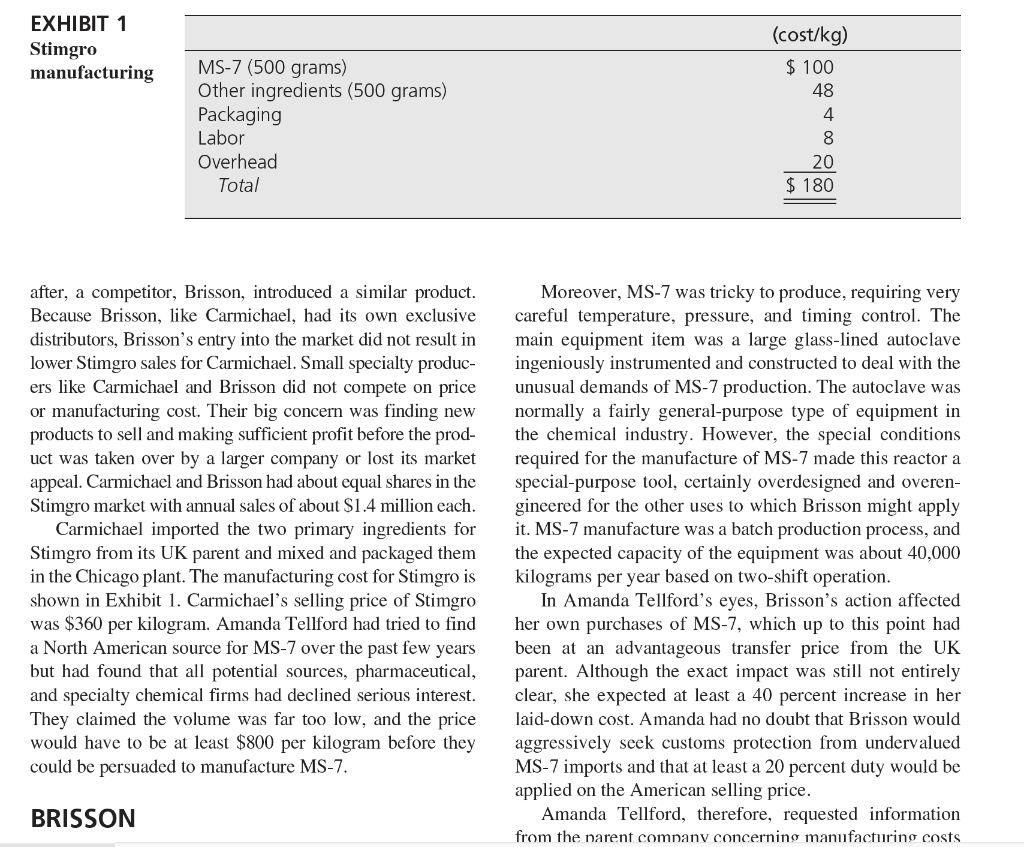

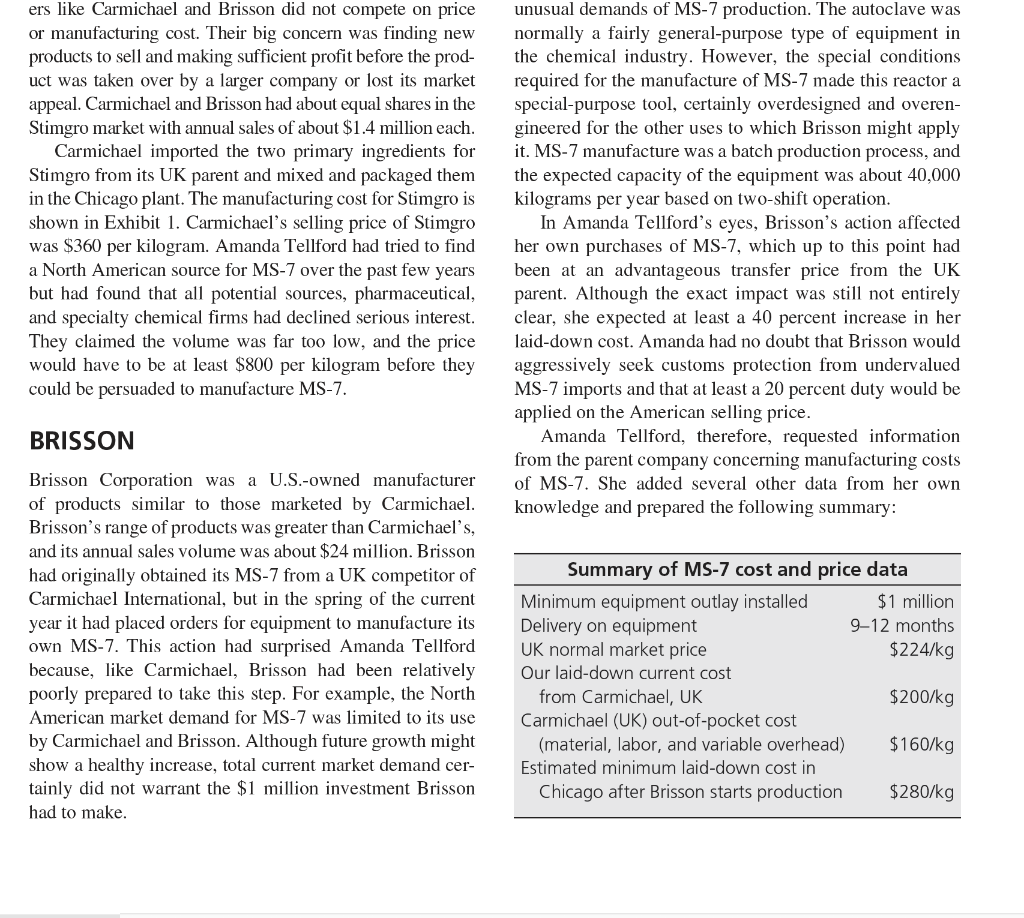

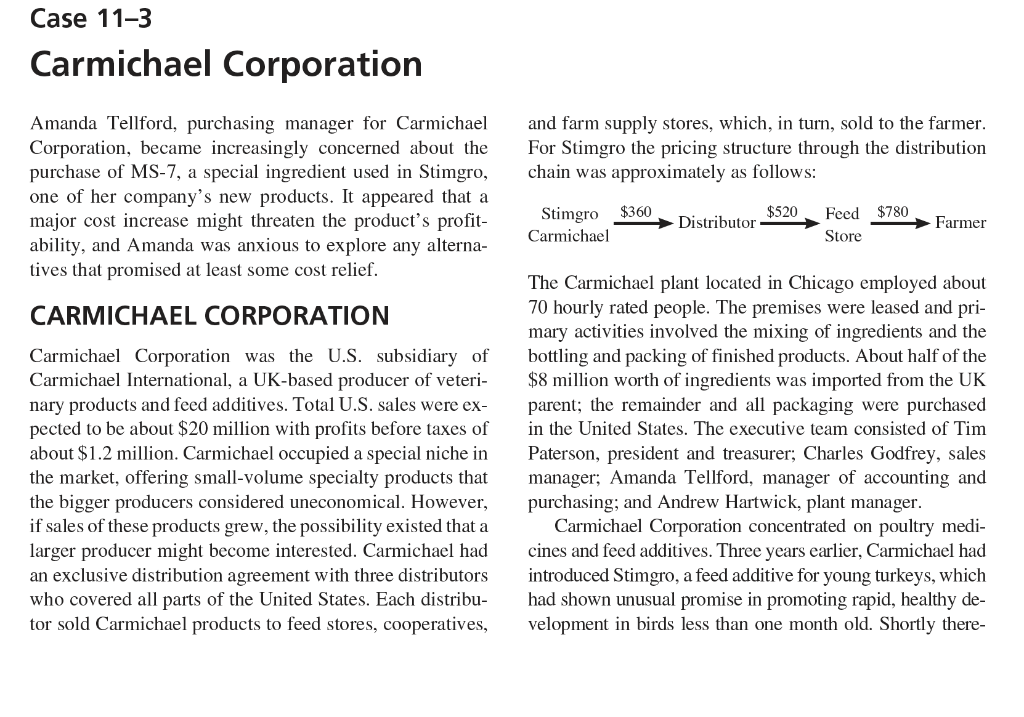

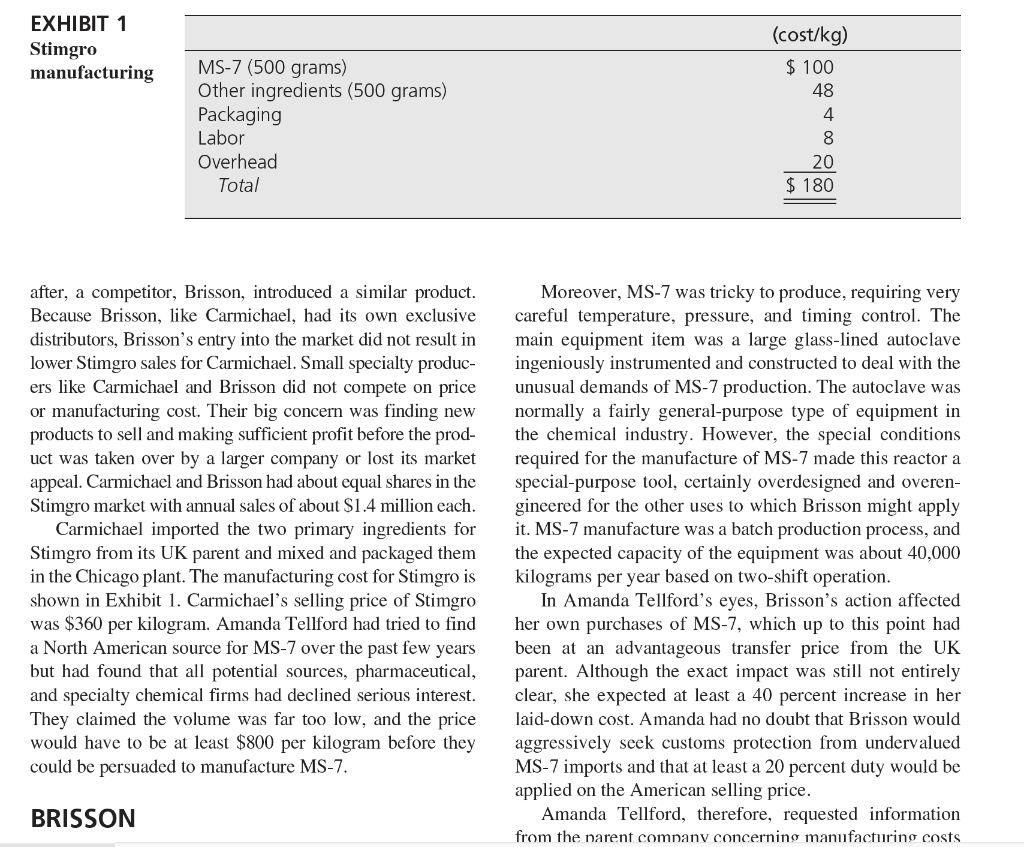

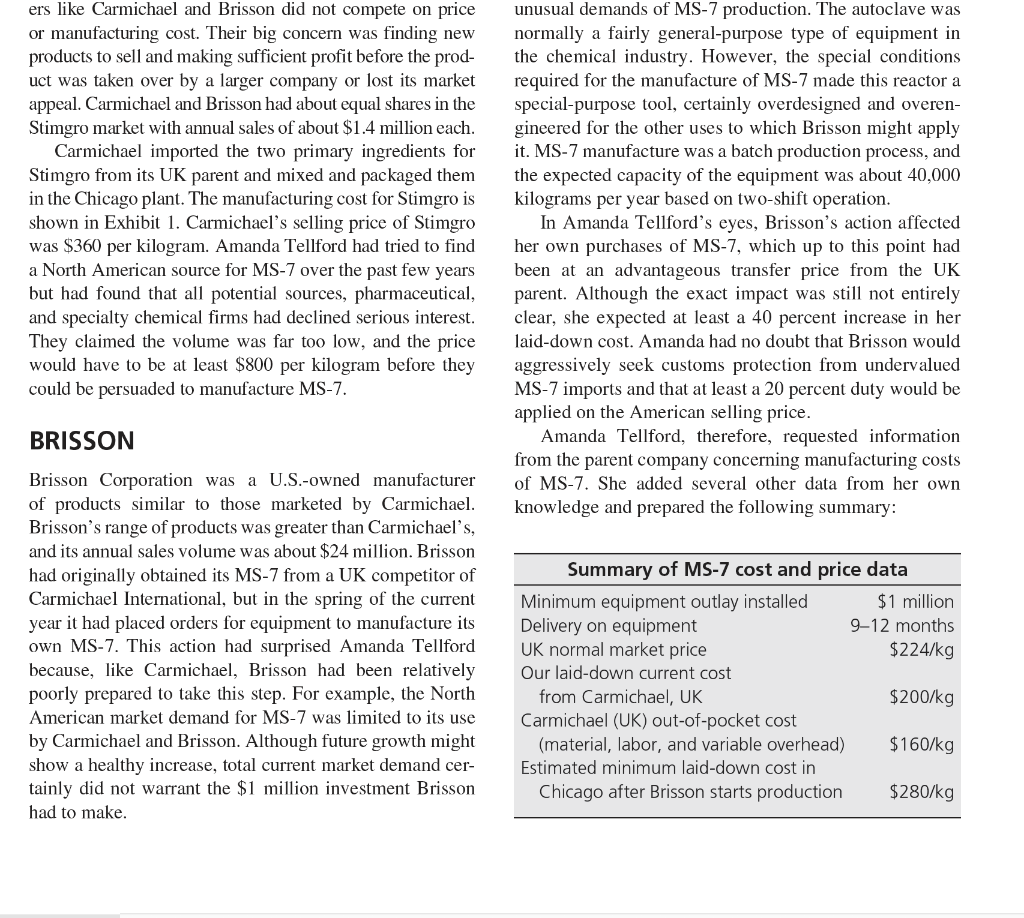

Case 11-3 Carmichael Corporation and farm supply stores, which, in turn, sold to the farmer. For Stimgro the pricing structure through the distribution chain was approximately as follows: Amanda Tellford, purchasing manager for Carmichael Corporation, became increasingly concerned about the purchase of MS-7, a special ingredient used in Stimgro, one of her company's new products. It appeared that a major cost increase might threaten the product's profit- ability, and Amanda was anxious to explore any alterna- tives that promised at least some cost relief. $360 Distributor $520 Stimgro Carmichael Feed $780 Store Farmer CARMICHAEL CORPORATION Carmichael Corporation was the U.S. subsidiary of Carmichael International, a UK-based producer of veteri- nary products and feed additives. Total U.S. sales were ex- pected to be about $20 million with profits before taxes of about $1.2 million. Carmichael occupied a special niche in the market, offering small-volume specialty products that the bigger producers considered uneconomical. However, if sales of these products grew, the possibility existed that a larger producer might become interested. Carmichael had an exclusive distribution agreement with three distributors who covered all parts of the United States. Each distribu- tor sold Carmichael products to feed stores, cooperatives, The Carmichael plant located in Chicago employed about 70 hourly rated people. The premises were leased and pri- mary activities involved the mixing of ingredients and the bottling and packing of finished products. About half of the $8 million worth of ingredients was imported from the UK parent; the remainder and all packaging were purchased in the United States. The executive team consisted of Tim Paterson, president and treasurer, Charles Godfrey, sales manager, Amanda Tellford, manager of accounting and purchasing; and Andrew Hartwick, plant manager. Carmichael Corporation concentrated on poultry medi- cines and feed additives. Three years earlier, Carmichael had introduced Stimgro, a feed additive for young turkeys, which had shown unusual promise in promoting rapid, healthy de- velopment in birds less than one month old. Shortly there- EXHIBIT 1 Stimgro manufacturing (cost/kg) $ 100 MS-7 (500 grams) Other ingredients (500 grams) Packaging Labor Overhead Total 00 O $ 180 after, a competitor, Brisson, introduced a similar product. Because Brisson, like Carmichael, had its own exclusive distributors, Brisson's entry into the market did not result in lower Stimgro sales for Carmichael. Small specialty produc- ers like Carmichael and Brisson did not compete on price or manufacturing cost. Their big concern was finding new products to sell and making sufficient profit before the prod- uct was taken over by a larger company or lost its market appeal. Carmichael and Brisson had about equal shares in the Stimgro market with annual sales of about $1.4 million each. Carmichael imported the two primary ingredients for Stimgro from its UK parent and mixed and packaged them in the Chicago plant. The manufacturing cost for Stimgro is shown in Exhibit 1. Carmichael's selling price of Stimgro was $360 per kilogram. Amanda Tellford had tried to find a North American source for MS-7 over the past few years but had found that all potential sources, pharmaceutical, and specialty chemical firms had declined serious interest. They claimed the volume was far too low, and the price would have to be at least $800 per kilogram before they could be persuaded to manufacture MS-7. Moreover, MS-7 was tricky to produce, requiring very careful temperature, pressure, and timing control. The main equipment item was a large glass-lined autoclave ingeniously instrumented and constructed to deal with the unusual demands of MS-7 production. The autoclave was normally a fairly general-purpose type of equipment in the chemical industry. However, the special conditions required for the manufacture of MS-7 made this reactor a special-purpose tool, certainly overdesigned and overen- gineered for the other uses to which Brisson might apply it. MS-7 manufacture was a batch production process, and the expected capacity of the equipment was about 40,000 kilograms per year based on two-shift operation. In Amanda Tellford's eyes, Brisson's action affected her own purchases of MS-7, which up to this point had been at an advantageous transfer price from the UK parent. Although the exact impact was still not entirely clear, she expected at least a 40 percent increase in her laid-down cost. Amanda had no doubt that Brisson would aggressively seek customs protection from undervalued MS-7 imports and that at least a 20 percent duty would be applied on the American selling price. Amanda Tellford, therefore, requested information from the narent company concerning manufacturing costs BRISSON ers like Carmichael and Brisson did not compete on price or manufacturing cost. Their big concern was finding new products to sell and making sufficient profit before the prod- uct was taken over by a larger company or lost its market appeal. Carmichael and Brisson had about equal shares in the Stimgro market with annual sales of about $1.4 million each. Carmichael imported the two primary ingredients for Stimgro from its UK parent and mixed and packaged them in the Chicago plant. The manufacturing cost for Stimgro is shown in Exhibit 1. Carmichael's selling price of Stimgro was $360 per kilogram. Amanda Tellford had tried to find a North American source for MS-7 over the past few years but had found that all potential sources, pharmaceutical, and specialty chemical firms had declined serious interest. They claimed the volume was far too low, and the price would have to be at least $800 per kilogram before they could be persuaded to manufacture MS-7. unusual demands of MS-7 production. The autoclave was normally a fairly general-purpose type of equipment in the chemical industry. However, the special conditions required for the manufacture of MS-7 made this reactor a special-purpose tool, certainly overdesigned and overen- gineered for the other uses to which Brisson might apply it. MS-7 manufacture was a batch production process, and the expected capacity of the equipment was about 40,000 kilograms per year based on two-shift operation. In Amanda Tellford's eyes, Brisson's action affected her own purchases of MS-7, which up to this point had been at an advantageous transfer price from the UK parent. Although the exact impact was still not entirely clear, she expected at least a 40 percent increase in her laid-down cost. Amanda had no doubt that Brisson would aggressively seek customs protection from undervalued MS-7 imports and that at least a 20 percent duty would be applied on the American selling price. Amanda Tellford, therefore, requested information from the parent company concerning manufacturing costs of MS-7. She added several other data from her own knowledge and prepared the following summary: BRISSON Brisson Corporation was a U.S.-owned manufacturer of products similar to those marketed by Carmichael. Brisson's range of products was greater than Carmichael's, and its annual sales volume was about $24 million. Brisson had originally obtained its MS-7 from a UK competitor of Carmichael International, but in the spring of the current year it had placed orders for equipment to manufacture its own MS-7. This action had surprised Amanda Tellford because, like Carmichael, Brisson had been relatively poorly prepared to take this step. For example, the North American market demand for MS-7 was limited to its use by Carmichael and Brisson. Although future growth might show a healthy increase, total current market demand cer- tainly did not warrant the $1 million investment Brisson had to make. Summary of MS-7 cost and price data Minimum equipment outlay installed $1 million Delivery on equipment 912 months UK normal market price $224/kg Our laid-down current cost from Carmichael, UK $200/kg Carmichael (UK) out-of-pocket cost (material, labor, and variable overhead) $160/kg Estimated minimum laid-down cost in Chicago after Brisson starts production $280/kg 322 Purchasing and Supply Management Amanda Tellford went to see Charles Godfrey, Carmichael's sales manager, to discuss possible sales requirements for the future. Charles said, It's really anybody's guess. First, it depends on the popularity of turkeys. We are banking on continued growth there. Second, as soon as the feed compa- nies can develop a suitable substitute for our product, they will go for it. We appear to be very expensive on a weight basis, although research and actual results show we repre- sent excellent value. It takes such tiny quantities of Stimgro to improve the overall quality of a mix that it is difficult to believe it could have any impact. More competition can enter this market any day. We are just not large enough in the U.S. market to have any strong promotional impact. Each of our product lines is specialized, of relatively small volume, in an area where the big firms choose not to oper- ate. Should a larger firm enter this market, they could flat- ten us. Now you tell me how to turn this into a reasonable forecast. Amanda Tellford replied, I'm glad that's your prob- lem and not mine, Charles. Anytime you feel you're ready to put some figures down, please let me know, because it may become very important for us in the near future. In looking over past figures, Amanda estimated that the second half of this year's requirements would total about 1,000 kilograms of MS-7. Amanda decided that she had better think out the effect that Brisson's deci- sion to make MS-7 might have on her future purchasing strategy Case 11-3 Carmichael Corporation and farm supply stores, which, in turn, sold to the farmer. For Stimgro the pricing structure through the distribution chain was approximately as follows: Amanda Tellford, purchasing manager for Carmichael Corporation, became increasingly concerned about the purchase of MS-7, a special ingredient used in Stimgro, one of her company's new products. It appeared that a major cost increase might threaten the product's profit- ability, and Amanda was anxious to explore any alterna- tives that promised at least some cost relief. $360 Distributor $520 Stimgro Carmichael Feed $780 Store Farmer CARMICHAEL CORPORATION Carmichael Corporation was the U.S. subsidiary of Carmichael International, a UK-based producer of veteri- nary products and feed additives. Total U.S. sales were ex- pected to be about $20 million with profits before taxes of about $1.2 million. Carmichael occupied a special niche in the market, offering small-volume specialty products that the bigger producers considered uneconomical. However, if sales of these products grew, the possibility existed that a larger producer might become interested. Carmichael had an exclusive distribution agreement with three distributors who covered all parts of the United States. Each distribu- tor sold Carmichael products to feed stores, cooperatives, The Carmichael plant located in Chicago employed about 70 hourly rated people. The premises were leased and pri- mary activities involved the mixing of ingredients and the bottling and packing of finished products. About half of the $8 million worth of ingredients was imported from the UK parent; the remainder and all packaging were purchased in the United States. The executive team consisted of Tim Paterson, president and treasurer, Charles Godfrey, sales manager, Amanda Tellford, manager of accounting and purchasing; and Andrew Hartwick, plant manager. Carmichael Corporation concentrated on poultry medi- cines and feed additives. Three years earlier, Carmichael had introduced Stimgro, a feed additive for young turkeys, which had shown unusual promise in promoting rapid, healthy de- velopment in birds less than one month old. Shortly there- EXHIBIT 1 Stimgro manufacturing (cost/kg) $ 100 MS-7 (500 grams) Other ingredients (500 grams) Packaging Labor Overhead Total 00 O $ 180 after, a competitor, Brisson, introduced a similar product. Because Brisson, like Carmichael, had its own exclusive distributors, Brisson's entry into the market did not result in lower Stimgro sales for Carmichael. Small specialty produc- ers like Carmichael and Brisson did not compete on price or manufacturing cost. Their big concern was finding new products to sell and making sufficient profit before the prod- uct was taken over by a larger company or lost its market appeal. Carmichael and Brisson had about equal shares in the Stimgro market with annual sales of about $1.4 million each. Carmichael imported the two primary ingredients for Stimgro from its UK parent and mixed and packaged them in the Chicago plant. The manufacturing cost for Stimgro is shown in Exhibit 1. Carmichael's selling price of Stimgro was $360 per kilogram. Amanda Tellford had tried to find a North American source for MS-7 over the past few years but had found that all potential sources, pharmaceutical, and specialty chemical firms had declined serious interest. They claimed the volume was far too low, and the price would have to be at least $800 per kilogram before they could be persuaded to manufacture MS-7. Moreover, MS-7 was tricky to produce, requiring very careful temperature, pressure, and timing control. The main equipment item was a large glass-lined autoclave ingeniously instrumented and constructed to deal with the unusual demands of MS-7 production. The autoclave was normally a fairly general-purpose type of equipment in the chemical industry. However, the special conditions required for the manufacture of MS-7 made this reactor a special-purpose tool, certainly overdesigned and overen- gineered for the other uses to which Brisson might apply it. MS-7 manufacture was a batch production process, and the expected capacity of the equipment was about 40,000 kilograms per year based on two-shift operation. In Amanda Tellford's eyes, Brisson's action affected her own purchases of MS-7, which up to this point had been at an advantageous transfer price from the UK parent. Although the exact impact was still not entirely clear, she expected at least a 40 percent increase in her laid-down cost. Amanda had no doubt that Brisson would aggressively seek customs protection from undervalued MS-7 imports and that at least a 20 percent duty would be applied on the American selling price. Amanda Tellford, therefore, requested information from the narent company concerning manufacturing costs BRISSON ers like Carmichael and Brisson did not compete on price or manufacturing cost. Their big concern was finding new products to sell and making sufficient profit before the prod- uct was taken over by a larger company or lost its market appeal. Carmichael and Brisson had about equal shares in the Stimgro market with annual sales of about $1.4 million each. Carmichael imported the two primary ingredients for Stimgro from its UK parent and mixed and packaged them in the Chicago plant. The manufacturing cost for Stimgro is shown in Exhibit 1. Carmichael's selling price of Stimgro was $360 per kilogram. Amanda Tellford had tried to find a North American source for MS-7 over the past few years but had found that all potential sources, pharmaceutical, and specialty chemical firms had declined serious interest. They claimed the volume was far too low, and the price would have to be at least $800 per kilogram before they could be persuaded to manufacture MS-7. unusual demands of MS-7 production. The autoclave was normally a fairly general-purpose type of equipment in the chemical industry. However, the special conditions required for the manufacture of MS-7 made this reactor a special-purpose tool, certainly overdesigned and overen- gineered for the other uses to which Brisson might apply it. MS-7 manufacture was a batch production process, and the expected capacity of the equipment was about 40,000 kilograms per year based on two-shift operation. In Amanda Tellford's eyes, Brisson's action affected her own purchases of MS-7, which up to this point had been at an advantageous transfer price from the UK parent. Although the exact impact was still not entirely clear, she expected at least a 40 percent increase in her laid-down cost. Amanda had no doubt that Brisson would aggressively seek customs protection from undervalued MS-7 imports and that at least a 20 percent duty would be applied on the American selling price. Amanda Tellford, therefore, requested information from the parent company concerning manufacturing costs of MS-7. She added several other data from her own knowledge and prepared the following summary: BRISSON Brisson Corporation was a U.S.-owned manufacturer of products similar to those marketed by Carmichael. Brisson's range of products was greater than Carmichael's, and its annual sales volume was about $24 million. Brisson had originally obtained its MS-7 from a UK competitor of Carmichael International, but in the spring of the current year it had placed orders for equipment to manufacture its own MS-7. This action had surprised Amanda Tellford because, like Carmichael, Brisson had been relatively poorly prepared to take this step. For example, the North American market demand for MS-7 was limited to its use by Carmichael and Brisson. Although future growth might show a healthy increase, total current market demand cer- tainly did not warrant the $1 million investment Brisson had to make. Summary of MS-7 cost and price data Minimum equipment outlay installed $1 million Delivery on equipment 912 months UK normal market price $224/kg Our laid-down current cost from Carmichael, UK $200/kg Carmichael (UK) out-of-pocket cost (material, labor, and variable overhead) $160/kg Estimated minimum laid-down cost in Chicago after Brisson starts production $280/kg 322 Purchasing and Supply Management Amanda Tellford went to see Charles Godfrey, Carmichael's sales manager, to discuss possible sales requirements for the future. Charles said, It's really anybody's guess. First, it depends on the popularity of turkeys. We are banking on continued growth there. Second, as soon as the feed compa- nies can develop a suitable substitute for our product, they will go for it. We appear to be very expensive on a weight basis, although research and actual results show we repre- sent excellent value. It takes such tiny quantities of Stimgro to improve the overall quality of a mix that it is difficult to believe it could have any impact. More competition can enter this market any day. We are just not large enough in the U.S. market to have any strong promotional impact. Each of our product lines is specialized, of relatively small volume, in an area where the big firms choose not to oper- ate. Should a larger firm enter this market, they could flat- ten us. Now you tell me how to turn this into a reasonable forecast. Amanda Tellford replied, I'm glad that's your prob- lem and not mine, Charles. Anytime you feel you're ready to put some figures down, please let me know, because it may become very important for us in the near future. In looking over past figures, Amanda estimated that the second half of this year's requirements would total about 1,000 kilograms of MS-7. Amanda decided that she had better think out the effect that Brisson's deci- sion to make MS-7 might have on her future purchasing strategy