Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What information do you need? I just want to I supply all needed. im going to add the questions leading up to those... [Q24-35) Your

What information do you need? I just want to I supply all needed. im going to add the questions leading up to those...

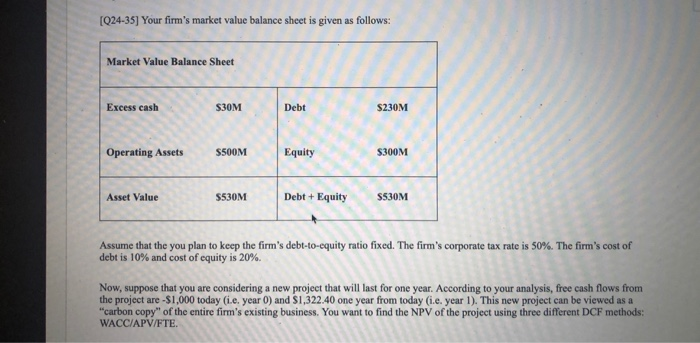

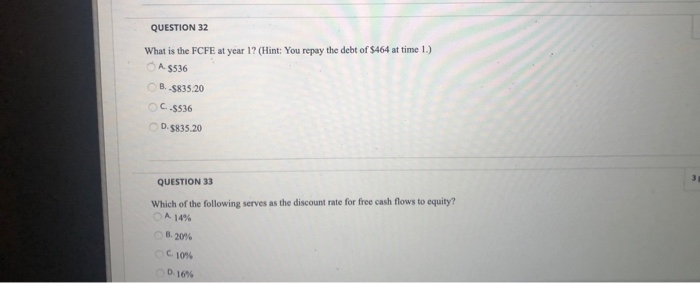

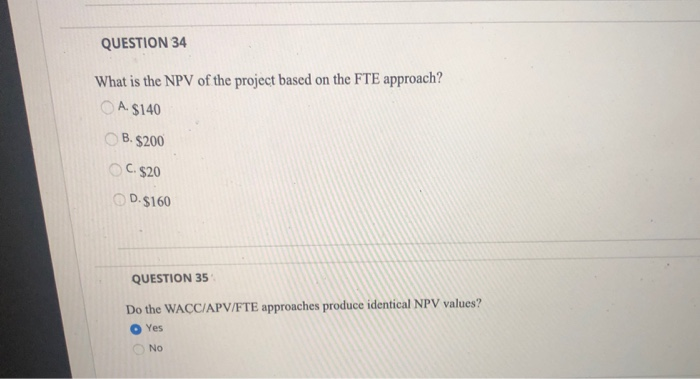

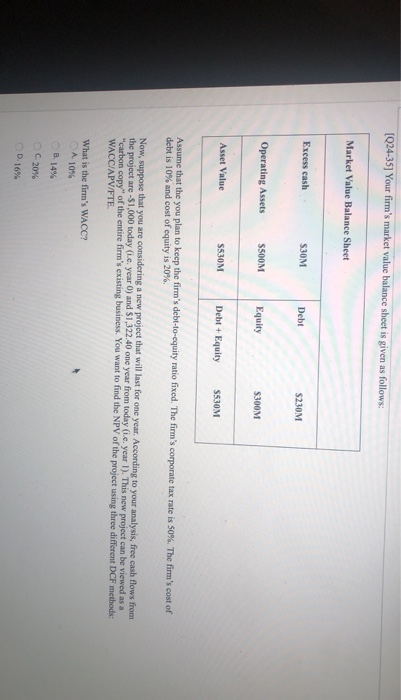

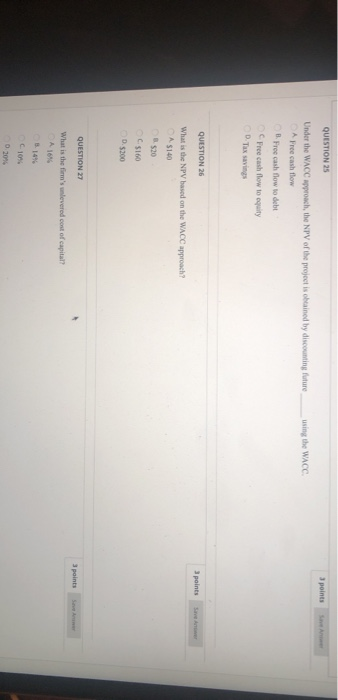

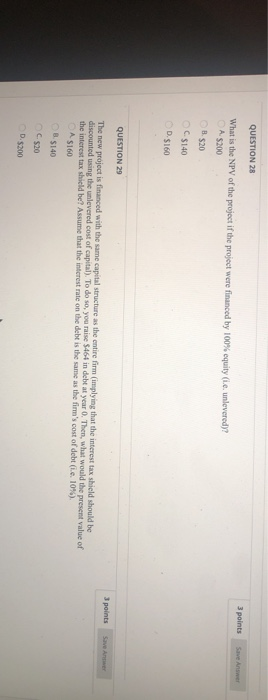

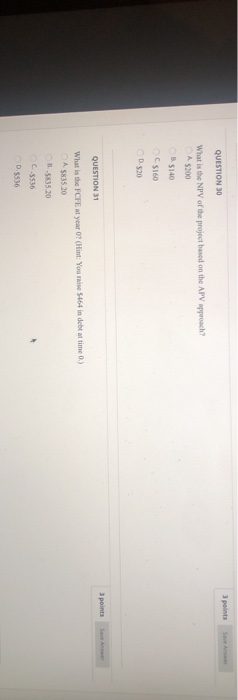

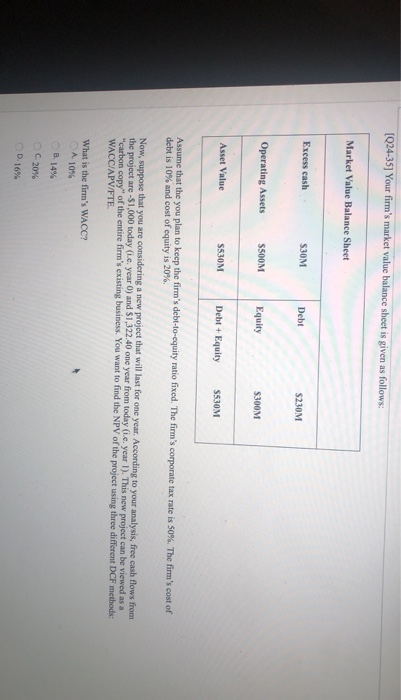

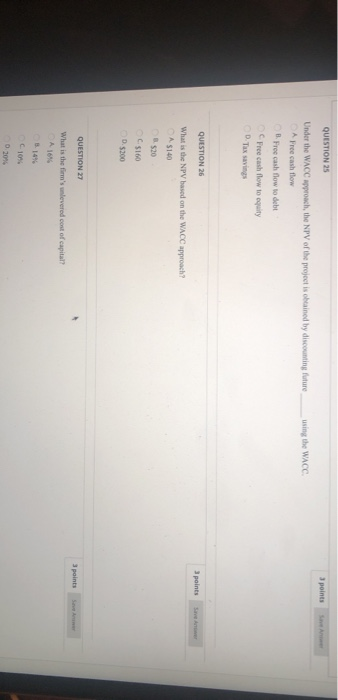

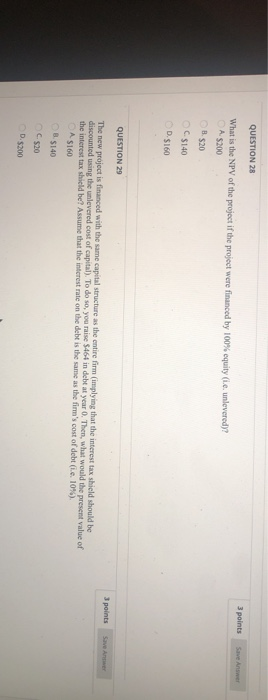

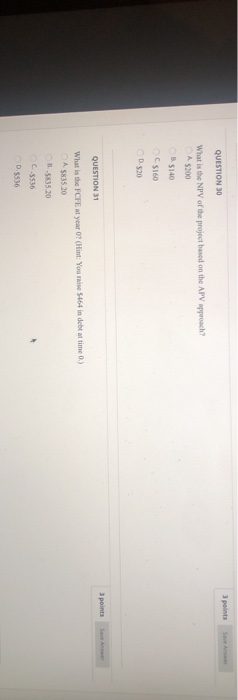

[Q24-35) Your firm's market value balance sheet is given as follows: Market Value Balance Sheet Excess cash som S30M Debt $230M S230M 230M Operating Assets S500M Equity S300M Asset Value $530M Debt + Equity $530M Assume that the you plan to keep the firm's debt-to-equity ratio fixed. The firm's corporate tax rate is 50%. The firm's cost of debt is 10% and cost of equity is 20% Now, suppose that you are considering a new project that will last for one year. According to your analysis, free cash flows from the project are -$1,000 today (i.e. year 0) and S1,322.40 one year from today (i.e. year 1). This new project can be viewed as a "carbon copy of the entire firm's existing business. You want to find the NPV of the project using three different DCF methods: WACC/APV/FTE. QUESTION 32 What is the FCFE at year 1? (Hint: You repay the debt of $464 at time 1.) A $536 3.5835 20 6.5536 D. 5835.20 QUESTION 33 Which of the following serves as the discount rate for free cash flows to equity? A 14% 5.2017 10% 0.167 QUESTION 34 What is the NPV of the project based on the FTE approach? A. $140 B. $200 C. $20 D.$160 QUESTION 35 Do the WACC/APV/FTE approaches produce identical NPV values? Yes No [Q24-35] Your firm's market value balance sheet is given as follows: Market Value Balance Sheet Excess cash SJOM Debt S230M Operating Assets S500M Equity S300M Asset Value $530M Debt + Equity S530M Assume that the you plan to keep the firm's debt-to-equity ratio fixed. The firm's corporate tax rate is 50%. The firm's cost of debt is 10% and cost of equity is 20%. Now, suppose that you are considering a new project that will last for one year. According to your analysis, free cash flows from the project are -$1,000 today (i.e. year 0) and $1,322.40 one year from today (ie. year 1). This new project can be viewed as a "carbon copy of the entire firm's existing business. You want to find the NPV of the project using three different DCF methods: WACC/APV/FTE What is the firm's WACC? A 10% 8.14% 20% D.16% the WACC QUESTIONS Under the WACC croch, the NPV of the project is obtained by discounting future Free cash flow to QUESTION 26 What is the NPV on the WACC approach? 520 C5160 3 points Swim QUESTION 22 QUESTION 28 3 points Save Antw What is the NPV of the project if the project were financed by 100% equity (ieunlevered)? A $200 B. $20 $140 D. $160 QUESTION 29 3 points The new project is financed with the same capital structure as the entire fimm(implying that the interest tax shield should be discounted using the unlevered cost of capital). To do so, you raise $464 in debeat year. Then, what would the present value of the interest tax shield be? Assume that the interest rate on the debt is the same as the firm's cost of debt (ie. 10%). OASIGO BS1 C520 D. $200 3 points QUESTION 30 What is the NPV of the project based on the APV approach? A $200 5140 C$160 D.520 QUESTION 31 What is the CFE at year 07 (Hint: You maise $464 in debt of time 0) A 5835.20 1.535.20 C5536 D.5536

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started