Answered step by step

Verified Expert Solution

Question

1 Approved Answer

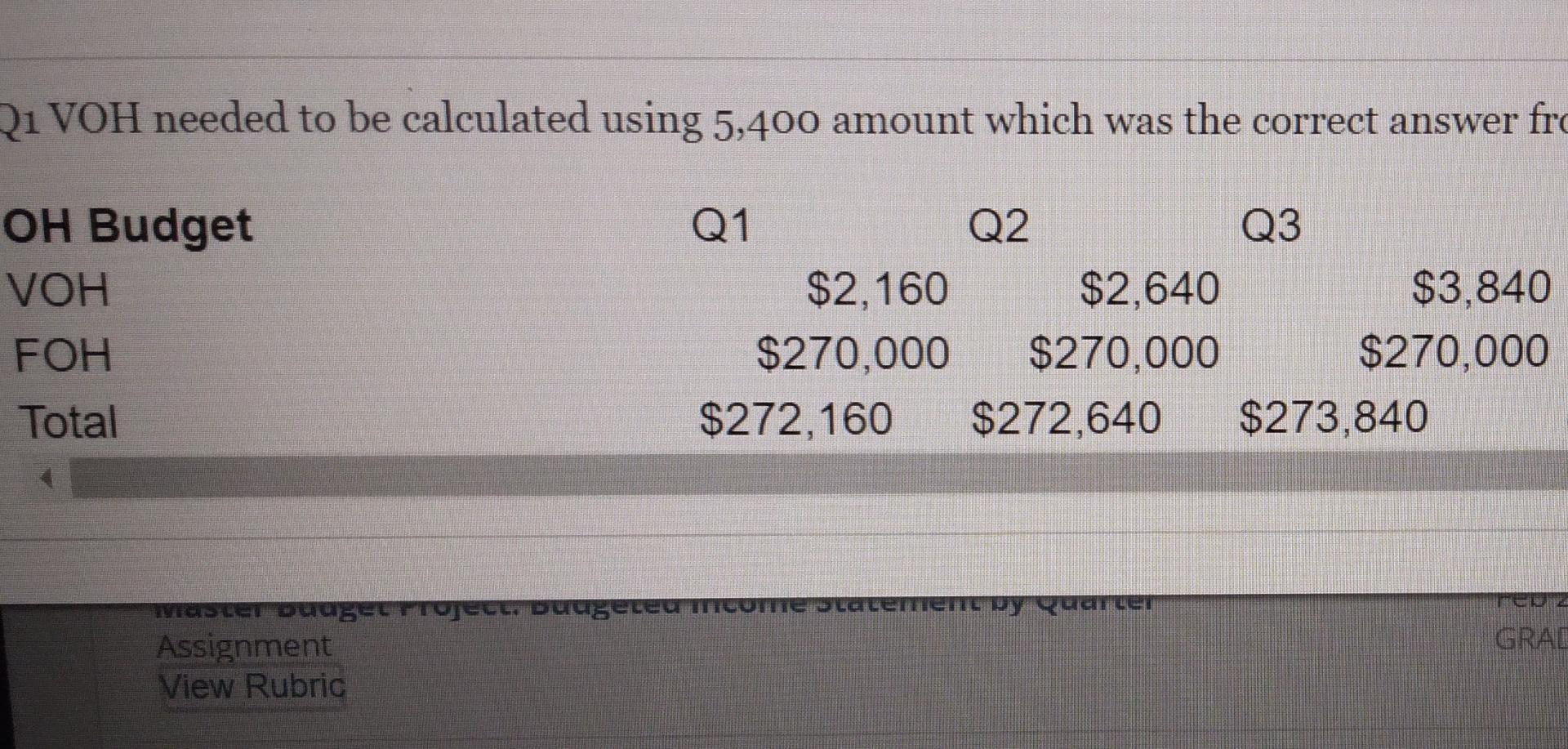

what information do you need? I need the cash budget filled in for the four quarters. the first picture are the voh and foh numbers

what information do you need? I need the cash budget filled in for the four quarters.

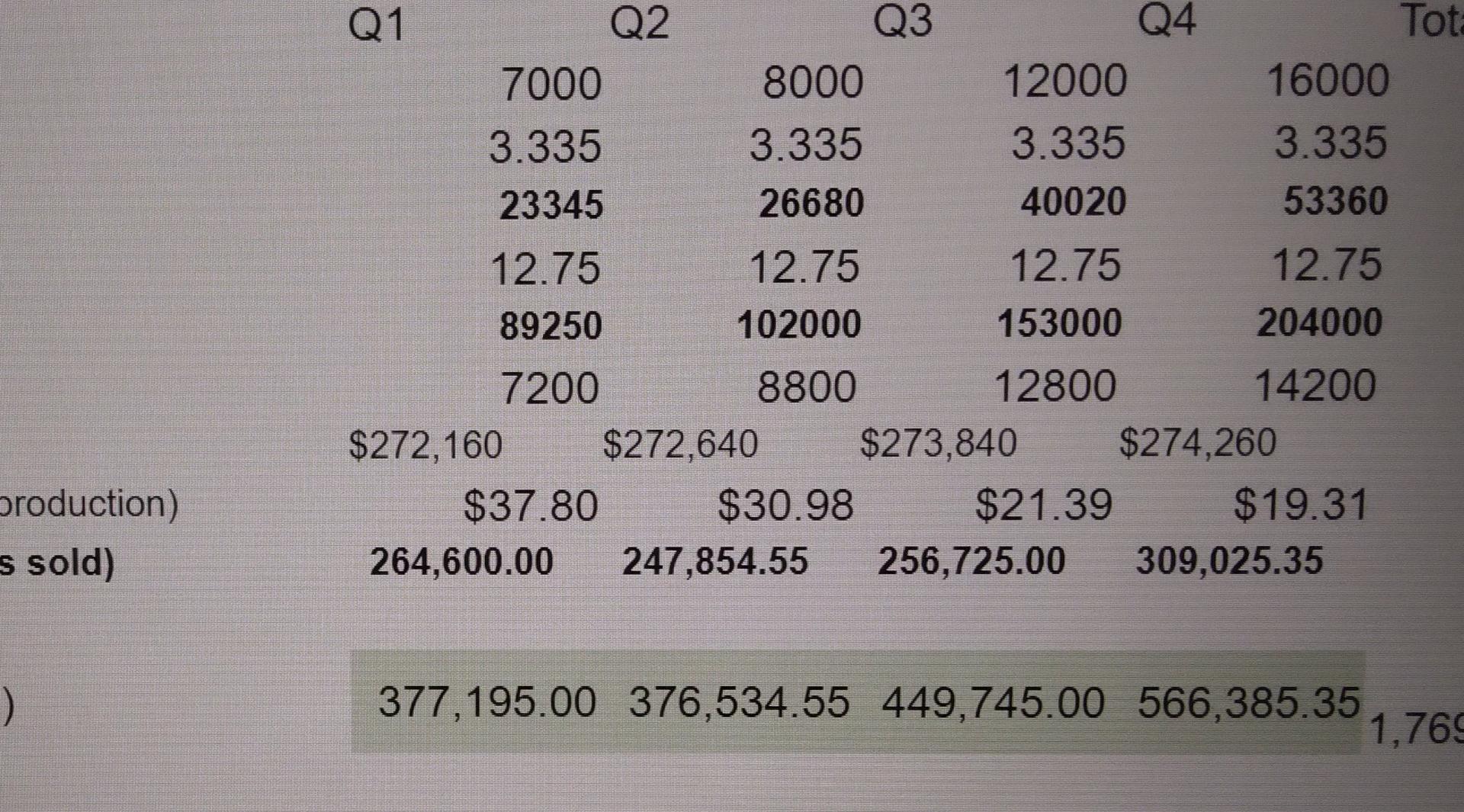

the first picture are the voh and foh numbers for each quarter.

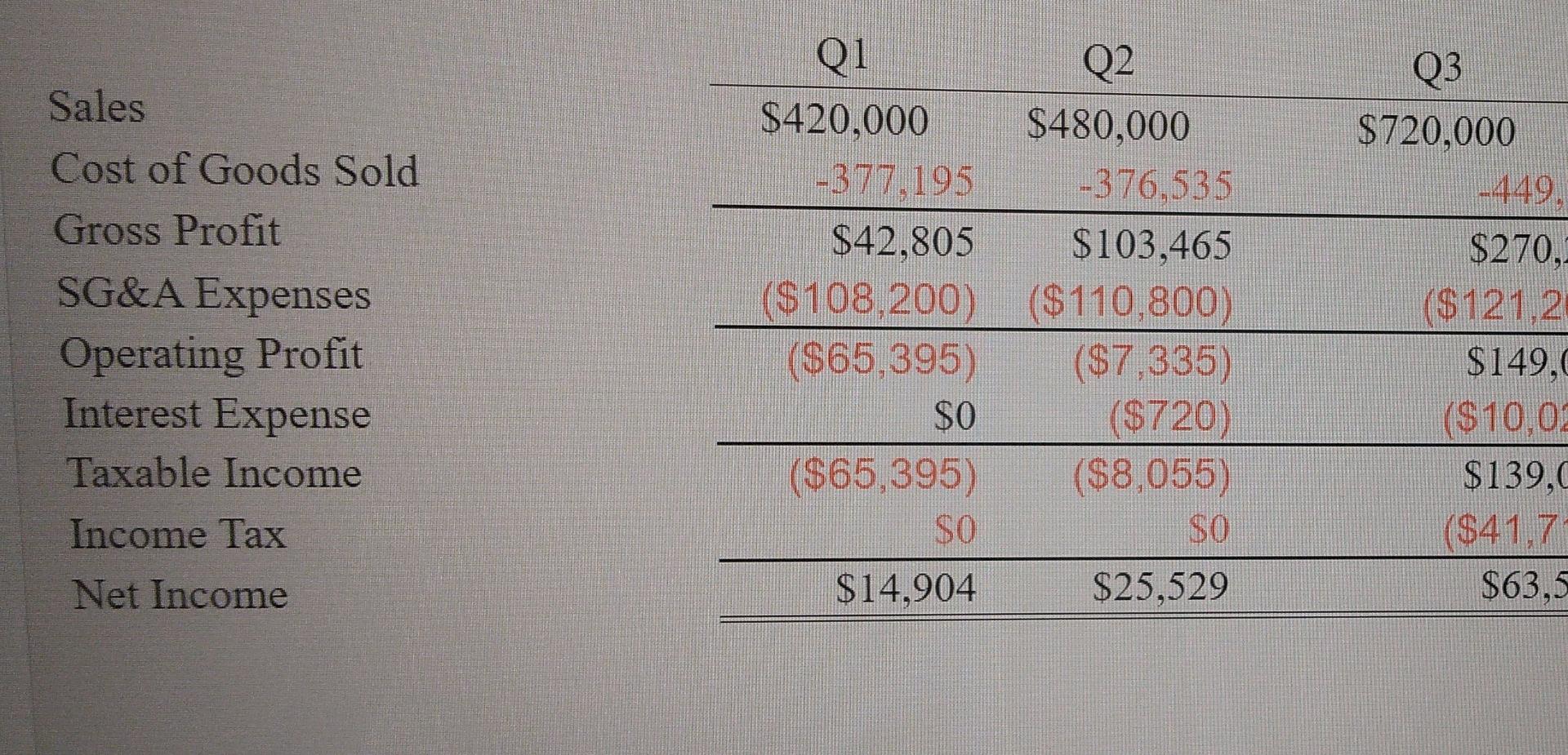

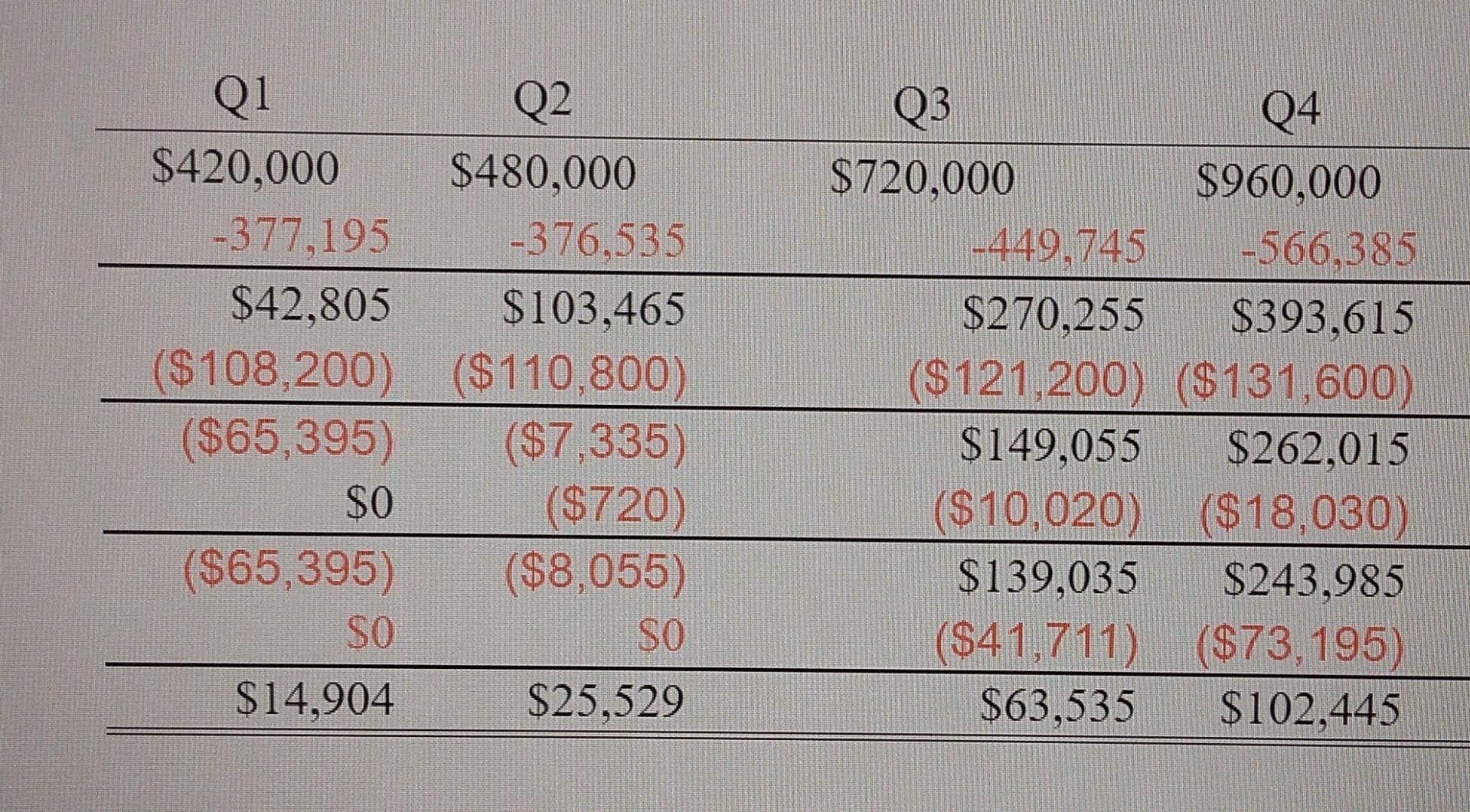

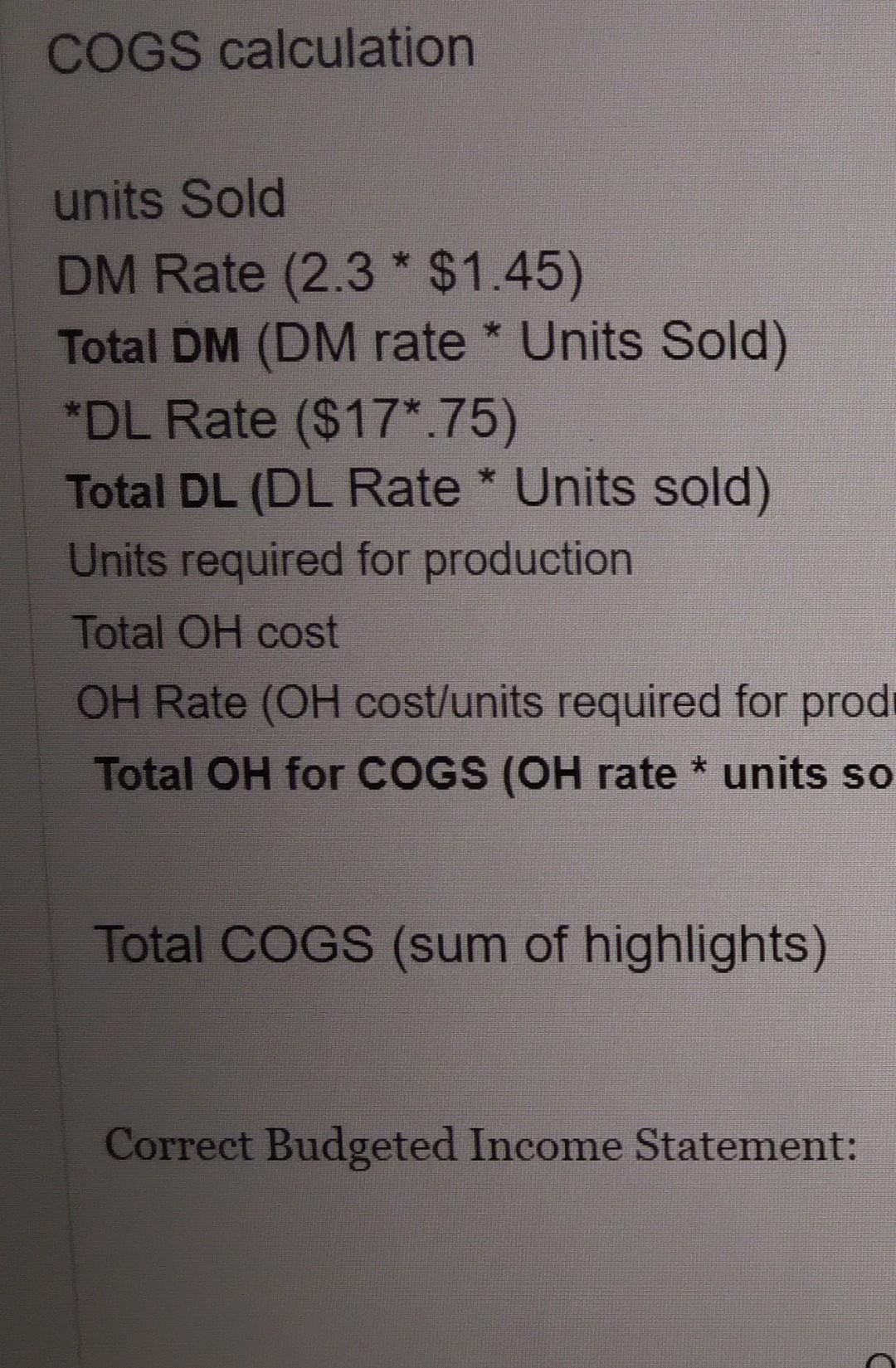

second picture are the cogs for each quarter.

this picture goes with the second picture.

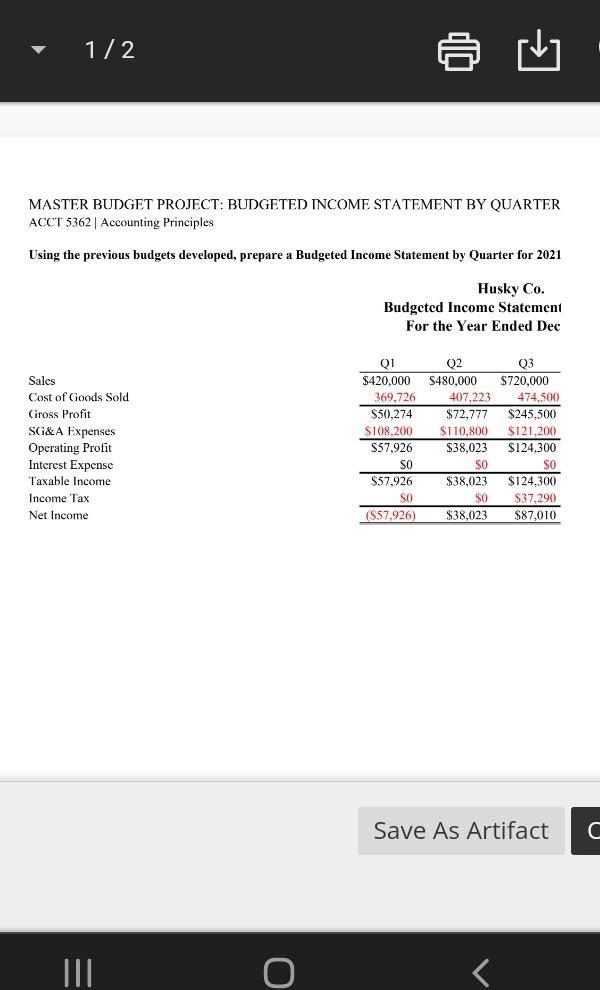

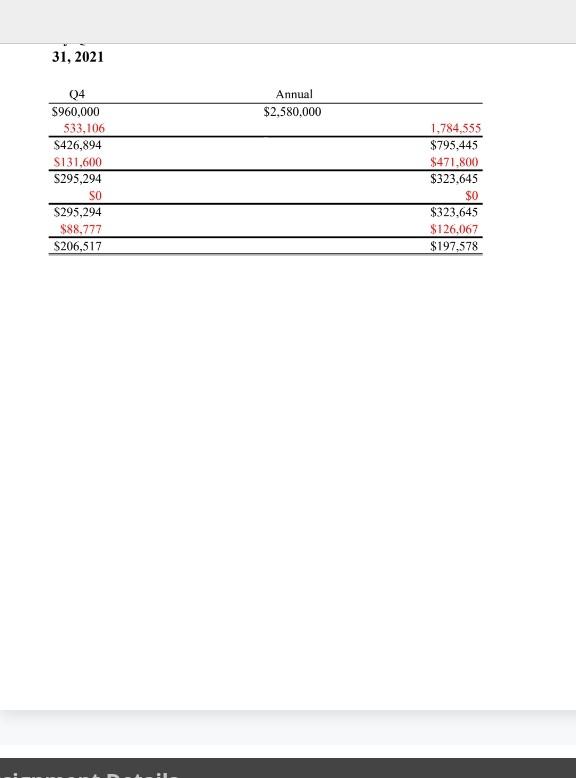

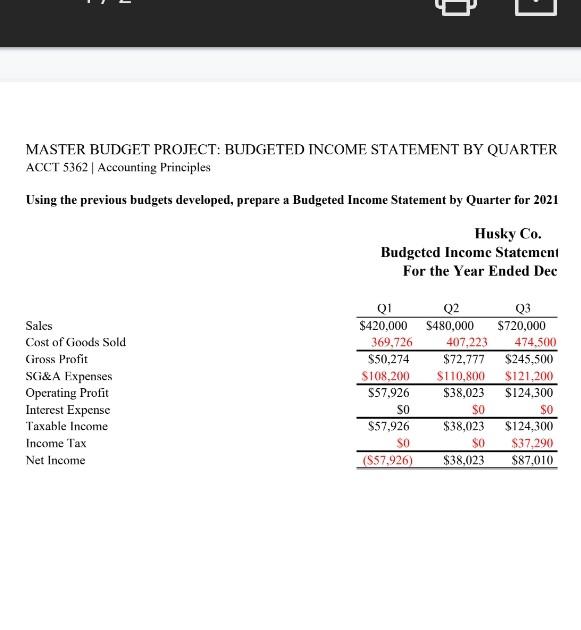

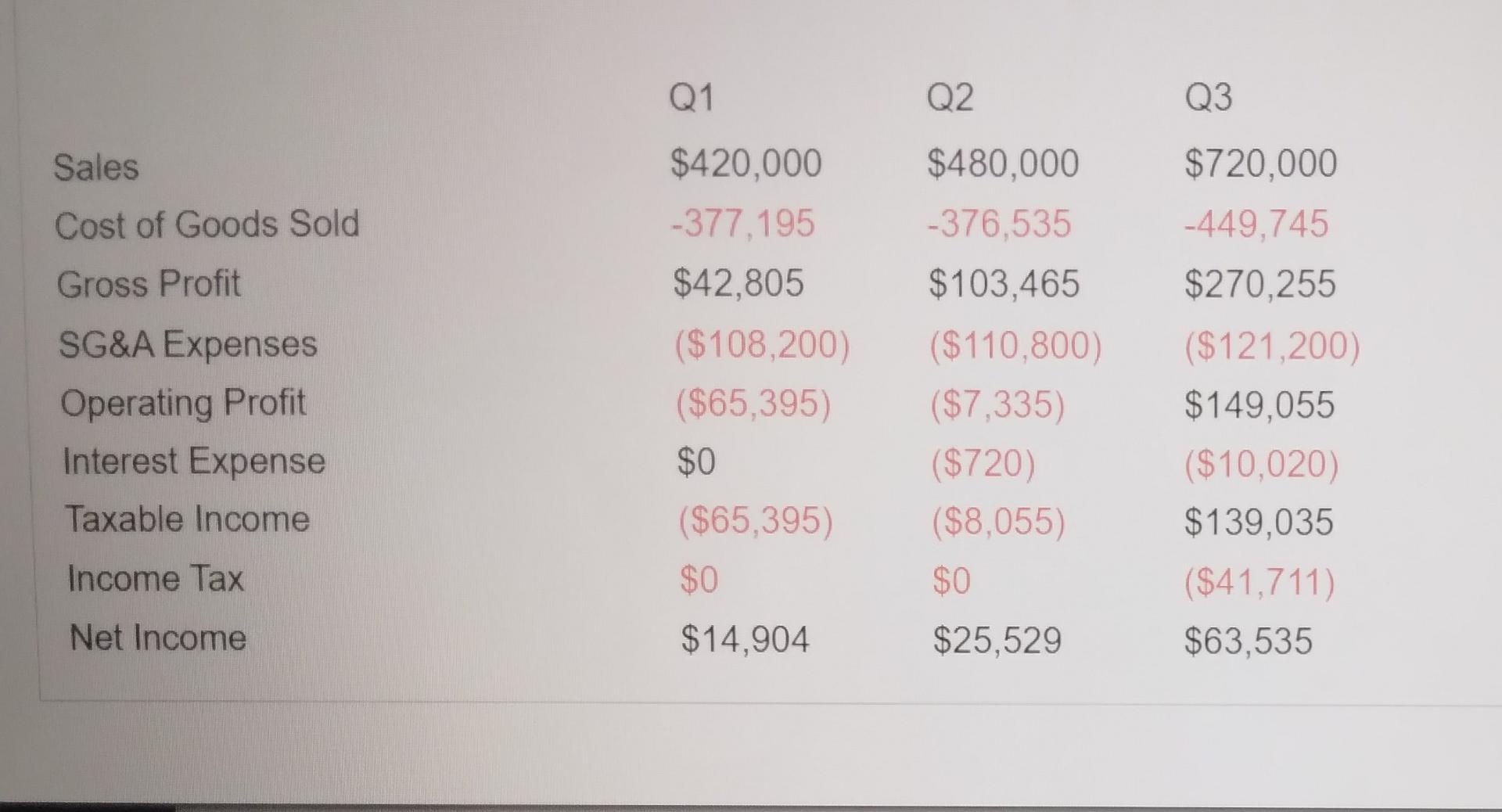

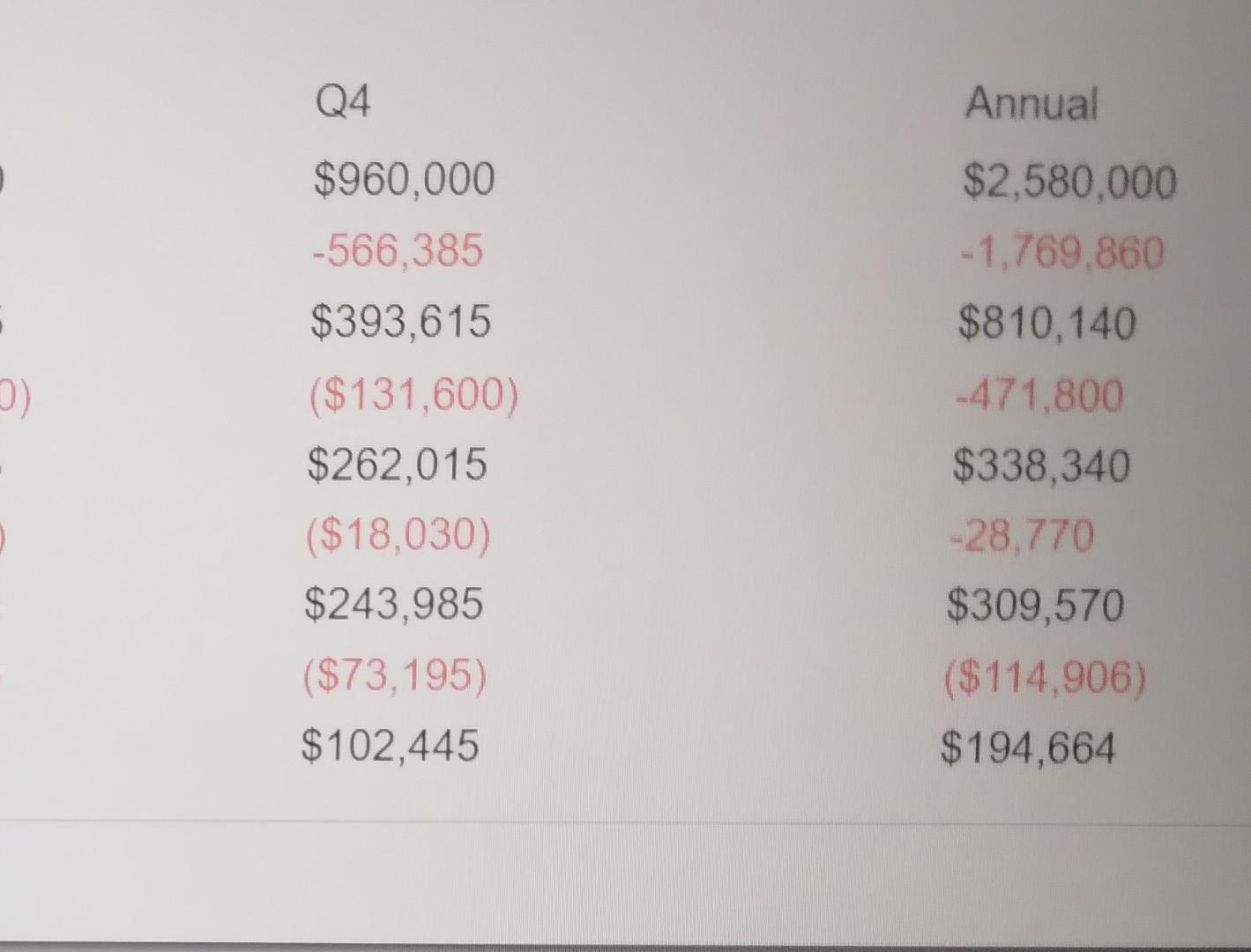

this is the budget income statement.

I need help filling out the second picture. The first picture is the problem that needs to be solved.

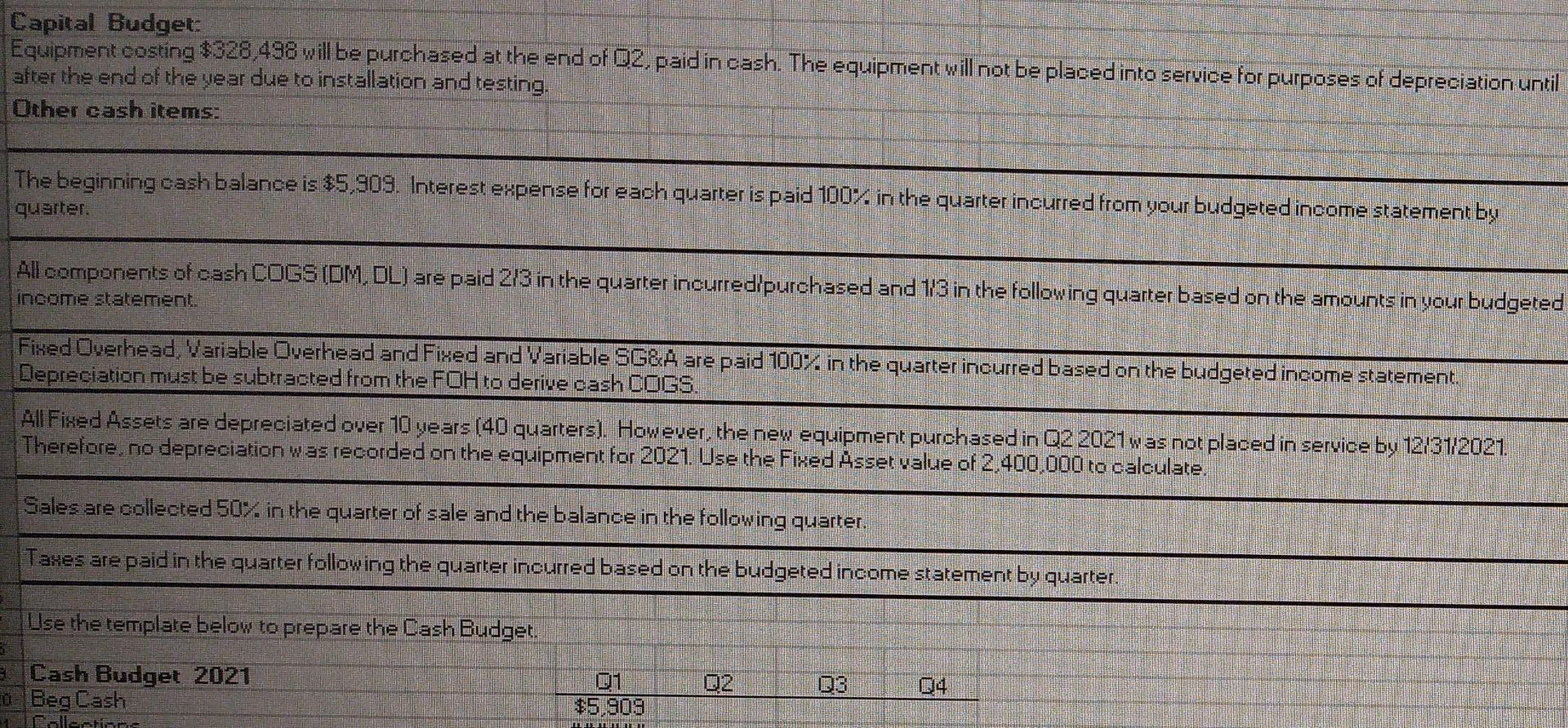

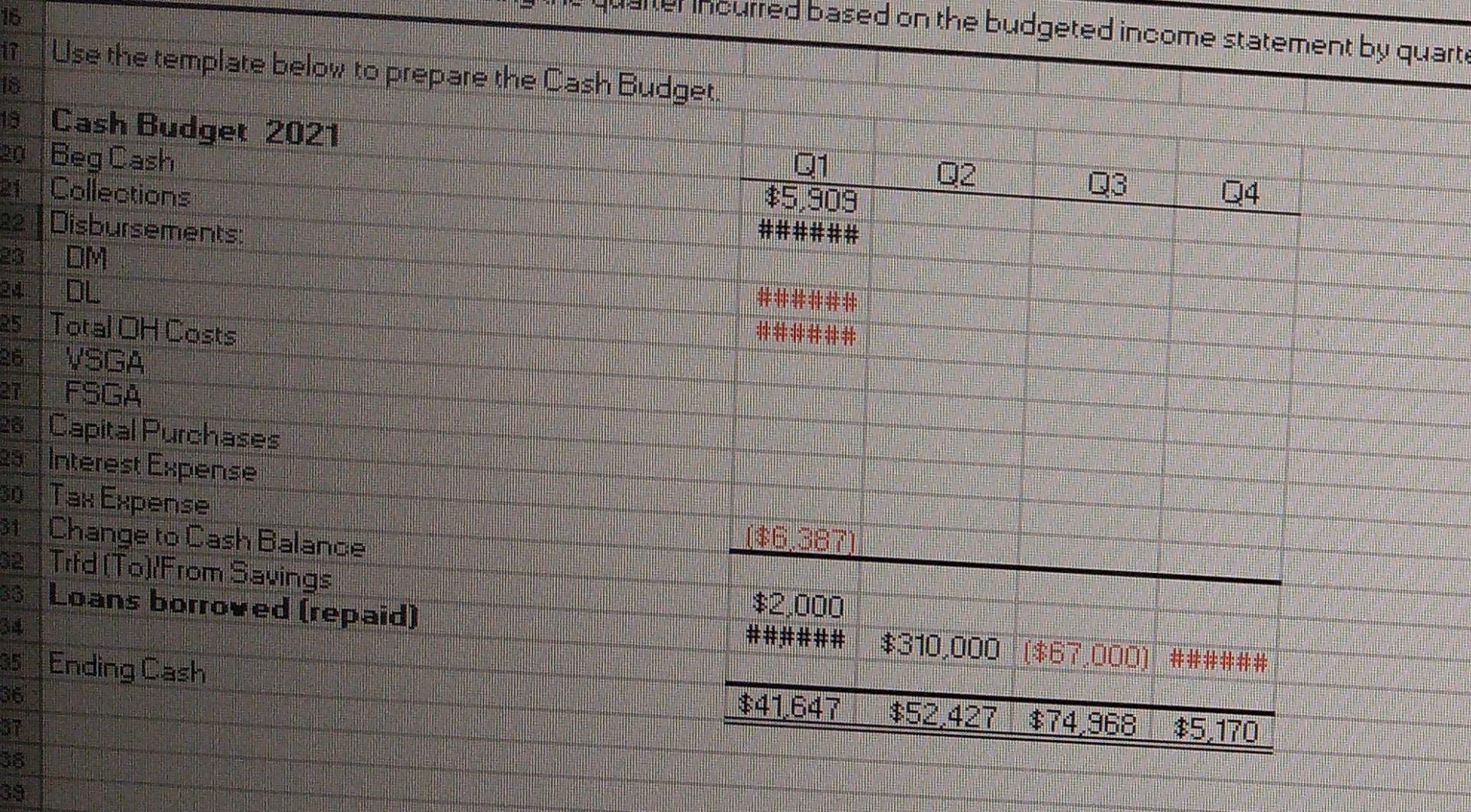

Capital Budget: Equipment costing $328,498 will be purchased at the end of O2, paidin cash. The equipment will not be placed into service for purposes of depreciation until after the end of the year due to installation and testing. Other cash items: The beginning cash balance is $5.909. Interest expense for each quarter is paid 100%. in the quarter incurred from your budgeted income statement by quarter. All components of cash COGSIOM, DL) are paid 2/3in the quarter incurred purchased and 1/3 in the following quarter based on the amounts in your budgeted income statement. Fixed Overhead Variable Overhead and Fixed and Variable SG&A are paid 100% in the quarter incurred based on the budgeted income statement. Depreciation must be subtracted from the FOH to derive cash COGS. All Fixed Assets are depreciated over 10 years (40 quarters) . However, the new equipment purchased in 02 2021 was not placed in service by 12/31/2021. Therefore, no depreciation was recorded on the equipment for 2021. Use the Fixed Asset value of 2,400,000 to calculate, W Sales are collected 50% in the quarter of sale and the balance in the following quarter. Taxes are paid in the quarter following the quarter incurred based on the budgeted income statement by quarter. Use the template below to prepare the Cash Budget 3 Cash Budget 2021 Beg Cash tinn DG $5,909 based on the budgeted income statement by quarta 17. Use the template below to prepare the Cash Budget. 18 Cash Budget 2021 20 Beg Cash 21 Collections 22 Disbursements: Q2 $5,909 03 Q4 25 Total OH Costs VSGA #***#* | ### ## 28 Capital Purchases 23 Interest Expense Tax Expense 31 Change to Cash Balance 33. Trid (Toll From Savings 33 Loans borroved (repaid) ($6.387) $2.000 ###### $310,000 ($67.000]###### 35 Ending Cash $41647 $52.427 $74.968 +5.170 1/2 MASTER BUDGET PROJECT: BUDGETED INCOME STATEMENT BY QUARTER ACCT 5362 Accounting Principles Using the previous budgets developed, prepare a Budgeted Income Statement by Quarter for 2021 Husky Co. Budgeted Income Statement For the Year Ended Dec Sales Cost of Goods Sold Cross Profit SG&A Expenses Operating Profit Interest Expense Taxable Income Income Tax Net Income 01 $420.000 369,726 $50,274 $108,200 $57,926 SO $57.926 SO (557.926) 02 S480.000 407.223 $72.777 $110.800 $38,023 SO $38,023 SO $38,023 03 $720,000 474.500 $245,500 $121,200 $124.300 $0 $124.300 $37.290 $87,010 Save As Artifact III O 31, 2021 Annual $2,580.000 04 $960,000 533,106 S426,894 S131,600 S295,294 SO $295,294 $88,777 S206,517 1,784,555 $795,445 $471,800 $323,645 $0 $323,645 $126.067 $197.578 Sales Cost of Goods Sold Gross Profit SG&A Expenses Operating Profit Interest Expense Taxable Income Income Tax Q1 Q2 $420,000 $480,000 -377.195 -376,535 $42.805 $103,465 ($108,200) ($110,800) ($65,395) ($7,335) SO ($720) ($65,395) ($8,055) SO $0 $14,904 $25,529 Q3 $720,000 -449. $270. ($121.2 $149.0 ($10.00 $139, ($41,7 $63,5 Net Income D MASTER BUDGET PROJECT: BUDGETED INCOME STATEMENT BY QUARTER ACCT 5362 | Accounting Principles Using the previous budgets developed, prepare a Budgeted Income Statement by Quarter for 2021 Husky Co. Budgeted Income Statement For the Year Ended Dec Sales Cost of Goods Sold Gross Profit SG&A Expenses Operating Profit Interest Expense Taxable income Income Tax Net Income Q1 Q2 Q3 $420,000 $480,000 $720,000 369,726 407,223 474,500 $50,274 $72,777 $245,500 S108.200 $110.800 $121,200 $57,926 $38,023 $124.300 SO SO SO $57.926 $38,023 $124.300 SO SO $37,290 (S57.926) $38,023 $87,010 Q1 Q2 $420,000 $480,000 -377,195 -376.535 $42,805 $103,465 ($ 108,200) ($110.800) ($65,395) ($7,335) SO ($720) ($65,395) ($8,055) SO SO $14,904 $25,529 Q3 Q4 $720,000 $960,000 -449.745 -566,385 $270,255 $393,615 ($121,200) ($131,600) $149,055 $262.015 ($10,020) ($18,030) $139,035 $243,985 ($41,711) ($73,195) $63,535 $102,445 21 VOH needed to be calculated using 5,400 amount which was the correct answer fr OH Budget VOH FOH Q1 Q2 Q3 $2,160 $2,640 $3,840 $270,000 $270,000 $270,000 $272,160 $272,640 $273,840 Total TITEIL DY QuarLET He Master ouagetTroell, Duusele Assignment View Rubric GRAN Q1 Q2 7000 3.335 23345 Q3 8000 3.335 Q4 12000 3.335 40020 Tot 16000 3.335 53360 26680 12.75 12.75 12.75 12.75 89250 102000 153000 204000 7200 8800 12800 14200 $272,160 $272,640 $273,840 $274,260 $37.80 $30.98 $21.39 $19.31 264,600.00 247,854.55 256,725.00 309,025.35 production) s sold) ) 377,195.00 376,534.55 449,745.00 566,385.35 1,76 COGS calculation * units Sold DM Rate (2.3 * $1.45) Total DM (DM rate * Units Sold) *DL Rate ($17*.75) Total DL (DL Rate * Units sold) Units required for production Total OH cost OH Rate (OH cost/units required for prod Total OH for COGS (OH rate * units so Total COGS (sum of highlights) Correct Budgeted Income Statement: Q1 Q2 Q3 Sales Cost of Goods Sold Gross Profit SG&A Expenses Operating Profit Interest Expense Taxable income $420,000 -377,195 $42,805 ($108,200) ($65,395) $0 ($65,395) $0 $480,000 -376,535 $103,465 ($110,800) ($7,335) ($720) ($8,055) $720,000 -449,745 $270,255 ($121,200) $149,055 ($10,020) $139.035 Income Tax $0 ($41,711) $63,535 Net Income $14,904 $25,529 Q4 Annual $960,000 -566,385 $393,615 ($131,600) $262,015 ($18,030) $243,985 ($73,195) $102,445 $2,580,000 -1,769,860 $810,140 -471,800 $338,340 -28,770 $309,570 ($114,906) $194,664 Capital Budget: Equipment costing $328,498 will be purchased at the end of O2, paidin cash. The equipment will not be placed into service for purposes of depreciation until after the end of the year due to installation and testing. Other cash items: The beginning cash balance is $5.909. Interest expense for each quarter is paid 100%. in the quarter incurred from your budgeted income statement by quarter. All components of cash COGSIOM, DL) are paid 2/3in the quarter incurred purchased and 1/3 in the following quarter based on the amounts in your budgeted income statement. Fixed Overhead Variable Overhead and Fixed and Variable SG&A are paid 100% in the quarter incurred based on the budgeted income statement. Depreciation must be subtracted from the FOH to derive cash COGS. All Fixed Assets are depreciated over 10 years (40 quarters) . However, the new equipment purchased in 02 2021 was not placed in service by 12/31/2021. Therefore, no depreciation was recorded on the equipment for 2021. Use the Fixed Asset value of 2,400,000 to calculate, W Sales are collected 50% in the quarter of sale and the balance in the following quarter. Taxes are paid in the quarter following the quarter incurred based on the budgeted income statement by quarter. Use the template below to prepare the Cash Budget 3 Cash Budget 2021 Beg Cash tinn DG $5,909 based on the budgeted income statement by quarta 17. Use the template below to prepare the Cash Budget. 18 Cash Budget 2021 20 Beg Cash 21 Collections 22 Disbursements: Q2 $5,909 03 Q4 25 Total OH Costs VSGA #***#* | ### ## 28 Capital Purchases 23 Interest Expense Tax Expense 31 Change to Cash Balance 33. Trid (Toll From Savings 33 Loans borroved (repaid) ($6.387) $2.000 ###### $310,000 ($67.000]###### 35 Ending Cash $41647 $52.427 $74.968 +5.170 1/2 MASTER BUDGET PROJECT: BUDGETED INCOME STATEMENT BY QUARTER ACCT 5362 Accounting Principles Using the previous budgets developed, prepare a Budgeted Income Statement by Quarter for 2021 Husky Co. Budgeted Income Statement For the Year Ended Dec Sales Cost of Goods Sold Cross Profit SG&A Expenses Operating Profit Interest Expense Taxable Income Income Tax Net Income 01 $420.000 369,726 $50,274 $108,200 $57,926 SO $57.926 SO (557.926) 02 S480.000 407.223 $72.777 $110.800 $38,023 SO $38,023 SO $38,023 03 $720,000 474.500 $245,500 $121,200 $124.300 $0 $124.300 $37.290 $87,010 Save As Artifact III O 31, 2021 Annual $2,580.000 04 $960,000 533,106 S426,894 S131,600 S295,294 SO $295,294 $88,777 S206,517 1,784,555 $795,445 $471,800 $323,645 $0 $323,645 $126.067 $197.578 Sales Cost of Goods Sold Gross Profit SG&A Expenses Operating Profit Interest Expense Taxable Income Income Tax Q1 Q2 $420,000 $480,000 -377.195 -376,535 $42.805 $103,465 ($108,200) ($110,800) ($65,395) ($7,335) SO ($720) ($65,395) ($8,055) SO $0 $14,904 $25,529 Q3 $720,000 -449. $270. ($121.2 $149.0 ($10.00 $139, ($41,7 $63,5 Net Income D MASTER BUDGET PROJECT: BUDGETED INCOME STATEMENT BY QUARTER ACCT 5362 | Accounting Principles Using the previous budgets developed, prepare a Budgeted Income Statement by Quarter for 2021 Husky Co. Budgeted Income Statement For the Year Ended Dec Sales Cost of Goods Sold Gross Profit SG&A Expenses Operating Profit Interest Expense Taxable income Income Tax Net Income Q1 Q2 Q3 $420,000 $480,000 $720,000 369,726 407,223 474,500 $50,274 $72,777 $245,500 S108.200 $110.800 $121,200 $57,926 $38,023 $124.300 SO SO SO $57.926 $38,023 $124.300 SO SO $37,290 (S57.926) $38,023 $87,010 Q1 Q2 $420,000 $480,000 -377,195 -376.535 $42,805 $103,465 ($ 108,200) ($110.800) ($65,395) ($7,335) SO ($720) ($65,395) ($8,055) SO SO $14,904 $25,529 Q3 Q4 $720,000 $960,000 -449.745 -566,385 $270,255 $393,615 ($121,200) ($131,600) $149,055 $262.015 ($10,020) ($18,030) $139,035 $243,985 ($41,711) ($73,195) $63,535 $102,445 21 VOH needed to be calculated using 5,400 amount which was the correct answer fr OH Budget VOH FOH Q1 Q2 Q3 $2,160 $2,640 $3,840 $270,000 $270,000 $270,000 $272,160 $272,640 $273,840 Total TITEIL DY QuarLET He Master ouagetTroell, Duusele Assignment View Rubric GRAN Q1 Q2 7000 3.335 23345 Q3 8000 3.335 Q4 12000 3.335 40020 Tot 16000 3.335 53360 26680 12.75 12.75 12.75 12.75 89250 102000 153000 204000 7200 8800 12800 14200 $272,160 $272,640 $273,840 $274,260 $37.80 $30.98 $21.39 $19.31 264,600.00 247,854.55 256,725.00 309,025.35 production) s sold) ) 377,195.00 376,534.55 449,745.00 566,385.35 1,76 COGS calculation * units Sold DM Rate (2.3 * $1.45) Total DM (DM rate * Units Sold) *DL Rate ($17*.75) Total DL (DL Rate * Units sold) Units required for production Total OH cost OH Rate (OH cost/units required for prod Total OH for COGS (OH rate * units so Total COGS (sum of highlights) Correct Budgeted Income Statement: Q1 Q2 Q3 Sales Cost of Goods Sold Gross Profit SG&A Expenses Operating Profit Interest Expense Taxable income $420,000 -377,195 $42,805 ($108,200) ($65,395) $0 ($65,395) $0 $480,000 -376,535 $103,465 ($110,800) ($7,335) ($720) ($8,055) $720,000 -449,745 $270,255 ($121,200) $149,055 ($10,020) $139.035 Income Tax $0 ($41,711) $63,535 Net Income $14,904 $25,529 Q4 Annual $960,000 -566,385 $393,615 ($131,600) $262,015 ($18,030) $243,985 ($73,195) $102,445 $2,580,000 -1,769,860 $810,140 -471,800 $338,340 -28,770 $309,570 ($114,906) $194,664Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started